Tax policies come in various forms, including exemptions, progressive taxes, flat taxes, transitional taxes, and transaction-based taxes, reflecting each country's economic strategy and policy focus.

There is a significant contradiction between the government's demand for tax revenue and investors' concerns about high taxes, leading to capital flowing to overseas exchanges.

To make progress in cryptocurrency taxation, balanced policies for revenue collection need to be developed to support the healthy development of the market.

1. Cryptocurrency Trading and Taxation

Since the emergence of the cryptocurrency trading market, taxation on cryptocurrency trading has been a hot topic of discussion. However, a core conflict has always existed—the differing demands of the government and investors. The government emphasizes the necessity of ensuring tax revenue, while investors worry that high taxes will lead to decreased profitability.

However, taxation is an inevitable component of modern capitalist systems and a key driving force for market development. In particular, cryptocurrency taxation is expected to lay the foundation for market growth through three key effects.

First, it can establish a formal market. The example of the stock market shows that taxing profits or transactions is often linked to the official recognition of assets. This helps to create a stable foundation for market activities.

Second, it can enhance protection for investors. The U.S. Consumer Financial Protection Act and the Consumer Financial Protection Bureau (CFPB), established in 2010, are examples of proper regulation to protect investors. In the Web3 market, limiting indiscriminate product releases and misleading advertising helps prevent fraud and protect investors' rights.

Finally, taxation can accelerate the integration of cryptocurrencies into the existing financial system by clarifying their legal status. This integration can improve market stability and trust.

However, given the uniqueness of the cryptocurrency market, it is difficult to expect taxation to have positive effects based solely on the experiences of the stock market. Due to the rapid growth of cryptocurrencies, many existing tax systems have been criticized as purely means of extracting value. This has led to an increasing contradiction between the government and investors.

In this context, this report will examine the cryptocurrency tax systems of major Asian countries. It will analyze how the three effects mentioned earlier—market establishment, investor protection, and system integration—are implemented. By doing so, it will provide a balanced perspective from both investors and the government.

2. Comparative Analysis of Cryptocurrency Taxation in Major Asian Markets

Source: X

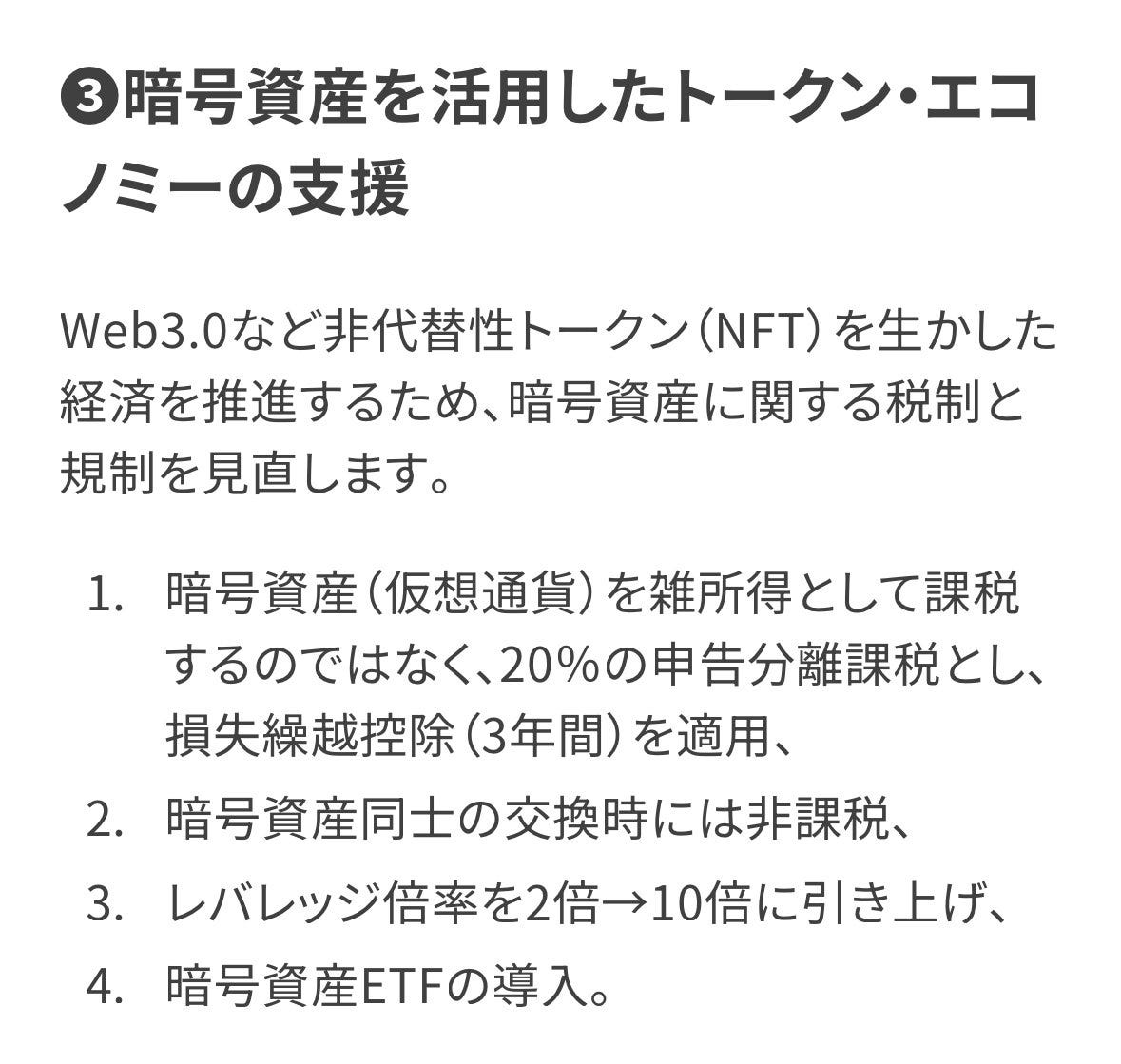

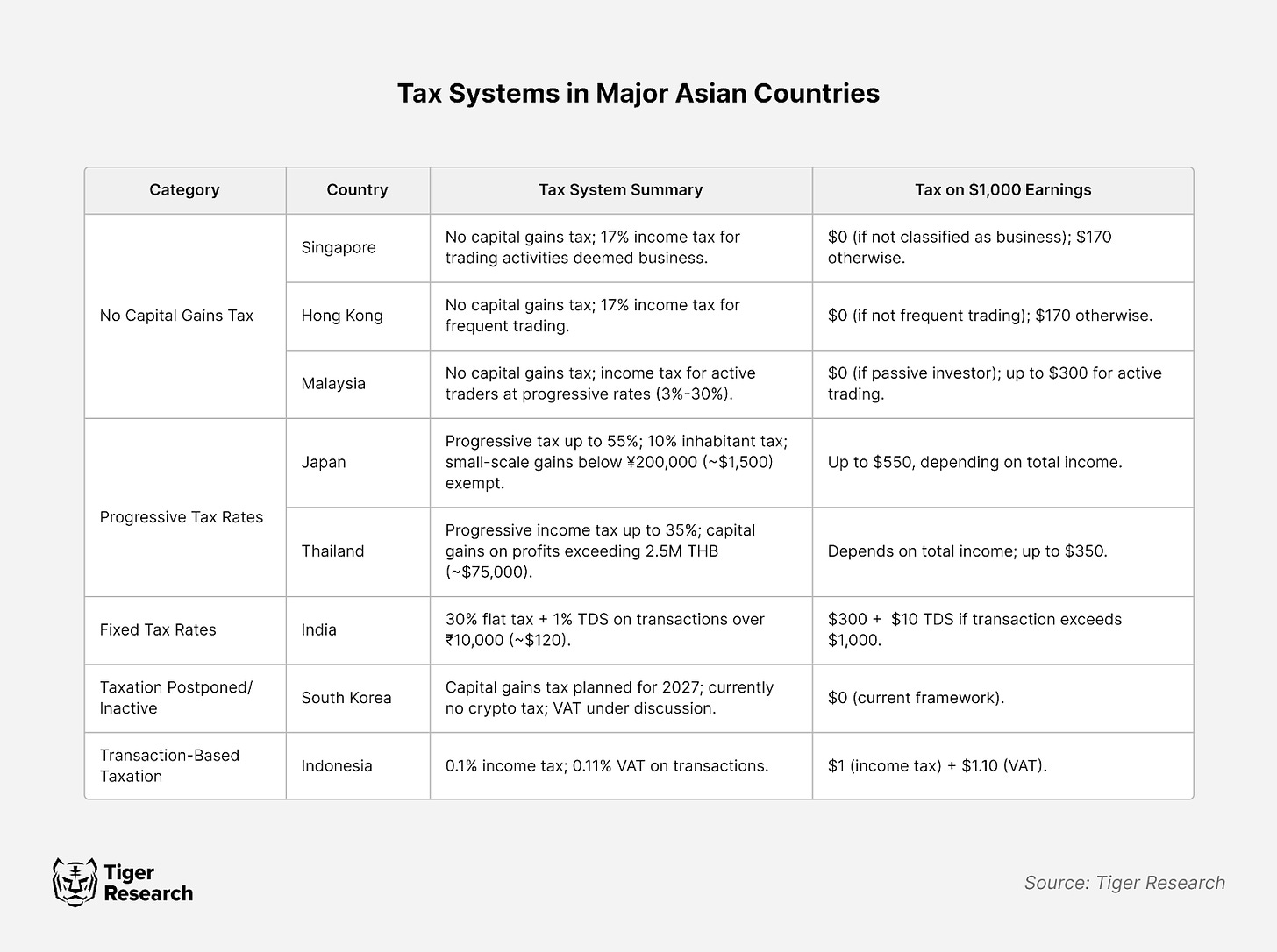

Our analysis of the cryptocurrency tax systems in major Asian countries reveals five different policy types. These differences reflect each country's economic structure and policy focus.

For example, Singapore exempts capital gains tax and only imposes a 17% income tax when cryptocurrencies are recognized as business income. This flexible approach solidifies Singapore's position as a global cryptocurrency hub. Similarly, Hong Kong is considering a tax exemption policy for investment returns from hedge funds and family offices, further enhancing its appeal to institutional investors.

In contrast, Japan imposes high tax rates of up to 55%, focusing on curbing speculative activities. However, Japan is also considering a proposal to reduce the tax rate to 20%, which could indicate a potential change in its current cryptocurrency tax approach.

2.1. Tax-Exempt Focus Countries: Singapore, Hong Kong, Malaysia

Major financial centers in Asia, such as Singapore, Hong Kong, and Malaysia, have adopted capital gains tax exemption policies for cryptocurrencies, aligning with their long-standing economic strategies.

These countries' tax exemption policies are consistent with their traditional financial frameworks. Historically, they have attracted global capital through low tax rates, including not imposing capital gains tax on stock investments. Maintaining this stance on cryptocurrencies demonstrates policy consistency and a clear commitment to their economic principles.

This strategy has yielded significant results. For instance, Singapore became Asia's largest cryptocurrency trading center in 2021. With no tax burden on investment profits, investors actively participated in the market, accelerating its growth.

However, tax exemption policies are not without limitations. Major challenges include the risk of speculative overheating and reduced direct tax revenue for the government. These countries are taking alternative measures to address these issues. They ensure indirect tax revenue through the development of the financial services industry and maintain market stability through strict regulation of exchanges and financial institutions.

2.2. Progressive Tax System Countries: Japan and Thailand

Japan and Thailand impose high progressive tax rates on profits from cryptocurrency trading. This policy reflects a broader social goal of "wealth redistribution" by taxing high-income groups. In Japan, the highest tax rate is 55%, consistent with policies for traditional financial assets.

However, such high tax rates also have considerable downsides. The most significant issue is "capital flight," where investors move their assets to tax-exempt regions like Singapore, Hong Kong, or Dubai. There are also concerns that the heavy tax burden may stifle market growth. Regulators are closely monitoring market feedback.

2.3. Flat Tax Rate Country: India

Source: ISH News Youtube

India imposes a flat tax rate of 30% on profits from cryptocurrency trading. This approach differs from the progressive tax system used in traditional financial markets, reflecting India's strategic choice to achieve two key goals: administrative efficiency and market transparency.

India's flat tax rate policy has produced several notable effects. First, the tax system is straightforward, reducing the administrative burden on taxpayers and tax authorities. Additionally, applying the same tax rate to all transactions minimizes tax avoidance strategies, such as splitting or evading transactions.

However, the flat tax system also has clear limitations. The biggest concern is that it may discourage small investors from entering the market. Even minimal profits are subject to a high tax rate of 30%, placing a heavy burden on small-scale investors. Furthermore, imposing the same tax rate on both high-income and low-income groups raises questions about tax equity.

The Indian government is aware of these issues and is currently exploring solutions. Proposed measures include lowering the tax rate for small transactions or providing incentives for long-term holders. These efforts aim to retain the benefits of the flat tax system while promoting balanced market growth.

2.4. Transitional Approach: South Korea

Source: Kyunghyang News

South Korea has taken a cautious approach to cryptocurrency taxation, reflecting the high uncertainty in the cryptocurrency market. A notable example is the postponement of the financial investment income tax originally scheduled for implementation in 2021 to 2025. The implementation of cryptocurrency taxation has also been further delayed to 2027.

This transitional approach has clear advantages. It allows the market to grow organically while providing time to observe the policy outcomes of other countries and global regulatory trends. By studying the cases of Japan and Singapore, South Korea aims to establish an optimized tax framework post-factum.

However, this approach also presents challenges. At the same time, the lack of a clear tax system may cause market confusion and increase the risk of speculative overheating. Additionally, the absence of regulatory infrastructure may impact investor protection, potentially hindering long-term market development.

2.5. Transaction-Based Taxation: Indonesia

Indonesia has implemented a unique transaction-based tax system, differing from other Asian countries. This system imposes a 0.1% income tax and a 0.11% value-added tax (VAT) on transactions. The policy was launched in May 2022 as part of Indonesia's broader financial market modernization reforms.

The transaction tax enhances market transparency by applying a low and uniform tax rate to all transactions, simplifying procedures, and encouraging the use of licensed exchanges. Since its implementation, trading volumes on these exchanges have increased.

However, the policy also has limitations. Similar to India, the uniform tax rate places a heavy burden on small-scale traders. For frequent traders, the cumulative tax costs can be very high, raising concerns about decreased market liquidity.

The Indonesian government is aware of these challenges and plans to refine the policy based on market feedback. Proposed measures include tax reductions for small transactions and incentives for long-term investments. These adjustments aim to retain the advantages of transaction-based taxation while addressing its shortcomings.

3. Conflicts Between Investors and Government

Despite the differences in tax systems across countries, the conflict between governments and investors regarding cryptocurrency taxation remains a common issue. These conflicts arise not only from the act of taxation but also from fundamental differences in the perception of digital assets. The nature of this conflict varies according to each country's tax policies.

Governments view profits from cryptocurrency trading as a new source of tax revenue. In particular, the rapid growth of the cryptocurrency market has become an attractive means of obtaining stable income, especially as the COVID-19 pandemic has exacerbated fiscal deficits. For example, Japan's progressive tax system imposes rates as high as 55%, while India's flat rate is 30%, both highlighting the government's strong push for taxation.

Source: GMB Labs

From the investors' perspective, excessive taxation is seen as an obstacle to market growth. Higher tax rates, compared to traditional financial products, combined with the cumulative tax burden from frequent trading, hinder investment activities. As a result, capital flight has become a major issue. Many investors are transferring their assets to overseas platforms like Binance or relocating to tax-exempt jurisdictions such as Singapore and Hong Kong. This indicates that the government's efforts to ensure tax revenue may backfire.

In some cases, governments focus solely on taxation without implementing policies to support market development, further exacerbating the conflict, as investors perceive this approach as overly restrictive and shortsighted.

Finding a new balance between the government and investors is becoming increasingly important. Solutions require more than just simple tax adjustments. They demand the formulation of innovative policies that support healthy market growth while ensuring adequate tax revenue. Achieving this balance will be a key policy challenge for governments in the coming years.

4. National-Level Market Revitalization Policies and Activation Strategies

Cryptocurrency taxation has a dual impact on market development. While some countries leverage it as an opportunity for institutionalization and market growth, others face market stagnation and talent drain due to strict tax policies.

Singapore is a prime example of successfully activating the market. By exempting capital gains tax and providing systematic support and regulatory sandboxes for blockchain companies, Singapore encourages innovation. This comprehensive approach solidifies its position as Asia's leading cryptocurrency hub.

Hong Kong is also implementing proactive market development strategies. While maintaining a tax-exempt policy for individual investors, Hong Kong is expanding the licensing framework for digital asset management companies. Notably, starting in 2024, Hong Kong will allow qualified institutional investors to trade cryptocurrency ETFs, further increasing market participation.

On the other hand, the strict tax policies of some countries have become obstacles to market growth. High tax rates and complex regulations prompt investors to transfer their assets overseas, leading to the outflow of innovative companies and skilled talent. This raises concerns about these countries' long-term competitiveness in the digital finance sector.

Ultimately, the success of cryptocurrency tax policies depends on balancing them with market development. Beyond simply ensuring short-term tax revenue, governments must consider how to nurture a healthy and sustainable market ecosystem. Looking ahead, countries need to continuously adjust their policies to achieve this critical balance.

5. Conclusion

Taxing cryptocurrencies is an inevitable step in developing the digital asset market. However, the stabilizing effects of taxation require careful reconsideration. Some argue that transaction taxes can curb speculative trading and reduce market volatility, but historical cases suggest that these effects are often not realized.

A notable example is Sweden in 1986. When the financial transaction tax was significantly increased from 50 basis points to 100 basis points, a substantial portion of stock trading shifted to the UK market. Specifically, 60% of the trading volume of 11 major Swedish stocks moved to the London market, highlighting the unintended consequences of ineffective tax policy.

Both governments and investors must seriously assess the actual impact of taxation. Governments should not focus solely on simple tax revenue but should aim to cultivate a sustainable and healthy market environment. Investors, on the other hand, should view taxation as an opportunity to institutionalize the market, promoting a more stable and mature investment environment.

Ultimately, the success of cryptocurrency taxation depends on whether governments and market participants can find a balanced approach. This is not merely a matter of adjusting tax rates but a critical challenge that will determine the long-term direction and development of the digital asset market.

Original link: https://reports.tiger-research.com/p/cryptocurrency-taxation-in-asia-bullish-eng

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。