Author: Weilin, PANews

On December 16, DeFi project Ethena Labs announced the official launch of its new stablecoin USDtb. As a blockchain-based dollar stablecoin, 90% of USDtb's reserve funds are invested in BlackRock's tokenized fund BUIDL, in collaboration with leading real asset tokenization company Securitize.

On its first day of launch, according to DefiLlama data, USDtb's TVL reached $64.5 million. Previously, Ethena CEO Guy Young predicted that USDtb's first-month TVL would reach between $500 million and $1 billion. He also mentioned that some TradFi entities, despite not having truly engaged with other cryptocurrencies, currently have significant exposure to what Ethena is doing.

Supported by BlackRock's BUIDL Fund, Addressing Market Volatility in a Bear Market

The newly launched USDtb is a relatively traditional crypto stablecoin, appearing almost identical to USDC and USDT. The only difference is that Ethena uses BlackRock's BUIDL treasury fund as collateral to support this stablecoin. BUIDL is a tokenized fund that invests in assets equivalent to the dollar (such as cash, U.S. Treasury bonds, and repurchase agreements). Ethena does not manage financial assets directly but entrusts them to various banks or service providers in the real world. Essentially, BlackRock and Securitize are responsible for the entire process. Therefore, USDtb operates on a completely different product principle compared to Ethena's flagship stablecoin USDe.

USDtb will serve as an alternative stablecoin for Ethena, absorbing funds from USDe during extreme market conditions. Ethena's CEO Guy Young recently introduced on the Unchained podcast that USDtb looks very similar to regular stablecoins and does not generate yield on its own, meaning retail users purchasing it will not earn returns like they would with treasury funds. He stated that the two products actually work in parallel, and in 98% of cases, when cryptocurrency exchange rates appear more attractive than traditional financial rates, USDe operates as it does now. Then, as the environment changes (for example, entering a bear market), users always retain the option to close (positions) and switch to USDtb, keeping their balance sheet in their own products.

Thus, USDtb may help USDe holders "navigate difficult market conditions." Ethena Labs stated in its announcement on December 16: "Ethena will be able to close the hedging positions behind USDe and reallocate its supporting assets to USDtb to further mitigate related risks."

This stablecoin is 90% supported by BlackRock's BUIDL and collaborates with blockchain tokenization company Securitize. One of Ethena's committee members, Block Analiticia, noted in an approved proposal that stablecoins like USDC will account for the remaining 10% of USDtb's reserves, providing additional liquidity during weekends or other periods when treasury markets are not tradable. The "core" part of USDtb's smart contract passed three complete audits in October by Pashov, Quantstamp, and Cyfrin.

USDtb Expected to Drive Significant Capital Inflow from TradFi

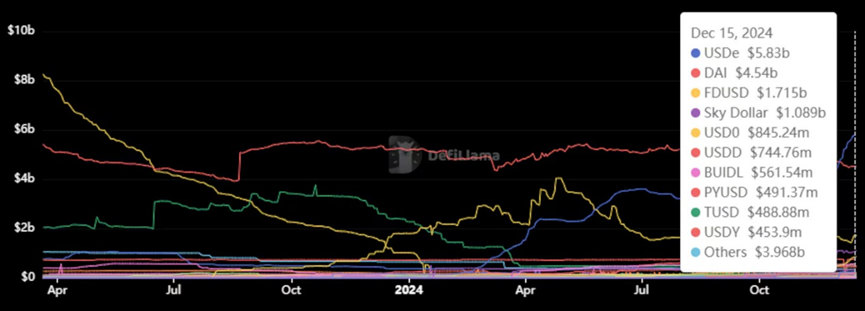

Ethena Lab's synthetic stablecoin USDe was launched in February this year and has since grown rapidly, now ranking as the third-largest stablecoin after USDT and USDC. Since November 1, just a month and a half ago, its market capitalization has more than doubled to nearly $6 billion, even surpassing DAI, a long-established DeFi native stablecoin.

The key to USDe's success lies in the yield it offers. The token has an annual yield of 27%, significantly higher than the 12.5% offered by DAI and USDS. USDe is created by depositing Bitcoin, Ethereum, or Solana into the Ethena protocol and then opening short (bearish) positions on futures exchanges like Bybit. This creates what is known as a "delta-neutral" position, where the value of the assets and the short positions offset each other, maintaining overall price stability.

Currently, as most traders hold a bullish outlook on cryptocurrencies, they pay Ethena to short, and the protocol passes these funds on to USDe holders through staking. As long as this situation continues, USDe's yield should remain high. However, if traders turn bearish, Ethena will not be able to provide such high yields.

Additionally, Ethena's Staked USDe (sUSDe) is a yield-bearing token that allows users to earn extra returns by staking USDe tokens. Through staking rewards and basis trading strategies, sUSDe offers high yields to its holders.

Blockworks Research recently published on Twitter about the different ways Ethena is primarily used. Pendle is the preferred destination for Staked USDe with assets exceeding $1 billion, followed by Aave. Ethena CEO Guy Young recently mentioned on the Unchained podcast that about 50% to 60% of Pendle's TVL is built on sUSDe. Aave has seen an increase of over $1 billion in TVL within a few months.

Returning to the new stablecoin USDtb itself, after its launch, Ethena's growth lead Seraphim Czecker stated that Ethena's roadmap is clear:

- Bring conservative TradFi into USDtb

- Help them adapt to USDe

- Assist them in understanding on-chain opportunities like Aave and Maker

José Maria Macedo, one of the founders of blockchain research and development company Delphi Labs, predicts that USDtb will become the largest tokenized treasury product within a month of its launch. Ethena's growth lead Seraphim Czecker stated that USDtb has the potential to expand to $100 billion, as the company can now effectively allocate capital in a bearish market environment by creating an APY "floor" around treasury rates. "USDtb will drive significant capital inflow from TradFi into our space," Seraphim concluded.

Currently, Ethena has indeed surpassed a number of crypto-native protocols across many different metrics. One of them is that it has consistently been one of the highest fee "generators." It has repeatedly outperformed Tether, Uniswap, Ethereum, Jito, Solana, and has become an important project for DeFi user interaction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。