Original Author: Joy Lou

Bit Deer (NASDAQ code BTDR) updated its operational figures for November, with the market-focused A2 mining machine (Sealminer A2) starting mass production, with the first batch of 30,000 units for external sale.

First Growth Curve: Self-developed chips, sales of mining machines, self-operated mining farms.

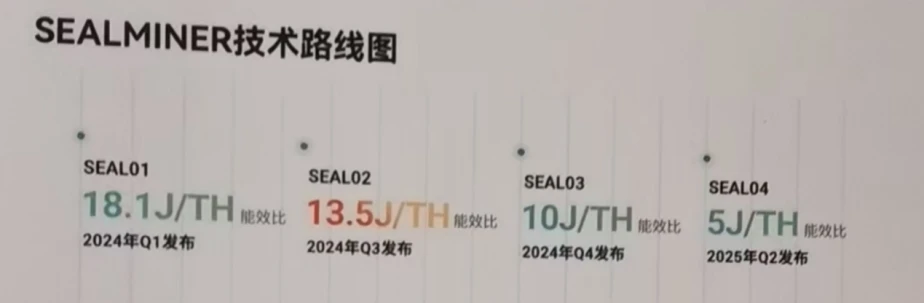

The capability of self-developed chips has always been the core competitiveness of mining machine manufacturers. In the past six months, Bit Deer has successfully completed the first batch of A2 and A3 mining machine chips.

Figure 1: Bit Deer Technology Roadmap

Source: Bit Deer Official Website

Figure 2: Bit Deer Main Mining Machine Parameter Forecast

Source: Model Forecast, Company Guidance

According to public information, the operational parameters of the A2 mining machine are currently at a historically leading position among all mining machines available on the market. Although the A3 has not yet officially launched, based on known parameters, it is expected to become the largest single hash power mining machine globally, with leading energy consumption. The short-term possibility of external sales for this product is extremely low, as it will be prioritized for deployment in self-operated computing power.

Figure 3: Latest Global Mining Machine Companies and Mining Machine Parameters

Source: Bitmain, Bit Deer, Shenma Mining Machine, Canaan Technology Official Website

In terms of power plants, as of the end of November, the company has completed the deployment of a total of 895MW of power plants in the United States, Norway, and Bhutan. There are still 1,645MW projects under construction, with 1,415MW expected to be completed in the latter half of 2025. According to the conference call minutes from Guosheng, the company has established a special department dedicated to acquiring more power plant projects, with the expectation of adding over 1GW of new power plants by 2026; the average electricity price of all self-operated power plants is less than $0.04 per kilowatt-hour, which is an absolute leading advantage compared to peers.

Figure 4: Completed and Under Construction Power Plants of Bit Deer

Source: Company Official Website

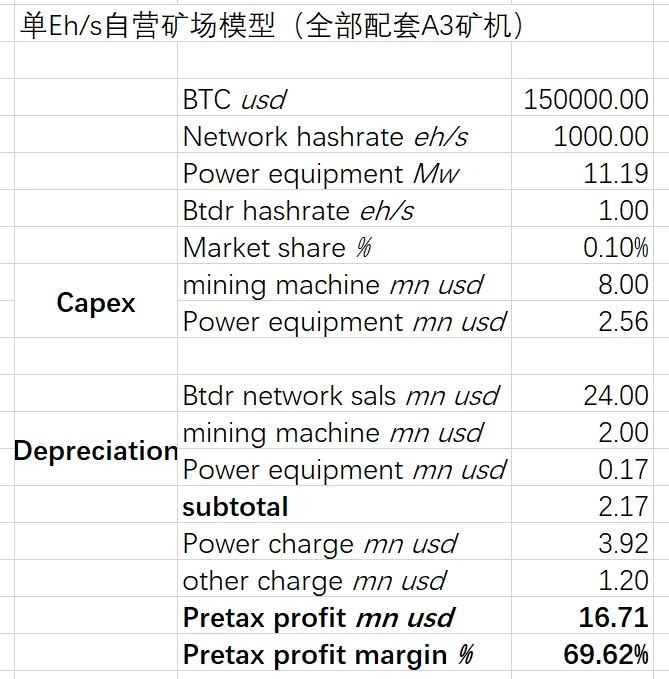

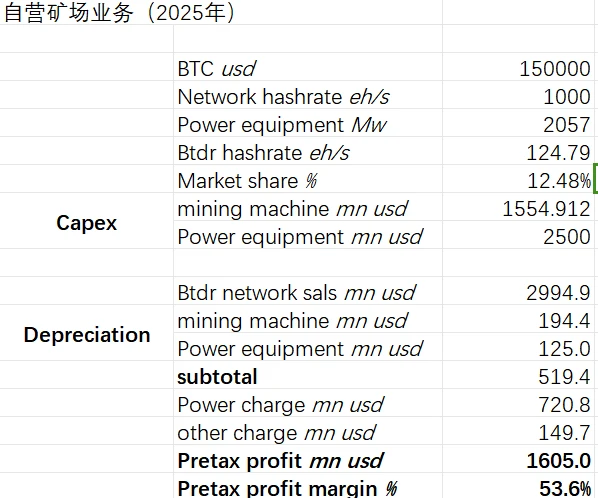

In light of the above operational figures, Bit Deer’s 1EH/s model is as follows:

Figure 5: Bit Deer Single EH/s Model

Source: Model Forecast

The key assumptions of this model include a mining machine depreciation period of 4 years (North American financial standards allow for depreciation up to 5 years), a power plant depreciation period of 15 years (North American financial standards allow for depreciation up to 20 years), and other costs (including labor and operation) accounting for 5% of revenue (the company's historical operational figures have only been 1-1.5%). According to the model, the shutdown price for Bit Deer’s self-operated mining farms is $35,000 per Bitcoin.

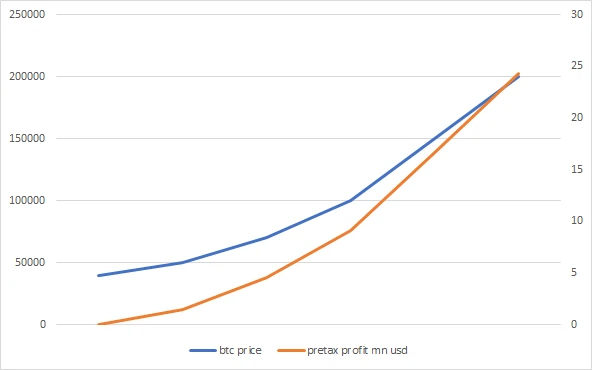

Figure 6: Relationship Between Bit Deer Self-operated Mining Farm Pre-tax Profit Margin and Bitcoin Price

Source: Model Forecast

When the price of Bitcoin exceeds $150,000, the pre-tax profit slope of Bit Deer’s self-operated mining farms can exceed the rate of Bitcoin's increase. If the price of Bitcoin reaches $200,000, the pre-tax profit margin of Bit Deer’s self-operated mining farms will approach 80%.

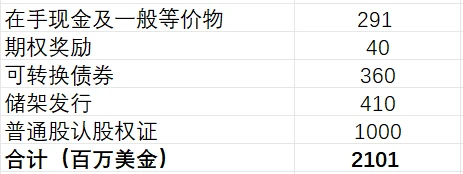

On December 11, the company released its 6-K and 3-F forms, adjusting the shelf offering from $250 million to $580 million, while also announcing the issuance of $1 billion in common stock debt securities warrants.

As mentioned earlier, Bit Deer is expected to reach a power plant reserve of 2.3GW by mid-2025. If all the above mining farms are equipped with A3 mining machines, the self-operated computing power will approach 220EH/s (calculated based on A3 mining machines at 325Th, corresponding to about 700,000 units). Assuming linear growth of the total network computing power, it will account for about 20% of the total network computing power by the end of 2025. According to the company's third-quarter report, it has $291 million in cash and cash equivalents, $40 million in options, completed $360 million in convertible bonds by the end of November, and completed $410 million in shelf offerings (originally planned for $250 million, with $170 million issued, and an additional $330 million). The company’s cash on hand will reach $2.1 billion. Based on TSMC's current wafer prices and Guosheng's latest conference call, the cost for 10,000 wafers at the 3NM process corresponds to $200 million, which corresponds to 90,000 A3 mining machines. 700,000 mining machines correspond to 80,000 wafers, which corresponds to $1.6 billion in capital expenditure. TSMC's latest quarterly report shows that the current 3NM capacity is about 80,000 wafers/month, which will increase to 100,000 wafers/month by 2025. After increasing financing efforts, Bit Deer will actively secure future wafer production capacity to prepare for the early launch of its self-operated mining farms.

Figure 7: After Completing All Financing Increases, Bit Deer’s Cash on Hand Will Reach $2.1 Billion

Source: Bit Deer Company Announcement

Regarding the competitive relationship between Bitmain and Bit Deer. The core of the commercial competition still lies in the performance of mining machines and the cost of self-operated computing power. According to public data and laboratory data, Bit Deer holds a sufficient competitive advantage in both the mining machines produced and self-operated costs. With the development of high-end process chips, mining machines, as the downstream of the industry, will also be affected by the competitive landscape upstream.

Second Growth Curve: AI Computing Power

In addition to mining machine sales and self-operated mining farms, the company’s operational figures report for November showed that it has begun deploying NVIDIA H200 chips in TIER3 data centers for AI computing power construction.

Mr. Wu Jihan wrote an article titled "The Beauty of Computing Power" in 2018: Computing power may be an effective means for humanity to reach a higher civilization and the most effective way to combat entropy increase.

The original intention remains.

NVIDIA's latest 13F report shows that as of the end of the third quarter of 2024, the company has added 7.72 million shares of Applied Digital (APLD), accounting for 3.6%. The latter is committed to transforming into high-performance computing and artificial intelligence infrastructure solutions and cloud services; on December 2, NVIDIA, as a strategic investor, led the investment in the Dutch AI infrastructure service provider Nebius (NBIS), which issued approximately 33.33 million new shares at $21 per share to accelerate the promotion of the AI manufacturing industry. JPMorgan's latest research report predicts that global AI capital expenditure will reach $480 billion by 2025. Recently, major SaaS companies in North America have begun promoting B-end AI Agent services and will increase investment in 2025, which will enhance overall ROI expectations. As a mining farm owner with abundant power resources, transitioning from mining business to AI cloud services is in line with expectations. Bit Deer is currently beginning to engage with large North American technology companies (MEGA7) and will allocate more power to AI cloud services in the medium term.

Investment Recommendations and Valuation

Timing, location, and human factors are the best explanations for investing in Bit Deer at the current moment. The company is well-prepared for growth, with the first and second growth curves expected to rise in tandem, forming a synergy, making it the most cost-effective target among U.S. mining stocks.

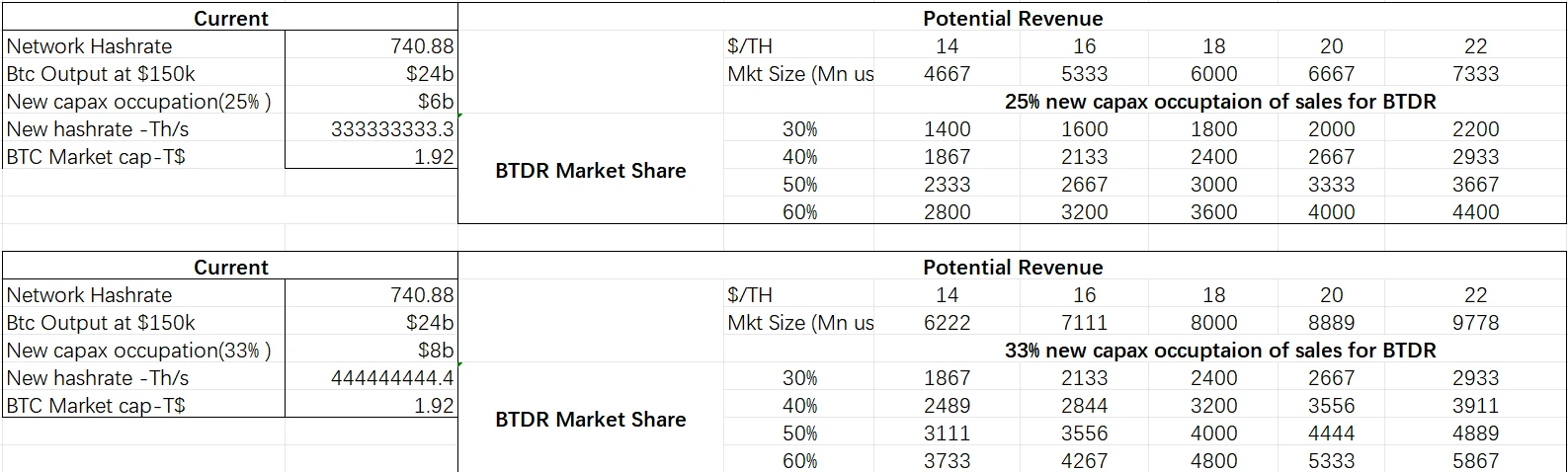

However, valuing the company and defining its value in the profit model presents challenges. The profit valuation generated solely from mining machine sales or self-operated mining farms is insufficient to cover Bit Deer’s true operational situation. Therefore, the two business models are fitted as follows:

Figure 8: Bit Deer Mining Machine Sales Model Calculation

Source: Model Forecast

Figure 9: Bit Deer Self-operated Mining Farm Forecast Model

Source: Model Forecast

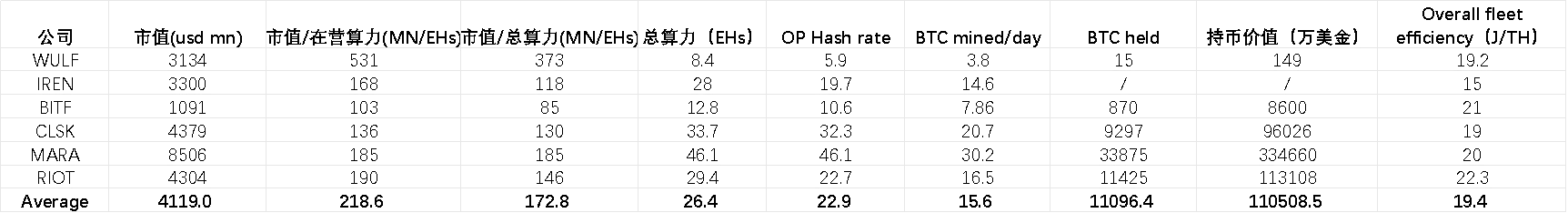

Currently, the average valuation method for mainstream mining companies in North America is $170 million/EH, which is closest to market consensus. It is reasonable to believe that in the next two years, Bit Deer’s actual self-operated mining farms will reach between 120–220EH/s, with a potential market value of approximately $20.4 billion to $37.4 billion, representing a price increase of 4.8–9.7 times from the current stock price.

Figure 10: Valuation of Major North American Mining Companies

Investment Risks:

- Bitcoin price volatility risk;

- Risks from sanctions affecting TSMC wafer production.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。