Web3 New Force Brands Targeting the $30 Trillion RWA Market

Written by: Wenser, Odaily Planet Daily

Influenced by Trump's impending inauguration and a series of potential favorable policies in the U.S., the cryptocurrency market has once again welcomed a trading peak, with BTC prices briefly surpassing $107,000. Countless investment institutions are not only pouring substantial funds into BTC ETFs, ETH ETFs, and other funds but are also seeking new value growth points.

At the same time, as Binance founder CZ previously predicted, the altcoin season has arrived. In addition to established tokens and meme coins, L1 public chain tokens are also experiencing strong growth, particularly SUI, which has continuously broken new highs. The Sui ecosystem not only has a solid foundation in the DeFi sector but also shows significant development in the meme coin sector. Furthermore, unlike other L1 public chains limited to the crypto market, its recent major moves in the RWA sector have brought new possibilities for attracting liquidity and attention from outside the crypto space.

On December 13, Sui officially announced a partnership with Ant Group and its Web3 technology brand ZAN to bring ESG-related RWA (Real World Assets) into the Sui ecosystem. One party is a rising public chain, while the other is a pioneer in digital assets. It appears that both sides will embark on a "spring of RWA" for physical assets, bringing more possibilities to the crypto market. Odaily Planet Daily will analyze this in detail in this article.

The Best Reason to Choose RWA: A Future Market Size of Up to $30 Trillion

The primary reason Sui and Ant Group chose the RWA sector as their collaboration ground is its position at the intersection of TradFi and DeFi, with a potentially massive market size. According to information from RWA.xyz, the current on-chain RWA asset size exceeds $14 billion, with stablecoin assets reaching $20.177 billion and asset issuers numbering 116. However, compared to future prospects, there remains over 100 times the market space.

Global consulting firm McKinsey & Company stated that by 2030, the tokenized asset market (RWA) could reach $4 trillion, with many projects moving from pilot phases to large-scale deployment. Colin Butler, head of global institutional capital at Polygon, previously mentioned that RWA represents a $30 trillion market opportunity globally. High-net-worth individuals and private equity funds will drive adoption in this field, as tokenization brings liquidity and accessibility to historically illiquid asset classes. A previous research report from Tren Finance pointed out that if the RWA industry can reach an expected median of about $10 trillion, its value would increase by more than 54 times compared to the current level.

Information from RWA.xyz website

According to asset management giant Bitwise's earlier released "Top 10 Predictions for the Crypto Market in 2025," the RWA market size is expected to reach $50 billion by 2025, with the potential for exponential growth as Wall Street institutions accelerate their entry. Venture capital firm ParaFi predicts that the tokenized RWA market could grow to $2 trillion by 2030, while the Global Financial Markets Association forecasts it could reach $16 trillion. Such a hot market expectation has naturally attracted a host of world-class giant institutions:

Goldman Sachs' digital asset platform has officially launched and helped a European investment bank issue €100 million in two-year digital bonds. Additionally, Goldman Sachs has partnered with traditional financial institutions to launch related businesses and plans to build a private chain for asset tokenization.

Siemens Group previously issued €60 million in on-chain digital bonds, marking the "first attempt in the RWA field."

Financial giants like HSBC, JPMorgan, and Citigroup are also exploring the tokenization of government bonds to improve financial efficiency and settlement speed.

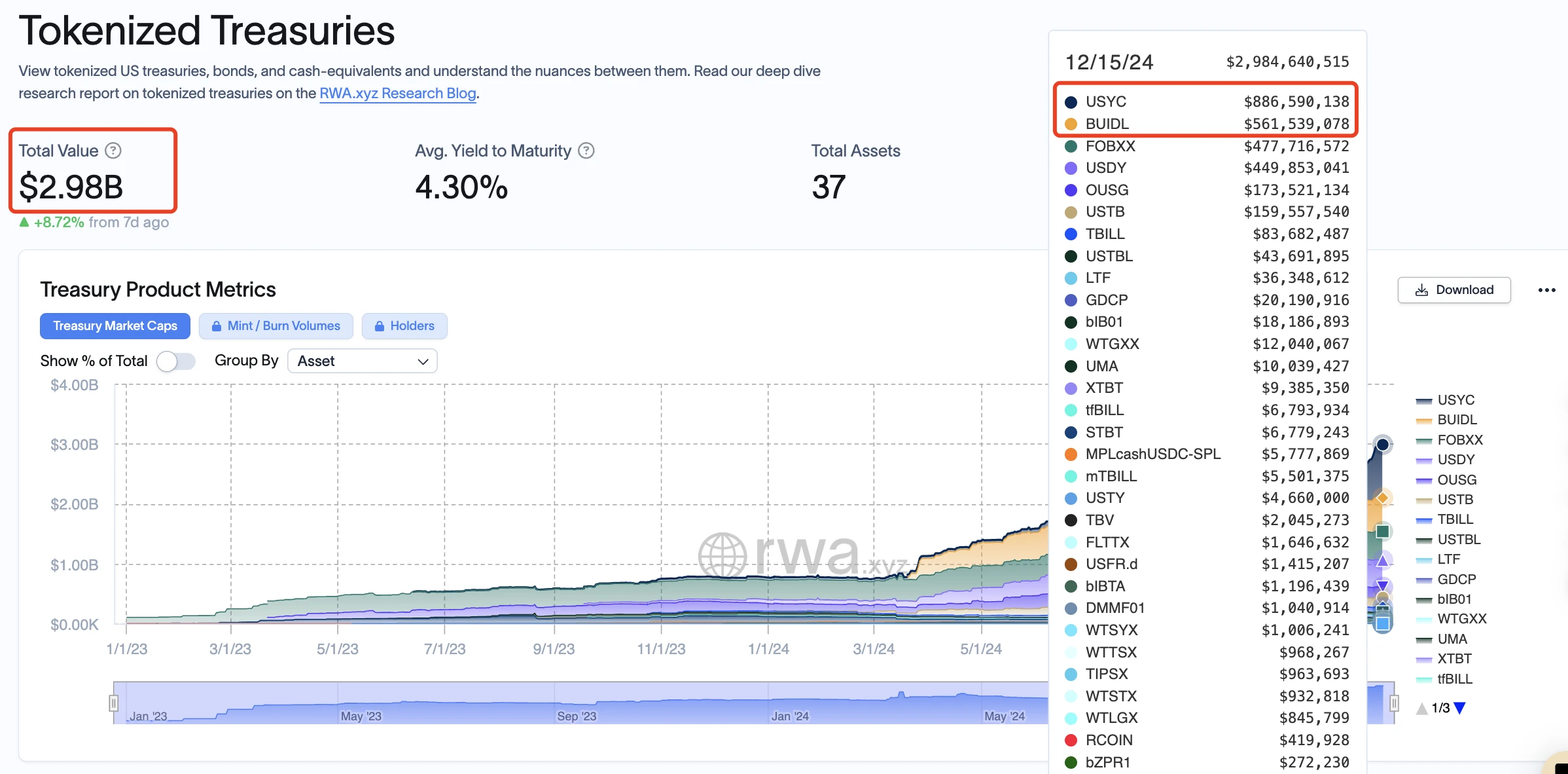

The U.S. Treasury RWA market is currently nearing $3 billion, having grown nearly 30 times from $100 million at the beginning of 2023, with USYC, launched in collaboration with Hashnote and cryptocurrency custodian Copper, reaching $880 million; BlackRock's BUIDL has reached $560 million.

Information on the U.S. Treasury RWA market

It is understood that the collaboration between Ant Group and Sui primarily aims to promote the tokenization of ESG-related RWA, expanding its reach to global investors, with the underlying assets being renewable energy assets from a Chinese solar materials manufacturer.

As a blockchain ecosystem that has seen its TVL grow over 14 times to $14 billion this year, supported by U.S. asset management giants like Grayscale and VanEck, Sui views the RWA market as "the next growth point." Jameel Khalfan, head of ecosystem development at Sui Foundation, stated, "Tokenization of the ESG market is a significant step forward for real-world assets. Through this collaboration, investors will be able to enter a whole new market, all happening on the most suitable platform, Sui."

It is evident that RWA has become a strategic track valued by both blockchain networks and digital asset institutions, with extremely high industry value.

Dual Support for RWA Development: Internal Advantages and Market Demand

Specifically, the strategic significance of the RWA track is reflected in the following three aspects:

Asset Transparency and Efficient Trading: By tokenizing physical assets and introducing them to the blockchain network, investors can deeply participate in market transactions through the transparency of on-chain data and the high efficiency of on-chain operations.

Enhanced Liquidity of Physical Assets: Based on improved transparency and enhanced security, RWA assets can achieve partial ownership splitting, significantly increasing the digital liquidity of physical assets.

Acting as a Bridge Between Traditional and Crypto Markets: By introducing low-risk, high-return tokenized products, more physical assets and investors will inject a new wave of liquidity into both traditional and crypto markets, revitalizing real-world physical assets while bringing more quality targets and liquidity to the crypto market.

RWA can represent many different types of traditional assets, including tangible and intangible assets. In overseas markets, RWA mainly consists of bonds and gold.

Why did Sui, a leading blockchain network in the crypto market, choose Chinese renewable energy assets?

Industry experts point out that "this reflects, to some extent, the 'industrial characteristics of China'." According to data from the Forward Industry Research Institute, in 2023, China's renewable energy industry accumulated installed capacity reached 1.57 billion kilowatts, with a five-year compound growth rate of 15.31%. From solar power generation to charging piles and new energy vehicle products, renewable energy has become China's "new label." "These renewable energy assets, once converted into RWA, have high potential and high growth." said the aforementioned individual.

It can be said that the tokenization of physical assets into RWA will truly promote a deep coupling of Web3 technology and digital assets, achieving the digital redevelopment of real assets.

Looking Ahead: New Possibilities for Diversified Development Routes in the RWA Market

In the past, the development of the RWA track mainly revolved around fixed assets like U.S. Treasury bonds, with relatively single asset types and technical routes. Thanks to the deep cooperation between Ant Group and its Web3 technology brand ZAN with Sui, both parties will jointly promote the tokenization of RWA assets on a larger scale, injecting new vitality into traditional and crypto markets from aspects such as technical support, ecosystem development, and capital introduction.

"By tokenizing traditional assets from low liquidity environments to high liquidity markets," BiFinance Research Institute mentioned in its latest report, "this collaboration will bring quality assets in the ESG field into the blockchain, empowering the real industry and is expected to become a new driving force for the bull market."

Previously, Ant Group launched the largest on-chain asset platform for renewable energy in China—composed of "Asset Chain," "Transaction Chain," and "Ant Chain Trusted Cross-Chain Bridge," with over 12 million devices on-chain; the Web3 product ZAN aimed at overseas markets has also been launched. The total market capitalization of the Sui blockchain has reached $13 billion, with total locked value (TVL) exceeding $18.9 billion. After the announcement of their collaboration, Sui's price surged 10% within 24 hours, setting a new historical high.

In the future, with the support of Sui's ecosystem, the RWA market landscape for both parties is expected to welcome a new round of expansion. It is foreseeable that the spring of the RWA market is about to arrive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。