Major cryptocurrency custodians are turning to the European market and providing excess returns for investors through on-chain staking services.

Written by: Pzai, Foresight News

The compliance of cryptocurrencies is gaining momentum, with ETFs/ETPs receiving significant attention from market investors as important asset investment vehicles. On December 17, cryptocurrency asset management company Bitwise launched a Solana staking ETP in Europe, with the stock code BSOL. Notably, this ETP was issued in collaboration with the Solana staking service provider Marinade, offering users an annualized return of 6.48%, standing out among various ETPs. Before Trump's presidency, Europe took the lead in the rapid progress of cryptocurrency compliance outside the United States by introducing the Markets in Crypto-Assets Regulation (MiCA), which clearly delineates the issuance and custody of crypto assets. As a result, Europe has become one of the few regions supporting compliant products and the integration of on-chain economic returns.

First-Mover Advantage

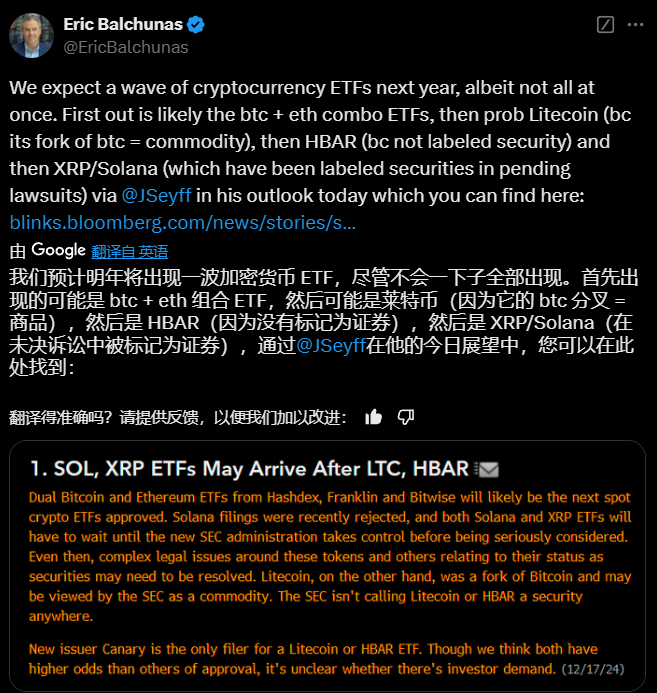

Before launching this ETP, Bitwise registered a Solana-related statutory trust in Delaware, USA, in November this year, aiming to provide potential Solana ETF services for American investors in the future. With the approval of spot ETFs for Bitcoin and Ethereum this year, expectations for a Solana ETF are also rising. However, for American investors, the constraints of existing securities laws and the SEC's compliance progress regarding Solana's classification as a security have led to an uncertain date for the issuance of a Solana ETF in the U.S., and investors cannot access staking returns from these products. In ETF listing predictions, Bloomberg analyst Eric Balchunas placed Solana and XRP, which are closely monitored by the SEC, at the bottom of the priority list for ETF decisions. Under these circumstances, major cryptocurrency custodians are shifting to the European market and providing excess returns for investors through on-chain staking services, while granting investors greater freedom.

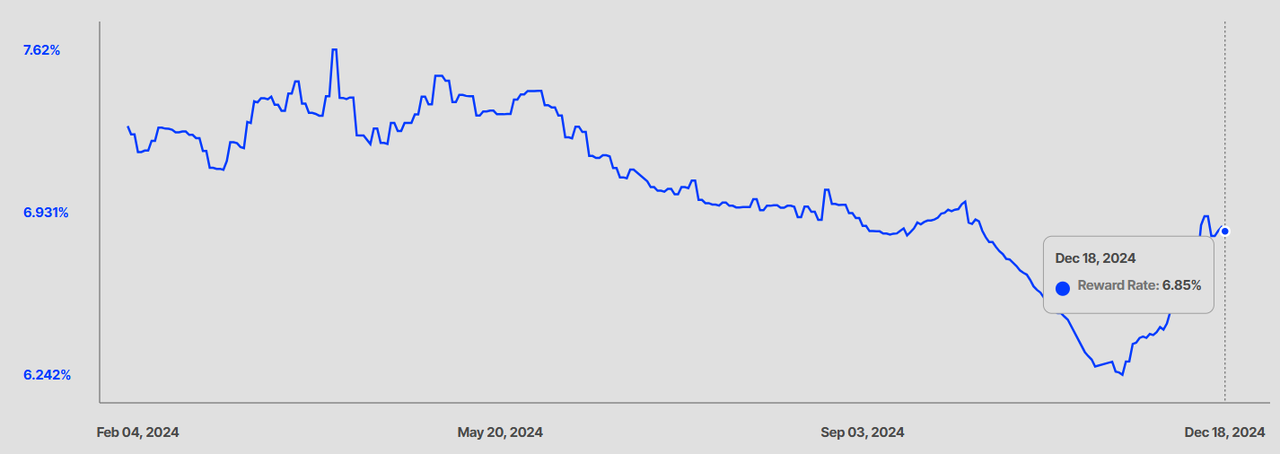

Prior to Bitwise, VanEck and 21Shares had already entered the market, with 21Shares achieving over $1.2 billion in total scale for its Solana ETP, reflecting investor preference for Solana. Investment in staking-type products also demonstrates investor confidence in network activity. Over the past year, Solana has performed exceptionally well in on-chain activities, with its network staking annualized return once soaring above 7.5%, surpassing many types of ETF products.

Annualized staking returns of SOL over the past year (Source: stakingrewards.com)

Annualized staking returns of SOL over the past year (Source: stakingrewards.com)

Compliance Implementation in Europe

At a time when the cryptocurrency sector is thriving, Europe has taken the lead in responding to the rapid market developments and challenges by introducing the Markets in Crypto-Assets Regulation (MiCA). This legislation officially became law in 2023 and will conclude its transition period on June 30, 2026. MiCA aims to establish a unified regulatory framework for the cryptocurrency market, clarifying the scope of the law's applicability, the classification of crypto assets, regulatory authorities, and corresponding information reporting systems. This makes the EU the first jurisdiction in the world to adopt comprehensive cryptocurrency regulations, which is significant for companies looking to enter the EU cryptocurrency market. For ETF service providers, while offering services in Europe, the improvement of the compliance environment can create a regional migration effect, serving as a model for subsequent new government administrations and the crypto compliance matters under Paul Atkins' leadership at the SEC. The market expects custodians to use the staking ETP infrastructure adopted in Europe to offer the same products in the U.S.

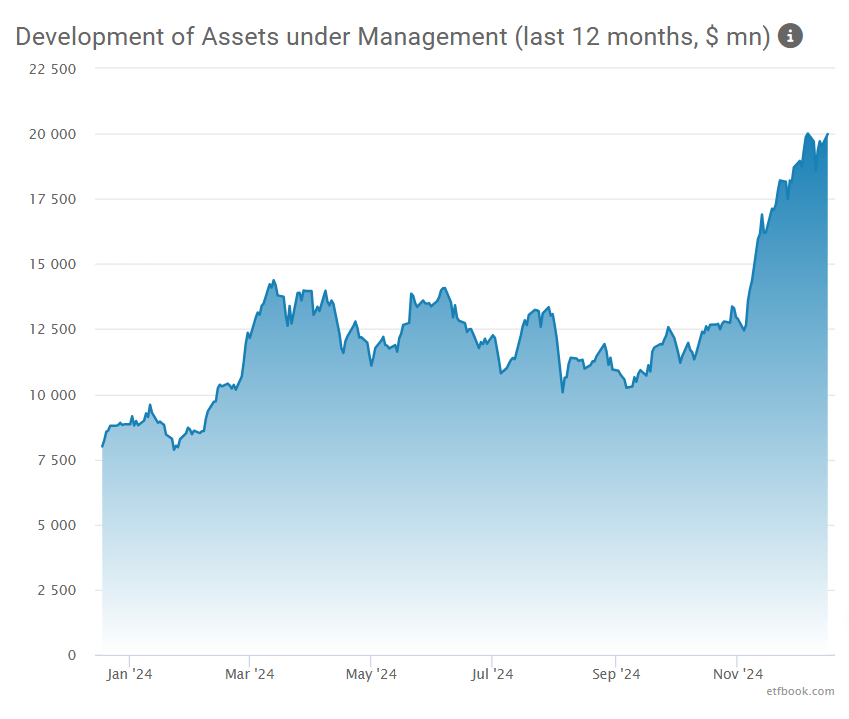

Globally, especially in Europe, the number of cryptocurrency ETPs and the scale of assets under management are rapidly increasing. As of today, there are 222 cryptocurrency ETPs in the European market, with assets under management (AUM) reaching $20 billion, growing nearly 60% in the past month. These products provide retail and institutional investors with a convenient, regulated, and low-cost way to access a range of underlying investments, including but not limited to Bitcoin, Ethereum, and other mainstream cryptocurrencies. Additionally, as more traditional financial institutions (such as BlackRock) join the ranks of cryptocurrency-native companies issuing products, ETPs not only expand investors' access to cryptocurrency investments but also enhance the overall acceptance of cryptocurrencies in global financial markets.

With the compliance environment established in Europe, it is expected that more compliant product models will be launched in Europe first (such as RWA, compliant custody, stablecoin payments). This not only reflects the EU's open attitude and effective regulatory framework as a testing ground and incubator for cryptocurrency compliance but also provides valuable experience for other global markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。