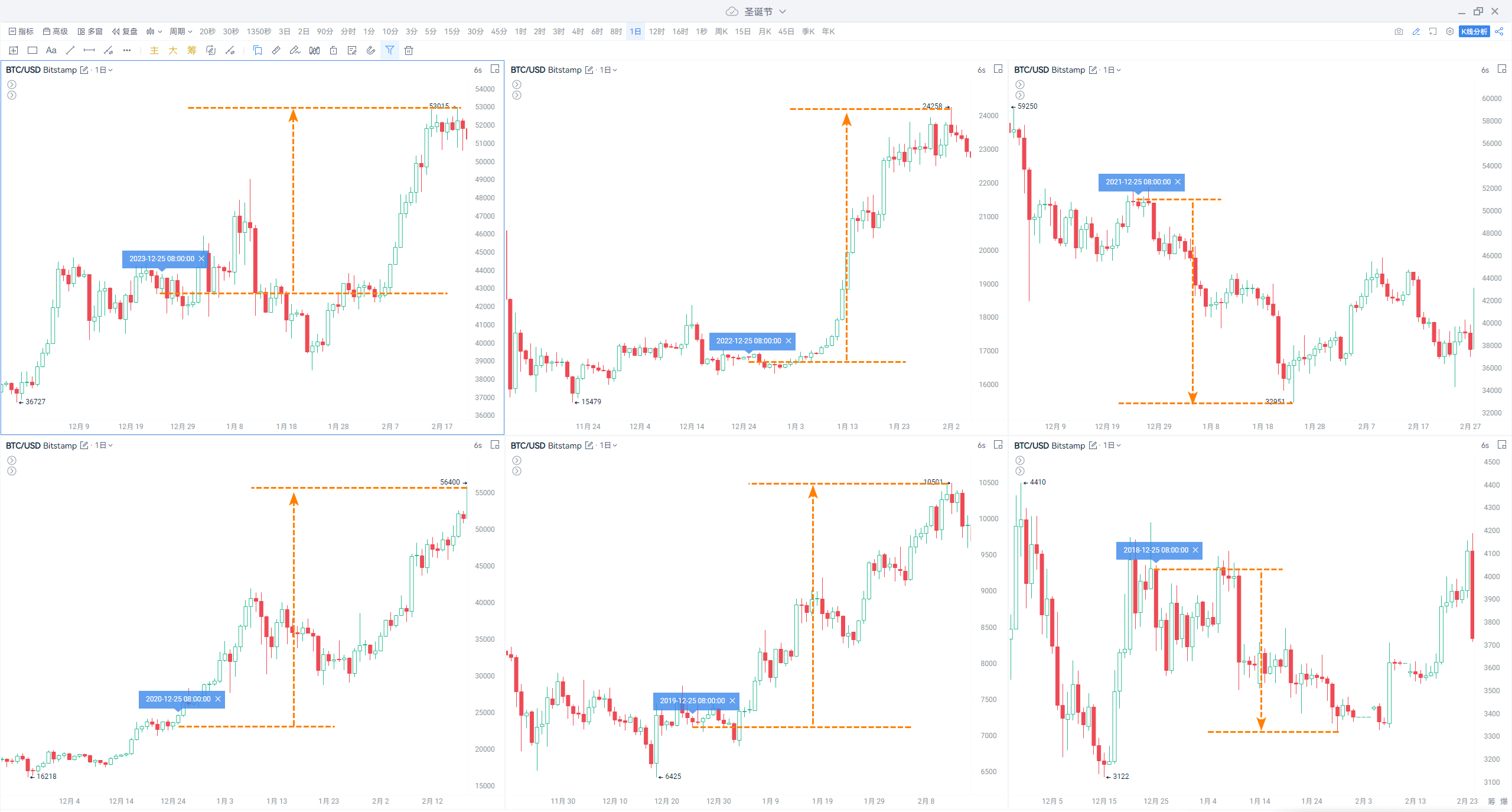

Every December, the crypto market always puts on a crazy stage play of "Christmas market trends." This is not unfounded; it is a market phenomenon with traceable patterns. According to data from the past eight years, Bitcoin has closed with "three ups and three downs" on Christmas Day, with a maximum fluctuation of 9.28%. Moreover, after Christmas, there have been four instances of a bull market starting, with the highest increase exceeding 177%!

Behind this revelry is the heightened investor sentiment and accelerated market liquidity release. In other words, this is the year-end party of the crypto world, with Bitcoin as the main character on stage.

However, this year's "Christmas market trend" may be more special than ever. Market analysts have already begun to call out a short-term target of "120,000 USD," and some have boldly predicted that Bitcoin will reach six-figure heights within the next few years. Next, we will delve into the underlying logic of this phenomenon and explore how to efficiently seize this wave using the "one-to-many" high-efficiency ordering tool.

1. Bullish Sentiment Soars: What Surprises Will the Year-End Market Bring?

• Short-term Target: 120,000 USD

From the market trend, Bitcoin's price has recently shown strong upward momentum. Multiple analysts point out that the year-end frenzy combined with increased liquidity may push Bitcoin to break through the 120,000 USD mark in the short term.

More importantly, the participation of institutional investors is rapidly increasing, while the supply of Bitcoin in the spot market continues to decrease. This supply-demand imbalance will further intensify the likelihood of price increases.

According to AICoin PRO data, large spot traders on Binance are focusing their bets on the 110,000 USD and 120,000 USD levels, with order amounts exceeding 30 million USD; at the same time, large traders on Bitstamp have placed seven large orders above 110,000 USD that have lasted over six days, demonstrating the confidence of the main players.

• Long-term Aspiration: 800,000 USD

If 120,000 USD is the short-term target, then analysts' predictions for the next few years are even bolder. Some analysts suggest that by 2025, Bitcoin's price could reach 800,000 USD or even higher. This prediction is not only based on historical halving cycles but is also driven by macro factors such as Trump potentially becoming the next U.S. president and the Federal Reserve's interest rate cuts.

As more institutions position themselves in Bitcoin, the acceptance of crypto assets in traditional financial markets is also continuously increasing. From a safe-haven asset to a store of value, Bitcoin's role is becoming increasingly diversified. Behind this lies a common demand among global investors to combat inflation and hedge risks.

2. One-Click Control of Multiple Accounts: Precisely Locking in Market Opportunities

• Multi-Account Ordering: Making Trading Simple and Efficient

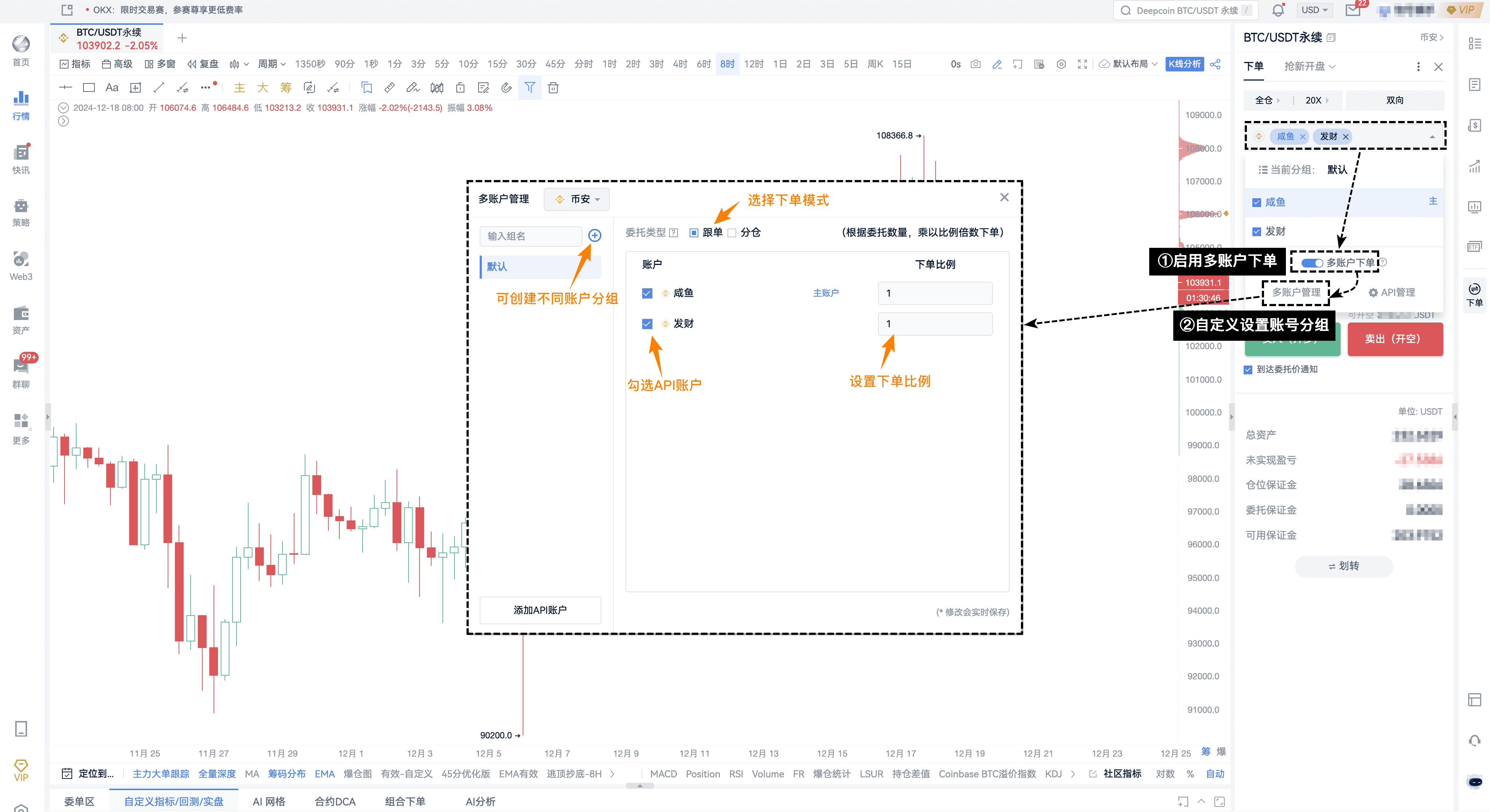

In the face of such a highly volatile market, relying solely on a single account may no longer meet investors' needs. AICoin's multi-account ordering feature provides a new solution for complex trading scenarios. With this tool, users can manage multiple API accounts simultaneously, achieving synchronized operations across accounts and significantly improving trading efficiency.

This feature is especially suitable for professional investors who need to operate multiple accounts simultaneously, such as institutional traders, risk management experts, or team leaders. By centralizing management, users can quickly execute trading strategies without frequently switching accounts.

• "Copy Trading" or "Split Position"? Flexible Modes to Meet Personalized Needs

AICoin's multi-account ordering feature supports two core modes: copy trading mode and split position mode.

1. Copy Trading Mode: After placing an order in the main account, other accounts will automatically complete the order according to a preset ratio. For example, if a user wants four accounts to place orders in a 1:2:3:4 ratio, they only need to input the order quantity in the main account, and the other accounts will automatically complete the operation proportionally. This mode is particularly suitable for synchronously executing multi-account strategies, saving time and increasing efficiency.

2. Split Position Mode: In this mode, users can allocate the total order quantity to multiple accounts. For example, if a user wants to place a total order of 1,000 units, distributed in a 1:2:3:4 ratio among four accounts, the system will automatically complete the allocation. This mode is more suitable for investors who need to evenly spread risk.

3. Quick Batch Operations: From Take Profit and Stop Loss to Synchronized Order Cancellation, None Can Be Missed

In addition to placing orders, AICoin's multi-account ordering feature also supports batch order cancellations, batch order modifications, and other operations. More importantly, users can directly copy trading strategies to multiple accounts through this tool, greatly simplifying the complexity of strategy execution.

For example, the leader of a trading team can apply their trading strategy to client accounts, ensuring that all accounts perform synchronized operations at the same time, avoiding missed market opportunities due to delays. Whether it's market price closing or take profit and stop loss, this feature provides users with great convenience.

4. Efficiently Empowering Trading: A User Guide for Multi-Account Ordering

Getting started with the multi-account ordering feature is actually not as complicated as one might think. Here are the quick start steps:

1. Preparation: Download and log in to the AICoin PC client, and authorize trading.

2. Enable Feature: Enable the "Multi-Account Ordering" feature in the ordering panel.

3. Select Accounts: Connect the API accounts that need to follow the operations.

4. Set Groups and Modes: Choose "Copy Trading Mode" or "Split Position Mode" based on needs, and adjust the order ratios.

5. One-Click Operation: Whether buying, selling, or canceling orders, just perform the operation in the main account, and the other following accounts will automatically synchronize.

6. Monitor and Adjust: Use the multi-account position management feature to monitor account dynamics in real-time and flexibly adjust strategies.

For detailed operation guide, see: https://www.aicoin.com/article/430706.html

5. Seizing Year-End Market Trends: Tools and Strategies Go Hand in Hand

Whether it's the short-term bullish expectations for Bitcoin or the optimistic outlook for the medium to long term, the market is providing investors with unprecedented opportunities. AICoin's multi-account ordering feature is an important tool to help investors efficiently seize these opportunities.

With this feature, investors can not only simplify the trading process but also manage risks more flexibly and maximize returns. In the face of the highly volatile crypto market, having quality trading tools may be the key to gaining an advantage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。