Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: December 18, 15:19 Beijing time

Market Information

- The Federal Reserve is cautiously lowering interest rates, and Bitcoin is taking a slight break after a doji candle;

- Arthur Hayes: Expects the market to crash around January 20, and Maelstrom will reduce positions in advance;

- Arthur Hayes: High expectations from crypto investors for Trump may lead to a vicious sell-off;

- The Chairman of the U.S. Senate Banking Committee calls cryptocurrency the "next miracle" of the world;

- Bank of America survey: Influenced by factors such as Trump's second term, investor sentiment in December is super optimistic;

Market Review

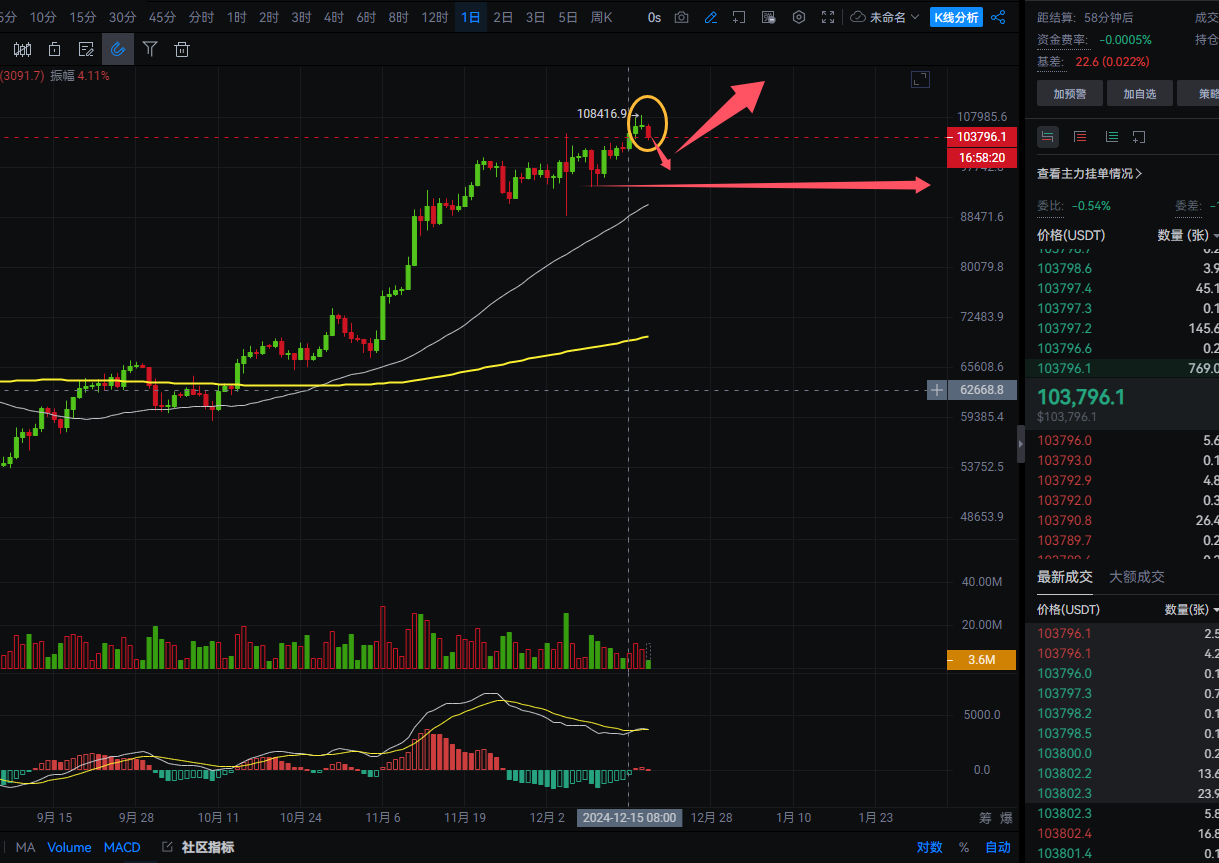

Yesterday, both Bitcoin and Ethereum showed strong bullish trends. Bitcoin also refreshed its high as expected, but after reaching the high, it did not continue to rise to around 110,000. The highest point was at 108,416. The profit from the long positions set yesterday was only 1,000-2,000 points. Those who did not exit should have stopped loss by now. The rebound of Bitcoin was given, and the high was refreshed, but the rebound did not continue. This morning, it started to show a correction, and Ethereum performed even worse. When Bitcoin refreshed its high, Ethereum barely moved, and when it fell, it followed suit, breaking below the 4,000 level. Those who set long positions should have also stopped loss. In the offline group, Bitcoin took profits while Ethereum stopped loss, which is a bit absurd. Bitcoin is showing short-term bearish signals, and the decline will continue. Those who want to go long should wait a bit longer; this wave of correction may be a bit deep. Tonight is also the Federal Reserve's interest rate decision, with a high chance of a 25 basis point cut. However, Bitcoin has already consumed most of the expectations for a rate cut with such a high rebound before the cut. Once the shoe drops, I believe there will be little opportunity to push the price up again. In trading, it is recommended to wait for a correction before going long or to seize this wave of correction opportunity;

Market Analysis

BTC:

From the daily chart, today's Bitcoin daily line has shown a short signal, with a high position doji. The daytime also showed a decline, and the current trend is a large bearish candle. There has not yet been a rebound signal in the short term. Pay attention to whether the previous short-term low of 94,039 can be broken. If it does not break, there is not much problem; it is a normal correction and still operating within an upward channel. The target range for this decline is 99,500-97,100. After reaching this range, consider setting long positions based on the lower shadow line situation. In short-term trading, you can wait for the decline, or you can set a light short position around 105,000, with a stop loss not exceeding 2,000 points. The target is the 99,500-97,100 range. Manage your entry opportunities; in short-term trading, control risks and manage your own profits and losses;

ETH:

From the daily chart, Ethereum has again broken the short-term high of 4,096 and the previous high of 4,090, with a maximum of 4,109, indicating a strong bullish trend. However, the market is not absolute; when Bitcoin rises, Ethereum does not move, and when Bitcoin falls, Ethereum follows the decline. Since the market has not continued to rise, and Bitcoin has started to correct, plus there is a doji on the Ethereum daily line, this wave of Ethereum's rebound also needs to wait a bit longer. In the short term, pay attention to whether the lower level of 3,451 can be broken. The upward momentum of Ethereum is still not as strong as Bitcoin, but the correction is much faster. The short-term decline target range for Ethereum is 3,710-3,610. After reaching this range, consider going long if a long lower shadow line is formed. In trading, you can wait for the decline to open long again, or you can set a light short position around 3,870, with a stop loss suggested to be controlled around 100 points, targeting the 3,710-3,610 range. Manage your entry opportunities; in short-term trading, control risks and manage your own profits and losses;

In summary:

Both Bitcoin and Ethereum have shown short-term correction signals, and there is still room for decline;

The article is time-sensitive, be aware of risks, the above is only personal advice, for reference only!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

Everything, the root of suffering is the pursuit of certainty. Impermanence is the norm and the way life should be. Always wanting to grasp the market, not acting on a 50% certainty, not acting on a 70% certainty, must wait for a 100% certainty. Where is there a 100% certainty in the market? Trading is about trading risks, trying to make the odds stand on your side. Those who give love will receive love in return; those who bring blessings will receive blessings. Sometimes, learn to take a little loss, be a bit foolish, a bit clumsy. For example, if the market is bullish, once this is confirmed, don’t get too stuck on the position, lower the position a bit, and then get in first. At worst, it will reverse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。