Hyperliquid is an innovative decentralized platform focused on efficient perpetual contract trading, offering perpetual contracts, spot trading, and a low-latency, high-throughput Layer 1 chain trading environment. It employs HIP-1 and HIP-2 to enhance liquidity, requires no KYC, has low fees, supports HyperEVM for DeFi application development, and incentivizes community participation through the HYPE token. As of December 2024, it has reached 230,000 users, a trading volume of $500 billion, and an asset accumulation of 1.12 billion USDC, with an ecosystem that includes projects like PURR, HFUN, and farm. The total supply of HYPE tokens is 1 billion, distributed through various methods to incentivize ecosystem development. The team consists of experts in the trading field, led by Jeff, who rejects external investment and is committed to becoming a top-tier high-performance public chain, focusing on user experience and decentralization principles to attract more users and developers to enrich its ecosystem.

Project Introduction

Hyperliquid is an innovative decentralized trading platform focused on efficient perpetual contract trading. It has attracted significant attention from users and investors through its unique liquidity aggregation technology and the distribution strategy of its native token HYPE.

Website: https://app.hyperliquid.xyz/

Twitter: https://x.com/HyperliquidX

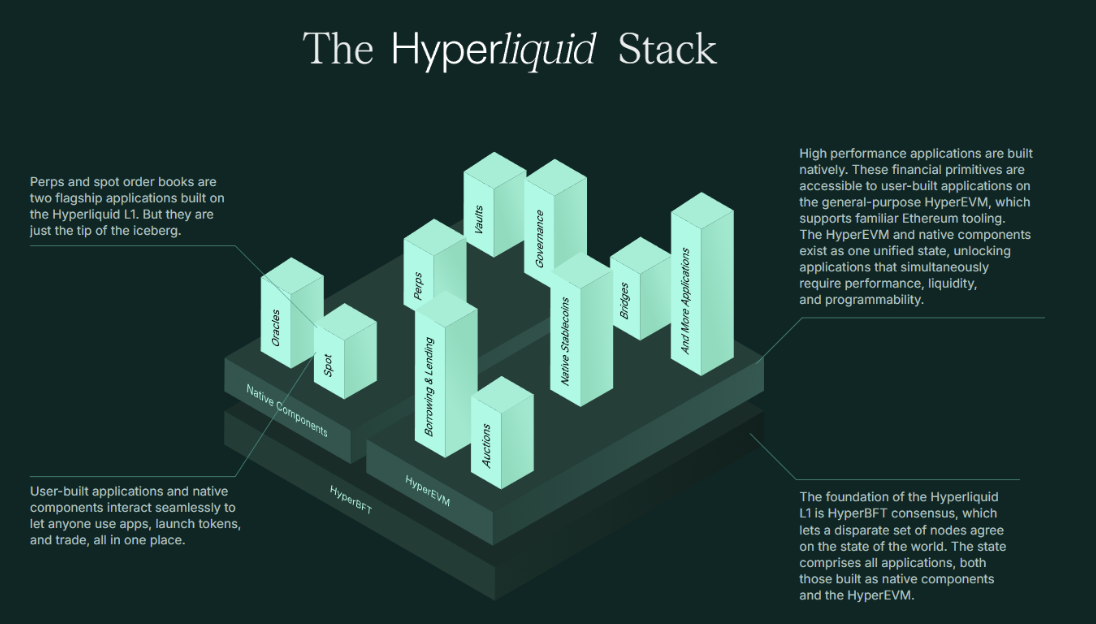

Figure 1 Hyperliquid Product Development

1. Product Features

Perpetual Futures Trading: Users can trade perpetual contracts with no expiration date on Hyperliquid, supporting leverage trading of up to 50 times.

Spot Trading: In addition to derivatives, Hyperliquid also supports spot trading, allowing users to buy and sell crypto assets directly.

High-Performance L1 Chain: Hyperliquid is built on its proprietary Layer 1 blockchain, supporting high throughput and low latency, providing an almost instant trading experience.

HIP-1 and HIP-2 Standards: HIP-1: Allows the deployment of native tokens on-chain and the creation of a spot order book.

HIP-2: The "Hyperliquidity" mechanism provides an innovative way to ensure liquidity, permanently locking it in the HIP-1 token's spot order book.

No KYC Trading: As a decentralized platform, Hyperliquid does not require users to undergo identity verification (KYC), offering greater privacy protection.

Low Fees: Hyperliquid has set low trading fees, particularly with a negative fee model for makers, incentivizing users to provide liquidity.

HyperEVM Support: Hyperliquid supports an enhanced EVM, allowing developers to build various DeFi applications on it while seamlessly integrating with native components.

Community Participation and Rewards: Through a points system and airdrops, Hyperliquid encourages users to participate and contribute to the ecosystem's development, with the distribution strategy of the HYPE token also aimed at incentivizing long-term community involvement.

2. Advantages of Hyperliquid

Decentralization and Transparency: As a decentralized platform, Hyperliquid provides completely transparent trading records and a KYC-free trading experience, enhancing user privacy and security.

High-Performance Trading: Built on its dedicated Layer 1 chain, Hyperliquid supports high throughput and low latency, providing fast trade execution and reducing slippage.

Innovative Liquidity Mechanism: Through HIP-1 and HIP-2 standards, Hyperliquid introduces a new liquidity model, "Hyperliquidity," ensuring market depth and stability.

Low Trading Fees: The negative fee strategy for makers and the overall low fee structure significantly reduce trading costs, attracting more traders.

Diverse Trading Products: Supporting both perpetual contracts and spot trading, it meets the trading needs of different users.

User Incentives: Through the distribution of HYPE tokens and community participation rewards, Hyperliquid incentivizes users to engage long-term and contribute, building an active ecosystem.

Community Governance: A community governance mechanism will be introduced in the future, allowing HYPE token holders to participate in the platform's decision-making process.

EVM Compatibility: HyperEVM supports developers and applications within the EVM ecosystem, expanding its application possibilities in the DeFi space.

Compliance and Openness: Despite being decentralized, Hyperliquid is also committed to compliance, ensuring that its services can operate legally worldwide.

Figure 2 Technical Principles of HyperLiquid

Source: HyperLiquid

3. Data Analysis

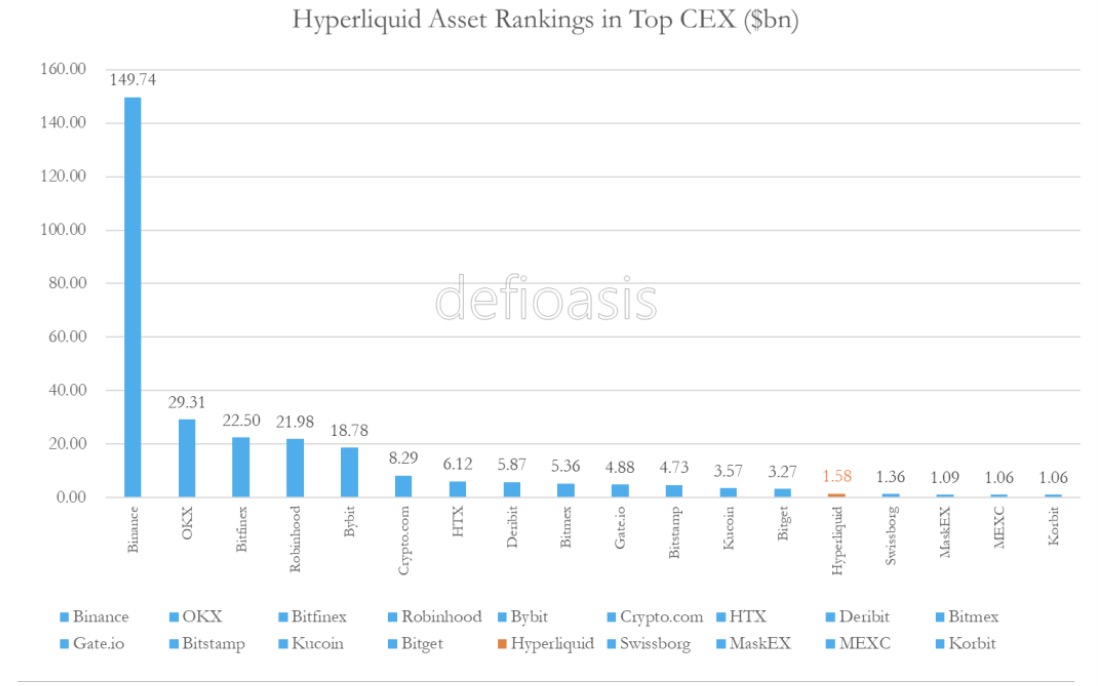

Hyperliquid is customized as a high-performance derivatives exchange Layer 1 and is EVM compatible. Assets deposited in Hyperliquid are primarily facilitated through the Arbitrum Bridge, currently supporting USDT, USDC.e, and USDC assets on Arbitrum, but only USDC is accepted as collateral. As of December 14, the assets in the Hyperliquid Deposit Bridge contract: 0x2D…3dF7 reached 1.12 billion USDC and are still on the rise. When comparing Hyperliquid's asset accumulation with the clean assets of CEXs, Hyperliquid ranks as the fourteenth largest exchange globally, surpassing MEXC (approximately $1.09 billion), with its next target being Bitget (approximately $3.27 billion).

Comparison of CEX Asset Accumulation

Source: @defloasis

Overall Data: As of December 14, HyperLiquid's total user count has reached 230,000, with a total trading volume of $500 billion.

Figure 3 Overall Data of HyperLiquid

Source: HyperLiquid

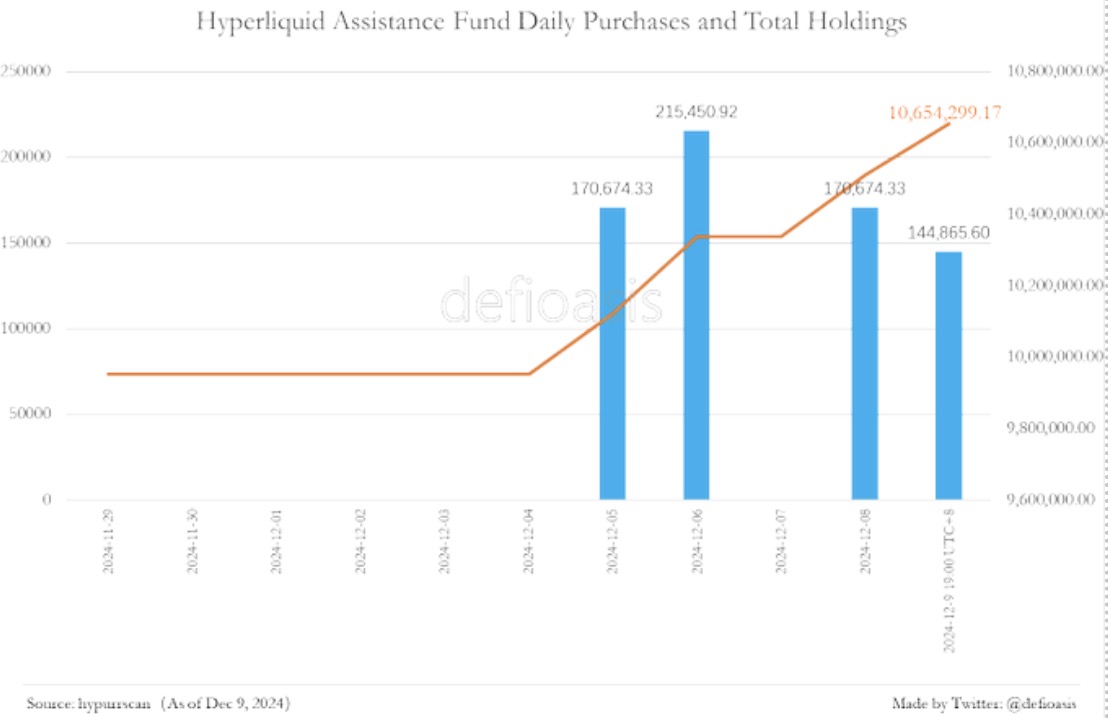

Hyperliquid Assistance Fund, Profits Exceeding $82 Million

The funding for the Hyperliquid Assistance Fund primarily comes from the contract trading revenue of the Hyperliquid platform, where a portion of the USDC fees goes into this fund to support various activities of the platform, mainly including the repurchase of HYPE tokens. According to the hypurrscan browser, from December 5 to December 9, 19:00 UTC+8, the Assistance Fund repurchased 567,083.22 HYPE from the secondary market, with a repurchase value of $7,364,369.45, at an average price of approximately $12.99.

Figure 4 Changes in Hyperliquid Assistance Fund

Source: defioasis

4. Token Ticket Auction for Spot Positions

Projects wishing to launch on Hyperliquid need to obtain permission to issue new tokens through a Dutch auction mechanism, typically held every 31 hours. For a long time, Hyperliquid's focus has been more on derivatives trading, and participants in the Token Ticket Dutch auctions have mostly been meme-based, with auction prices rarely exceeding $20,000. However, with the wealth effect and popularity brought by the HYPE TGE, as well as the opening of Hyperliquid EVM, it is expected that more types of projects will consider issuing tokens on Hyperliquid. Additionally, some important tickets that were previously auctioned at low prices may be selected by a legitimate project with the same name in the future, becoming a shell for launching on Hyperliquid and then being bought back at a higher price by the original project.

In recent auctions, the final prices have risen significantly, with the Token ticket for "SOLV" setting a new auction record for Hyperliquid at $128,000 on December 6, considering that Solv Protocol is about to TGE, this "SOLV" is likely to be that SOLV. If so, Solv Protocol will become the first major project to launch on Hyperliquid.

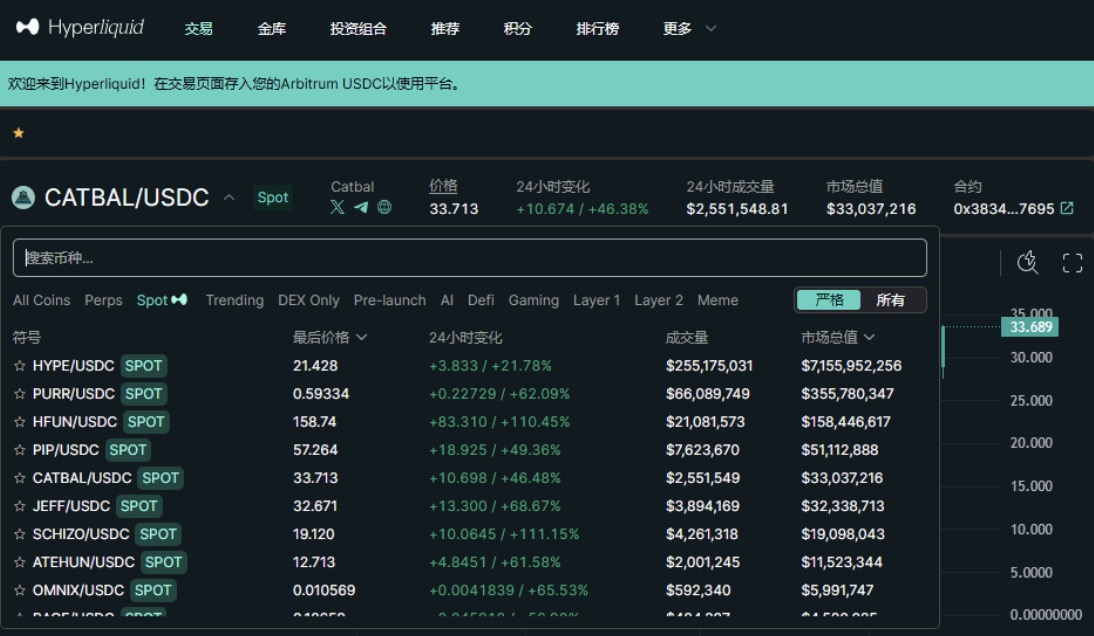

Analysis of Hyperliquid Ecosystem

Many people believe Hyperliquid is a decentralized derivatives exchange, but its essence is a high-performance L1 public chain with zero gas fees. The market capitalization of the $HYPE token has reached $20 billion, directly comparable to Sui and Solana. Many high-quality projects have already emerged within the ecosystem.

1. Meme Leader of the Ecosystem: PURR

Twitter: https://x.com/hyperintern

This is the leading meme project of Hyperliquid, with a market capitalization of $340 million and a daily trading volume reaching $65 million, already achieving significant scale.

2. Token Launch Platform in the Ecosystem: HFUN

Website: https://hypurr.fun/ can be simply understood as a pump platform on the Solana chain. Currently, it has a market capitalization of $150 million and a daily trading volume of $20 million.

3. The First AI Agency Project: farm

Twitter: https://x.com/thefarmdotfun can be simply understood as projects like ai16z or virtual, currently with a market capitalization of $36 million and a daily trading volume of $43 million.

Overall, HyperLiquid's decentralized derivatives business has been very well established. Both user experience and liquidity are top-notch. However, the ecosystem is still on the brink of explosion.

Figure 5 HyperLiquid Market Data

Token Economic Model

Total Supply: The total supply of HYPE tokens is 1 billion.

Token Distribution: Genesis Distribution: 31% of the tokens (310 million) were allocated to users participating in the genesis event, and these tokens are fully unlocked.

Future Emissions and Community Rewards: 38.888% of the tokens are allocated for future emissions and community incentives, including distribution through activities, points, and participation rewards.

Core Contributors: 23.8% are allocated to the team and early contributors, with these tokens locked for one year after the genesis, most of which will unlock between 2027-2028, and some will continue to unlock after 2028.

Hyper Foundation Budget: 6% is used to support the development and ecosystem building of Hyperliquid.

Community Grants: 0.3% is allocated for grants to community projects.

Hyperliquidity (HIP-2): 0.012% is allocated to the "Hyperliquidity" mechanism for permanently locking liquidity.

Use: Trading Fees: HYPE tokens can be used to pay trading fees on the Hyperliquid platform.

Governance: A governance mechanism may be introduced in the future, allowing users holding HYPE tokens to participate in platform decision-making.

Incentives: A points system and airdrop activities are used to incentivize users to participate and provide liquidity.

Points System: Points can be earned through trading volume, participation in activities, etc., which can be converted into HYPE tokens or other rewards, promoting user activity and the healthy development of the platform ecosystem.

No Private Placement or Centralized Exchange Allocation: Hyperliquid has not reserved HYPE tokens for private investors, centralized exchanges, or market makers to maintain its decentralized philosophy.

Team Background

The Hyperliquid team consists of experts who have served as market makers in centralized exchanges, providing services for multiple large platforms from 2020 to 2022. Currently, the only publicly identified member is HyperLiquid's founder Jeff (https://x.com/chameleon_jeff).

Investment and Financing Background: None, has not accepted any institutional investments.

Project Summary

HyperLiquid's ultimate goal is to become a top-tier high-performance L1 public chain. Founder Jeff learned from the dilemma of no trading after airdropping on other decentralized derivatives exchanges that only by putting users first can the project truly progress and improve. Therefore, the project has rejected all investment institutions and collaborations. It has also not actively launched on any centralized exchanges, directly airdropping 31% of the tokens to users while maintaining ultra-low trading fees and zero gas fees. This is the ultimate form of a decentralized derivatives exchange. With the improvement of the project's ecosystem, more top developers and users will enter the HyperLiquid ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。