As the end of the year approaches, the volatility of the cryptocurrency market seems to heat up along with the festive atmosphere, and the "Christmas rally" feels like a mysterious gift from the market to investors. Some see the dawn of a bull market, while others sense the undercurrents of a bear market. Today, we will analyze this year-end Bitcoin frenzy from multiple dimensions, including historical data, market sentiment, and investment strategies, to determine whether it is an opportunity or a trap.

"The Past and Present of the Christmas Rally: The Rhythms of Bull and Bear Markets"

Historical Data Revealed: Bitcoin's "Temperament" During Christmas is Quite Willful

Don't think of Christmas as a quiet day; for Bitcoin, its performance is like a willful child. According to AICoin's statistics, over the past decade, Bitcoin has experienced multiple "big ups and downs" around Christmas. For instance, in the past ten years, there have been four instances of price increases after Christmas, but also seven instances of declines. The performance on Christmas Day is even more interesting, with prices higher than the previous week on eight occasions, but also eight instances of a post-holiday pullback. This "seemingly regular yet actually chaotic" market often leaves investors feeling both excited and anxious.

From a historical perspective, Christmas Day appears more like a "selling opportunity" rather than a purely bullish day. What secrets lie behind this contradictory performance? Is it the market's liquidity, retail investors' emotions, or some institutions' "holiday operations"? Let's dig deeper.

The "Market Temperament" During Christmas: Low Liquidity and Emotional Trading Rampant

During the Christmas period, Bitcoin's market "temperament" tends to be particularly volatile. Why? One core reason is the significant decrease in market liquidity. During the holidays, most traders are enjoying their time off, and even the roles of quantitative trading and market makers become minimal. In this vacuum, retail investors, emotional trading, and a few large orders can more easily influence market trends.

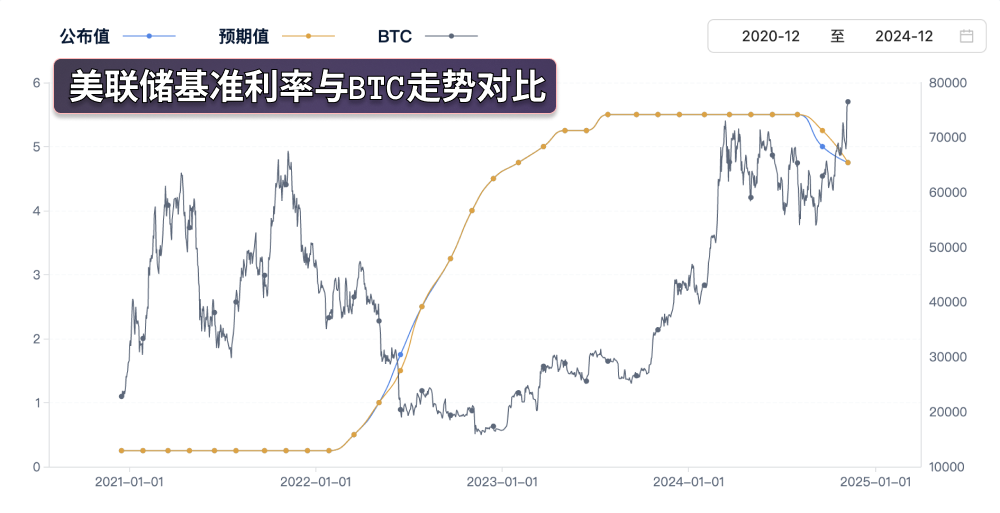

Trader CrypNuevo shared an interesting perspective: "In the week leading up to Christmas, market volatility intensifies, and the Federal Reserve's interest rate decisions act like a match that ignites the fuse, making market sentiment even more erratic." In other words, the "willfulness" of the Christmas rally is not just a historical pattern but a result of the interplay between market structure and sentiment.

The Dream of $140,000? Where Does Bitcoin's Momentum to Hit New Highs Come From?

The "Collective Delusion" of the Market: Optimistic Sentiment is Brewing

"Bitcoin could hit $140,000 in the coming weeks!" This is not a joke but the latest prediction from Filbfilb, co-founder of DecenTrader. He pointed out that mid-December has always been a critical time window for Bitcoin, and this year is no exception. The analysis account Bitcoindata21 is even more aggressive, suggesting that Bitcoin could break this psychological barrier in mid-January. Such predictions sound exciting, but what is the logic behind them?

The market generally expects the Federal Reserve to cut interest rates by 0.25% on December 18, providing strong fundamental support for Bitcoin's rise. A rate cut means increased dollar liquidity and heightened attractiveness of risk assets, while Bitcoin's safe-haven properties as "digital gold" will be further highlighted. In other words, this "dream of $140,000" is not unfounded but is supported by both fundamentals and market sentiment. Additionally, technical analysis (from AICoin) also provides confidence:

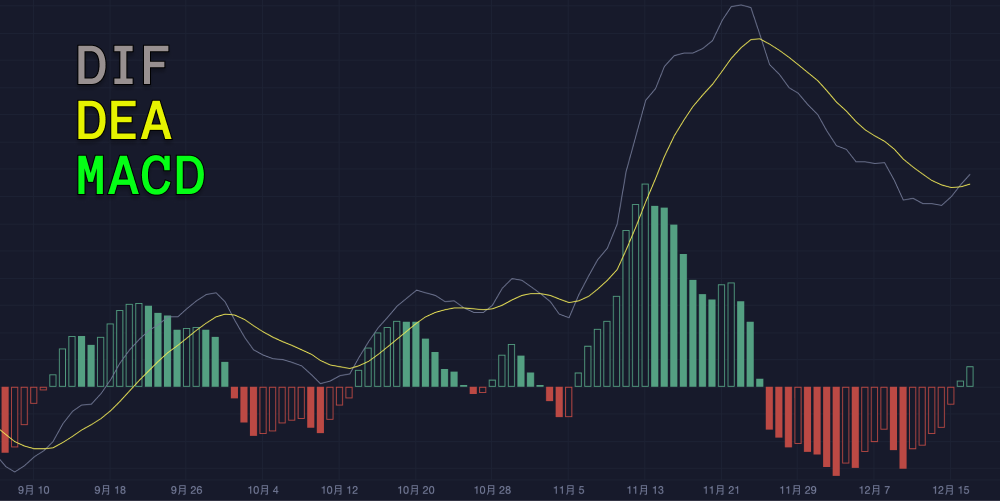

MACD: Both DIF and DEA are above the zero line, and DIF is greater than DEA, indicating that the current market is in a bullish trend. The MACD histogram shows positive values and is gradually expanding, further confirming the upward trend.

RSI: The RSI is currently around 79, close to the overbought zone, but no pullback signal has appeared, indicating that there is still upward space in the market.

EMA: Short-term EMA(7) > Mid-term EMA(30) > Long-term EMA(120), with all moving averages showing a bullish arrangement, supporting the continued bullish outlook.

Institutional Giants Taking Action: Bitcoin's "Moat" is Deepening

What’s more noteworthy is that the continued accumulation by institutional investors has injected more confidence into this rally. For example, MicroStrategy has recently significantly increased its Bitcoin holdings, with its market value surpassing $45 billion. This "real money" buying not only provides liquidity to the market but also conveys a "bullish signal from institutions."

In addition, the news that the elected U.S. President Trump plans to establish a national Bitcoin reserve has sent market sentiment on a roller coaster ride. If this plan is implemented, Bitcoin's status will receive unprecedented recognition. Such favorable policy news could become a catalyst for further price increases in Bitcoin.

How to Navigate the Christmas Rally with Ease?

Seize the Timing: Key Events Determine Your Success or Failure

For investors, while the Christmas rally is full of opportunities, it is by no means a simple game of "ALL IN" to make a profit. According to AICoin's data, there are two important time points to closely monitor: the Federal Reserve's interest rate meeting on December 19 and the effective date of the Nasdaq 100 index on the 20th. These two events could become the "watershed" for the market, determining the final direction of the Christmas rally.

If the Federal Reserve cuts rates as the market expects, Bitcoin may experience a short-term bullish rebound, making it a good time to go long. However, if there are unexpected policy decisions, such as maintaining interest rates or adopting a hawkish stance, the market may undergo severe adjustments, and investors need to decisively cut losses.

Altcoins: Can They Ride Bitcoin's "Coattails"?

During Christmas, while Bitcoin often takes center stage in the market, the performance of altcoins should not be overlooked. Ben Simpson, founder of Collective Shift, offered an interesting perspective: "Bitcoin's dominance may decline, but that doesn't mean altcoins will immediately enter a 'shitcoin season'." In other words, while Bitcoin's volatility may lead to a short-term rebound in altcoins, the long-term trend still requires cautious consideration.

For altcoin investors, the Christmas rally resembles a "sprint" rather than a "marathon." If you notice signs of a surge in certain altcoins before the holiday, consider taking advantage of market sentiment for short-term trading, but remember not to be greedy.

"Cool Reflection Amidst the Revelry: How to Maintain Rationality in Volatility?"

The Christmas rally seems full of opportunities, but essentially it is a high-risk, high-reward investment game. Low market liquidity and high emotional volatility make the market even more unpredictable. Investors need to keep the following points in mind when participating:

Pay attention to key events: The Federal Reserve's interest rate meeting and major market news can become the "fuse" for market movements.

Keep an eye on institutional movements: The buying or selling actions of institutional investors often serve as a barometer for market trends.

Control positions and risks: No matter how bullish you are on the market, do not easily go all-in; diversification is an eternal truth.

Manage emotions: Market fluctuations can evoke excitement or fear, but maintaining rationality is key to long-term success.

In summary, Bitcoin's Christmas rally is a rare market feast, but it also harbors dangers. I hope this analysis provides you with valuable insights to help you navigate this rally and maximize your returns. Regardless of how the market changes, cautious operation is always the first principle of investing. May you enjoy the joy of the festive cryptocurrency market while maintaining a rational bottom line!

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。