The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke screens.

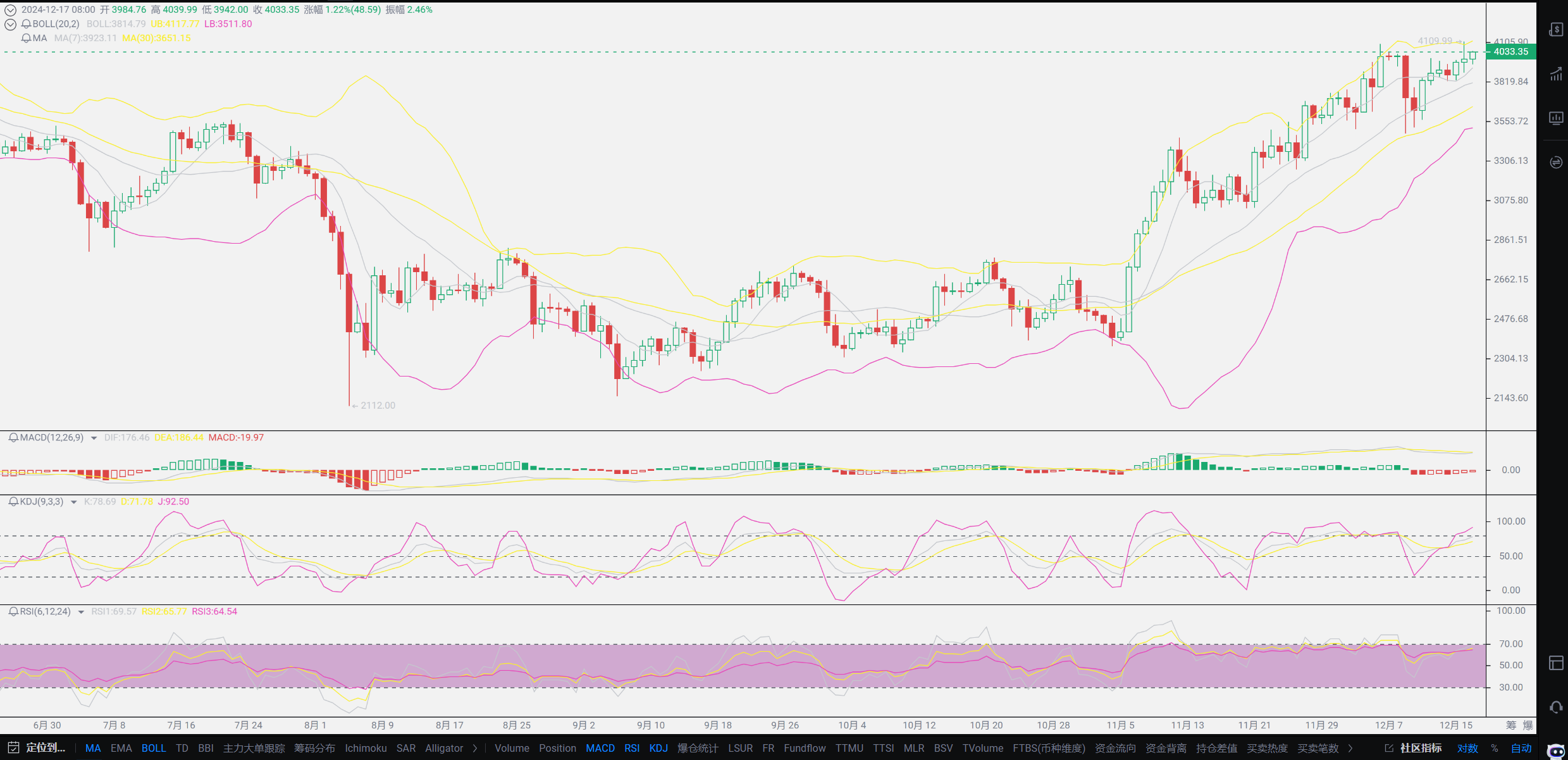

With Bitcoin continuously reaching new highs, other coins seem to have entered a downward channel. Indeed, from a technical perspective, the downward range dominated by SOL is very obvious, which has led many bloggers to primarily take a bearish stance on small coins in the short term. Apart from Ethereum, there are almost no coins that follow Bitcoin's rise; they are mainly focused on correcting previous trends. Lao Cui's view is basically consistent; it has been mentioned before that small coins will focus on correcting previous lows, waiting for Bitcoin to surge to one hundred thousand before a new round of growth occurs. However, this conclusion is not solely based on technical aspects but also on the level of capital. I wonder if you all feel that the judgment on capital seems to have stagnated; large funds do not favor small coins as much, and many friends have started to sell small coins to invest primarily in Bitcoin and Ethereum. At this moment, Lao Cui does not support your choices and reminds everyone that the opening of the downward channel means an opportunity for you to enter the market, not to choose selectively. The current trend, the timing of small coins' pullback, is an opportunity for you to enter the market in batches. SOL's push towards three hundred is not a big issue; this bull market is fully open, and the growth space for small coins will not end here. The top ten by market capitalization all belong to small coins; anything else can only be considered altcoins.

From the perspective of capital, the largest market is definitely dominated by the United States. The economic situation in the U.S. is very peculiar, with all three major markets growing: the dollar, U.S. stocks, and government bonds. All the data almost indicates a feeling of entering a prosperous era. At this point, I believe everyone has their own judgment standards; how could there be such glamorous data in the current financial environment? Is it a data issue, or is it our judgment issue? Everyone needs to be clear that in a normal financial environment, foreign trade is linked to the exchange rate. The growth of foreign trade represents a considerable income GDO, and the exchange rate should ideally remain stable. Looking at our situation, the exchange rate has remained between 6.2-6.8, which is our most prosperous period for foreign trade. In contrast, the U.S. data is quite the opposite; the dollar continues to rise, while foreign trade data has not reached optimal levels, yet it has eased the funds in the U.S. stock market. Under normal circumstances, stock market growth and exchange rate decline belong to a healthy financial market. Correspondingly, the issuance of government bonds will almost certainly decrease, while the growth of government bonds is mainly for subsequent investments. Simply put, only when there is no money and a need for development will the yield on government bonds increase, prompting everyone to invest in them. On one hand, there are good data, yet there is still such emphasis on government bonds, which somewhat contradicts the underlying logic of finance!

What Lao Cui wants to clarify is whether it is a data issue or if it is a trap. In such a strong economic situation, there is still a need to cut interest rates; the two are completely on different channels. This is not to sing the blues for U.S. stocks; the underlying issues need to be approached with caution. A misstep could lead to more than just economic problems. To give a simple example, if currently, over thirty percent of the returns from the three major markets are all converted to cash, the U.S. bubble would likely evaporate instantly. This means that the current trend cannot support the growth of the three major markets with their existing capital system, although there are certainly short-term gains. The indices are all in the green, almost creating a bull market environment, and this situation reflects similarly in the crypto space. The drawbacks of the crypto market are also very obvious; the top is desperately pushing up, while the bottom cannot attract funds. Two extremes, reflecting from U.S. stocks to the crypto market, sufficiently indicate that the current capital situation has already encountered problems. Of course, this is not to sing the blues for U.S. stocks and the crypto market; it is a reminder that these two are complementary and also mutually restrictive. A mere ten percent outflow of funds from U.S. stocks would be enough to triple the crypto market; our crypto market is still in its infancy compared to other markets.

Having said so much, I believe you have a certain understanding of the capital situation. As for Bitcoin, it depends on how many people enter around 97,000; basically, as long as users enter, the lowest position is around 96,000. The current profit should also be around ten thousand points. Users who want to exit in the short term can consider exiting directly after this round of interest rate cuts and wait until January to choose an entry opportunity. As for users who have not yet entered, keep an eye on the institutions; there will be opportunities for everyone to enter in the next couple of days. If you observe carefully, you will find that the current trend of the two listed coins, Bitcoin and Ethereum, is almost completely consistent, while other coins are starting a new round of pullback. Can you intuitively understand the benefits of being listed? Lao Cui has been mentioning since April that being listed means having traditional capital backing. The current situation almost reaffirms Lao Cui's speculation; since Trump's election, the index has been in net inflow, and only the spot fund inflow situation in the crypto market has issues; other aspects do not require too much concern. Throughout December, trading must be reduced; small coins and the two mainstream coins belong to a layered trend, where the first rich lead the later rich!

Lao Cui's summary: Overall, in December, the exchange rate situation, the dollar will still maintain its strength, and may even become stronger. Users holding USDT can consider cashing out after December ends. Overall, you do not need to expend too much energy worrying about the exchange rate; the current strategy is to maintain a strong stock market, and the exchange rate will inevitably be neglected; some things will still appreciate. Secondly, after this round of interest rate cuts, domestic capital will start to exit, so be cautious of this pullback; with a large amount of capital, it is estimated that the pullback depth will reach at least ten thousand points, which belongs to a medium-term fluctuation. For ordinary investors, this round of interest rate cuts should primarily focus on going long; the exit time should be within 1-2 days after the interest rate cut, clearing all positions, and then waiting for domestic capital to exit before looking for low entry points. As for deeper aspects, Lao Cui will not elaborate further; if you are unsure about the points, you can directly ask Lao Cui. Be sure to keep a close eye on the interest rate cut signals; every round of signals is an opportunity for you to enter the market. The interest rate cut around one hundred thousand will definitely not stop, and it will at least stabilize at one hundred thousand. The bottom support after the interest rate cut is like the previous nine thousand mark; do not be influenced by the anchoring effect. If you missed the opportunity to enter at the nine thousand mark, you can only go against the wind now. If the entry position is uncertain, be sure to ask! A special reminder, small coins still have opportunities (excluding altcoins)!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or positions, aiming for the ultimate victory, while the novice fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。