Key Points

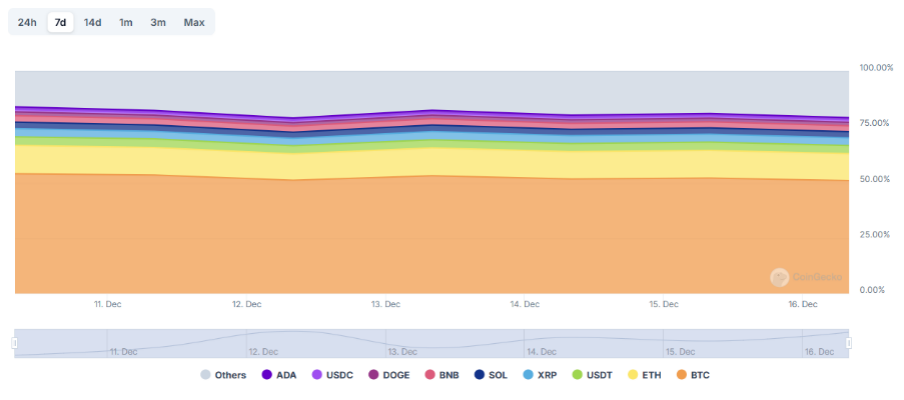

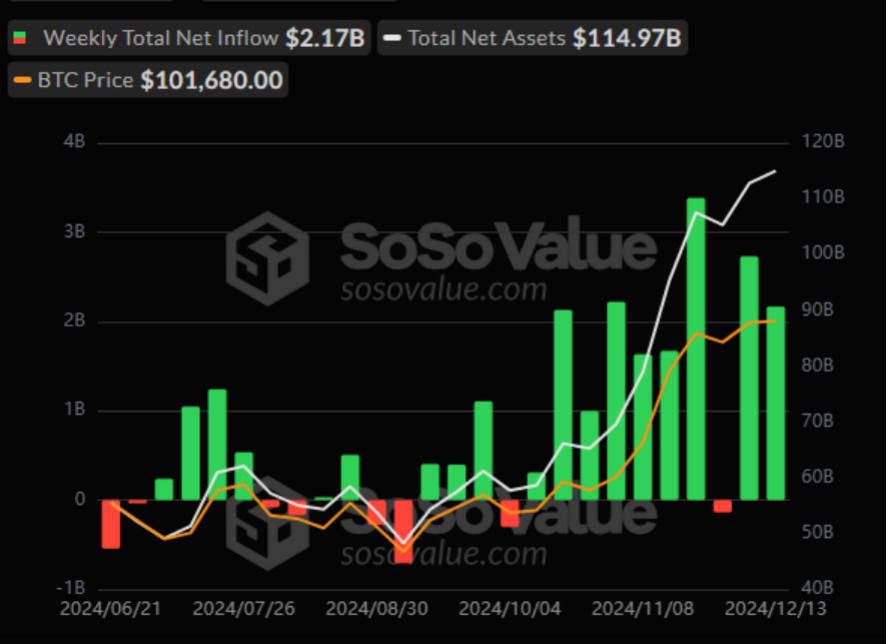

● The total market capitalization of cryptocurrencies is $3.92 trillion, up from $3.84 trillion last week, with a weekly increase of 2%. As of December 16, 2024, the cumulative net inflow for Bitcoin spot ETFs in the U.S. is approximately $35.6 billion, and for Ethereum spot ETFs, it is approximately $2.26 billion.

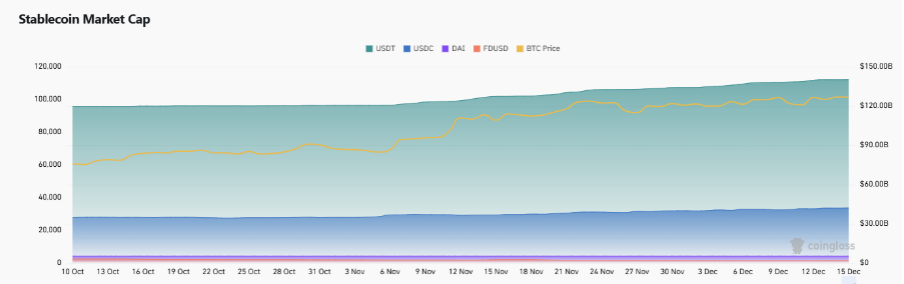

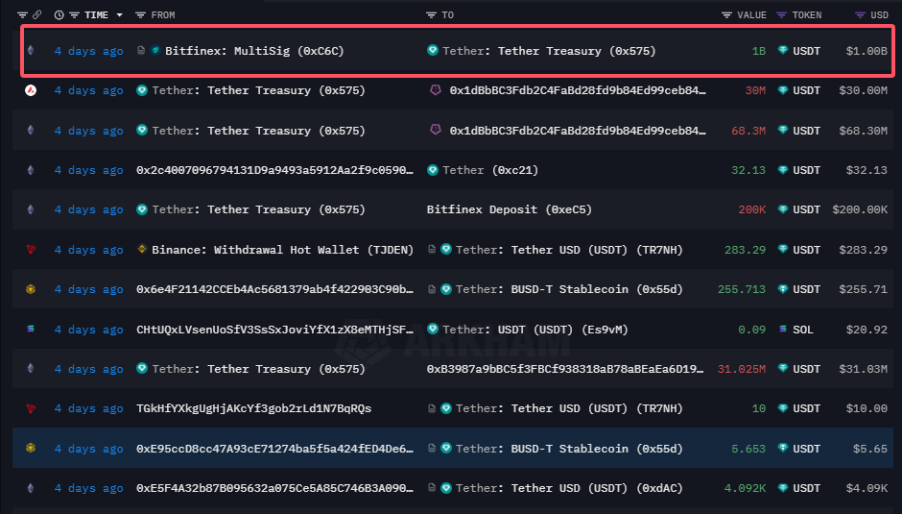

● The total market capitalization of stablecoins is $208 billion, accounting for 5.3% of the total cryptocurrency market capitalization. Among them, USDT has a market capitalization of $140.1 billion, accounting for 67.4% of the total stablecoin market; USDC has a market capitalization of $42.1 billion, accounting for 20%; and DAI has a market capitalization of $5.3 billion, accounting for 2.5%. This week, Tether issued 1 billion USDT on the Tron chain and 1 billion USDT on the Ethereum chain, totaling 2 billion USDT. As of December 16, Tether has minted $5 billion USDT this month, with a weekly increase of 40%.

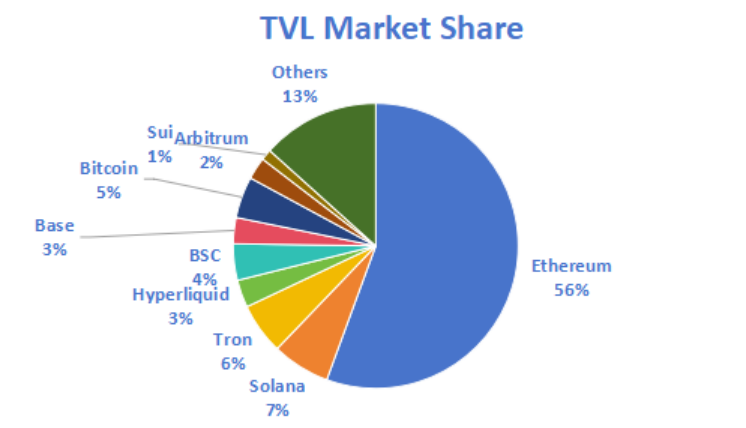

● This week, the total TVL (Total Value Locked) in DeFi is $141.3 billion, an increase of 2.7% from last week. By public chain, the top three chains by TVL are Ethereum at 57%; Solana at 7%; and Tron at 6%. ETH remains the absolute leader in the DeFi space, with a DeFi TVL of $78.7 billion and a circulating market capitalization of $482.3 billion. This week, the TVL on the Hyperliquid chain has seen significant growth, reaching $2.52 billion as of December 16, accounting for 3% of the total DeFi TVL, with a monthly increase of 75%.

● From on-chain data, in terms of daily trading volume, BNB and SUI have shown significant increases this week, with BNB up 52% and SUI up 45% compared to last week. In terms of daily active addresses, except for ETH and APT chains, all other chains showed an upward trend, with a notable increase of 12% in active addresses on the SOL chain.

● Innovative projects to watch: Katōshi: Katoshi is the automated trading layer of Hyperliquid, supporting one-click integration with TradingView. Meritt: A social network supported by Worldcoin, which has surpassed 30,000 users and over 6 million views in just one month since its launch. 246 Club: Proposes the concept of integrating the lending market into a unified layer, with the official website yet to be launched.

I. Market Overview

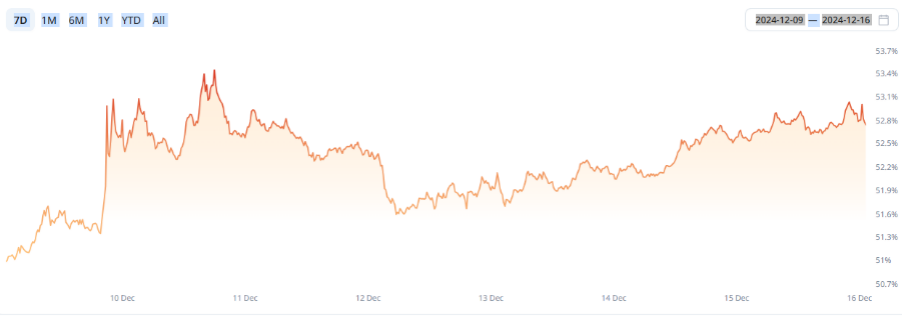

- Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

The global cryptocurrency market capitalization is $3.92 trillion, up from $3.84 trillion last week, with a weekly increase of 2%.

Data Source: cryptorank

As of the time of writing, the market capitalization of Bitcoin (BTC) is $2.09 trillion, accounting for 53.18% of the total market capitalization. Meanwhile, the market capitalization of stablecoins is $208 billion, accounting for 5.3% of the total cryptocurrency market capitalization.

Data Source: coingeck

2. Fear Index and ETF Inflow/Outflow Data

The cryptocurrency fear index is at 83, indicating extreme greed.

Data Source: coinglass

3. ETF Inflow/Outflow Data

As of December 16, 2024, the cumulative net inflow for Bitcoin spot ETFs in the U.S. is approximately $35.6 billion, and for Ethereum spot ETFs, it is approximately $2.26 billion, setting new historical highs. As of December 14, the U.S. spot BTC ETF has seen net inflows for four consecutive trading days, totaling $1.688 billion. The largest inflow during this period was into IBIT, totaling $1.12 billion, followed by FBTC with $423 million.

Data Source: sosovalue

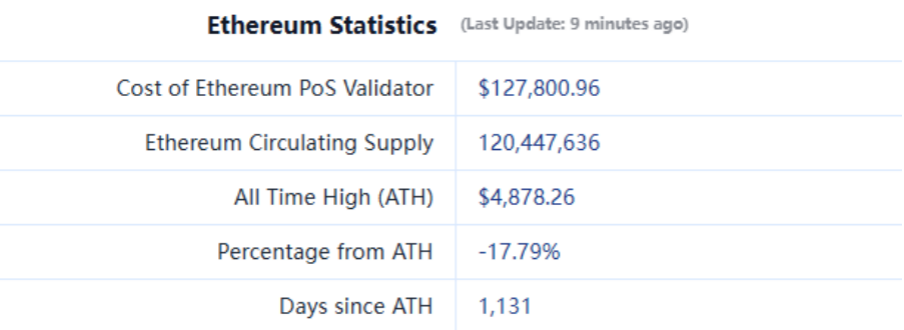

- ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Currently at $3,997, with a historical high of $4,878.

ETHBTC: Currently at 0.038006, with a historical high of 0.1238, down approximately 69.3%.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

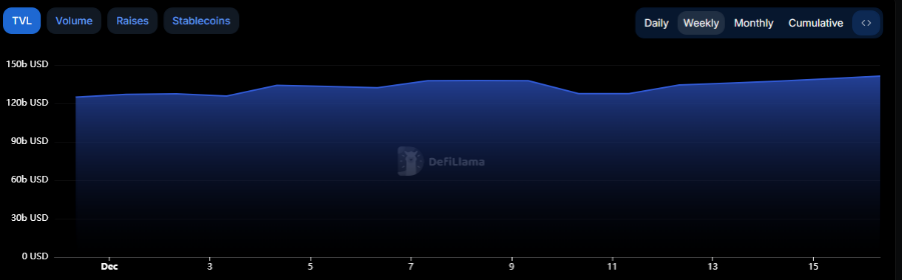

According to DeFiLlama, the total TVL in DeFi this week is $141.3 billion, an increase of 2.7% from last week.

Data Source: defillama

● By public chain, the top three chains by TVL are Ethereum at 57%; Solana at 7%; and Tron at 6%. This week, the TVL on the Hyperliquid chain has seen significant growth, reaching $2.52 billion as of December 16, accounting for 3% of the total DeFi TVL, with a monthly increase of 75%.

Data Source: CoinW Research Institute, defillama

Data as of December 16, 2024

6. On-Chain Data

Analyzing the relevant data of major public chains ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, transaction fees, and total locked value (TVL).

Data Source: CoinW Research Institute, defillama, Nansen

Data as of December 16, 2024

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, BNB and SUI have shown significant increases in daily trading volume, with BNB up 52% and SUI up 45% compared to last week. In terms of transaction fees, the fees on the ETH chain have increased significantly, up 28% from last week.

● Daily Active Addresses: Daily active addresses reflect the ecological participation and user stickiness of public chains. SOL still occupies the first position in daily active addresses. This week, except for ETH and APT chains, all other chains showed an upward trend. The SOL chain saw a notable increase in active addresses, up 12% compared to last week.

● Total Locked Value (TVL) and Circulating Market Capitalization: Reflecting the maturity of DeFi and the level of user trust in the platform. In terms of TVL, ETH remains the absolute leader in the DeFi space, with a DeFi TVL of $78.7 billion and a circulating market capitalization of $482.3 billion, still a standout among public chains.

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is currently reported at $208 billion, setting a new historical high, with a weekly increase of 5.6%. Among them, USDT has a market capitalization of $140.1 billion, accounting for 67.4% of the total stablecoin market; USDC has a market capitalization of $42.1 billion, accounting for 20%; and DAI has a market capitalization of $5.3 billion, accounting for 2.5%.

Data Source: CoinW Research Institute, Coinglass

Data as of December 16, 2024

This week, Tether issued 1 billion USDT on the Tron chain and 1 billion USDT on the Ethereum chain, totaling 2 billion USDT. As of December 16, Tether has minted $5 billion USDT this month, with a weekly increase of 40%.

Data Source: intel.arkm

Data as of December 16, 2024

II. This Week's Hot Money Trends

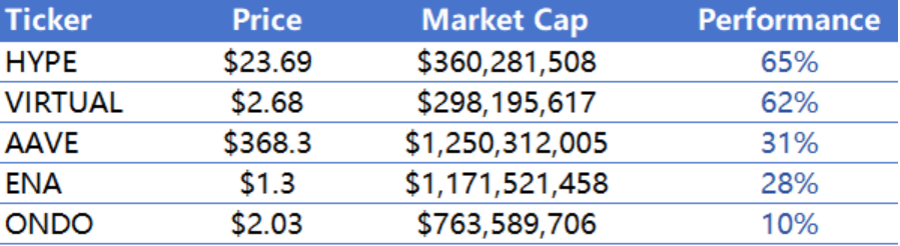

- The top five VC coins and Meme coins by increase this week

The top five VC coins by increase over the past week.

Data Source: CoinW Research Institute, Coingeck

Data as of December 16, 2024

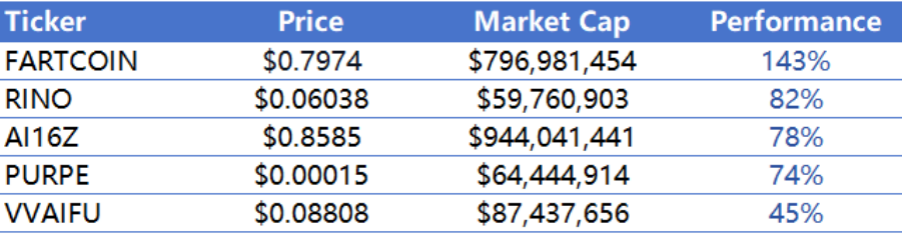

The top five Meme coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of December 16, 2024

2. New Project Insights

● Katōshi: Katoshi is the automated trading layer of Hyperliquid, supporting one-click integration with TradingView.

● Meritt: A social network supported by Worldcoin, which has surpassed 30,000 users and over 6 million views in just one month since its launch.

246 Club: Proposes the concept of integrating the lending market into a unified layer, with the official website yet to be launched.

III. Industry News

1. Major Industry Events This Week

● Morph has launched a three-layer growth strategy: DeFi, application scenarios, and payment layout. Cecilia Hsueh, co-founder of the consumer-grade public chain Morph, stated that Morph aims to promote the large-scale application of Web3 in a consumer-friendly manner. The first layer: transforming DeFi projects (Morph will make traditional DeFi projects more accessible to ordinary users); the second layer: focusing on how to bring everyday users onto the chain through on-chain application scenarios. For example, the early-stage Impackt project helps users exercise with an AI physical coach while earning token rewards as incentives; the third layer: payment solutions, Morph will launch Morph Pay, supporting fiat and crypto payments, simplifying transaction processes, and helping users more easily use blockchain services.

● The Arweave computing network AO mainnet will be launched on February 8, 2025.

● The French financial group Oddo is developing a euro stablecoin, expected to launch next year. Paris-based financial group Oddo BHF SCA is collaborating with crypto technology company Fireblocks to develop a euro-denominated stablecoin, which Oddo expects to launch next year, pending regulatory approval.

● According to Google's official blog, Google has released the next generation of its AI model, Gemini 2.0. Gemini 2.0 supports multimodal inputs such as text, images, video, and audio, and features native image generation and multilingual text-to-speech (TTS) capabilities. Compared to Gemini 1.5 Pro, the model's speed has doubled, optimizing multimodal reasoning, complex instruction execution, and tool usage capabilities, supporting calls to Google Search, code execution, and third-party functions. The experimental version Gemini 2.0 Flash is now open to developers, with a full rollout of multimodal features and a multimodal real-time API planned for January 2025, providing more application support for developers.

● Donald Trump has been named Time magazine's Person of the Year for 2024. According to Time magazine, the elected U.S. President Donald Trump has been recognized as the Person of the Year for 2024 and has been photographed for the cover. This is his first major photo shoot since winning the election, conducted by renowned photographer Platon, who has previously photographed several global leaders, including Obama and Putin, at Trump's private club in Mar-a-Lago.

2. Major Events Coming Next Week

● The token creation and distribution infrastructure Streamflow will launch the STREAM TGE on December 17, 2024.

● Swan Chain will launch the SWAN token TGE on December 16, with a total supply of 1 billion SWAN tokens, of which 20% will be allocated for early users and future community reward airdrops, 20% for investors, 20% for the DAO treasury, 25% for the ecological fund, and 15% for key developers and team members.

● The Ethereum L2 Taiko Season 2 will run from September 17 to December 16, 2024, offering a total of 6 million TAIKO tokens as rewards, with 5 million for participants and 1 million for DApps.

● The Telegram ecosystem application Tomarket has announced that the TOMA token will be launched on December 20, with a round of airdrop activities before the token launch, distributing 30% of the total TOMA tokens as rewards to users who actively participate in platform activities before the token goes live. The minimum threshold for this airdrop is Silver I level, and all users who reach this level or above can participate. The airdrop amount will be distributed based on user levels, considering participation in activities such as blind boxes and check-ins, with a snapshot scheduled for December 19, 2024.

● The TON Global Ecosystem Winter Competition Hackers League will be held from September 12 to December 20, with a total prize pool of $2 million, including five tracks: DeFi, social networks and utilities, GameFi & Onboarding, and on-chain data analysis interoperability.

3. Important Financing Events Last Week

● Klickl Group, Series A, raised $25 million, with investors including Aptos, Web3Port, and others. Klickl is a global virtual asset service provider offering spot and futures trading, fiat OTC, B2B institutional solutions, payments, wallets, custody, and wealth management services. Klickl has received principle approval (IPA) for a financial services license (FSP) from the Abu Dhabi Global Market (ADGM), allowing it to operate as a brokerage and provide digital asset custody services. (December 10)

● Relai, Series A, raised $12 million, with investors including Ego Death Capital, Timechain, Plan B Bitcoin Fund, and others. The Relai platform allows retail investors to buy and sell Bitcoin without additional registration, verification, or deposit limits, and it also supports investors in fully controlling their funds through non-custodial Bitcoin wallets. (December 10)

● Exabits, Seed, raised $15 million, with investors including Hack VC and others. Exabits is a decentralized infrastructure for AI and compute-intensive applications. Exabits enables users to provide distributed GPU services, data storage, or expertise to the AI community without a central authority or intermediary. Participants can use their web3 identities, such as blockchain wallet addresses or decentralized identities (DID), to engage in the market and provide services to the AI ecosystem. (December 11)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。