With the market filled with expectations for Trump's proposal to create a national Bitcoin reserve, and the optimistic anticipation of an interest rate cut by the Federal Reserve this week, Bitcoin surged past the $106,000 mark this morning, breaking the previous high set on December 5. Bitcoin has recorded seven consecutive weeks of gains, marking the longest weekly winning streak since 2021. Since the U.S. elections, Bitcoin has skyrocketed over 55%, with a gain of more than 14% in the past month. The market sentiment indicator, the "Greed and Fear Index," has soared to 83 points, entering the "Extreme Greed" zone, indicating that investors are extremely confident about future market trends.

However, the upward momentum of Bitcoin may face correction risks, especially as the rate of increase slows, which could mean increased short-term pullback pressure. As of the time of writing, it has retreated to $104,615, with a gain of about 2.75% in the last 24 hours.

Trump's friendly attitude towards cryptocurrencies has completely reversed the high-pressure regulatory atmosphere of the Biden administration, becoming a significant driving force behind Bitcoin's rise. He not only proposed establishing a national Bitcoin strategic reserve but also declared the goal of making the U.S. a leader in the global cryptocurrency industry, reigniting market expectations. Such policy direction is undoubtedly a catalyst for Bitcoin to break new highs and will drive the cryptocurrency market into a new wave of excitement.

The Federal Reserve will hold an interest rate policy meeting on December 18, with the market widely expecting a rate cut of 25 basis points (0.25%). If the rate decision meets expectations, it will further drive funds into the high-yield cryptocurrency market.

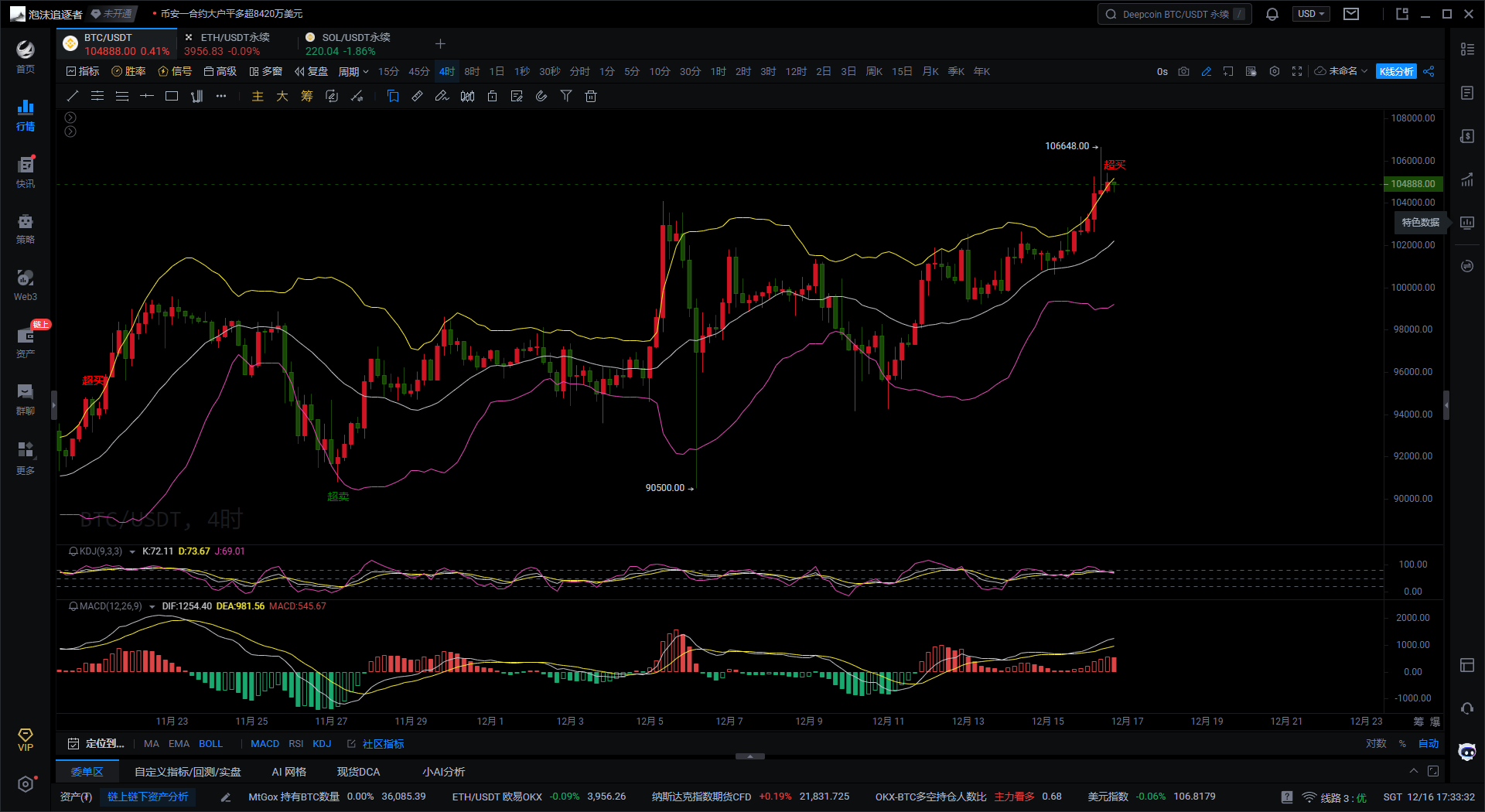

Bitcoin Four-Hour Chart

First, according to the Bollinger Bands indicator on the Bitcoin 4H chart, the current price is near the upper band, in the overbought zone, which indicates a risk of a pullback in the short term. The Bollinger Bands channel is expanding upwards, suggesting that the market is overall in an upward trend, but the divergence between the price and the upper band is significant, making it prone to adjustments.

Second, based on the KDJ indicator on the Bitcoin 4H chart, the K and D line values are above 80 in the overbought zone, while the J line is at an even higher position and starting to flatten. This situation indicates that the market is in an overbought area in the short term, and a correction may occur subsequently.

Finally, according to the MACD indicator on the Bitcoin 4H chart, the DIF line and DEA line are above the zero axis, indicating that the market is still in a strong bullish phase. The MACD histogram is in red and gradually increasing, suggesting strong bullish momentum currently, but it is important to note that a divergence may occur at the top. If the MACD red histogram starts to shorten, it indicates that bullish momentum is beginning to weaken, and the price may experience fluctuations and pullbacks in the short term.

Bitcoin One-Hour Chart

First, according to the Bollinger Bands indicator on the Bitcoin 1H chart, the price began to retreat after touching the upper band and is currently above the middle band. The Bollinger Bands are overall opening upwards, indicating that the market is in an upward trend. However, there is resistance after the price touches the upper band, showing signs of a pullback. In the short term, it may retest the middle band (around 104,000) for support. If the price stabilizes at the middle band, it may continue to push towards the upper band.

Second, based on the KDJ indicator on the Bitcoin 1H chart, the three KDJ line values have turned down from the overbought area. Although a clear death cross has not formed, it also indicates that the market may face pullback pressure in the short term.

Finally, according to the MACD indicator on the Bitcoin 1H chart, the DIF line and DEA line have formed a death cross at a high level, indicating a weakening of bullish momentum in the short term. The MACD histogram has also turned from red to green, suggesting that market momentum is gradually weakening, and there may be pullback pressure in the short term.

In summary, the Bollinger Bands channel is still opening upwards, indicating that the overall trend remains upward. However, the formation of a death cross in the MACD on the 1H level and the KDJ indicator being in the overbought area suggest that there may be some pullback pressure in the short term. It is crucial to pay attention to the support strength near the middle band (104,000) on the 1H level. If it effectively breaks below the middle band, it may further test the 103,000 level.

Based on the above, I offer the following suggestions for reference:

Suggestion 1: Short Bitcoin near 104,800, targeting 103,300-103,000, with a stop loss at 105,300.

Suggestion 2: Long Bitcoin near 103,300, targeting 104,000-105,000, with a stop loss at 102,800.

Instead of giving you a 100% accurate suggestion, I prefer to provide you with the right mindset and trend. After all, teaching someone to fish is better than giving them fish. Suggestions may help you earn temporarily, but learning the mindset will help you earn for a lifetime! The focus is on the mindset, grasping the trend, and planning positions. What I can do is use my practical experience to assist you, guiding your investment decisions and management in the right direction.

Writing time: (2024-12-16, 17:30)

(Written by - Daxian Talks Coins) Disclaimer: Online publication has delays, and the above suggestions are for reference only. The author is dedicated to research and analysis in the fields of Bitcoin, Ethereum, altcoins, forex, stocks, etc., with years of experience in the financial market and rich practical operation experience. Investment carries risks; please proceed with caution. For more real-time market analysis, please follow the official account Daxian Talks Coins for discussion and exchange.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。