As long as there is tomorrow, today will always be the starting line. Smart people understand, shrewd people are accurate, and wise people see far. Do not be amazed by this market; let this market amaze you! The results of gains and losses in the market today are the choices made yesterday, and the future's balance sheet, good or bad, is determined by today's decisions. Choice is greater than effort; if the choice is wrong, effort is wasted.

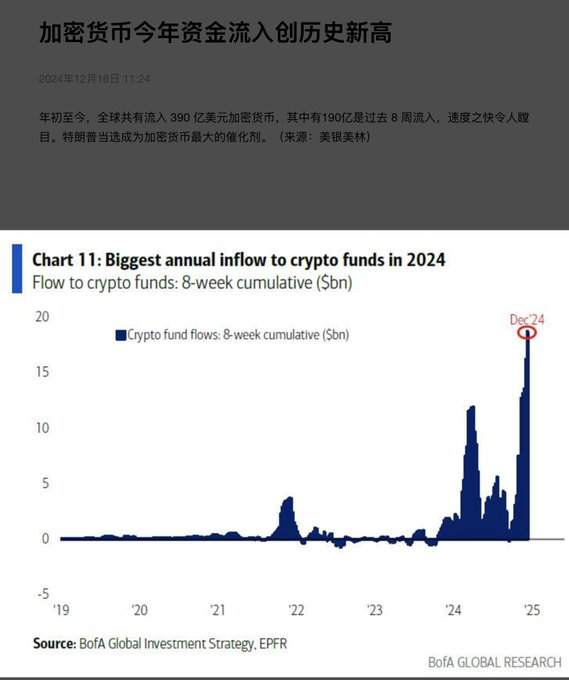

A weekend has passed, and Bitcoin has once again surged, continuing to set new historical highs. In such a market, the buying power is indeed immense. The above chart shows the inflow of funds into the crypto market this year. Since the victory of the special leader, the frenzy in the crypto market has never stopped. To be honest, with Bitcoin rising to this level, most opinions in the market still believe it is not the end. If you don't believe it, then the market will rise to a point that makes you have to believe it.

This week has an important time point, which has also been emphasized before regarding interest rate cut expectations. According to current market predictions, there is over a 95% probability of a 25 basis point cut, which is also a positive factor for the crypto market from a fundamental perspective, and will bring a significant impact on the market at that time.

At the beginning of the week, looking at the daily chart, the upward trend remains strong, and the movement is very stable. The upward structure is well maintained, and technical indicators are running upwards. This aligns with our previous emphasis that there is no problem with the big trend. From both fundamental and technical perspectives, the current high is not a cyclical high for Bitcoin. Last week, during the pullback, it should be remembered that in a bull market cycle, a pullback to the MA20 to MA30 area is a good buying point. Looking back now, under a strong market, this point has indeed been validated.

On the four-hour chart, after the market surged, a pullback began. Currently, the MACD is in a bullish momentum, and there is a certain need for a pullback adjustment to complete the indicator's repair process. The last four-hour cycle closed with a long upper shadow bullish candle. It can be seen that after reaching a new high, the market faced some selling pressure, which suppressed the market. However, given the current market sentiment and the influence of the fundamental trend, such selling pressure has a limited impact on the market trend. This explains the recent market behavior, where small adjustments have been ongoing due to profit-taking. The final result is that the market continues to rise, indicating that in the current market, due to the buying power of bulls, they still dominate.

Looking at the intraday situation, the market surged and then pulled back in the morning. Most of the time, the continuation of the morning trend is weak. Currently, a few points can be considered. Personally, I think the most suitable approach is to reach a short-term high, then pull back for indicator repair, and then surge again. This kind of movement is the most favorable. Therefore, in the short term, it is still advisable to short and then position for long. For the short term, consider shorting around 105600, and for the pullback, look to buy around 103500.

For Ethereum, consider shorting near 40000, with support at 3760.

Now, regarding altcoins, the current market performance shows that AI-related MEME coins are the strongest. As long as they are related to AI, they become a hot topic for speculation. This trend has been very obvious recently and is a significant narrative concept worth paying attention to. Furthermore, the market has rotations, and so does the capital. Therefore, previously strong coins are also worth monitoring during pullbacks, as there can be a return to value.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies.】

Scan the code to follow the public account!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。