The key observation is whether BTC can take over from AI and become the core driver of economic growth in the new political and economic cycle welcomed by the U.S. under Trump's administration.

Author: @Web3_Mario

Abstract: First, I apologize for the delay in updates last week. After a brief study of AI Agents like Clanker, I found it very interesting and spent some time developing a few small frame tools. After assessing the development and potential cold start costs, I realized that quickly chasing market trends might be the norm for most small and medium-sized entrepreneurs struggling in the Web3 industry, and I hope everyone understands and continues to support this. Back to the main topic, this week I hope to discuss a viewpoint that I have been contemplating recently, which I believe can also explain the recent market volatility. That is, after BTC's price broke new highs, how to continue capturing incremental value. My viewpoint is that we should focus on whether BTC can take over from AI and become the core driver of economic growth in the new political and economic cycle welcomed by the U.S. under Trump's administration. The game has already begun with the wealth effect of MicroStrategy, but the entire process will inevitably face numerous challenges.

As the wealth effect of MicroStrategy unfolds, the market has begun to speculate whether more listed companies will choose to allocate BTC for growth

We know that last week the crypto market experienced significant volatility, with BTC's price fluctuating between $94,000 and $101,000. There are two core reasons for this, which I will briefly outline.

First, we need to trace back to December 10, when Microsoft officially rejected the "Bitcoin Financial Proposal" put forward by the National Center for Public Policy Research (NCPPR) at its annual shareholder meeting. In the proposal, the think tank suggested that Microsoft diversify 1% of its total assets into Bitcoin as a potential hedge against inflation. Prior to this, MicroStrategy's founder Saylor publicly declared through X as a representative of NCPPR's FEP, giving a three-minute online presentation, which led the market to have some hope for the proposal, even though the board had already clearly recommended rejecting it beforehand.

Let me elaborate a bit on this so-called National Center for Public Policy Research. We know that think tanks are composed of industry experts and are generally funded by governments, political parties, or commercial companies. Most think tanks are non-profit organizations and are not official institutions. This operational model allows them to be tax-exempt in countries like the U.S. and Canada. Typically, the viewpoints expressed by think tanks need to serve the interests of their sponsors. The NCPPR, established in 1982 and headquartered in Washington, D.C., holds a certain position among conservative think tanks, especially in supporting free markets, opposing excessive government intervention, and promoting corporate responsibility issues, but its overall influence is relatively limited compared to larger think tanks like the Heritage Foundation or the Cato Institute.

This think tank has faced criticism for its positions on issues like climate change and corporate social responsibility, particularly due to its suspected financial ties to the fossil fuel industry, which has limited its advocacy efforts. Progressives often label it as a "mouthpiece for interest groups," which undermines its influence across a broader political spectrum. In recent years, the NCPPR has initiated the FEP (Free Enterprise Project) and frequently proposed resolutions at shareholder meetings of various listed companies, questioning large corporations' policies on right-wing issues such as racial diversity, gender equality, and social justice. For example, they submitted proposals against mandatory racial and gender quotas for companies like JPMorgan, arguing that such policies lead to "reverse discrimination" and harm corporate performance. Regarding companies like Disney and Amazon, they have questioned the companies' excessive catering to progressive issues, advocating that businesses should focus on profitability rather than "pleasing minority groups." With Trump's election and his supportive stance on cryptocurrency policy, the organization has promoted Bitcoin adoption to major listed companies through FEP, including giants like Amazon in addition to Microsoft.

Following the formal rejection of this proposal, BTC's price briefly dropped to $94,000 before quickly rebounding. From the extent of the price fluctuations triggered by this event, we can observe that the current market is indeed in a state of anxiety, with the concern being what the new sources of growth are for BTC's market value after it broke historical highs. Recently, we have seen some key leaders in the crypto world choosing to leverage MicroStrategy's wealth effect to promote the financial strategy of allocating BTC on balance sheets to combat inflation and achieve performance growth, thereby increasing BTC's adoption. Now, let's look ahead to whether this strategy can succeed.

BTC as a substitute for gold has a long way to go to become a globally recognized store of value, and it is not easy to succeed in the short term

First, let's analyze the first attractive point of this strategy: whether allocating BTC to combat inflation is feasible in the short term. In fact, when discussing inflation hedges, gold is usually the first thing that comes to mind. Moreover, during Powell's press conference at the beginning of the month, he mentioned that Bitcoin is a competitor to gold. So, can Bitcoin become a substitute for gold and serve as a broadly recognized store of value globally?

This question has always been a key point in discussions about Bitcoin's value. Many have made various arguments based on the similarities in the intrinsic properties of assets, which I will not elaborate on here. What I want to point out is how long it will take to realize this vision, or whether this vision can support BTC's current valuation. My answer is that it is unlikely to be achieved in the foreseeable four years, or in the short to medium term, making it less attractive as a short-term promotional strategy.

Let’s refer to how gold developed to its current status as a store of value. As a precious metal, gold has always been regarded as a valuable item by various civilizations, possessing universality. The core reasons are as follows:

- Its obvious luster and excellent malleability give it significant utility as an important decorative item.

- The limited production of gold brings scarcity, endowing it with financial attributes, making it an emblem of class distinction in societies that have experienced class stratification.

- Gold's widespread distribution and relatively low extraction difficulty across the globe allow civilizations to be less constrained by cultural and productivity factors, thus facilitating a bottom-up spread of value culture.

These three attributes create universal value, allowing gold to play the role of currency in human civilization, and the entire development process has made gold's intrinsic value stable. Therefore, we see that even when sovereign currencies abandon the gold standard and modern financial instruments give them more financial attributes, gold's price has generally followed a long-term growth trend, effectively reflecting the real purchasing power of currency.

However, it is unrealistic for Bitcoin to replace gold's status in the short term. The core reason lies in its value proposition as a cultural viewpoint, which will inevitably contract rather than expand in the short to medium term for two reasons:

Bitcoin's value proposition is top-down: As a virtual electronic commodity, Bitcoin mining relies on computational power competition, which has two determining factors: electricity and computational efficiency. First, electricity costs reflect a country's level of industrialization, while the cleanliness of the energy behind electricity determines future development potential. Computational efficiency relies on chip technology. In simple terms, acquiring BTC is no longer something that can be achieved solely with a personal PC; as technology advances, its distribution will inevitably concentrate in a few regions, making it difficult for undeveloped countries, which represent a significant portion of the global population, to gain a competitive advantage. This adversely affects the efficiency of spreading this value proposition because when you cannot control a resource, you can only become its exploited object. This is why stablecoins compete with the sovereign currencies of some countries with unstable exchange rates, and from the perspective of national interests, this cannot be recognized, making it hard to see undeveloped countries encouraging this value proposition.

The retreat of globalization and the challenge to dollar hegemony: We know that with Trump's return, his isolationist policies will significantly impact globalization, with the most direct effect being on the dollar's influence as the global trade settlement currency. This has posed a challenge to the dollar's hegemonic status, a trend referred to as "de-dollarization." The entire process will lead to a short-term decline in the dollar's demand globally, and since Bitcoin is primarily priced in dollars, this will inevitably increase its acquisition costs, making it more difficult to promote its value proposition.

Of course, the above two points discuss the challenges of this trend in the short to medium term from a macro perspective, which does not affect Bitcoin's narrative as a substitute for gold in the long term. The most direct impact of these two points in the short to medium term is reflected in its high price volatility, as the rapid increase in its value in the short term is primarily based on speculative value rather than an enhancement of its value proposition's influence. Therefore, its price volatility is more aligned with speculative assets, exhibiting high volatility characteristics. However, due to its scarcity, if the dollar continues to be severely overissued, with the decline in the dollar's intrinsic purchasing power, all dollar-denominated goods can be said to have a certain anti-inflationary nature, similar to the luxury goods market in recent years. However, this anti-inflationary nature is not sufficient to give Bitcoin a stronger competitive ability in terms of value storage compared to gold.

Therefore, I believe that using anti-inflation as a short-term promotional marketing focus is not enough to attract "professional" clients to choose to allocate Bitcoin instead of gold, as their balance sheets will face extremely high volatility, which cannot be changed in the short term. Thus, it is highly likely that we will see large, stable publicly listed companies not aggressively choosing to allocate Bitcoin to combat inflation in the near future.

BTC taking over from AI, becoming the core driver of economic growth in the new political and economic cycle welcomed by the U.S. under Trump

Next, let's discuss the second viewpoint, which is whether some struggling listed companies can achieve overall revenue growth through BTC allocation, thereby driving up their market value. I believe this financial strategy is the core to judging whether BTC can gain new value growth in the short to medium term, and I think this is relatively easy to achieve in the short term. In this process, BTC will take over from AI and become the core driver of economic growth in the new political and economic cycle welcomed by the U.S. under Trump's administration.

In previous analyses, we have clearly examined MicroStrategy's successful strategy, which is to convert the appreciation of BTC into revenue growth for the company, thereby boosting its market value. This approach is indeed very attractive for some companies struggling with growth, as it is much more comfortable to embrace a trend than to burn oneself out trying to build a business. You can see many declining companies whose main business revenues are rapidly decreasing, ultimately choosing to allocate their remaining value using this strategy to retain some opportunities.

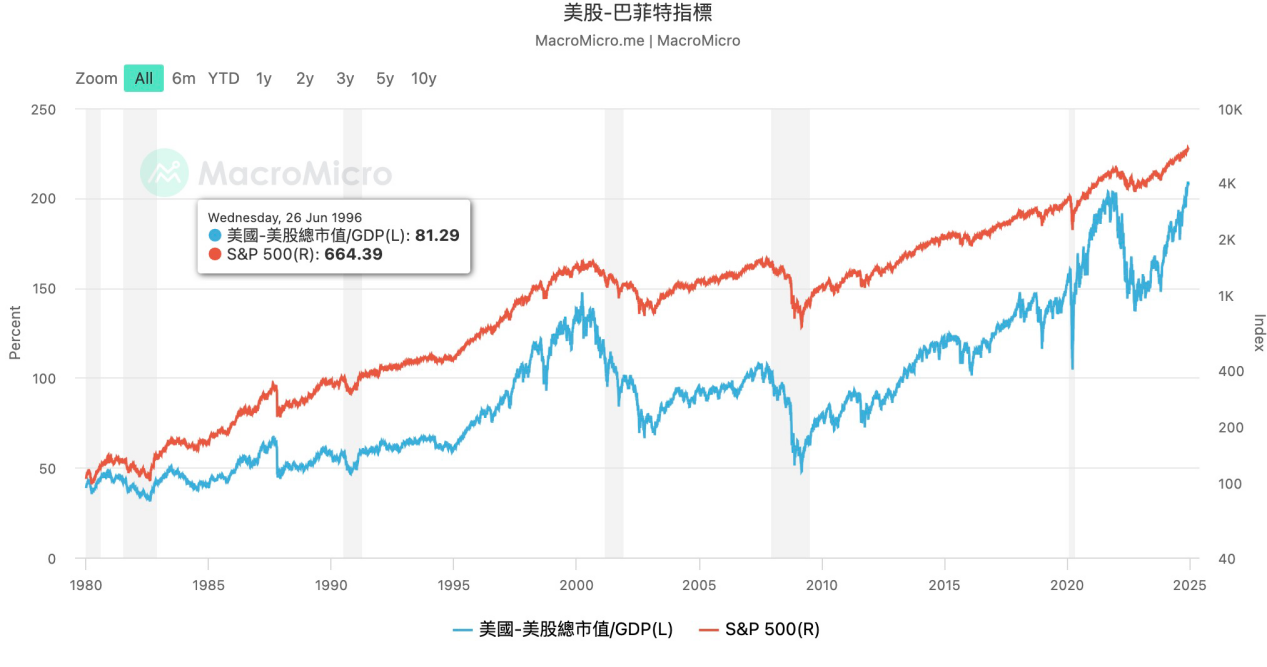

With Trump's return, his internal government policy cuts will significantly impact the structure of the U.S. economy. Let's look at a piece of data: the Buffett Indicator for U.S. stocks. The so-called Buffett Indicator, mentioned by the Oracle of Omaha in a December 2001 article in Forbes magazine, refers to the ratio of total stock market capitalization to GDP, which can be used to judge whether the overall stock market is overvalued or undervalued, hence it is commonly referred to as the Buffett Indicator. This indicator can measure whether the current financial market reasonably reflects the fundamentals, with Buffett's theoretical index indicating that a range of 75% to 90% is reasonable, while exceeding 120% indicates that the stock market is overvalued.

We can see that the current Buffett Indicator for U.S. stocks has exceeded 200%, indicating that the U.S. stock market is in a state of extreme overvaluation. Over the past two years, the core driving force preventing the U.S. stock market from experiencing a pullback due to tightening monetary policy has been the AI sector, represented by Nvidia. However, with Nvidia's third-quarter earnings report showing a slowdown in revenue growth, and its guidance indicating that revenue will further slow in the next quarter, this growth slowdown is clearly insufficient to support such a high price-to-earnings ratio. Therefore, there is no doubt that the U.S. stock market will face significant pressure in the coming period.

For Trump, the specific impact of his economic policies in the current environment is undoubtedly filled with uncertainty. For example, whether the tariff war will trigger internal inflation, whether cuts in government spending will affect domestic corporate profits, and the issue of rising unemployment rates, as well as whether reducing corporate income taxes will further exacerbate the already serious fiscal deficit problem. In addition, Trump seems more determined to rebuild ethical and moral standards within the U.S., and the impacts of advancing sensitive cultural issues, such as strikes, protests, and labor shortages caused by a decrease in illegal immigration, will cast a shadow over economic development.

If economic problems arise, particularly a stock market crash in the currently highly financialized U.S., it would severely impact his approval ratings, thereby affecting the effectiveness of his internal reforms. Therefore, implanting a core that drives economic growth into the U.S. stock market, which is already under control, seems very advantageous, and I believe Bitcoin is very suitable for this role.

We know that the recent "Trump trade" in the crypto world has fully demonstrated his influence on the industry, and most of the companies Trump supports are traditional domestic industries rather than tech companies, meaning their businesses did not directly benefit from the AI wave in the previous cycle. However, if the situation develops as we have described, it will be different. Imagine if domestic small and medium-sized enterprises in the U.S. choose to allocate a certain amount of Bitcoin reserves on their balance sheets; even if their main business is affected by some external factors, Trump could stabilize the stock market to some extent simply by promoting some crypto-friendly policies to drive prices. Moreover, this targeted stimulus is highly efficient and can even bypass the Federal Reserve's monetary policy, making it less susceptible to establishment constraints. Therefore, in the upcoming new political and economic cycle in the U.S., this strategy will be a good choice for Trump's team and many small and medium-sized enterprises, and its development process is worth watching.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。