The advantages of Rollup have brought the user experience of Ethereum back to its original state.

Author: Donovan Choy

Compiled by: Deep Tide TechFlow

Ethereum loves Rollup. Recently, "based" Rollup has gained significant attention.

What makes based Rollup special? The core lies in its sequencer.

Traditional Layer-2 solutions use centralized sequencers to process user transactions and submit them to Layer-1 for settlement, while based Rollup delegates the sequencing task to the validators of Ethereum Layer-1, a mechanism known as "based sequencing."

This design has two major advantages: censorship resistance and enhanced interoperability.

By allowing Layer-1 to act as the sequencer, based Rollup can provide the same liveness guarantees as the Ethereum mainnet while avoiding the censorship issues that may arise from centralized sequencers.

Read more: MagicBlock open-sources a16z-supported "temporary Rollup" technology

Another significant advantage is the substantial improvement in interoperability. Supporters of based Rollup (such as Justin Drake) refer to it as "synchronous composability," meaning that transactions on Ethereum can be synchronously ordered or bridged across different Layer-2s.

In simple terms, smart contracts on based Rollup can almost instantaneously call other contracts on Layer-1 within the same block, as if they were all on the same chain.

This synchronicity and the concept of "money legos" are not new; they have always been an essential part of Ethereum's original vision.

Read more: Rethinking Ethereum Consensus through Beam Chain

However, the current decentralized state of Rollup leads to asynchronous transactions between Arbitrum and Optimism, resulting in fee uncertainty. This uncertainty is further exacerbated by the calculation of Gas fees at different time points rather than uniformly within the 12-second time slot of Ethereum blocks.

In addition to enabling better interoperability for Ethereum, this mechanism also brings significant cost savings. Ahmad Mazen Bitar, the technical lead at Nethermind, explained:

"Users can initiate a transaction on Layer-1, utilize the deep liquidity pools of Layer-2 to complete the operation, and then return to Layer-1. This synchronous composability makes the entire process more efficient."

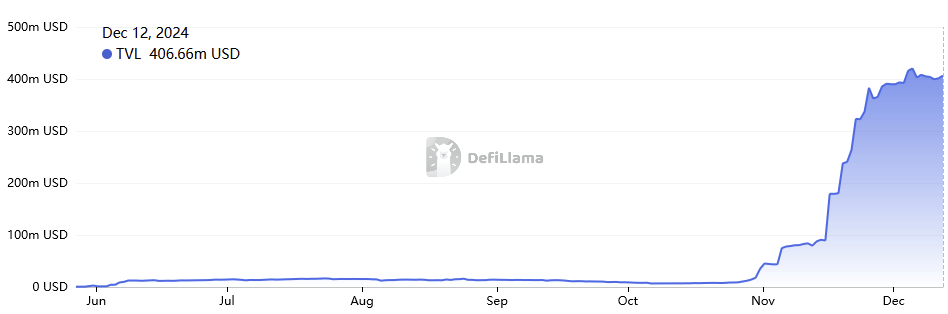

Currently, the largest based Rollup is Taiko, which has seen significant growth in both its TVL and daily transaction volume this month.

Source: DefiLlama

Other early based Rollup projects are also in development, such as Surge by the Nethermind team and UniFi by the Puffer Finance team. These projects are all based on Taiko forks.

Nevertheless, based Rollup also faces some challenges. Since the sequencing task is handled by Layer-1 validators, its performance is limited by Layer-1's 12-second block time.

As a result, the advantages of based Rollup (such as synchronous composability) may be difficult to fully realize in practice. It requires real-time zero-knowledge proofs to be completed within a 12-second time slot; otherwise, composable transactions cannot be executed quickly.

To address this, Taiko introduced various technologies, including zk proofs from Risc Zero and Succinct Labs, as well as a trusted execution environment (TEE) based on Intel SGX. This makes Taiko the first based Rollup to implement multiple proofs in a production environment without relying on a single trusted party.

"The performance of provers is rapidly improving. We are seeing more trusted execution environments (TEEs), more efficient and cost-effective zero-knowledge virtual machines (zkVMs), and verifiable state machines (AVS) being introduced. We believe that the progress of zk technology is going very smoothly, and the goal of generating proofs within sub-time slot delays is not far off," said Taiko co-founder Brecht Devos in an interview with Blockworks.

However, based Rollup also faces some challenges. For instance, the lack of a centralized sequencer may result in the loss of MEV (maximum extractable value), an important source of revenue. However, Devos stated that this issue can be addressed through some innovative approaches.

In the Taiko network, "MEV can be captured by auctioning 'execution tickets' to Layer-1 block proposers," Devos explained to Blockworks.

Therefore, while based Rollup defaults to giving sequencing rights to Layer-1 validators, this is not the only solution.

Matthew Edelen is the co-founder of Spire Labs, a company focused on Rollup infrastructure. He shared similar views in a recent Bell Curve podcast: "Auctions are not the only way to allocate sequencing rights. We can auction off 99% of the sequencing rights while allocating the remaining 1% to friends or independent stakers to present a better image on L2Beat."

In the long run, MEV may not be a major issue. This perspective stems from a simple cost-benefit analysis: currently, most of the revenue in blockchain comes from congestion fees, which far exceed MEV revenue. Moreover, as more efficient MEV solutions continue to emerge, the proportion of MEV revenue is gradually decreasing.

Thus, for Rollup, a better revenue model is to leverage the network effects brought by synchronous composability to benefit from congestion fees rather than relying on MEV fees.

As Justin Drake mentioned in the The Rollup podcast:

"Currently, the ratio of congestion fees to contention fees is about 80:20. In the revenue of the Ethereum mainnet (Layer-1), 80% comes from congestion fees—about 3200 ETH per day since the implementation of EIP-1559. Since the merge, MEV revenue has been about 800 ETH per day. I believe this ratio will become even more skewed, possibly evolving from 80:20 to 99:1."

In summary, the advantages of based Rollup have brought the user experience of Ethereum back to its original state.

Interestingly, this return actually evokes the characteristics that blockchain has possessed since its inception. Synchronous composability and the transaction ordering function of Layer-1 have always been core features of blockchain since the birth of the Bitcoin network.

The differentiation of execution layer responsibilities is primarily due to the recent centralization development path of Rollup (as well as the multi-chain architectures of Polkadot, Cosmos, and Avalanche). Now, based Rollup solutions are ready to reclaim this original intention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。