Original Title: "2024&2025, BTC's Last Mega Cycle - The Value and Price Discussion of BTC"

Original Source: Longye @ x Element

Abstract

As of the writing of this article, in Q4 2024, we are at the beginning of a new round of bull market in the cryptocurrency space. The value of BTC, in the macro context, can be compared to bonds and stocks in financial history, serving as the "fuel" for a new round of human technological development; in the meso context, it is the currency and index of the digital world that humanity will inevitably enter in the future; in the micro context, it is the new round of legal regulations being implemented, leading to the compliance of token issuance, thereby attracting global private investment demand. This may be the last "wild" cycle belonging to the crypto industry, and also the last mega cycle where BTC experiences significant beta growth. This means that after this cycle, BTC's beta will significantly decrease, but it does not imply that the broader token issuance market will lack opportunities for hundredfold alpha. The peak of this bull market for BTC is expected to occur in Q4 2025, with a high point of $160,000 to $220,000. Before that, excluding the "first wave" that has already occurred, there are two significant mid-cycle trends remaining. We are currently in the year 1999 of the internet era, which means that after the bull market peaks in the next 12-18 months, the crypto industry will face a long winter, similar to the bursting of the internet bubble in 2000-2001. Of course, this is also an opportunity for industry reshuffling and restructuring. I am looking forward to it.

When I feel the bull market approaching, it is also the time when I produce the most content.

About four years ago, at the beginning of the last cycle's bull market, I wrote "How Should We Invest in Digital Currency in 2021?." When we talk about the entire digital currency industry, we inevitably need to first mention the value and price of BTC.

If you already believe in the value of Bitcoin, feel free to jump directly to Section 5, which discusses expectations for Bitcoin's future price trends.

From an industrial perspective, I would like to discuss the value of BTC in three dimensions: macro, meso, and micro. From a macro perspective, BTC represents the risk-hedging expectations of the entire human financial market, and is the third capitalizable "financial medium" in human history after bonds and stocks; from a meso perspective, BTC is the best "index" of the "digital age" or web3 world that humanity will inevitably enter; from a micro perspective, BTC is gradually becoming compliant with regulations, which will attract a large amount of "traditional old money" in mainstream countries like the United States. In third-world countries, it siphons off unmet local private investment demand.

On a macro level, we view Bitcoin as a revolutionary asset in human financial history, and it is crucial to understand the changes in financial history. In "How Should We Invest in Digital Currency in 2021?, I positioned digital currency from a technological historical perspective. Behind every technological revolution, important financial infrastructures and entirely new financial "mediums" emerge.

Behind finance lies the change of the times. At present, we may be at the most uncertain moment in global political and economic situations in the past thirty years, and also the moment when the traditional financial order is the most fragile and likely to undergo significant reshuffling. I can no longer trace whether, during the famous financial bubbles like the "Dutch Tulip" hundreds of years ago, there were financial venues similar to the London Stock Exchange or the New York Stock Exchange, or whether Dutch vendors were accustomed to offline trading, merely speculating without establishing rules and order, leading to the bubble ultimately bursting. However, throughout history, every technological innovation remembered by humanity has been accompanied by a transformation of financial paradigms, and the transformation of financial paradigms is an inevitable product of changes in the times. These are mutually causal yet mutually reinforcing, ultimately writing a significant chapter in human history. I cannot predict whether, without the Civil War that brought about a dramatic change in American social structure, reshaping social classes and encouraging technological innovation to enter industry, the Second Industrial Revolution would have still begun in Britain but ultimately flourished in the United States, becoming a milestone.

At the same time, I have a more radical viewpoint: when everyone talks about economic stagnation and discusses how to find viable business models—why does business itself need a business model? Has the term "business model" itself lost its meaning?

Here are more of my thoughts, which are somewhat complex, and I will not elaborate further here. I will expand on this as the most important part in my future article "Philosophical Musings on Business and Investment in the Four-Part Series of Crypto Capital Theory."

[Excerpt: Discussing business models in the contemporary business and financial environment refers to the context of the past century, where the "corporate system" has been the mainstream business entity, developing a general path: expanding market size, increasing employee numbers, and ultimately going public, with a complete system for stock pricing based on profit * PE. This path may not hold in the future.

Currently, equity enterprises may account for 95% of the value held by "social capital" (or expressed as "private economy"), while publicly listed companies, which use stocks as value anchors, account for a large portion of capital value. However, in the future, this value may exist more in "businesses" (why can't limited partnerships work?) and "tokens" (foundations).]

Let’s spend a bit more time discussing the meso perspective of BTC's industry. At the end of the book I wrote in 2021, the first of the eight predictions mentioned that BTC is unbeatable. Referencing the electronic version of my book "Unlocking New Passwords - From Blockchain to Digital Currency" postscript four –

From the perspective of the technology industry, web3 is an inevitable trend for the future, and Bitcoin is the core asset of the entire web3 world, or in economic terms, it should be called "currency." In ancient times, gold was the most common "currency" in barter trade; after the development of modern nation-states and financial systems, national currencies became the most common "currency." In the future, with the arrival of the digital age, all life in the virtual space of the metaverse will require a new "currency."

Therefore, it is meaningless for some people to cling to "how can you invest in a token." Blockchain and crypto need a "plus," just like when someone asks you what sector you are investing in, you say, "I want to invest in equity enterprises," or "I want to invest in an internet enterprise." Web3, as a special industry, and crypto, as a new market tool and financial medium, are gradually integrating with other industries—Blockchain + AI = De AI, Blockchain + Finance = DeFi, Blockchain + Entertainment/Art = NFT + Metaverse, Blockchain + Scientific Research = DeSci, Blockchain + Physical Infrastructure = DePin…

The trend is clear, but what does it have to do with us? Or rather, how can we gain wealth appreciation after seeing the trend clearly?

Let’s shift our focus to AI.

In recent years, the main theme of the business society has been twofold: one is clear, and the other is hidden. AI is undoubtedly a hot topic that capital has been pursuing, one that can be showcased. Crypto is in the shadows, a place where various legends and myths of sudden wealth gather, but it is also limited in many ways, making it unattainable for many.

The potential of the AI market is widely regarded as being in the trillion-dollar range, especially in the fields of generative AI, AI chips, and related infrastructure. However, for investors, while everyone believes AI is a sunrise industry and is willing to invest their money, what should they invest in? Is there now an AI ETF index fund that comprehensively covers the AI ecosystem to effectively track industry growth?

There is not. In 2024, Nvidia's stock price rose nearly threefold, while the performance of most AI-themed ETFs during the same period appeared mediocre. Looking further ahead, Nvidia's stock performance will not necessarily correlate positively with the overall growth of the AI industry—chip companies cannot forever be represented solely by Nvidia.

Comparison of mainstream AI ETFs and Nvidia stock performance in 2024

AI is the main theme, but will there be a product that can anchor the future market value development of the AI industry, where the value of this ETF can rise as the entire industry’s output increases? Just as the Dow Jones Index/S&P 500 ETF represents the development of Web0 (equity enterprises), the Nasdaq ETF represents Web1, and investment opportunities in Web2 have not been presented in an indexed manner, the most suitable index for the value of the entire digital world of humanity in the Web3 world, or in the future, is BTC.

Why is the value of the Web3 world necessarily measured in BTC?

Because, since the birth of computers and the internet, humanity is destined to spend more and more time in the virtual world rather than the real world. In the future, when we wear VR/AR glasses, we can sit at home and visit Yellowstone National Park, experience the palaces of the Tang Dynasty in China, or enter a virtual meeting room to have coffee face-to-face with friends on the other side of the Earth… The boundaries between reality and the virtual will become increasingly blurred. This is what the future digital world, or the metaverse, will look like. And there, if you want to decorate a virtual space or have a digital person dance for you, you will need to pay—this cannot be in dollars, renminbi, or physical assets. The only thing I can think of that is most suitable and can be accepted by the entire digital world is Bitcoin.

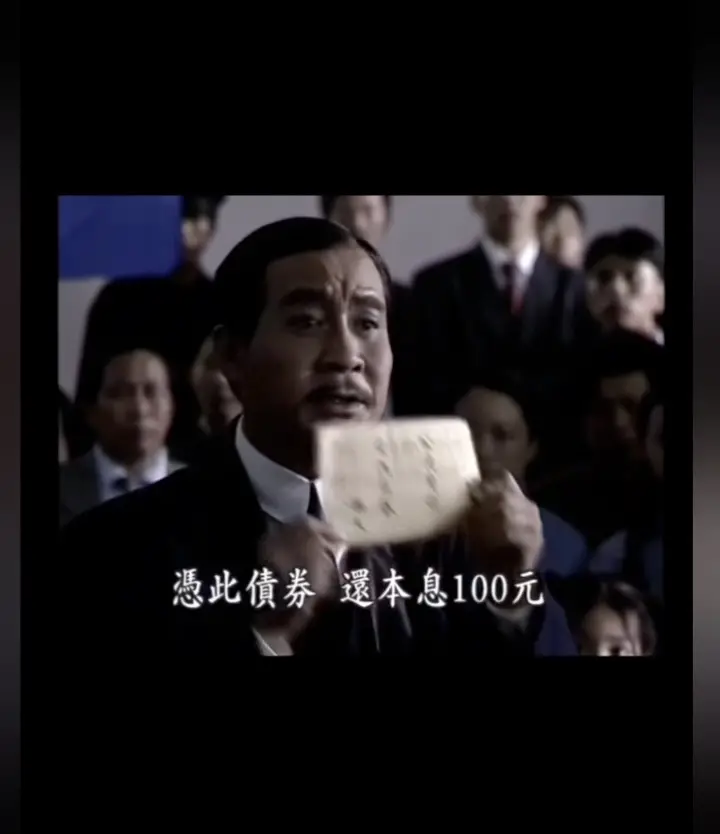

I remember in the movie "The Xinhai Revolution," Mr. Sun Yat-sen held up a 10 yuan bond: "Once the revolution succeeds, this bond can be exchanged for 100 yuan."

Back to the present.

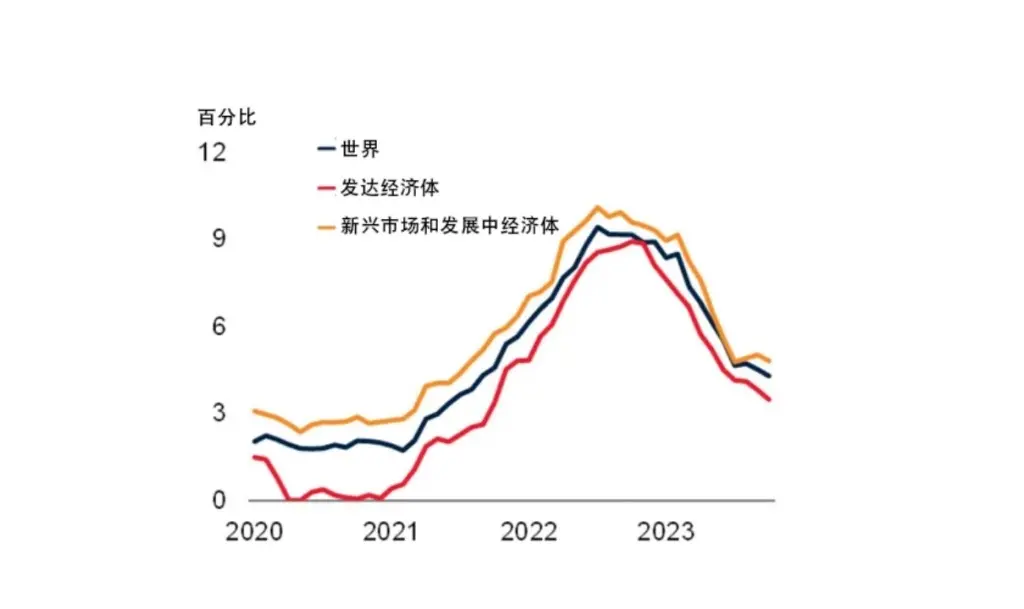

We live in economically stable countries where fiat currency can be trusted. However, this does not mean that the entire world's financial system is as stable as the society we live in: the first thing Argentina's new president did upon taking office was to announce the cancellation of Argentina's fiat currency system—after all, no one in Argentina trusts the government-issued fiat currency, so why bother? Turkey's inflation rate reached +127% in 2023, and correspondingly, the national digital currency ownership rate was as high as 52%. Especially in third-world countries, in recent years, as information technology infrastructure has gradually improved, traditional fiat currency mobile payments and digital currency payment methods have developed almost simultaneously. In comparison, it is like how, around 2010, China, during its booming information technology development period, skipped the 1.0 era of POS machines and bank card payments and directly entered the 2.0 era of mobile payments. In recent years, third-world countries have begun to develop, and the 3.0 era of digital currency payments has directly replaced the 2.0 era of mobile payment methods, making digital currency payments a common scene in daily transactions.

This brings up an interesting debate: Bitcoin has no controller, and if it cannot fulfill the macro-control functions of fiat currency as a currency or "medium," then in reality, the dollar is also issued by enterprises, so the so-called government macro-control must yield to the interest groups behind it; capital power is the driving force behind the world's operations. If we must say that fiat currency has macro-control, then the interest groups in Bitcoin mining are the biggest controllers.

Changes in inflation rates of major economies in recent years

Changes in Argentina's inflation rate in recent years

From a micro perspective, as the speed of capital flow accelerates, the cycles of technology and finance are becoming shorter and shorter. In an environment with weak economic anti-fragility, traditional equity markets require an 8-10 year lock-up period, and this characteristic of long-term investment raises concerns about liquidity for many. However, token rights provide the possibility of early monetization, which not only attracts more retail funds but also offers early investors more flexible exit expectations.

In traditional equity markets, angel round or early investors typically seek partial exits through equity transfers or company buybacks about five years after the establishment of the company, when the company has entered a relatively mature development stage but is still some time away from an IPO or acquisition (usually 8-10 years). This model can effectively alleviate the time cost of investment, but compared to token rights, its liquidity is clearly more limited.

The appeal of the token rights model lies in its ability to allow early investors to realize capital recovery earlier through token issuance or circulation, while also attracting a broader range of market participants. This flexibility may have a profound impact on the landscape of traditional equity markets.

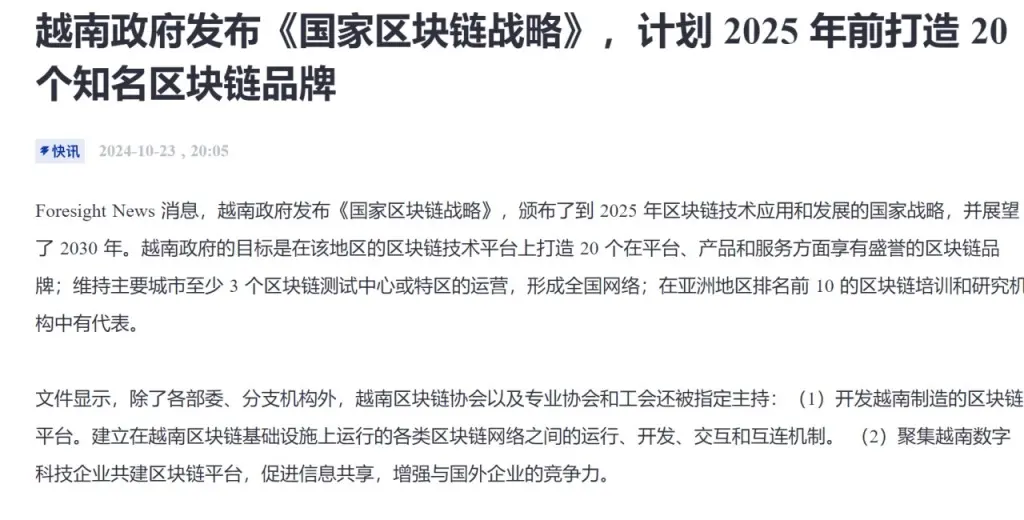

On another front, the financial markets of most sovereign countries around the world are extremely fragmented and lack liquidity, while the inherent global financial characteristics of crypto have greatly attracted these funds, including from countries like South Korea, Argentina, and Russia. Moreover, in some Southeast Asian countries led by Vietnam, the development of the stock market has not kept pace with the speed of wealth accumulation among the middle class, leading these emerging classes to skip the local financial market stage and transition directly to crypto. In the context of global digital currency compliance and integration with mainstream financial markets, the investment demand for private assets in these countries cannot be met by the weakened local financial infrastructure—South Korea's main board market (KOSPI) and the KOSDAQ have over 2,500 listed companies, but 80% of these companies have a market value of less than $100 million, and their daily trading volume can be negligible. In contrast, the digital currency market, which attracts global retail funds, has the most abundant liquidity, making it the best target for their investment participation.

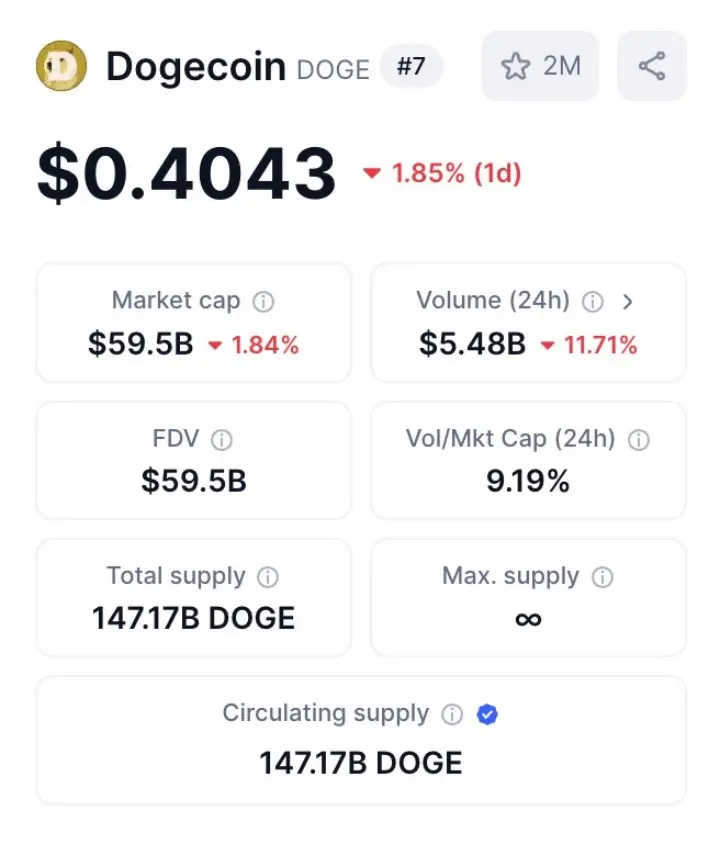

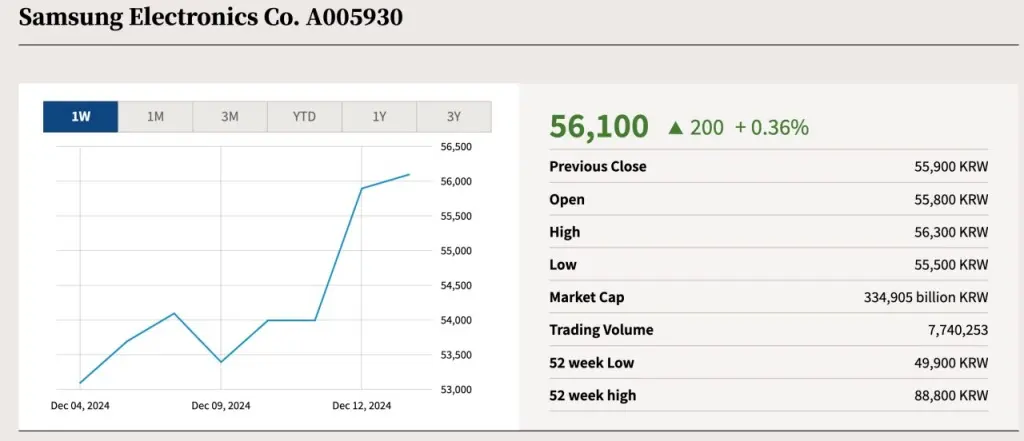

Current market value and trading volume of Doge

Current market value and trading volume of Samsung

Note: From the chart, we can see that Doge's current market value is about $60 billion, while Samsung's market value is about $234 billion, roughly four times that of Doge. However, Doge's 24-hour trading volume reached $5.5 billion, which is tens of thousands of times that of Samsung.

In the strategic hub of the global digital currency market—the United States, 2025 is likely to welcome a new transformation of the cryptocurrency legal system. The two most important bills—FIT21 and DAMS—will affect the future of the crypto space. These two blockchain bills, regulated by the Commodity Futures Trading Commission (CFTC) rather than the Securities and Exchange Commission (SEC), focus on treating token issuance (coin issuance) as commodity trading rather than securities issuance, thus falling under CFTC management. Considering that these two bills were proposed by the Republican Party, while the current SEC Chairman Gary Gensler represents the Democratic position, the bills face significant resistance. However, if Trump is re-elected, with the Republican Party in control, the likelihood of the bills passing will significantly increase.

To explain this bill simply, it means that coin issuance is treated as a commodity, regulated by the CFTC, thus legalizing it, which can greatly promote the enthusiasm for coin issuance financing. Companies will be able to legally and compliantly raise funds through coin issuance, attracting more capital into the crypto space. Moreover, with a stable channel for long-term compliant development, more people will remain engaged in this industry even after making money. Most importantly, after the U.S. takes the lead in introducing this bill, it will officially open up the competition among countries in the global digital currency financial market and blockchain technology market, with "grabbing projects" and "grabbing talent." In the fully globalized and freely flowing crypto space, further developments may occur in the future. If U.S. policies become more favorable, coin issuance may no longer be a gray industry but a respectable financial innovation, prompting founders currently residing in crypto-friendly countries like Singapore and Switzerland to migrate en masse.

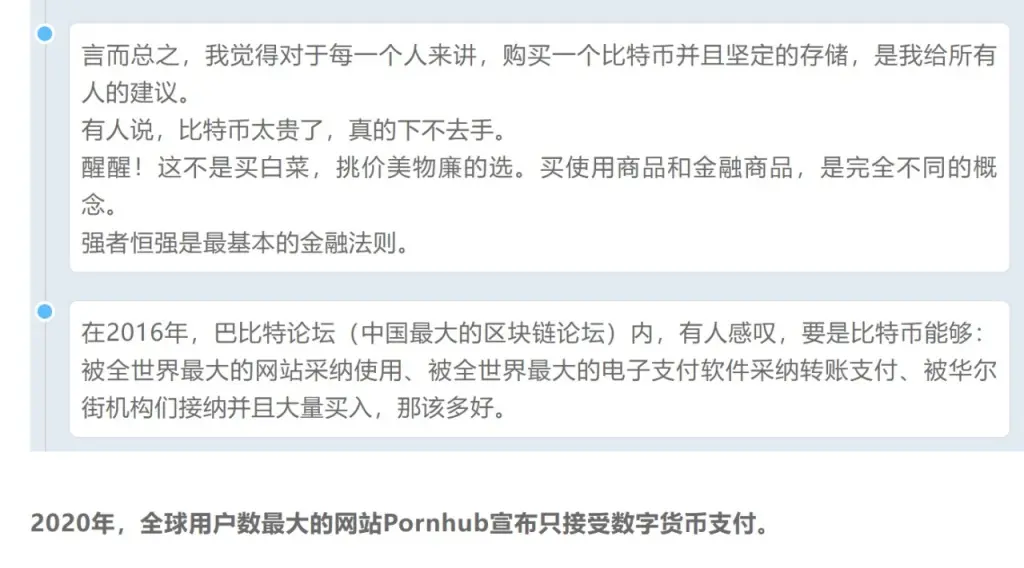

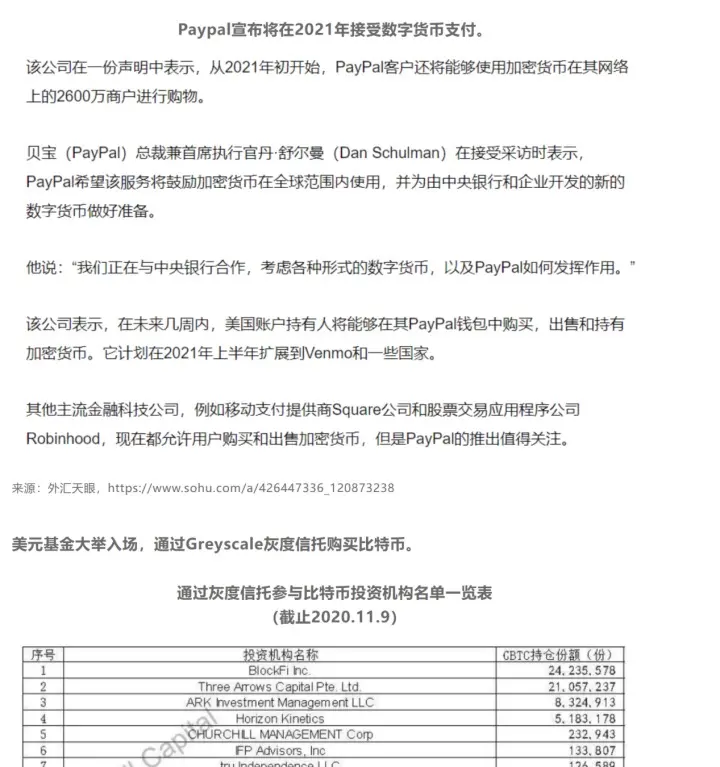

Looking back to 2016, when the types of crypto in the world could be counted on one hand, BTC was like a game currency that could be directly "recharged" with RMB into exchanges. Our generation of crypto natives had high hopes for the future.

That was also my dream.

Originally, I envisioned that these goals would take 8-10 years to achieve.

However, we only took four years.

It was also at that time that I had a new dream—since Bitcoin as a monetary asset has been gradually accepted by mainstream society, then other digital currencies, or tokens, should also play the role of digital goods in addition to digital equity, so that in the future digital world of humanity, they can generate utility beyond financial value, allowing humanity to better transition into the digital world.

Oh right, this thing later got a new name—NFT.

"Digital goods in the metaverse era" is my definition of the future of NFTs, and it is the most important link in truly realizing the web3 transformation and digitization of "goods in the internet era," leading to mass adoption.

For this reason, I resolutely began to build the NFT industry in early 2021. In the series of articles "The Road to the Future—Five Parts of Web3," I described my vision for its future.

Of course, the most visually appealing aspect, or rather, the one that makes more people willing to read my articles, is naturally the rise of BTC.

It's time to get to the point. It is necessary to mention my prediction for BTC's market: the peak of BTC in this cycle will occur at the end of 2025, with a reasonable range between $160,000 and $220,000. After that, in 2026, I suggest everyone to go into cash and take a break.

In my paper "Bitcoin Valuation Model Under Miner Market Equilibrium—Based on Derivative Pricing Theory," written on January 1, 2019, I mentioned the bottom of the four-year cycle from 2018 to 2021,

and the bottom of the four-year cycle from 2022 to 2025 that I mentioned in 2022.

From the current perspective, the entire crypto space is at a critical crossroads. Today's digital currency industry resembles the internet industry at the turn of the century; within the next 1 to 2 years, the bubble is not far from bursting. With the passage of crypto-friendly laws like the U.S. FIT21, the compliance regulation of assets like token rights will be completed, and a large amount of traditional old money, which previously lacked understanding of crypto or even scoffed at it, will begin to accept BTC and allocate 1%-10% of their portfolios. However, after this, if blockchain and digital currencies cannot gradually integrate with traditional industries and truly usher in the "blockchain + industry" transformation—similar to how the internet industry combined with and transformed consumption, social media, and media—I really cannot see any new incoming funds, nor any reason for this industry to present astonishing growth opportunities again. The DeFi of 2020, the NFT and metaverse of 2021—these were the right directions and sparked a wave of innovation at the time. However, throughout 2024, while BTC continues to hit new highs, the entire blockchain industry lacks sufficient innovative discussions; the market is merely filled with more memes and Layer 1, 2, and 3 projects, without any new "business concept innovations." Moreover, looking ahead to 2025, the atmosphere of the entire industry leads me to hold a pessimistic view regarding the emergence of milestone "business concept innovations."

As the tide rises, the water level rises, and now, with the floodgates open, small rafts are everywhere, competing to see who can row faster, even mocking those heavy, machine-powered iron ships. But when the big waves recede, the wooden boats will run aground; only those with enduring machine power can sail out of the harbor and embrace the sea.

In fact, making an interesting prediction, a sign that the crypto bubble has reached its peak will be when Buffett, the world's biggest opponent of Bitcoin, starts to change his tune and even participates in the industry. The phased victory of a revolution often coincides with the moment when the greatest crises are lurking.

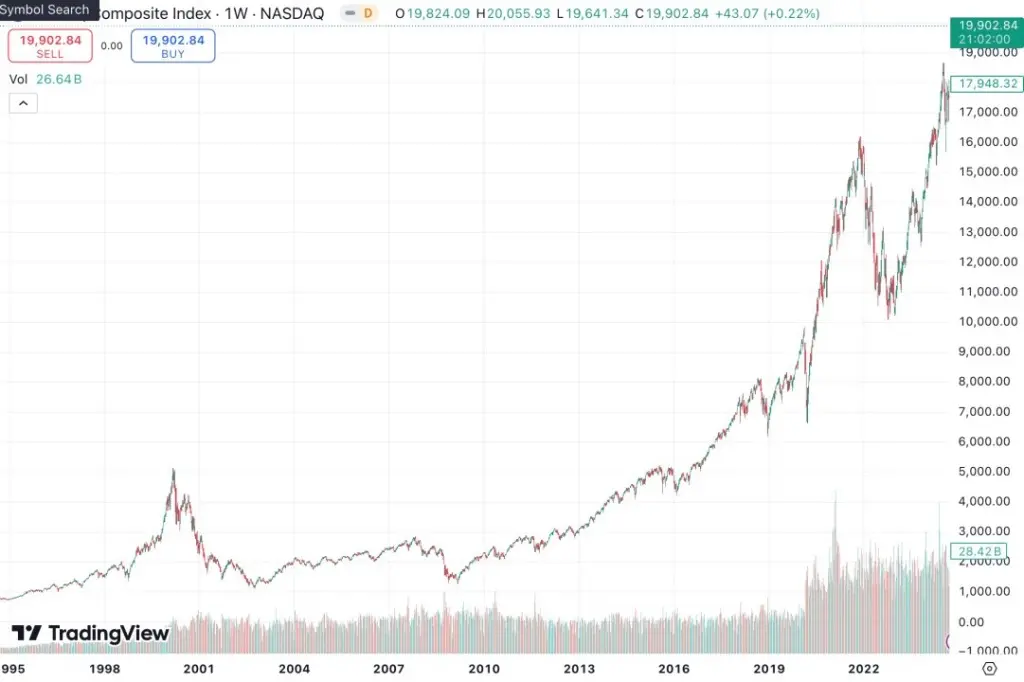

We can compare the current crypto space to the internet era of 1999. After experiencing a rapid surge towards normalization, the digital currency industry may face a severe adjustment due to a massive bubble starting from the end of 2025. Looking back at history, the internet industry welcomed the IPO of Netscape in December 1995, which sparked a market frenzy following Yahoo's listing in April 1996. On March 10, 2000, the Nasdaq index reached its historical peak of 5408.6 points. However, the bubble quickly burst, and by 2001, the market entered a winter period. Although the broad winter period lasted until 2004, the true low point was in October 2002, when the Nasdaq index nearly fell below 1000 points, marking the industry's lowest valley from a financial perspective.

In 2020, MicroStrategy successfully drove up its stock value by purchasing BTC, achieving a significant stock-coin linkage effect for the first time. By February 2021, Tesla announced its purchase of Bitcoin, marking a symbolic event for the entry of giants into the market. These historical moments inevitably remind us of the blockchain industry's "1995-1996"—the initial rise of the internet wave.

Looking ahead, I believe that by the end of 2025, Bitcoin's price may reach a long-term peak, but by early 2027, it may touch a new low. Once the FIT21 bill is passed, it could trigger a wave of public coin issuance, reminiscent of the unprecedented boom of the ".com" era.

If the threshold for token financing is lowered to nearly zero, allowing ordinary people to issue their own tokens as easily as high school students learn to create a website, then the limited capital in the market will be rapidly diluted by the influx of various tokens. In such an environment, the final wave of "frenzied bull market" belonging to token issuers may not last more than three months. Subsequently, due to market supply-demand imbalances and capital exhaustion, the industry will inevitably face a comprehensive collapse.

However, before that, in the next 12 months, we still have the potential for BTC to nearly double in beta growth, and for ordinary people, due to the global liquidity accumulation, there are countless early coin opportunities that could yield "hundredfold or thousandfold" returns in a very short time—why not participate?

Moreover, looking back at the internet industry, which was also criticized by many media as a "bubble" during its tumultuous rise. Today, the Nasdaq index has surpassed the 20,000-point mark. Looking back, what seemed like a peak in 2000 is now just a small hill. Even if one had entered the internet industry in 2000 and persisted until today, it would still be one of the most correct choices.

As for BTC, it’s just another small hill.

It has been 3202 days since I bought my first BTC on March 7, 2016.

I still remember the price displayed at the moment I clicked the mouse: 2807 RMB, which was less than $400.

Many people have asked me, how high do you think BTC can ultimately rise?

This question is meaningless. The price of gold has also been continuously hitting new highs in recent days and years.

The meaningful question is, how high can BTC's price rise before a certain point in time?

Let’s wait and see.

The best is yet to come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。