The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smokescreens.

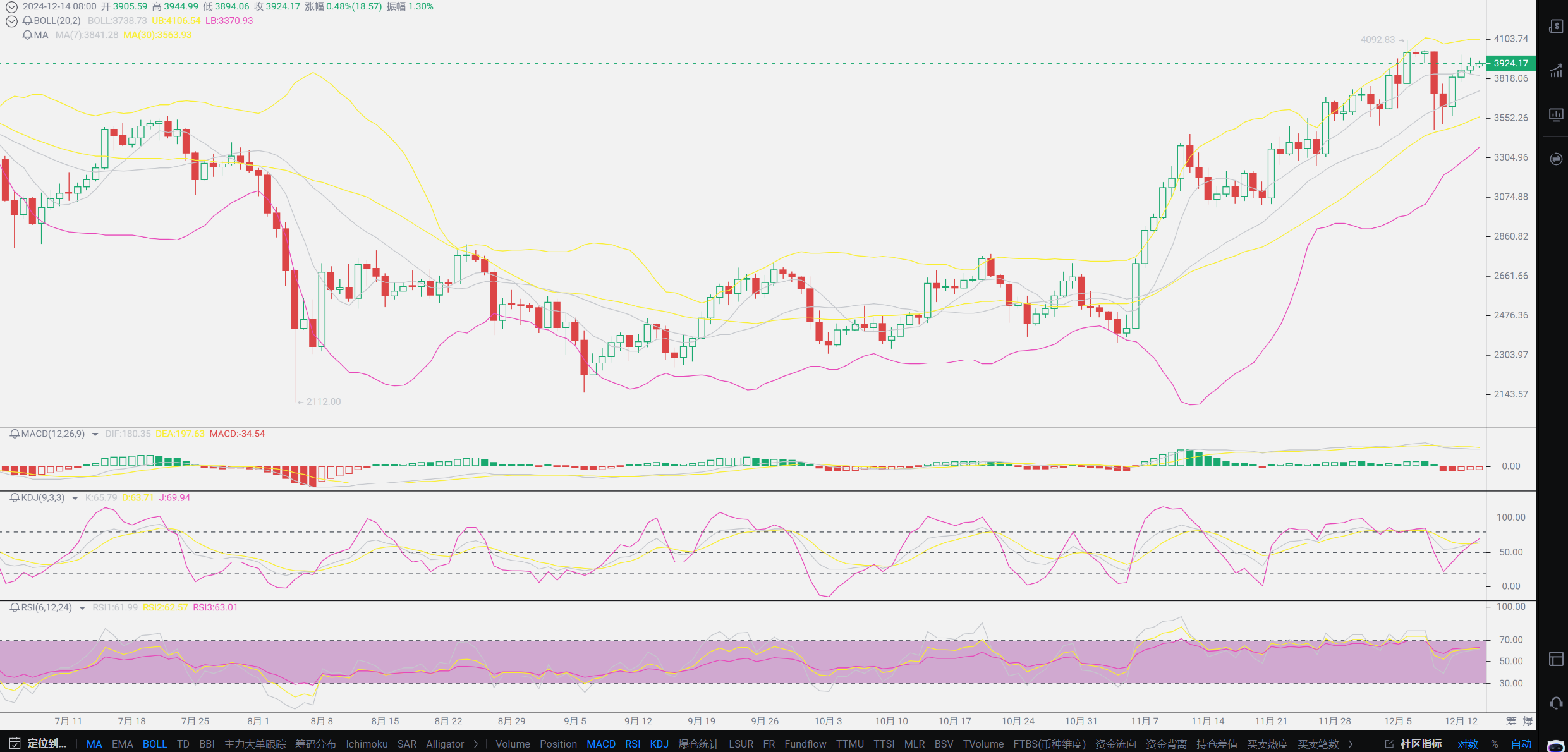

Yesterday was relatively calm, but the fluctuations still reached around 3000 points. As interest rates drop, many spot users are gradually becoming restless. Too many friends treat the cryptocurrency market as a speculative market, feeling that they will exit after a short-term surge to gain profits. This approach is naturally not a big problem, but the profits are generally average. Today, let's first talk about spot trading. Spot traders are mainly worried about the timing of Trump's potential exit, which Lao Cui mentioned earlier. So many friends feel that after Trump takes office, it may enter a downward phase, but this is not the case. Everyone must have a dual perspective on things. First, the profit-taking position that Lao Cui thinks is indeed around January, but that does not mean it will decline after January. This depends on many factors, such as the frequency of interest rate cuts next year, our monetary easing policy, and overall exchange rate fluctuations. A friendly reminder: monetary easing will definitely relax at the exchange rate level, so the strength of the dollar may gradually increase next year, and the exchange rate could reach various levels.

I have already talked about the impact of exchange rates on the cryptocurrency market; those who do not understand can look back. Regarding the end point of this bull market, it is actually difficult to see a reversal in the market. Whether it is the strength of Old A or the US stock market, the current impact on the cryptocurrency market can almost be ignored because the demand for capital in the cryptocurrency market is not as large as theirs. Everyone needs to learn to distinguish the impact of smokescreens, especially many coin friends conveying signals to Lao Cui, which are extreme and very radical. When a piece of news comes out, most people judge the bullish or bearish direction, while the real experts first think about the truth or purpose. For example, the CPI data from March to May this year in the US, with the economy declining, the data improved. The logic behind this must be an important piece of chess falling into place, and corresponding to Yellen's visit, everything becomes reasonable. This also includes that before every round of interest rate cuts, there will definitely be back-and-forth pulls. More friends will only think that the improvement in US data may really mean no interest rate cuts, but looking back at every interest rate cut process, and the first round of a 50 basis point cut, the problems behind the US are definitely not as glamorous as the data suggests. The CPI and previous data being flat already indicate that the previous planned interest rate cut strategy will continue, and this cannot be changed.

Once again, a friendly reminder: it is difficult to stabilize at the 100,000 mark before the interest rate cut. The current capital flow is not enough for Bitcoin, although the market value has increased, so various data displays cannot change this fact. True stabilization must have capital support. Interest rate cuts are indeed a good starting point, but they will definitely be accompanied by a deep washout phase. Do not let the bears disrupt your steps. Today, as expected, we have arrived at the 9 starting point. Many friends are starting to hesitate whether they can enter at the previous position. As long as your positions are entered according to what Lao Cui said, there shouldn't be too much of a problem. I remind you repeatedly that the profits from long positions are merely a matter of time and will not be trapped, but those trapped in short positions must stop losses in time or even change their strategies. The end time of the bull market will not end this year, and there will even be some continuation into next year. Looking back at the market at the beginning of this year, from the start of listing to the entry of large funds, it lasted less than half a year, and then later, the strong promotion by the US. Every step of the trend seems to be controlled by someone, so the high point is a height that is hard for everyone to imagine. As long as an analyst suggests shorting, they only need to show their short position records. Currently, shorting cannot maintain profits; do not go against the trend.

During the bull market phase, one can look bearish but cannot short. Everyone's grasp of methods ultimately has only one goal: profit. As long as it can be profitable, any method can be operated. Do not be confined to a single form of operation, whether it is doing T or bottom-fishing with longs. The focus of the bull market is for everyone to stay in the market. At this stage, as long as users enter the market, they can profit. Do not fear the depth of short-term pullbacks; the depth of pullbacks is a state that is inconsequential. This article was written on December 13th, and today continues from the previous text. Looking at the overall situation, it is still following our predictions. Yesterday was indeed too tiring, and I didn't finish writing an article, so I'm taking a break today. Today's market is completely a stage for Bitcoin; a single flower does not make spring. Through today's trend, it also confirms Lao Cui's speculation. At this stage, do you still think that the returns of small coins are higher than Bitcoin? Observe carefully; Trump's methods are not focused on the entire cryptocurrency market but have always concentrated on the Bitcoin market. Ethereum also gained attention after its listing, following the trend. For investments in small coins, as long as the investment is made before listing, do not pour all your main funds into it. As long as it is not listed, there is a risk of delisting. The advantage of the cryptocurrency market is that there is no regulation, but the risk is also due to the lack of regulation. The delisting of small coins is much easier than in the securities market.

Judging from the capital flow, Lao Cui's concerns about Bitcoin have always existed. In the past thirty days, too many people have cashed out and left, with net inflows reaching nearly 4 billion. Of course, these statistical figures are based on the data from various platforms. The inflow data of giants like BlackRock is independent of the platforms, so there is a discount on the credibility of the data. However, platform data can reflect market sentiment. Most retail investors do not have a positive outlook on this bull market, and the truth exists among a few. A cautious reminder: the trends of the past two days have basically established the decision to cut interest rates, and there will definitely be a rate cut. Do not let others blind you. Everyone is asking Lao Cui whether the interest rate cut will come. In Lao Cui's view, this is a predetermined fact. Currently, Lao Cui's long positions are still alive in the market, and there has been no outflow in spot trading. If there are other operations, Lao Cui will definitely remind everyone. Just keep an eye on Lao Cui; there may be a wave of pullback in the next few days, but do not move your chips. Just wait. Lao Cui will remind everyone of the exit date this month. The best days are 2-3 days after the interest rate cut, and the subsequent operations will be waiting for Trump's signal. With proper position management, those starting with 9 can all enter the market. I estimate that many of you may not have grasped this opportunity. If users who have not entered the market can directly ask, if you are unsure about the entry point, just ask Lao Cui. There is no high or low in the cryptocurrency market, only profit first!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; experts can see five, seven, or even more than ten steps ahead, while those with lower skills can only see two or three steps. The skilled consider the overall situation and strategize for the big picture, not focusing on a single piece or territory, aiming for the final victory. The less skilled, however, fight for every inch, frequently switching between bullish and bearish, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。