"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past seven days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

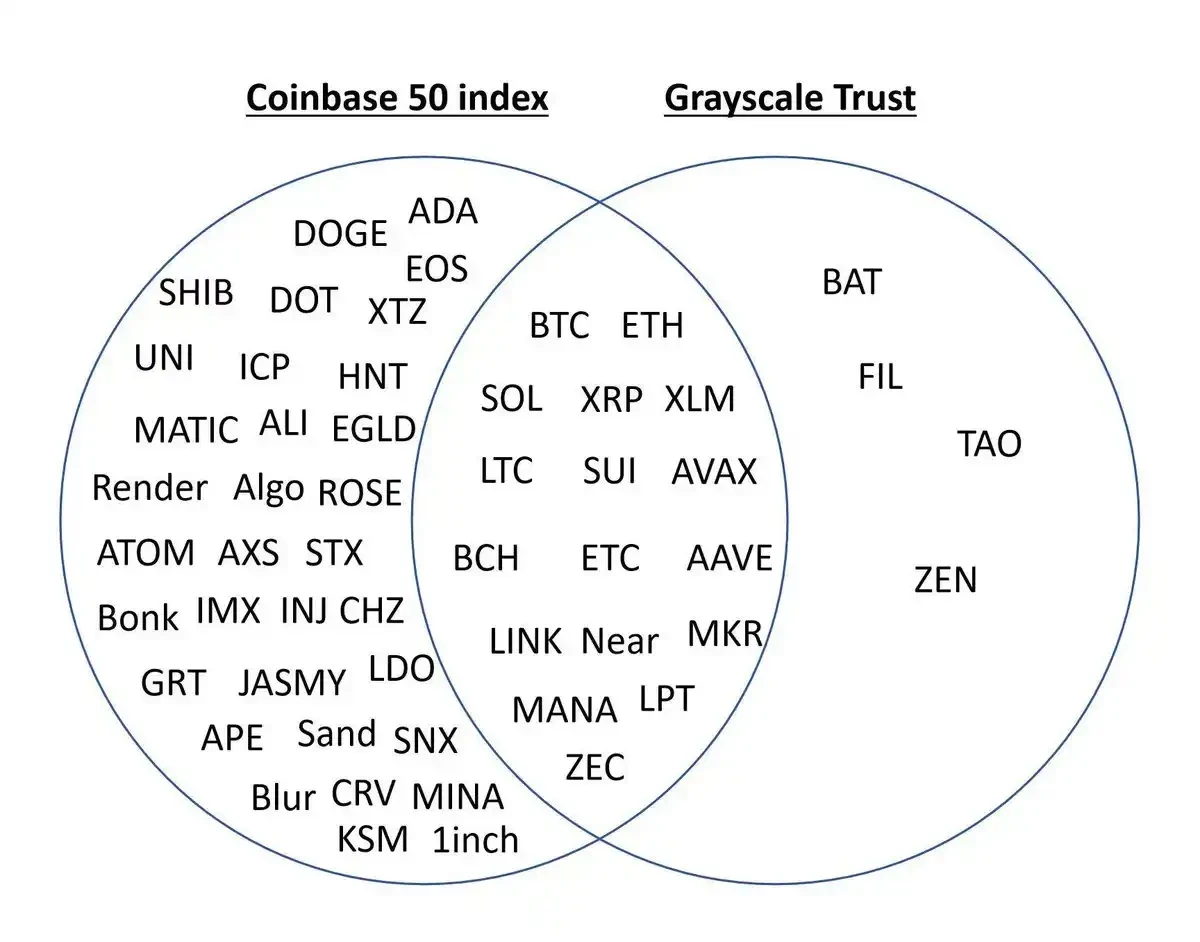

Grayscale's mainstream coin funds, decentralized AI funds, and DeFi funds have strong reference significance for "product selection." Combined with the Coin 50 Index, it can further filter overlapping coins, where the main capital for growth comes from U.S. institutions, capable of absorbing large funds.

Chainalysis Report: Stablecoins, TradFi, and RWA Are Leading the Next Wave of Web3

Current asset prices and DeFi activities are not the only indicators of market adaptability and resilience—global adoption of stablecoins, explosive interest in traditional finance (TradFi), and the rise of services for new application scenarios like tokenization (RWA) indicate that cryptocurrencies are being more widely accepted and integrated into the global economy.

XRP Soars 400%: Understanding the ISO 20022 Concept Behind the Surge of Old Coins

ISO 20022 (Financial Services - Universal Financial Industry message scheme) is an international financial communication standard developed by ISO (International Organization for Standardization) Technical Committee TC 68 (Financial Services). After years of development, it has become a unified standard for global financial messaging, covering multiple financial fields such as payments, securities, trade, cards, and foreign exchange.

Recognized ISO 20022 concept tokens include XRP (Ripple, also the only officially certified), XLM (Stellar), ADA (Cardano), QNT (Quant), ALGO (Algorand), HBAR (Hedera), IOTA (MIOTA), and XDC (XDC Network).

Rather than focusing on legitimacy, it is more important to pay attention to the actual implementation of the projects.

Also recommended: 《Delphi Digital 2025 Outlook: If History Repeats, BTC Will Break Above $175,000》《6 Strategies to Seize the Altcoin Market》《Electric Capital Report: 39,000 New Developers Joined, Solana Has the Most New Developers in Its Ecosystem》。

Meme

The Meme coin market performed brilliantly in 2024, with the Benchmark Index showing 279.8%, surpassing mainstream coins like Bitcoin and Ethereum.

The prosperity of the Meme coin market is largely based on the continuous improvement of underlying infrastructure, especially the innovation of launch platforms like Pump.fun, Sunpump, and Moonshot, which significantly reduce the cost of token issuance and player participation.

Currently, the narratives are dominated by animal-themed memes and cult culture memes, which have deep cultural roots and loyal fan bases.

Don't Let Slippage Eat Into Your Profits: Advanced Strategies for Profiting from Meme Trading

The article introduces how to maximize returns using Concentrated Liquidity (CL) pools while gradually exiting positions. It is important to note that providing liquidity for Memecoins has both advantages and disadvantages.

Meme Cultivation Manual: Rebirth as a Diamond Hand (Final Chapter)

In addition to profitability, attention should be paid to timing ability; it is necessary to "reverse the cause and effect" based on the style of smart addresses.

Tokens in the tens of millions market cap range are usually linked to AI tools, not just simple AI memes, and there is further upward potential as platforms develop.

The article further introduces GRIFFAIN, Top Hat, AVA, REALIS, FXN, and CHAOS.

ARC Rapidly Approaches a $30 Million Market Cap: Understanding the Narrative of New AI Tokens

After PEPE, Which Animal-Themed Meme Will Hit a Market Cap of $10 Billion Next?

FLOKI (FLOKI), Brett (BRETT), Peanut the Squirrel (PNUT), DOG•GO•TO•THE•MOON (DOG), Neiro (NEIRO), Moo Deng (MOODENG) are worth paying attention to.

Bitcoin Ecosystem

Cycle Trading: Bit Deer’s Original Intention - Rebirth - Leap

Its first growth curve: self-developed chips, selling mining machines, self-operated mining farms; market concerns revolve around the ratio of mining machine sales to self-use, and the competitive relationship between Bitmain and Bit Deer. The second growth curve is AI computing power.

Note: Bitcoin price volatility risk; risks from sanctions leading to TSMC wafer supply issues.

Behind the Historic High Stock Price, Bit Deer’s Three New Layouts

Behind the stock price performance, Bit Deer’s three major layouts in recent years are worth noting: entering the mining machine market, Tether becoming its major shareholder, and collaborating with the Kingdom of Bhutan to operate mining farms.

Also recommended: 《Roger Ver Reveals Dark History: How Bitcoin Was "Hijacked" by Intelligence Agencies?》《Bitcoin Breaks $100,000, Yet the Ecosystem Remains Tepid: What Do Veteran Players Think?》

Multi-Ecosystem and Cross-Chain

Recommended: 《Primitive Ventures: The Logic Behind Reverse Investment in Movement and the Growth Secrets of a $10 Billion FDV》《Comma3 Ventures: Why We Chose to Support the Sui Ecosystem in Its Earliest Stages?》。

DeFi

Sushi Official Plans to Liquidate SUSHI Tokens from the Treasury: Where Is DeFi 2.0 Headed?

Sushi's official announcement revealed the Super Swap roadmap. From ecological expansion to product aggregation, from seamless integration to cross-chain exchange, from LP risk management to LP process simplification, Sushi has begun a new round of product iteration and updates in multiple areas, hoping to attract greater liquidity and more users.

Other recent hot DeFi protocols and platforms include: Hyperliquid (an L1 public chain driving DeFi 2.0), Uniswap (Unichain gearing up), ORCA, RSR, DYDX, CRV, etc.

MemeFi may lead the next round of industry growth.

A Comprehensive Analysis of Aave's Movements: Trump Family "Endorsement," V4 Launch Imminent

V4 will build on the successful features of V3 (eMode, isolation mode, etc.), enhancing capital efficiency and integration with GHO. Its ultimate goal is to create a truly immutable, permissionless financial layer.

NFT

NFT Sector Recovery: What Participation Opportunities Are There?

Pudgy Penguins, Milady; in addition, NFT infrastructure projects still have room for growth (such as Metaplex on Solana).

Web3 & AI

OKX Ventures Report: From Innovation to Pricing, Potential and Development Path of the DeSci Track

The DeSci track is gaining popularity, but the market is in the early stages of competition. Research funding projects like BioDAO face closed-loop challenges. Meme-driven narratives are at the core of DeSci's current discourse. Product implementation and commercialization still have a long way to go. Returning to the core advantages of blockchain is essential to overcome implementation challenges.

A Summary of 14 Popular Use Cases for AI Agents

AI influencers and Memecoins, AI venture capital agents, hedge fund trading agents, multi-party governance agents, predictive market agents, AI response experts, autonomous community strategists, content review agents, hackathon organizers, developer assistants, analysts, all-day support service agents, DAO financial management agents, media subscription agents.

Weekly Hot Topics Recap

In the past week, the altcoin season continued; preliminary voting results showed Microsoft shareholders voted against the Bitcoin investment proposal;

Additionally, in terms of policy and macro markets, Russian lawmakers proposed establishing a national Bitcoin reserve to counter economic sanctions; the South Korean National Assembly has approved delaying the collection of virtual asset taxes until January 1, 2027; the Vancouver City Council in Canada passed a motion to become a “Bitcoin-friendly city”; Elon Musk became the world's first person with a net worth exceeding $400 billion; Google launched a new generation of quantum computing chip Willow;

In terms of opinions and statements, institutions: U.S. CPI data is unlikely to change the Federal Reserve's recent policies; Ray Dalio: will invest in gold and Bitcoin as “hard currencies”, while avoiding debt assets; Michael Saylor: suggests the U.S. sell its gold reserves to purchase at least 20% to 25% of circulating Bitcoin; Bloomberg: MicroStrategy disclosed in its October filing that a significant drop in BTC could have a major adverse impact on its financial condition; Matrixport: Stablecoin inflows are slowing, and Bitcoin's short-term gains may moderate; Bitwise released its top 10 predictions for 2025: the year of crypto IPOs, Bitcoin will break $200,000; Avalanche founder: The early P2PK format of Bitcoin could leak public keys, and under quantum threats, 1 million Bitcoins belonging to Satoshi should be frozen; Magic Eden CEO: Co-founders will lock up ME for 18 months; CZ: Project teams should launch products as soon as possible, or at least a minimum viable product;

Regarding institutions, large companies, and leading projects, Ripple CTO: still hopes RLUSD stablecoin will launch by the end of the year, currently significantly affected by the holidays; Movement launched TGE and Movement Mainnet Beta; Sushi released its 2025 product roadmap and hinted at a multi-token airdrop; EigenLayer: plans to launch upgraded Rewards v2 in January 2025 to enhance ecosystem flexibility; community users reported that OpenSea V2 has launched a trial experience points system; Milady founder's meme coin CULT launched; Nature magazine introduced the DeSci protocol ResearchHub;

In terms of data, since Trump's election victory, U.S. Bitcoin spot ETF inflows have approached $10 billion; on December 8, Pudgy Penguins' floor price surpassed BAYC;

In terms of security, the Cardano Foundation's Twitter account was hacked; Gate.io responded to theft rumors: reserves have exceeded 10 billion… well, it has been another eventful week.

Attached is the portal to the Weekly Editor's Picks series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。