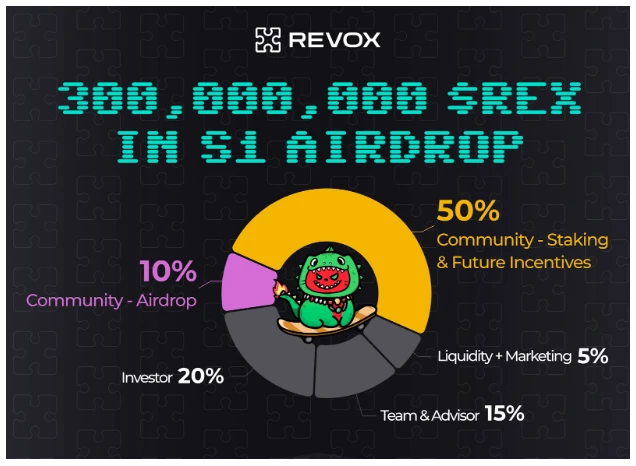

According to official news, the AI Agent infrastructure REVOX has announced its tokenomics, with a total supply of 3 billion REX tokens, of which 60% is allocated to the community, and the first phase airdrop accounts for 10%.

The REVOX tokenomics includes two types of tokens: REX and sREX.

REX is the main governance token of REVOX, playing a core role in platform governance, payments, and ecosystem rewards. The core uses of REX include:

Paying for AI service fees. REVOX's core products (such as Lense, SmartWallet, Studio, Agent Marketplace) and third-party products that support REVOX AI payments accept REX as a payment method. Using REX for payments offers discounts based on dynamic pricing.

Converting to sREX to earn ecosystem rewards. Users can convert REX to sREX to participate in various rights within the REVOX ecosystem.

sREX is a special staking token that can be converted from REX at a 1:1 ratio and can only be converted back to REX within a specific redemption period. sREX provides flexible redemption options, but redeeming before the lock-up period will result in token deductions, with specific rules as follows: 50% is permanently destroyed, removed from circulation, reducing the total supply. 50% is injected into the sREX staking pool to enhance reward earnings for long-term holders. The core uses of sREX include:

Stake-to-AI mechanism. sREX holders earn AI service points daily based on their holdings, which can be used for REVOX products and partner ecosystems.

Participating in staking pool rewards. sREX holders can join the staking pool to receive additional rewards: within 180 days after the TGE, the staking pool is directly funded by the REVOX Foundation. After 180 days, the rewards for the staking pool come from the foundation's funding and the deducted tokens from short-term redemptions.

Participating in future token airdrops. For projects built in REVOX Studio or distributed in the REVOX Marketplace, sREX holders will have the opportunity to receive airdrop tokens based on their level of participation and holdings.

The REVOX tokenomics achieves a dynamic balance between long-term incentives and market deflation through innovative design. The payment attributes and governance functions of $REX, combined with the staking rewards and ecosystem rights of $sREX, together construct a token system that encourages long-term holding. The advantages of this design include:

- Delayed staking inflation.

The staking reward inflation of sREX is dynamically delayed, not directly affecting the tradable REX, thereby reducing market volatility.

- Mitigating the impact of "paper hands" on inflation.

"Paper hands" who choose short-term redemptions will face higher token deduction rates, effectively alleviating the inflation pressure on REX.

- Dynamic balance between "paper hands" and "diamond hands."

The staking pool gains high deductions from short-term redemptions, further rewarding long-term holders, forming a positive incentive mechanism for "diamond hands."

- Long-term deflationary design.

By permanently destroying 50% of the deducted tokens, REX is designed as a deflationary token, enhancing the return rate for long-term holders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。