Original Author: Delphi Digital

Compiled by|Odaily Planet Daily (@OdailyChina)

Editor's Note: On December 11, the well-known research institution Delphi Digital released a market outlook report for the cryptocurrency industry for 2025. This article is the first part of that report, mainly outlining Delphi Digital's analysis of Bitcoin's trend and potential for growth since 2015.

Delphi Digital mentioned that if historical trends repeat, Bitcoin could rise to about $175,000 in this cycle, with short-term potential even reaching $190,000 - $200,000.

The following is the original content from Delphi Digital, compiled by Odaily Planet Daily.

At the end of 2022, we outlined the reasons why the bear market had bottomed out.

Fifteen months ago, we began to express our confidence in the upcoming bull market cycle more candidly.

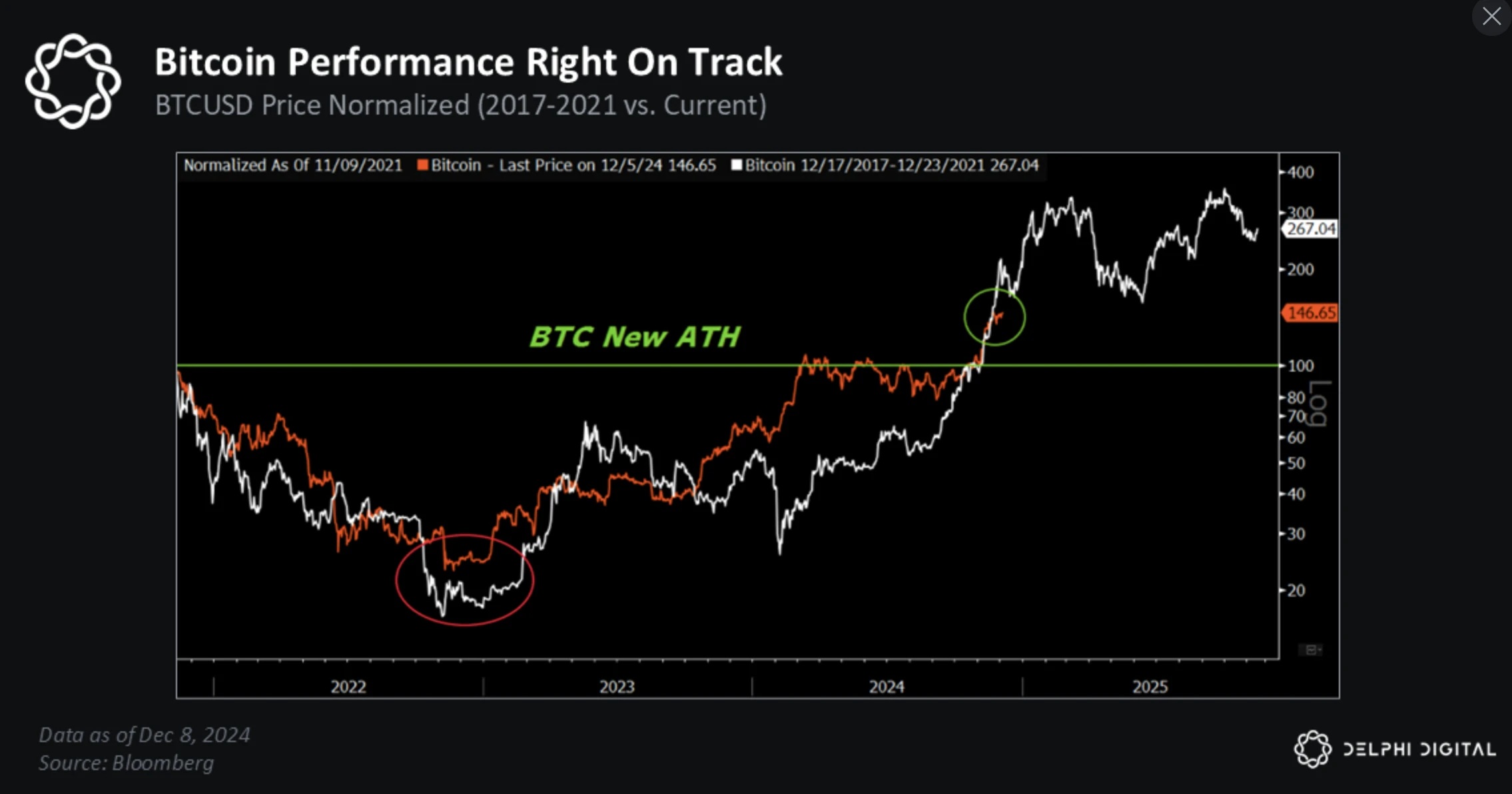

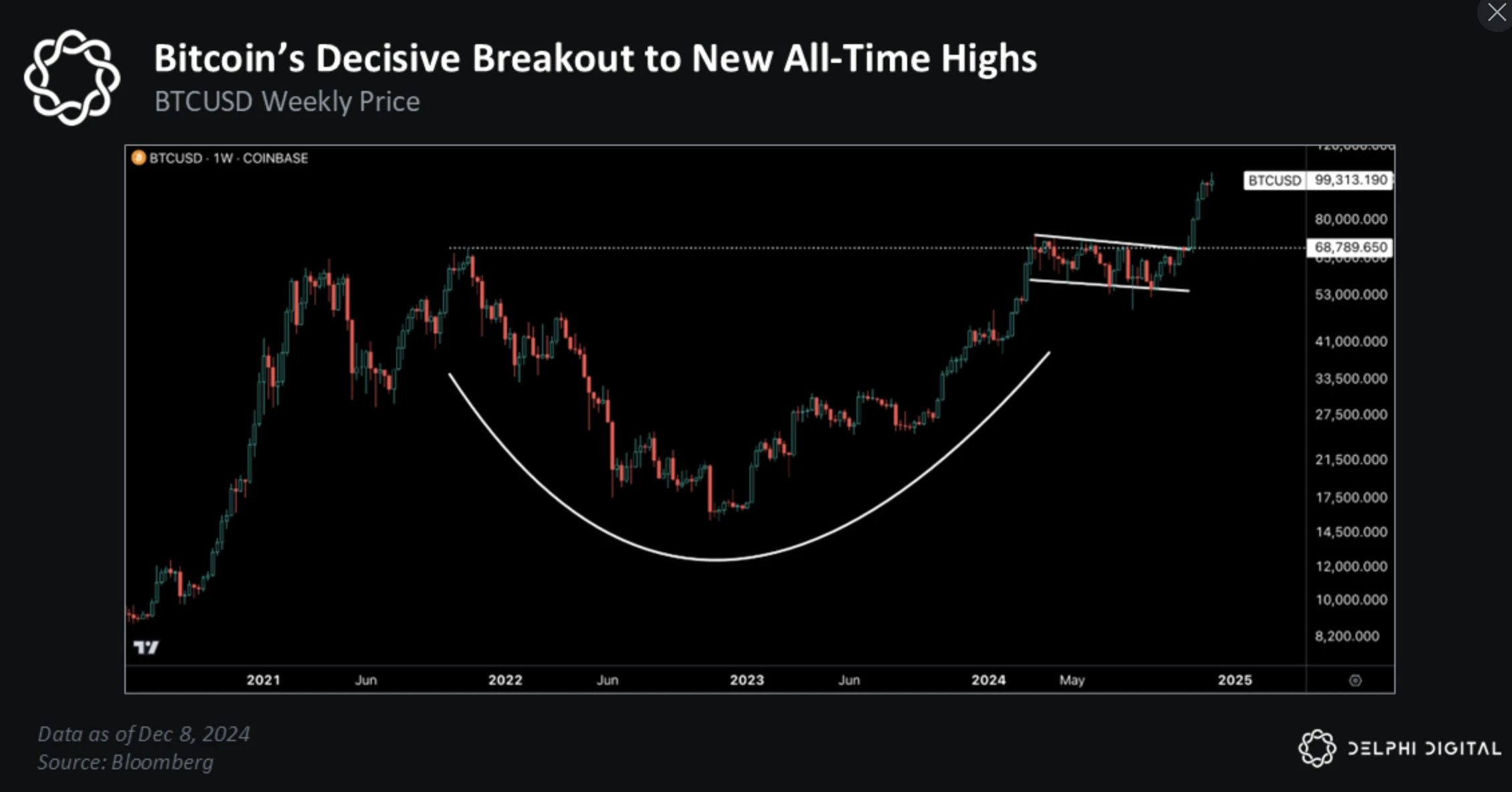

In last year's annual report, we also predicted that BTC would break new highs in the fourth quarter of 2024.

Although from a technical perspective, BTC had already reached new highs due to ETF speculation at the end of March this year, the recent breakout aligns more closely with our original expectations.

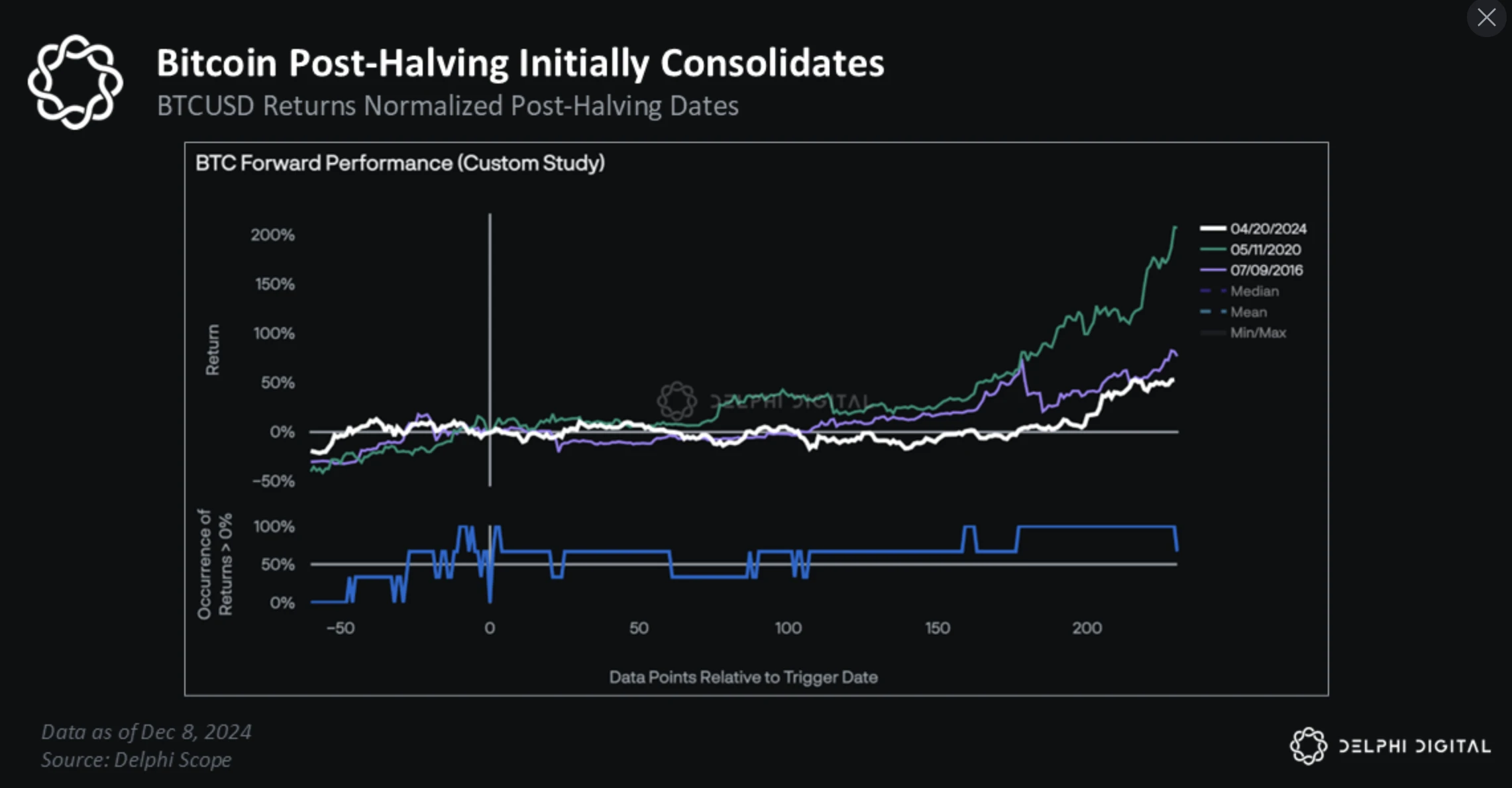

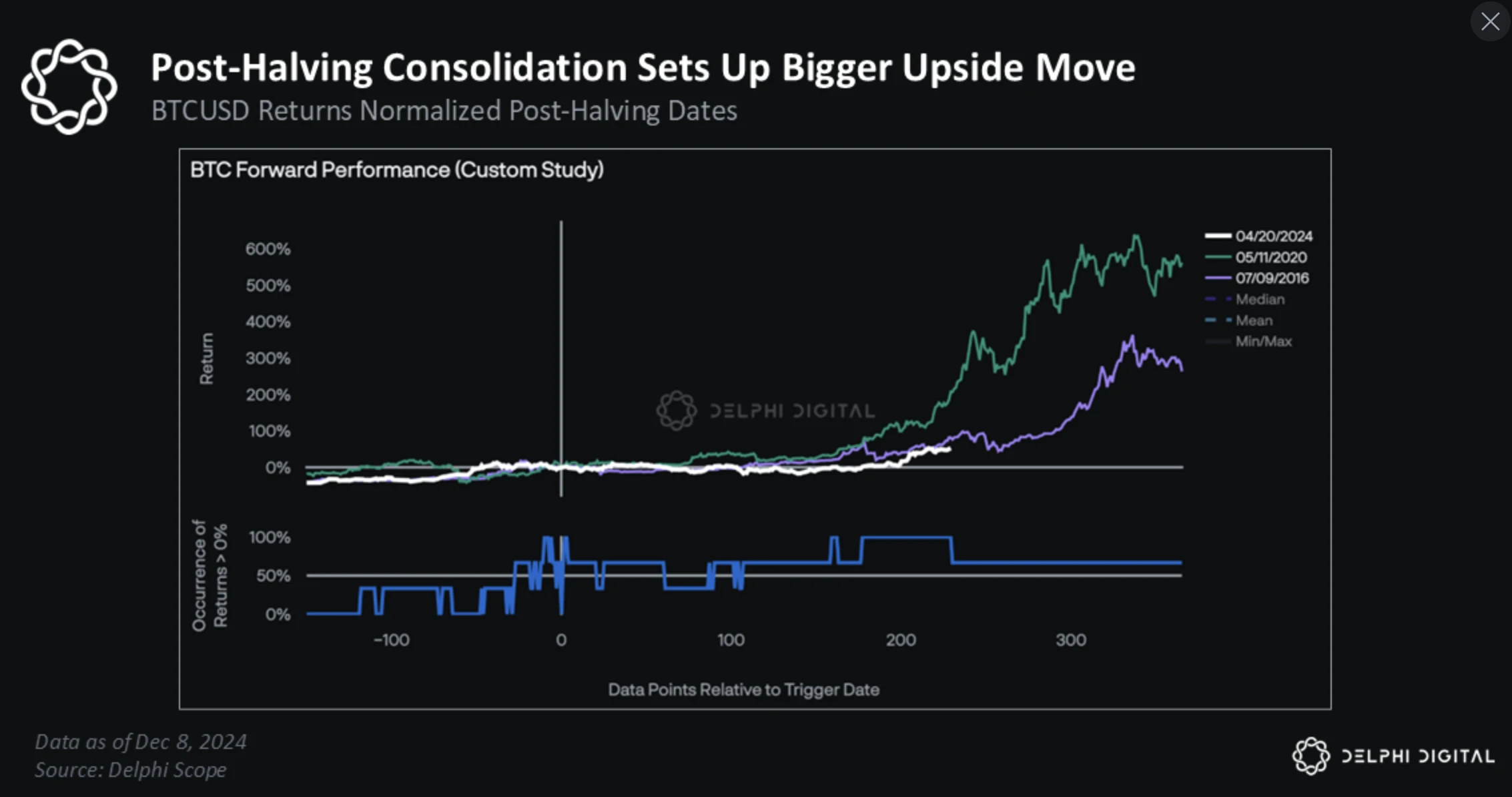

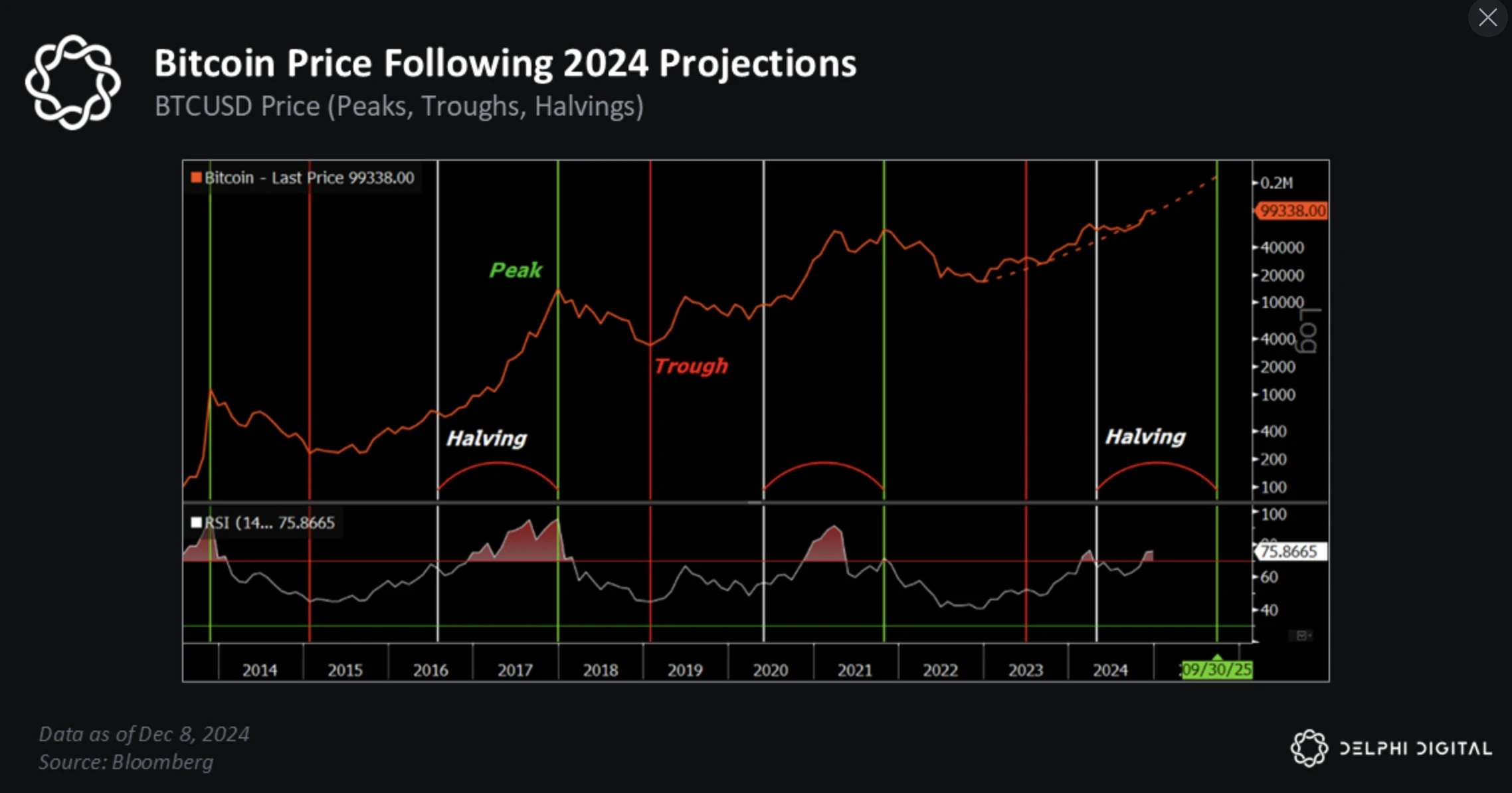

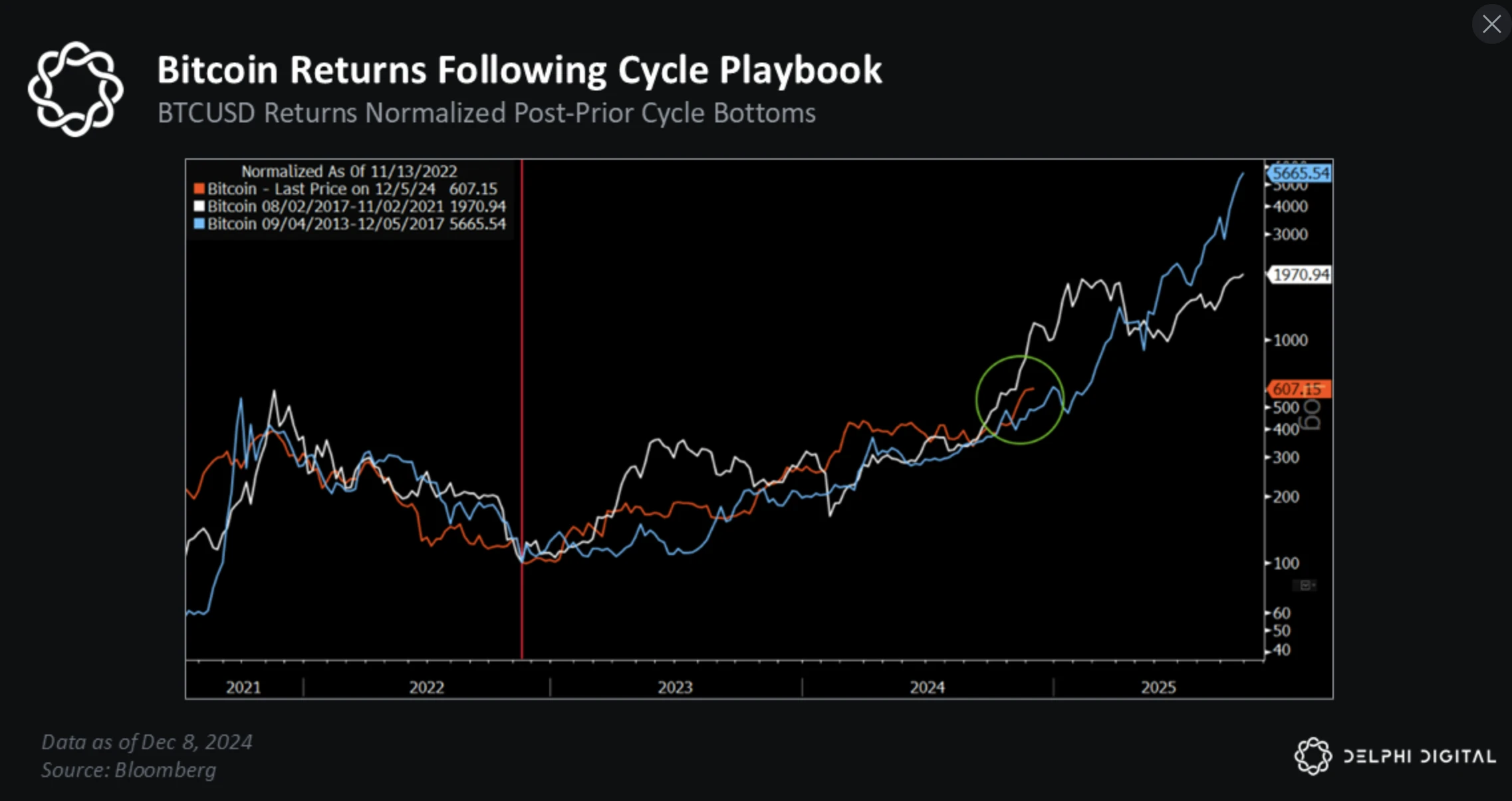

When we released last year's annual report, there were just over three months until the next Bitcoin halving. We observed from historical data that BTC often rises in the weeks leading up to the halving and enters a consolidation phase afterward, laying the groundwork for a larger increase later.

Fast forward to today, and BTC's actual performance closely follows this path.

Recently, BTC's surge has positioned the market very favorably for further growth.

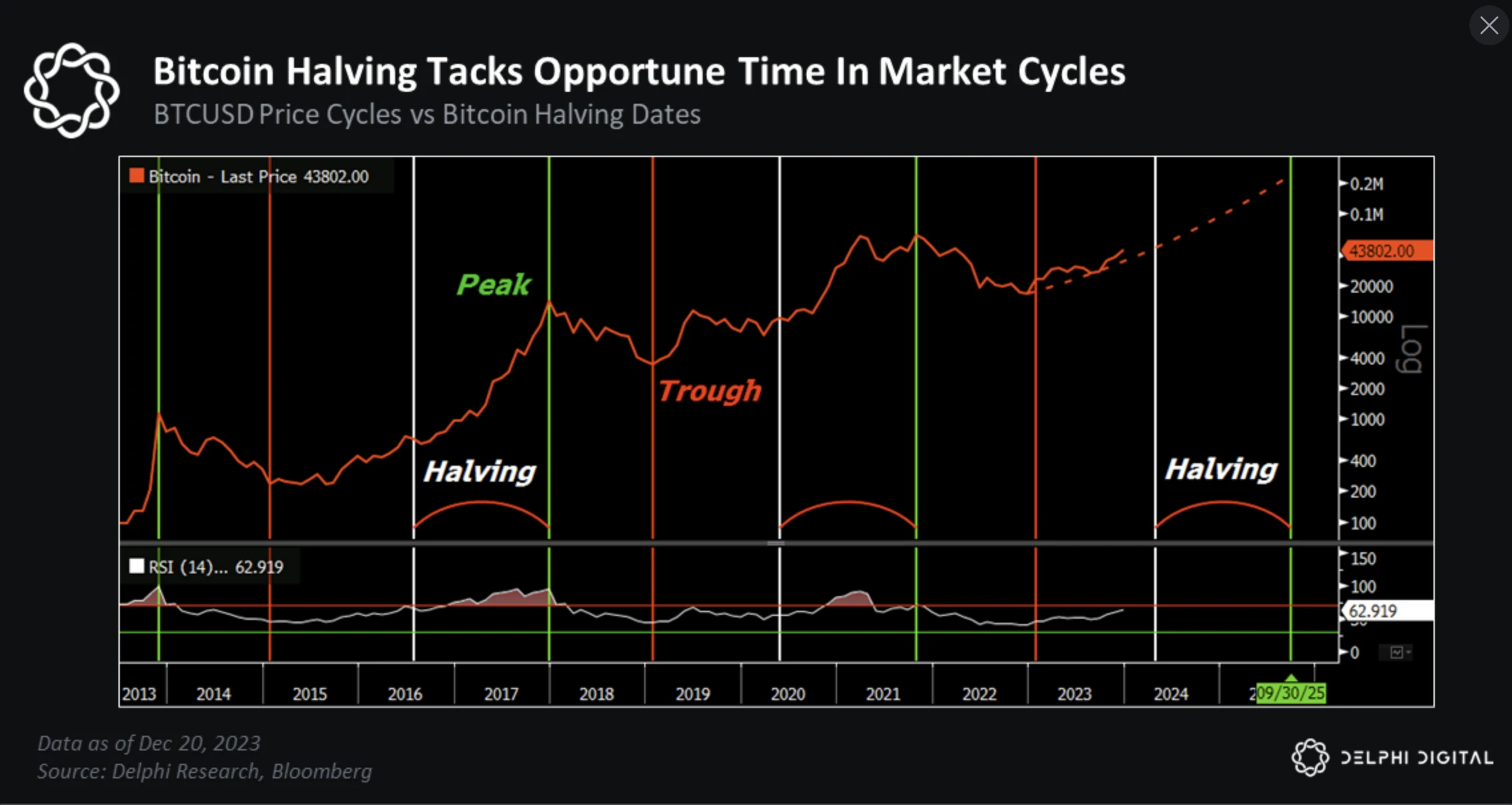

We also reaffirm our view that the Bitcoin halving is not the key catalyst for a bull market — it merely coincides with BTC's periodic upward timing.

As shown in the following chart, this was the situation at that time.

The current situation looks like this.

BTC's performance is highly consistent with Delphi Digital's cyclical predictions, which is almost miraculous.

Long-time readers of Delphi Digital's research reports may know why this is the case — it is not a miracle.

The market is driven by momentum, which is vividly reflected in BTC and other cryptocurrencies.

Every historical high of BTC coincides with the "monthly RSI breaking above 70." In previous bull markets, the market often did not exhaust its momentum until this indicator broke above 90.

If this historical pattern repeats, BTC must rise to about $175,000 in this cycle to reach the corresponding RSI level (and if it really starts to surge, it could even reach $190,000 - $200,000). This prediction assumes that the peak of the current cycle will experience an acceleration phase like most previous cycles.

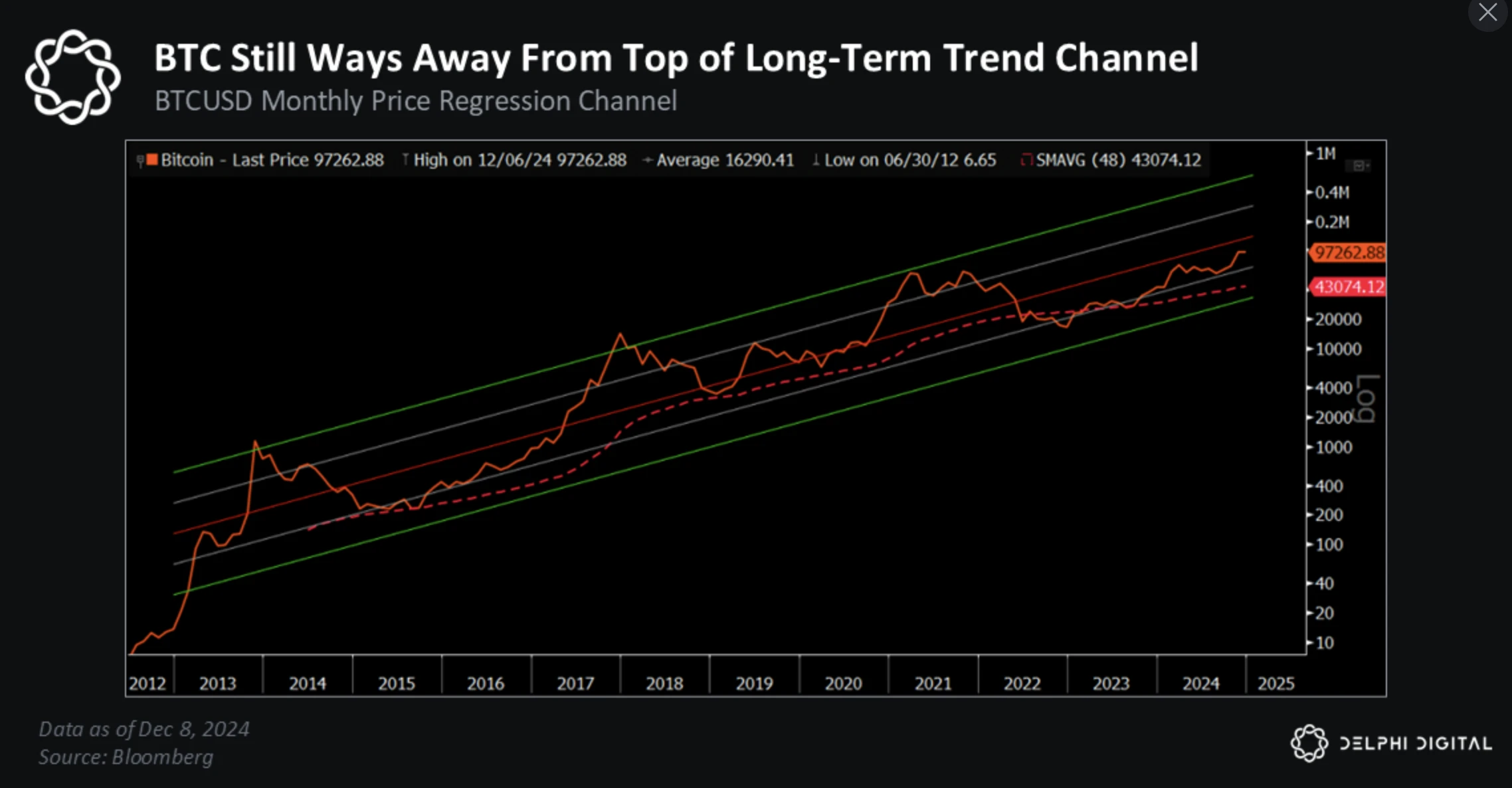

In terms of volatility, BTC's current volatility is also far below the "1-2 standard deviations" that typically indicate a cyclical peak.

In such a rapidly developing industry, it is difficult to see the forest for the trees. We all know that volatility is a double-edged sword, which is why the time span is important.

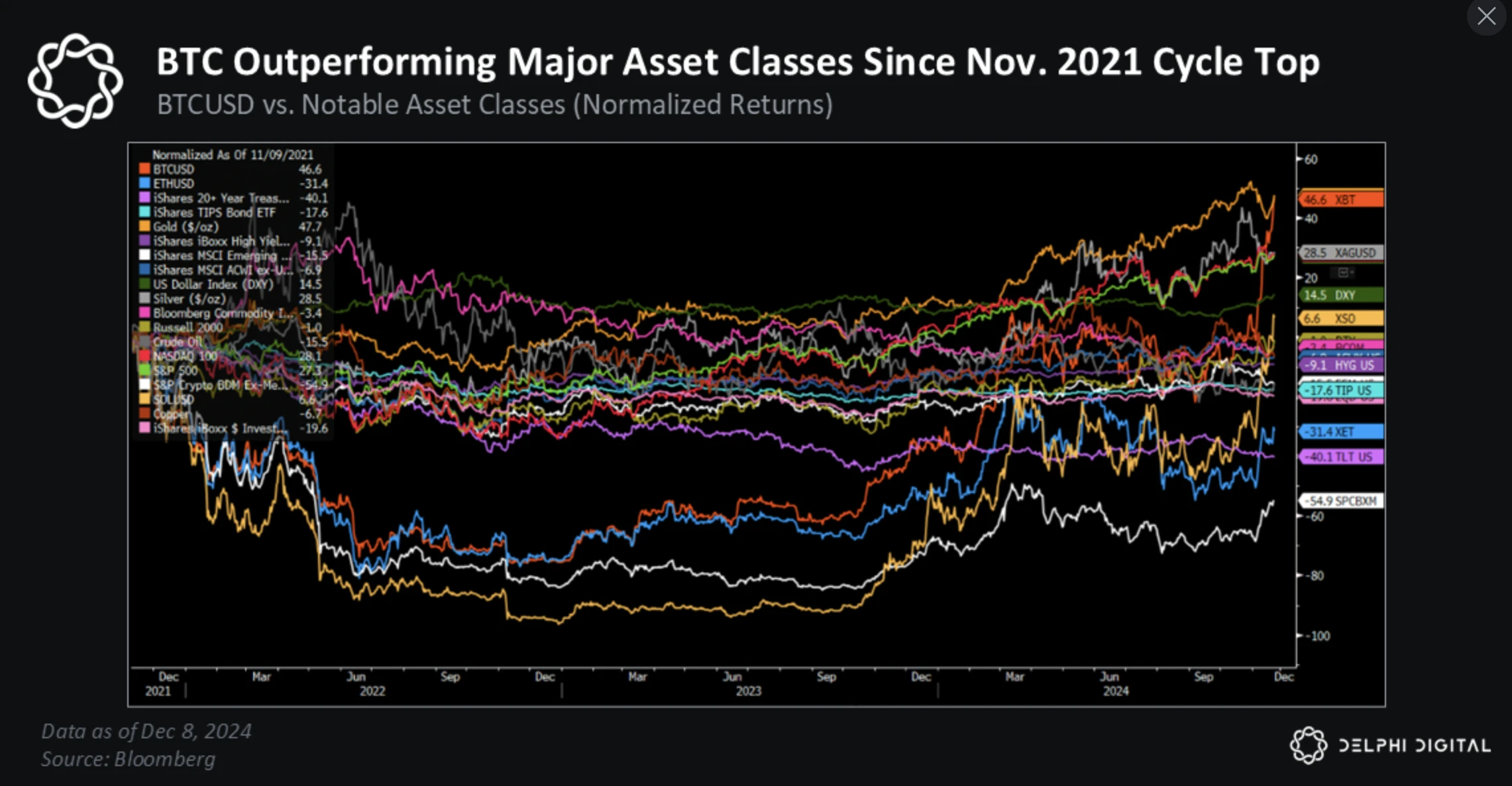

If you need more proof, here is an interesting fact. Even if you bought BTC at the cyclical peak in November 2021, if you could hold on, its performance today would still outperform all other major asset classes.

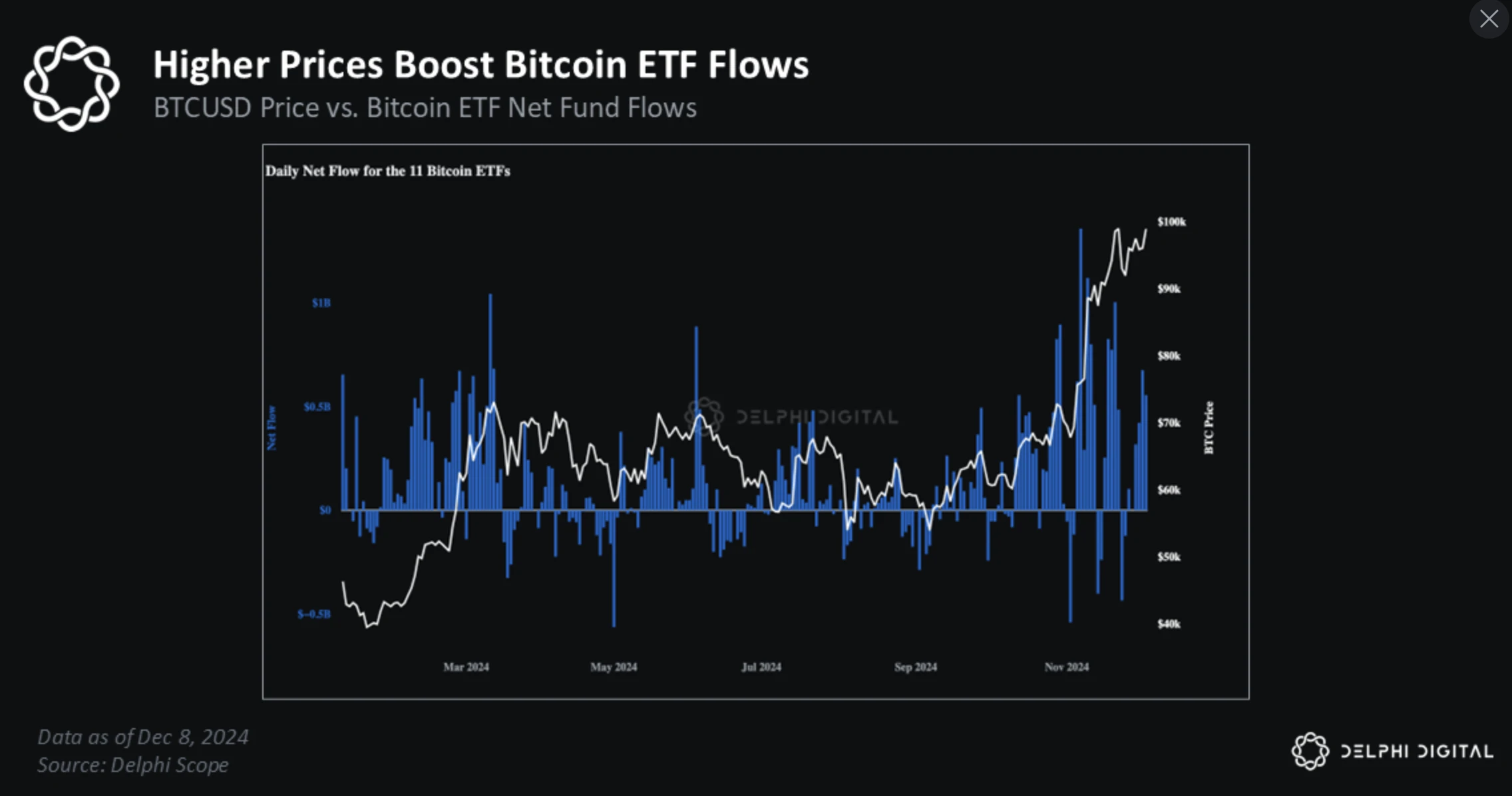

Bitcoin breaking historical highs is not just an attractive headline; for the cryptocurrency market, it is the ultimate driver of "risk appetite."

“Price is the ultimate driver of attention, capital flow, and on-chain activity."

In the last cycle, retail investors only flooded in once Bitcoin's price completely broke above previous highs. This trend can be seen from the surge in Google search volume and news coverage of "Bitcoin," as well as the increase in retail trading revenue on Coinbase. Investor confidence and risk appetite often rise when Bitcoin "takes off" and breaks previous highs.

Price drives increased attention, which in turn accelerates FOMO and capital inflow.

This year's BTC ETF flow trends clearly illustrate this trend.

The iShares Bitcoin Trust ETF (IBIT) ranks third in inflows among all ETFs this year, with only two of the largest S&P 500 ETFs surpassing it, whose total assets under management are 20 times that of IBIT (approximately $1.1 trillion).

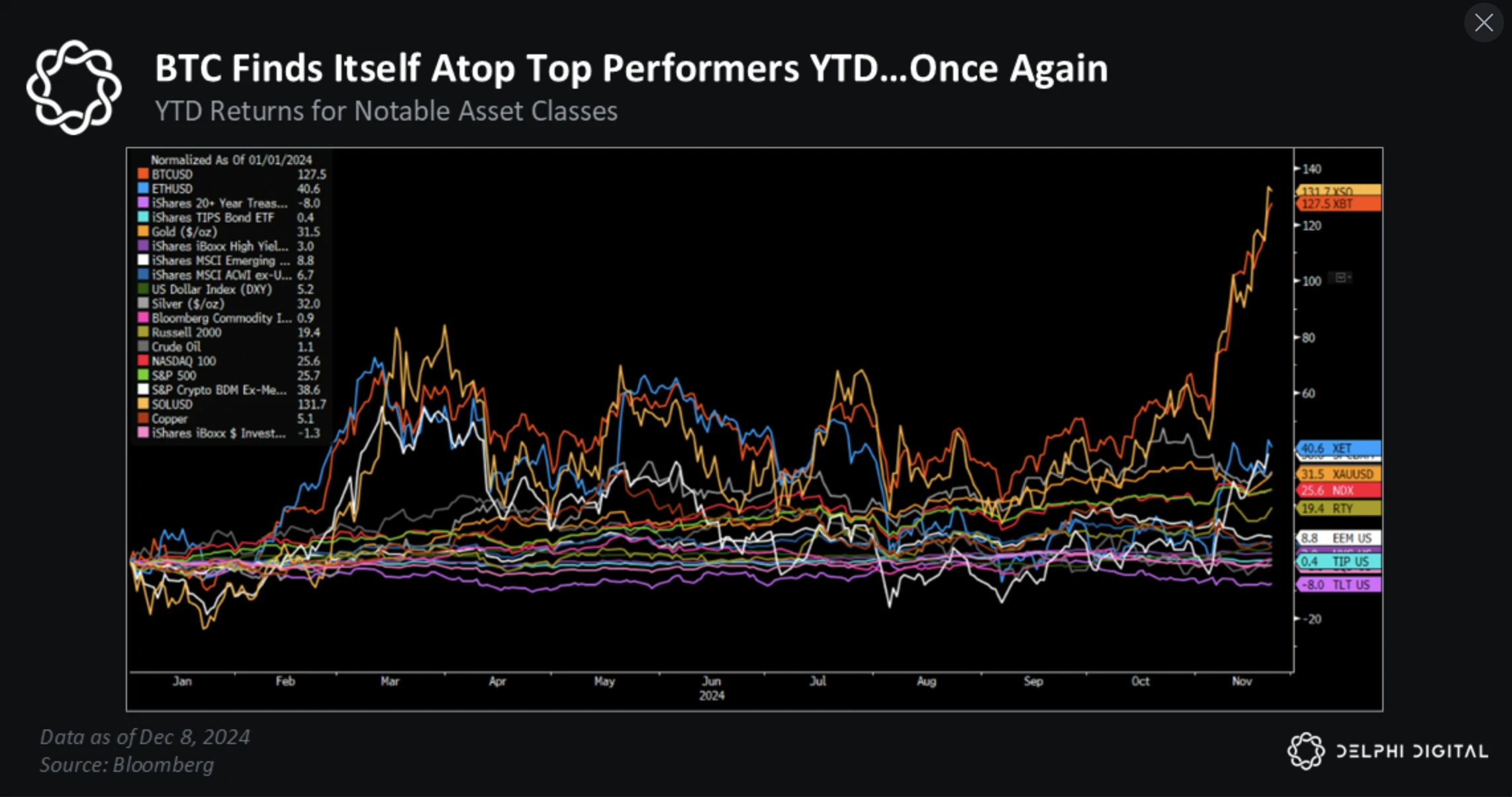

Price is the ultimate driver, and compared to traditional asset classes, Bitcoin has topped the asset growth chart for two consecutive years.

BTC has not only set a new high against the dollar but has also reached a new high against the NDX (Nasdaq 100 Index), which itself has risen nearly 30% this year.

BTC has also set a new high against the SPX (S&P 500 Index)… while the SPX is expected to achieve its best performance in the past thirty years this year.

Compared to gold, BTC has also reached new highs.

We have long said that one day, the stigma surrounding BTC will be removed. One day, not being involved in BTC will become the biggest risk faced by investors and institutions. In our view, that day has arrived.

Mocking Bitcoin is no longer a cool thing to do. This cycle will solidify BTC's status as a macro asset that can no longer be ignored.

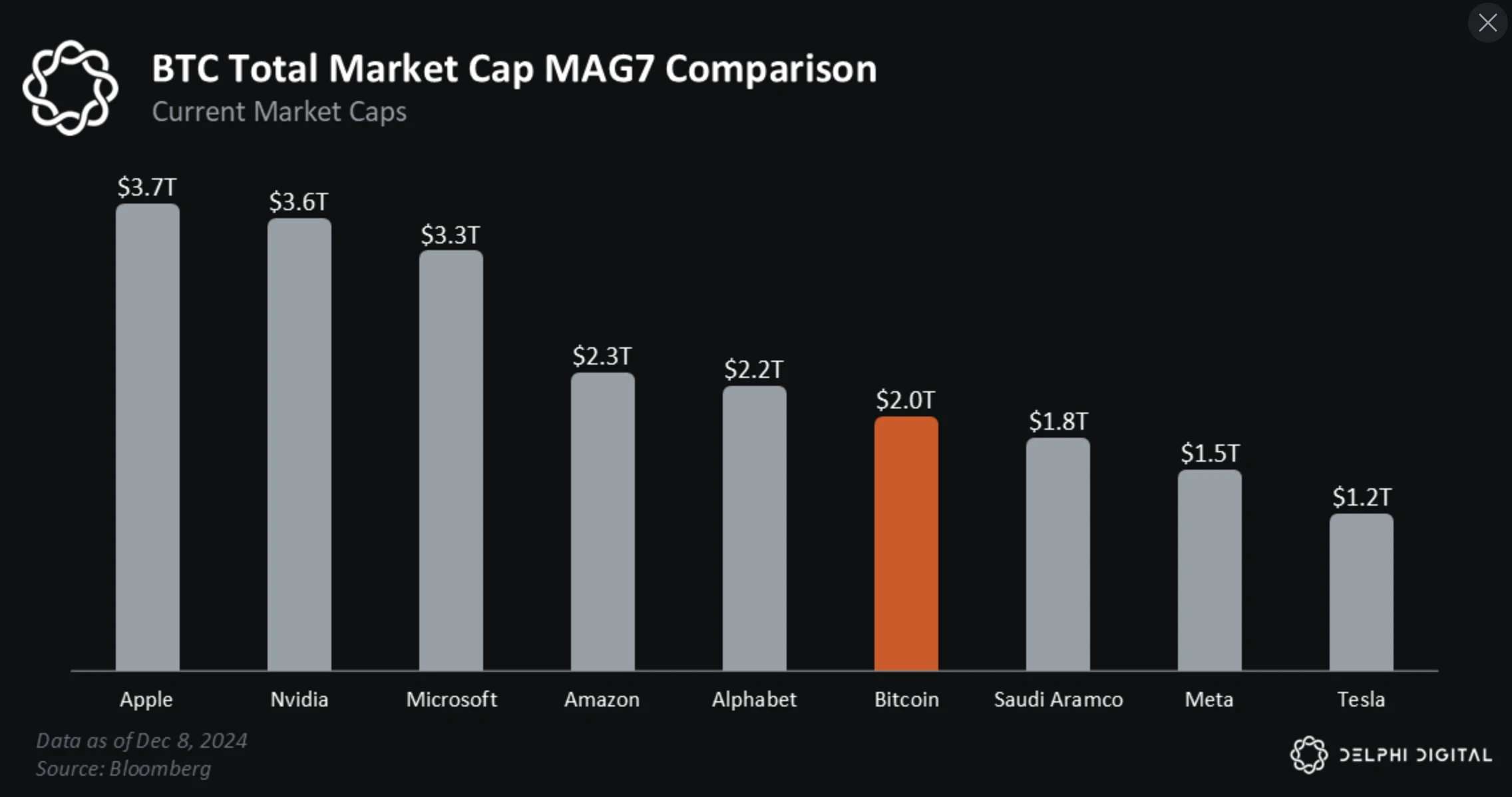

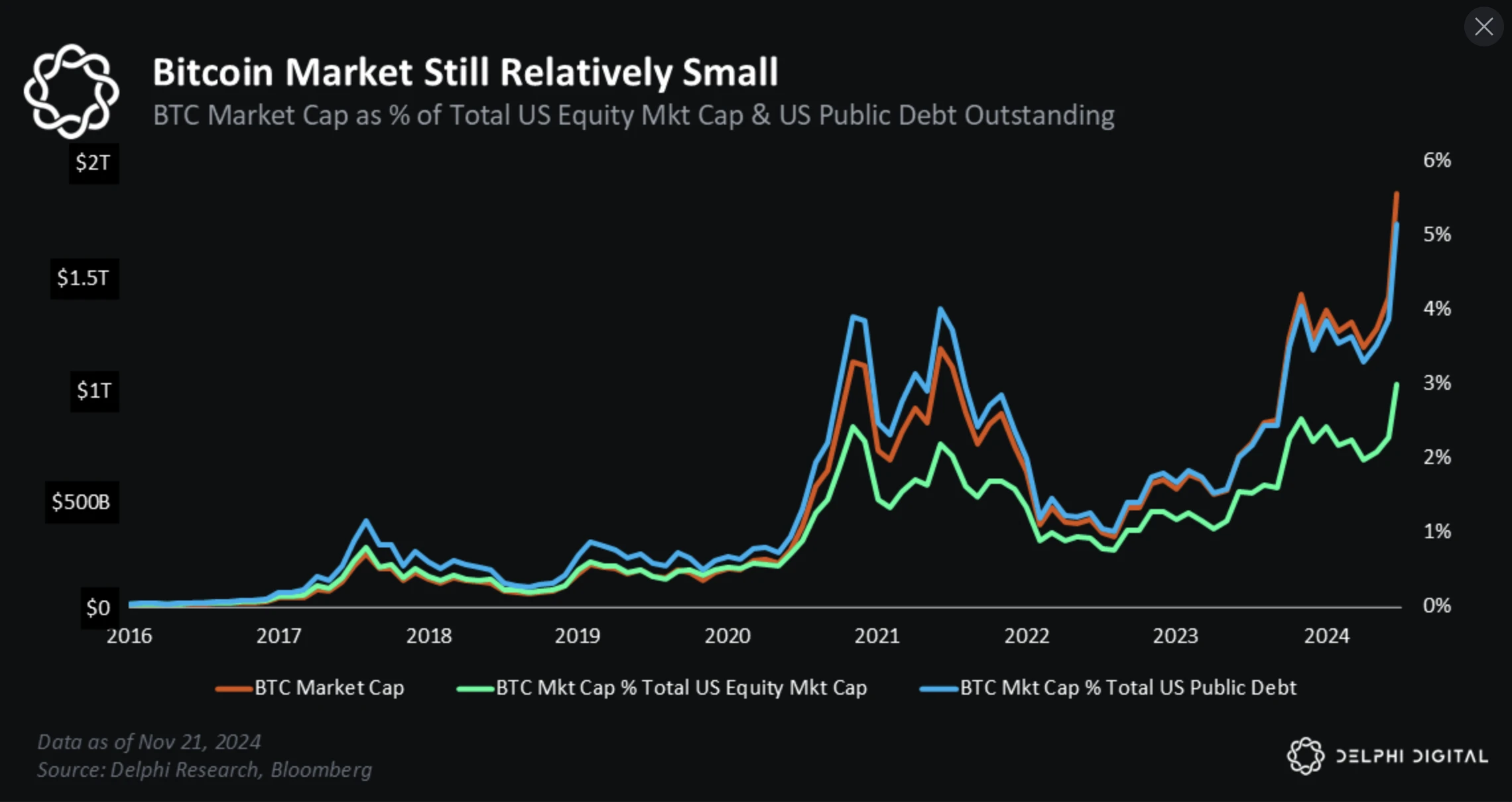

BTC now has a market capitalization of about $2 trillion.

That's a significant number. If Bitcoin were a publicly traded company, BTC would be the sixth most valuable asset in the world.

Not long ago, many people thought that a $100,000 BTC was just a pipe dream. Now, social media timelines are filled with expectations like the following.

At $91,150, BTC will flip Saudi Aramco;

At $109,650, BTC will flip Amazon;

At $107,280, BTC will flip Google;

At $156,700, BTC will flip Microsoft;

At $170,900, BTC will flip Apple;

At $179,680, BTC will flip Nvidia……

Bitcoin is now large enough to attract the attention it deserves, but it is not so large that it lacks sufficient room for growth.

At the time of writing:

BTC's market capitalization still only accounts for 11% of the total market capitalization of MAG7 (AAPL, NVDA, MSFT, AMZN, GOOGL, META, TSLA);

BTC's market capitalization is less than 3% of the total market capitalization of U.S. stocks and 1.5% of the total market capitalization of global stocks;

BTC's total market capitalization still only accounts for 5% of the total U.S. public debt and less than 0.7% of the global debt total (public debt + private debt);

The funds held by U.S. money market funds are three times BTC's market capitalization;

BTC's market capitalization still only corresponds to 15% of the total global foreign exchange reserve assets. Hypothetically, if global central banks reallocated 5% of their gold reserves to BTC, it would bring over $150 billion in additional purchasing power, equivalent to three times this year's total net inflow into IBIT;

Household net worth is at a historical high (over $160 trillion) — more than $40 trillion above the pre-pandemic peak — primarily driven by rising home prices and a booming stock market. This figure is 80 times Bitcoin's current market capitalization.

The key is that there are still substantial pools of capital available for BTC and the cryptocurrency market. When people are confident in the rising cryptocurrency market, all of this will become potential demand.

With the Federal Reserve and other central banks pushing their currencies to depreciate by 5-7% each year, investors need to achieve annual returns of 10-15% to hedge against the loss of real purchasing power.

This is why investors' attention is increasingly turning to high-growth industries, as this is the best place to seek above-average returns.

We believe that as the accumulated positive factors continue to outweigh potential negatives, investors will be more willing to take on certain risks in pursuit of higher returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。