Cryptocurrency knows no borders, but exchanges do.

Written by: Victor Ramirez, Coin Metrics

Translated by: Luffy, Foresight News

Key Points:

During a brief period of political turmoil in South Korea, the "kimchi premium" phenomenon re-emerged. At its peak, the trading price of Bitcoin approached $115,000.

Cryptocurrency trading exhibits strong regional differences across exchanges and assets.

Since the beginning of this year, on-chain activity for established altcoins has significantly increased, particularly tokens that are primarily traded in Asia and have become targets of enforcement actions by the U.S. Securities and Exchange Commission.

Introduction

Broadly speaking, cryptocurrency is considered a borderless market that never closes. Although the underlying technology of cryptocurrency is indeed independent of your geographical location, various markets are sensitive to regional patterns, regulatory characteristics, and the preferences of residents around the world.

In this week's "Network Status," we will use the South Korean market as an example to explore the regional and geographical characteristics of cryptocurrency trading activity. By utilizing timezone data, we can observe the localization characteristics of various cryptocurrency exchanges and assets. Finally, we will provide the latest status of on-chain activity for various altcoins.

Capital Controls Lead to Kimchi Premium

The "kimchi premium" is an interesting case study of specific market behavior occurring in certain regions. The kimchi premium refers to the difference between the price of cryptocurrencies traded in the South Korean market and the global "reference" price. The kimchi premium is primarily due to strong demand for crypto assets in a closed market environment, coupled with years of strict regulation that has reduced market efficiency due to difficulties in international arbitrage.

While there may be apparent arbitrage trading opportunities, local regulations make it difficult for foreign individuals and institutional investors to profit from them. Capital controls on the Korean won restrict the inflow and outflow of fiat currency to and from South Korean exchanges. According to legal provisions, only South Korean nationals or foreign residents holding a resident permit can trade through South Korean exchanges. Additionally, foreign exchanges face stricter regulations compared to domestic exchanges. South Koreans wishing to trade cryptocurrencies on foreign exchanges must first purchase them on domestic exchanges and then transfer them to foreign exchanges. These conditions collectively restrict the flow of Korean capital within the system.

Finally, banking channels slow the response to any arbitrage opportunities. Transferring funds from banks to exchanges can take several hours, sometimes even up to a day, during which time the arbitrage opportunity may have already disappeared.

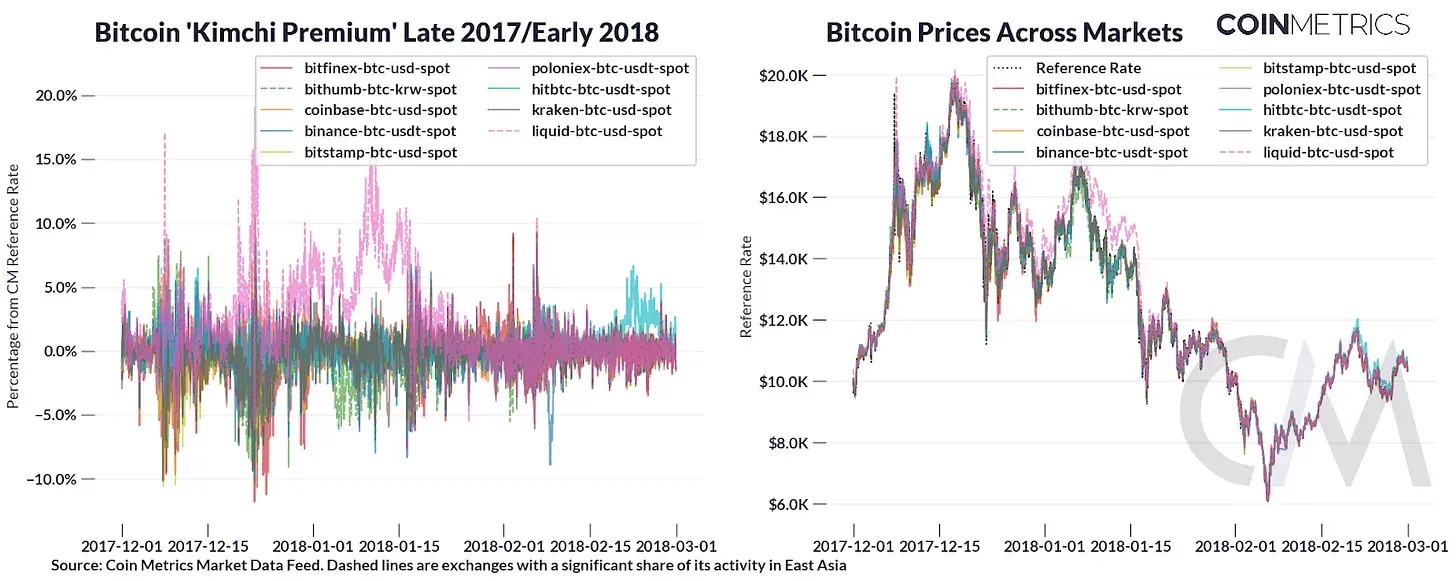

The kimchi premium has a detailed record in the history of cryptocurrency and began to attract attention at the end of 2017.

Data Source: Coin Metrics

During the peak of the 2017-2018 bull market, the kimchi premium persisted. At that time, market trading volume was low, leading to significant price discrepancies. Notably, FTX's sister trading firm Alameda Research began exploiting this regulatory arbitrage in 2017 and became one of the largest cryptocurrency trading firms at the peak.

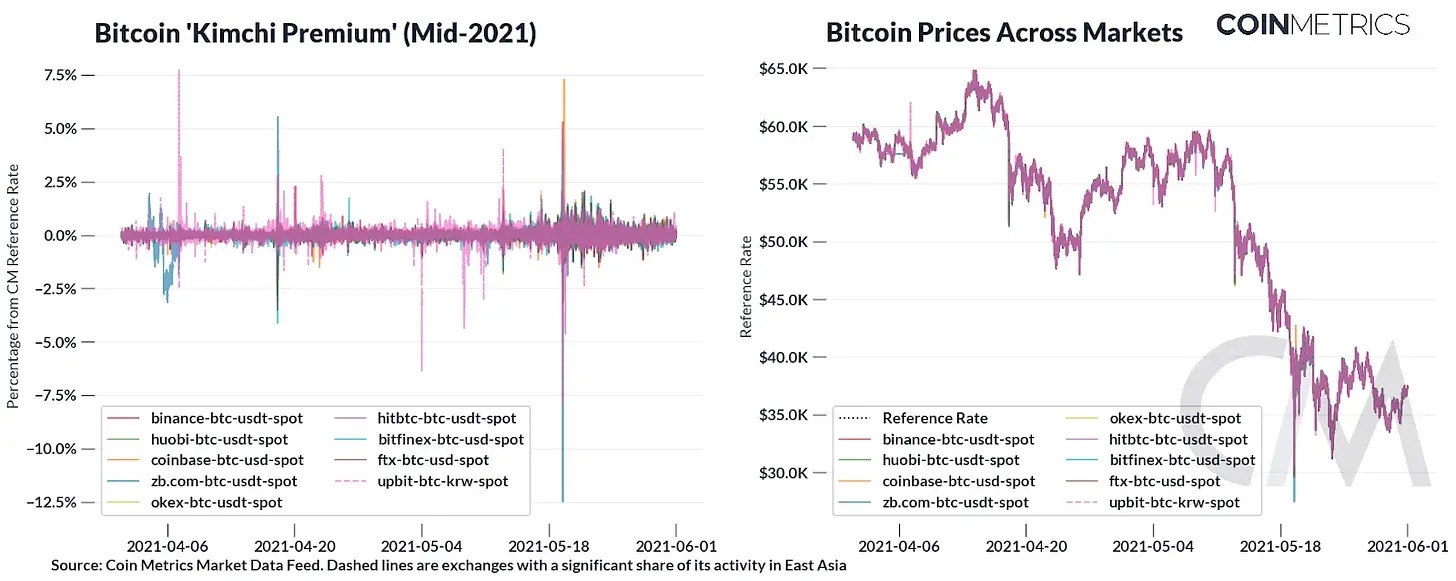

Data Source: Coin Metrics

In the 2021 bull market, we again observed the persistence of the kimchi premium, although to a lesser extent and with lower frequency compared to 2017. The trading volume of the Korean won - Bitcoin market on the South Korean exchange Upbit was highly volatile, with a discount reaching 12.5% during the flash crash in May 2021.

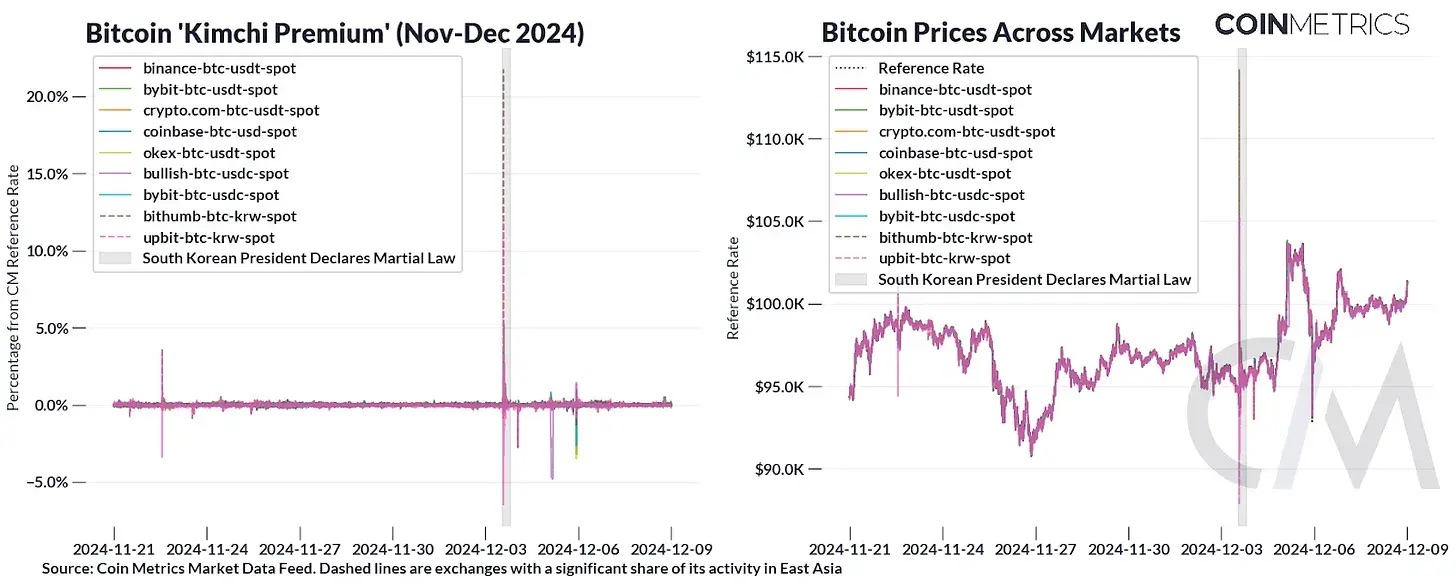

Data Source: Coin Metrics

The market has steadily grown over time, and the kimchi premium phenomenon has largely disappeared today, though there are some exceptions. The kimchi premium even pushed Bitcoin prices in certain South Korean markets above $100,000, two weeks before the global Bitcoin price broke $100,000. On December 3, South Korean President Yoon Suk-yeol announced a state of emergency, and the kimchi premium re-emerged. According to Coin Metrics' one-minute reference quotes, the premium peaked at 20%, with Bitcoin's price approaching $115,000.

Although the "kimchi premium" phenomenon is now widely known, strict capital controls make it difficult for overseas investors to participate in the South Korean market. This leads to the market being susceptible to liquidity shocks, resulting in price instability.

Cryptocurrency Trading Exhibits Strong Regional Characteristics

Regional Characteristics of Cryptocurrency Exchanges

Although blockchains themselves are permissionless, cryptocurrency exchanges remain a necessary intermediary for the vast majority of market participants. The cryptocurrency market is global, but each exchange must comply with local regulations to serve users in a specific country. Given the varying levels of regulation around the world, trading activity on cryptocurrency exchanges is concentrated in a few geographical regions. Very few exchanges truly operate without borders.

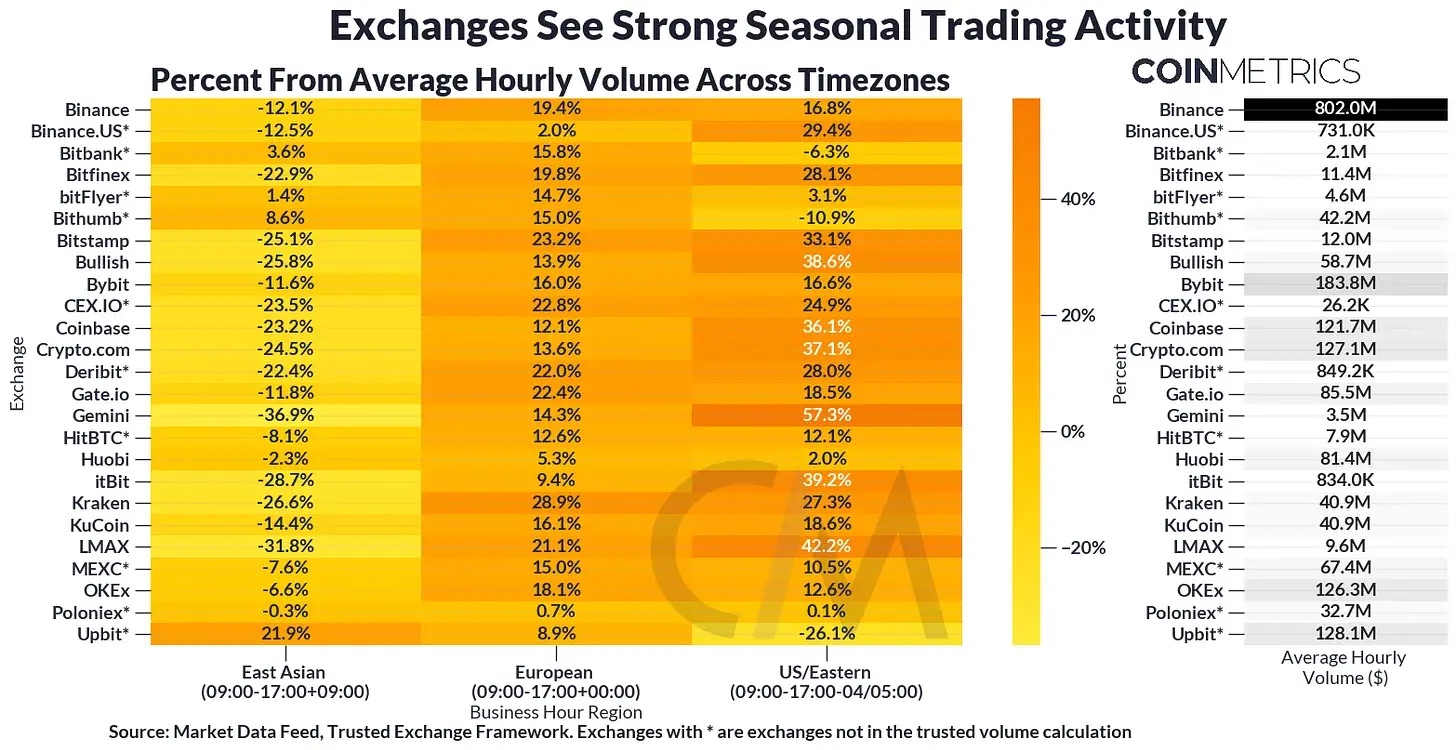

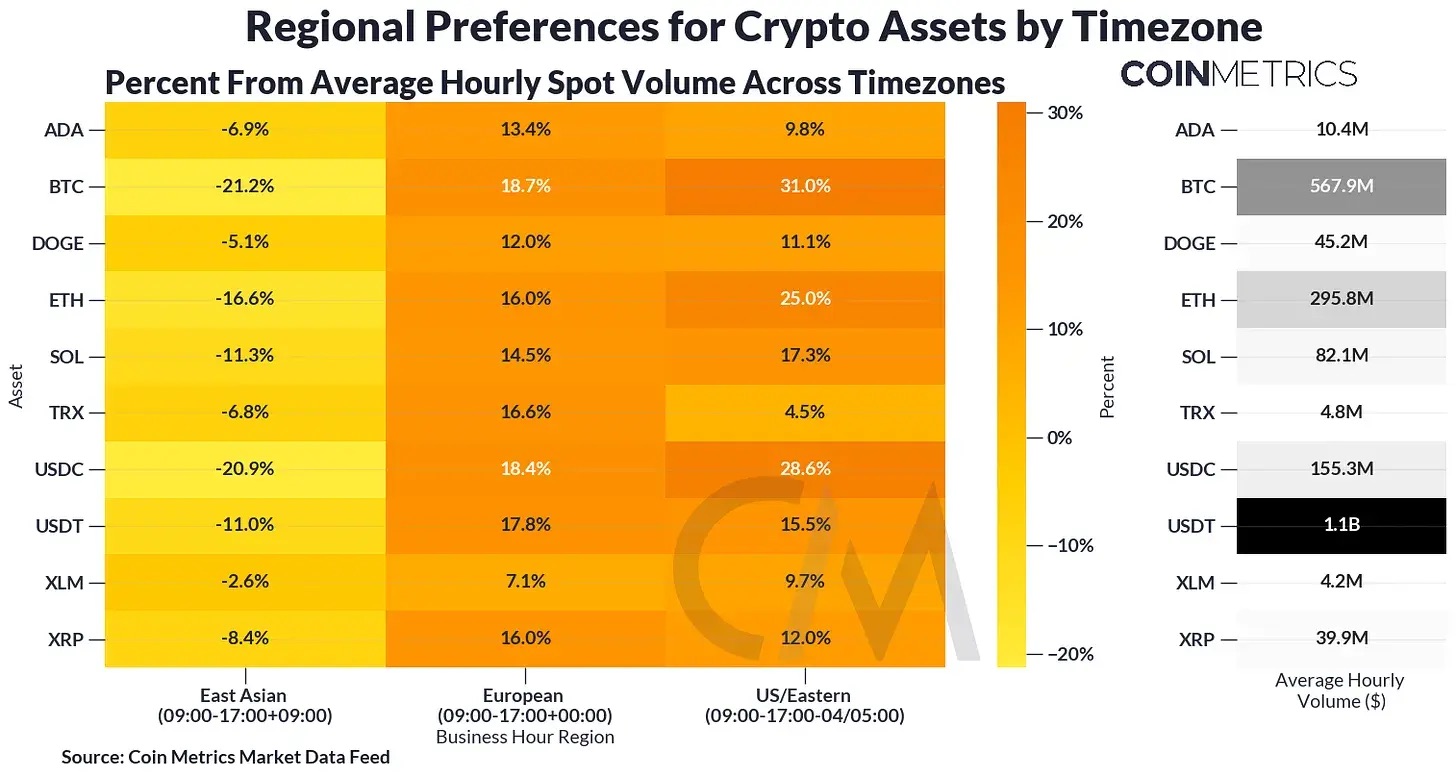

We can leverage this knowledge about local legal restrictions, as well as known user preferences in specific regions and indicators derived from market data, to understand the distribution of trading activity around the world. The following chart shows the trading activity share of specific exchanges across different time zones.

Each row represents an exchange, and each column represents the spot trading volume of that exchange during peak hours in a specific time zone: from 9 AM to 5 PM. The value in each cell compares the average trading volume of the exchange in a given time zone to its average hourly trading volume. The last column shows the average hourly trading volume for each exchange. For example, Binance's trading volume during East Asia hours is 12.1% lower than its average of $802 million, while its trading volume during European hours increased by 19.4%.

Data Source: Coin Metrics

As expected, we see that the trading volume indices for South Korean exchanges Bithumb and Upbit, as well as Japanese exchanges Bitbank and Bitflyer, tend to peak during East Asia hours. Upbit only serves East Asian markets such as South Korea and Singapore. In fact, it is illegal for anyone in the U.S. to trade on Upbit. Assuming that trading activity from users outside East Asia is negligible, we can use the trading activity occurring outside East Asia hours as a benchmark for non-peak trading activity.

Due to the overlap of European and U.S. time zones, it is difficult to distinguish activities in specific regions, but trading activity still exhibits distinct characteristics. Kraken is a U.S. exchange, but its trading activity during EU hours slightly exceeds that during U.S. hours.

Overall, we see that most exchanges are overly reliant on U.S. trading hours. Coinbase, Gemini, and Crypto.com show the greatest preference for U.S. trading hours, at 36.1%, 57.3%, and 37.1%, respectively. Interestingly, Bullish is illegal in the U.S. but shows a strong preference for Eastern U.S. time (38.6%).

Regional Characteristics of Asset Trading

Data Source: Coin Metrics

We can apply the same methodology to the asset trading volume across all exchanges. Similar to the classification of exchanges, most asset trading activity still occurs during EU/U.S. hours. Bitcoin, Ethereum, and USDC indices particularly align with U.S. hours.

Compared to other cryptocurrencies, Ripple, Tron, Stellar, and Cardano perform better during East Asia hours. South Koreans have shown strong interest in XRP, while Tether on Tron is the most widely used stablecoin in Asia.

Timezone analysis is clearly limited by longitude, so we cannot rely solely on it. We also need to depend on known user preferences. Bitso's "Cryptocurrency Landscape in Latin America" and "Stablecoins: The Emerging Market Story" indicate that residents of Latin America have a strong preference for stablecoins, especially Tether, which provides an attractive and stable alternative to inflationary currencies. On the other hand, Tether's solvency is under scrutiny by U.S. regulators, although it remains compliant and continues to serve U.S. users. While we see USDT activity concentrated during U.S. hours, its trading volume may come more from South America than North America.

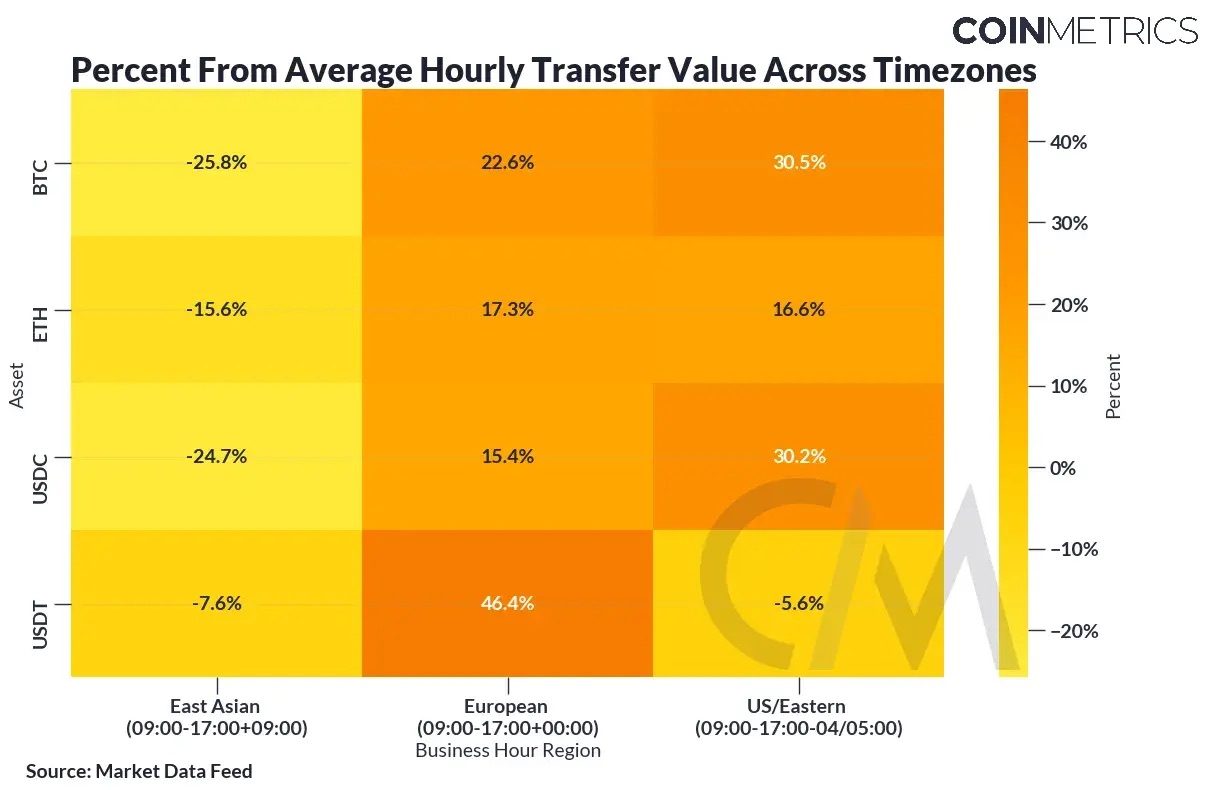

We can go further and directly examine the on-chain transfer value of assets.

Data Source: Coin Metrics

The results in the table above are consistent with what we learned from previous articles, where we observed that the on-chain activity of several assets exhibited different time preference patterns. The on-chain transfer value of Bitcoin, Ethereum, and USDC tends to favor EU/U.S. hours, which aligns with trading volume.

Tether's on-chain activity differs slightly from its off-chain activity. USDT's on-chain activity peaks significantly during EU hours, at +46.4%, while exchange off-chain activity is at +17.8%. During U.S. hours, Tether shows a +15.5% deviation in exchange trading, but a -5.6% deviation in on-chain activity.

This is consistent with the regional differences in stablecoin preferences we observed in the article "From East to West: the Global Pulse of Stablecoin Transactions."

On-Chain Activity: The Frenzy of Established Altcoins

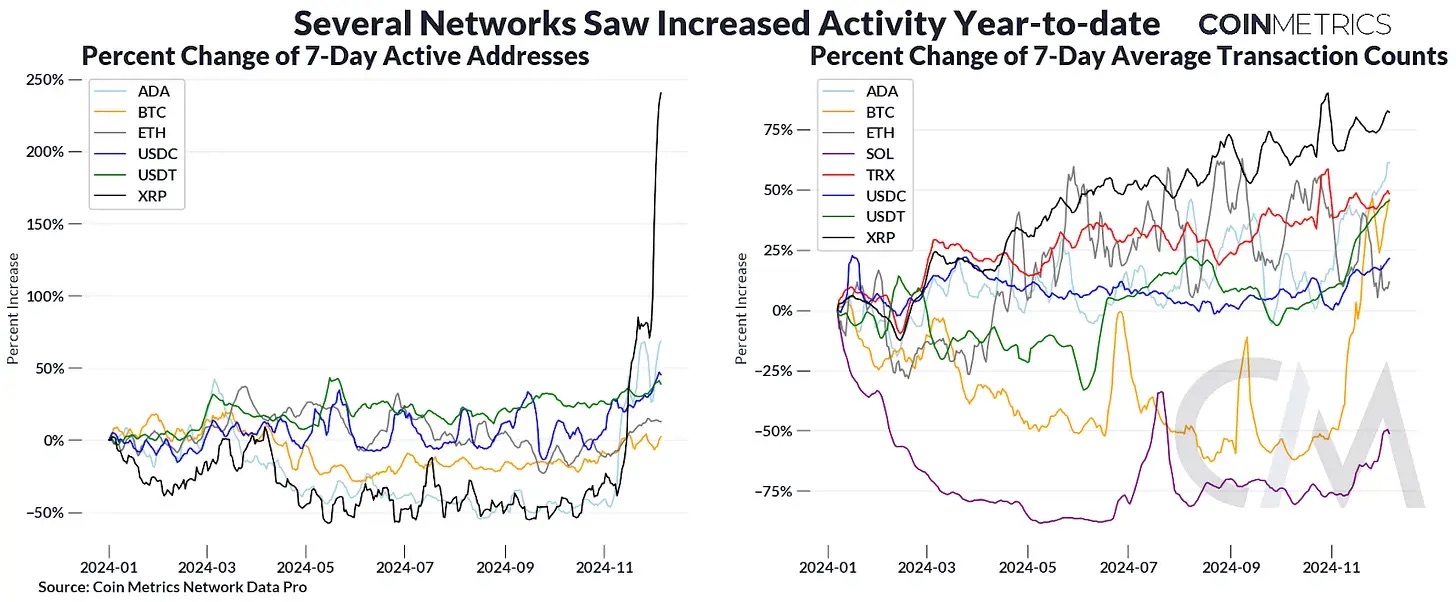

Established altcoins from 2017 and 2021 have seen significant price increases in recent weeks. XRP, TRX, ADA, and XLM have performed quite well, but does the price increase correspond to more on-chain activity?

We examined the on-chain metrics of these chains and compared them across different networks. Different blockchains account for transactions differently, so we standardized the on-chain metrics using percentage growth rates from early 2024.

Source: Coin Metrics

Overall, network activity across several chains is increasing. When measuring transaction counts and active addresses, Ripple (XRP) shows the largest increase in activity. We also observed an uptick in transaction volume for Cardano (ADA) and Tron (TRX). Notably, there are some significant similarities between the assets with the largest price and on-chain activity increases:

As we noted above, these tokens have a strong regional preference in East Asia compared to Bitcoin and Ethereum. Many of them are currently classified as securities by the U.S. Securities and Exchange Commission (SEC).

Traders may be vying for a comprehensive leniency policy towards cryptocurrencies under the Trump administration, as Paul Atkins, recently appointed as the SEC chair, is perceived to have a "friendly" attitude towards cryptocurrencies. Of course, when Gensler was initially appointed, the cryptocurrency industry also viewed him as friendly.

Conclusion

In this article, we highlighted the differences in how the cryptocurrency market performs around the world. Local regulations (such as those we observed in South Korea) strictly control the flow of capital in the market, leading to price distortions. Timezone analysis can clarify how markets express preferences for certain trading channels or assets in specific regions. Overall, the preferences exhibited by global market participants constitute the global cryptocurrency economy. Understanding the nuances of each market around the world will help guide the continued adoption of cryptocurrency on a global scale.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。