Through this method, you can profit from Ethereum's price fluctuations without actually holding or storing cryptocurrency.

What are Ethereum futures? In simple terms, Ethereum futures are like a "guessing game" about the price trend of Ethereum. Instead of actually buying Ethereum, you sign a contract predicting whether its price will rise or fall in the future. This way, you can profit from Ethereum's price fluctuations without needing to actually hold or store cryptocurrency.

Why trade Ethereum futures? Many people like Ethereum futures for several reasons:

Leverage trading: Control larger trading opportunities with less money, increasing potential returns.

Diversification: Try new strategies to enrich your trading portfolio.

Convenience: No need to worry about wallet management or transfer issues; futures contracts make trading very simple.

If you want to challenge your trading skills or are not satisfied with simply buying and holding Ethereum, futures trading might be the breakthrough you are looking for.

Who is this guide for? Whether you are a beginner just starting out or an experienced trader, this guide can help you. If you are a beginner, we will start with the basics and guide you step by step; if you are experienced, we will also share some advanced strategies and tips to elevate your trading.

Ethereum Futures 101: Basics

What are cryptocurrency futures? Cryptocurrency futures are a form of contract trading that allows you to predict the future price of a certain crypto asset (like Ethereum) without actually owning it. For example:

Suppose you believe that Ethereum's price will rise next week. Instead of directly buying Ethereum, you can sign a futures contract to agree to buy it next week at today's price. If the price does rise, you can profit from the price difference; if it falls, you will incur a loss. The core of futures trading lies in trading predictions, not the asset itself.

How do Ethereum futures work? Trading Ethereum futures involves some key concepts:

Contract types

Fixed-term futures (Dec Futures): These contracts have a specific expiration date (e.g., the last day of December each year). Upon expiration, the trade will be settled at the agreed price.

Perpetual futures: These contracts have no expiration date; as long as you are willing to hold the position, you can trade indefinitely, but you need to manage your position more actively.

Leverage and margin: Leverage allows you to control larger positions with smaller amounts of capital. For example, with 10x leverage, $100 can control $1,000 worth of Ethereum. Leverage can amplify profits, but it also amplifies risks, as losses are calculated based on the entire position.

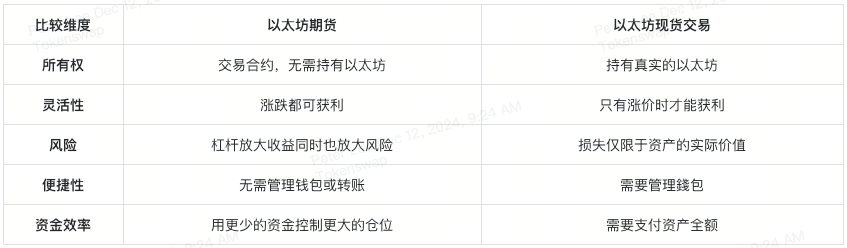

Ethereum Futures vs. Spot Trading

Understanding these differences helps determine whether futures or spot trading is more suitable for your goals and risk tolerance.

Advantages and Trading Risks of Ethereum Futures

Ethereum futures offer many opportunities for traders, but like other financial instruments, they come with both advantages and risks. Understanding both is key to making informed trading decisions.

Advantages

Leverage trading: Control larger positions with smaller investments, increasing potential returns.

Portfolio diversification: Hedge against price volatility risks or explore speculative opportunities beyond holding Ethereum.

Convenient operation: No need to manage wallets or transfers; futures trading simplifies operations.

High liquidity: Large trading volumes make it easy to enter and exit the market.

Risks

High volatility: Leverage can amplify the impact of market fluctuations, potentially leading to significant losses.

Complexity: Requires understanding concepts like margin, leverage, and liquidation.

Cost of fees: Funding rates and trading fees may cut into profits.

Risk Management Tips

Use stop-loss orders: Keep losses within acceptable limits.

Avoid excessive leverage: Especially for beginners, exercise caution.

Stay updated on market dynamics: Regularly check your positions and track market trends.

When combined with effective risk management strategies, Ethereum futures can enhance your trading experience to a higher level.

How to Trade Ethereum Futures on XT.COM

Here is a step-by-step guide to help you get started easily:

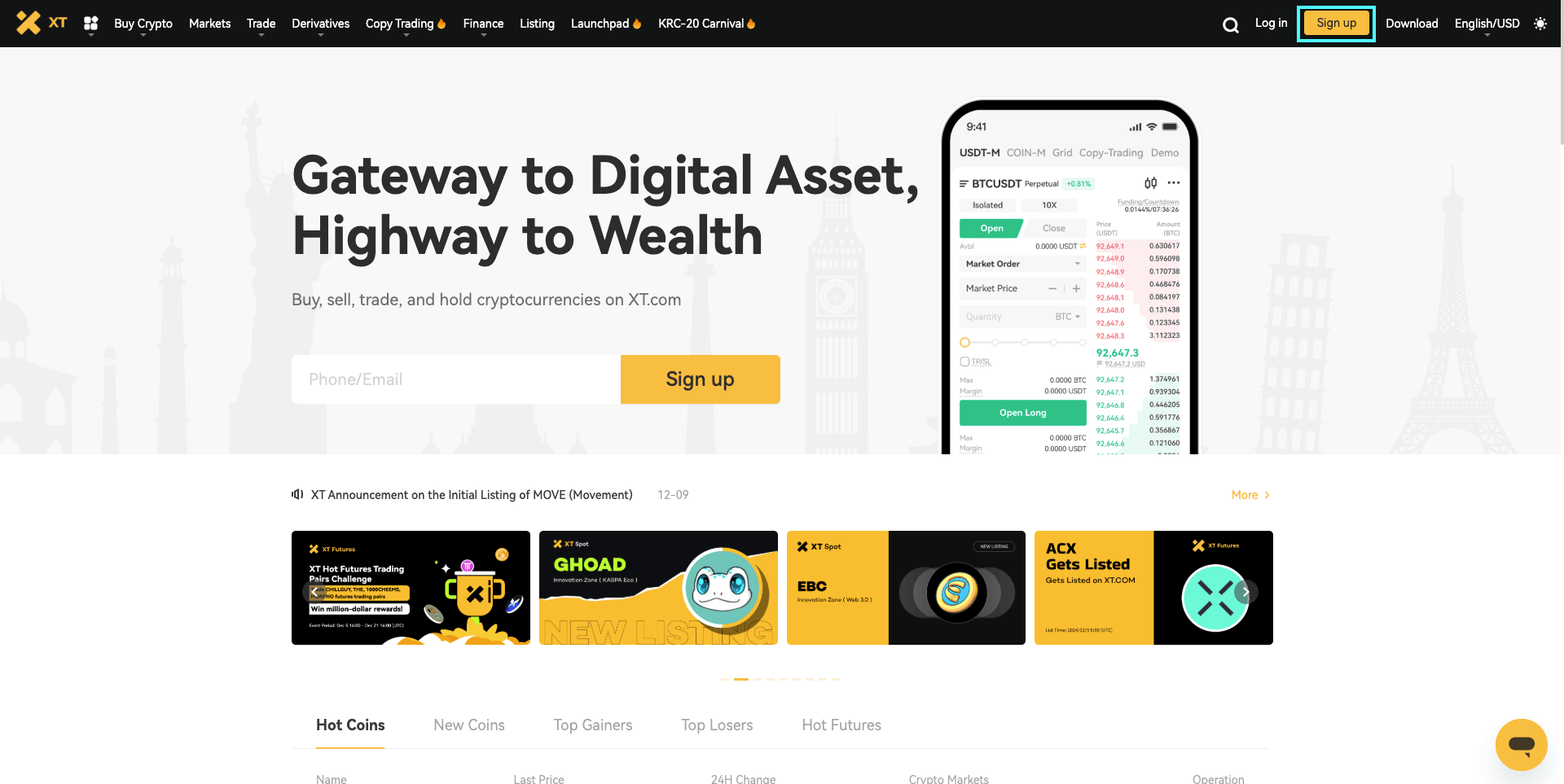

1. Register and secure your account. The first step is to create an XT.COM account.

- Visit the XT.COM website and click "Register."

- Enter your email or phone number, set a strong password, and complete the registration process.

- Enable two-factor authentication (2FA) to add an extra layer of security to your account and funds.

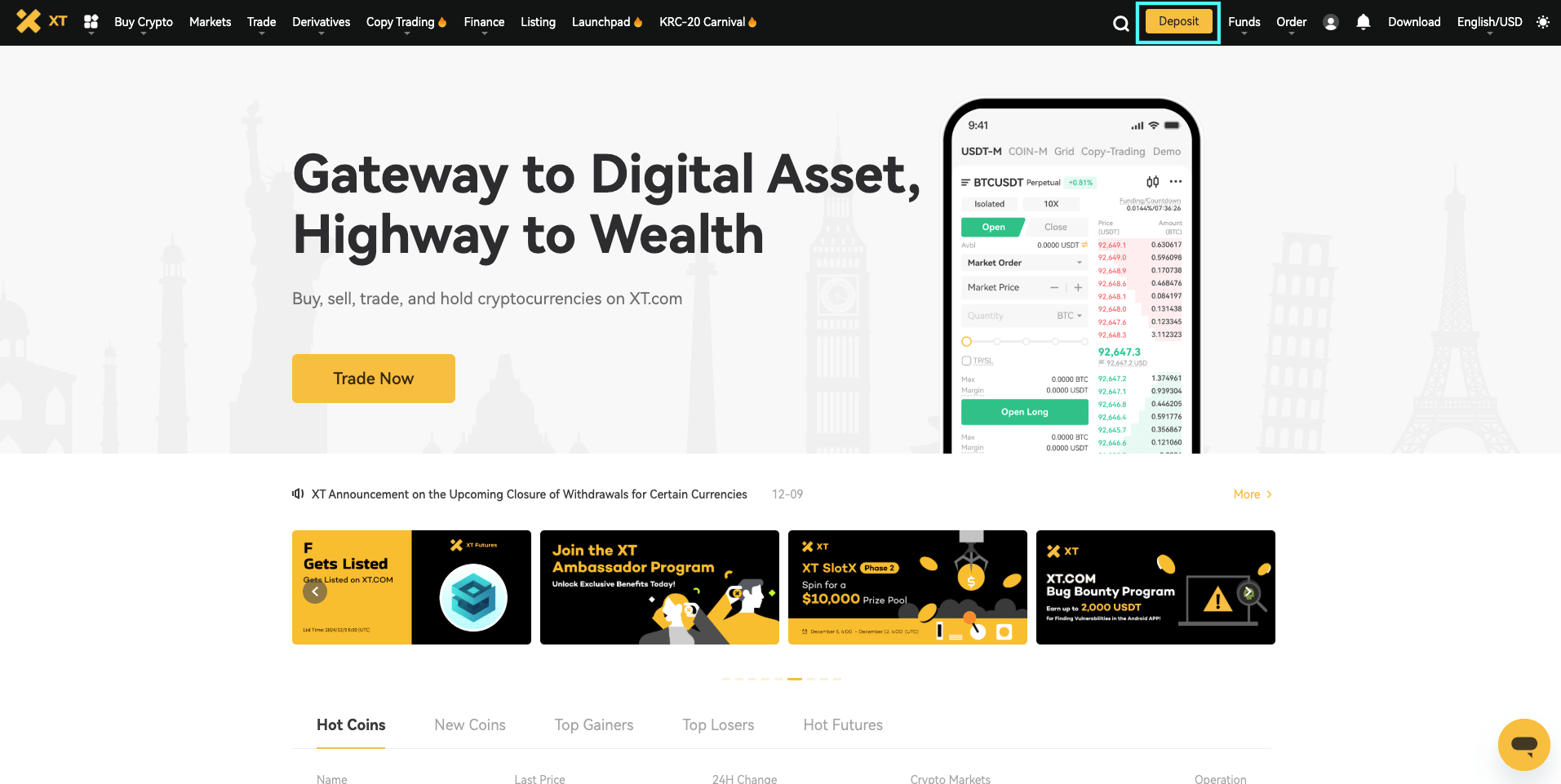

2. Deposit funds. After completing your account registration, you need to deposit funds to start trading:

- Go to the "Wallet" page and click "Deposit."

- Choose your preferred cryptocurrency, such as USDT or ETH.

- Follow the prompts to transfer funds from an external wallet or exchange to XT.COM.

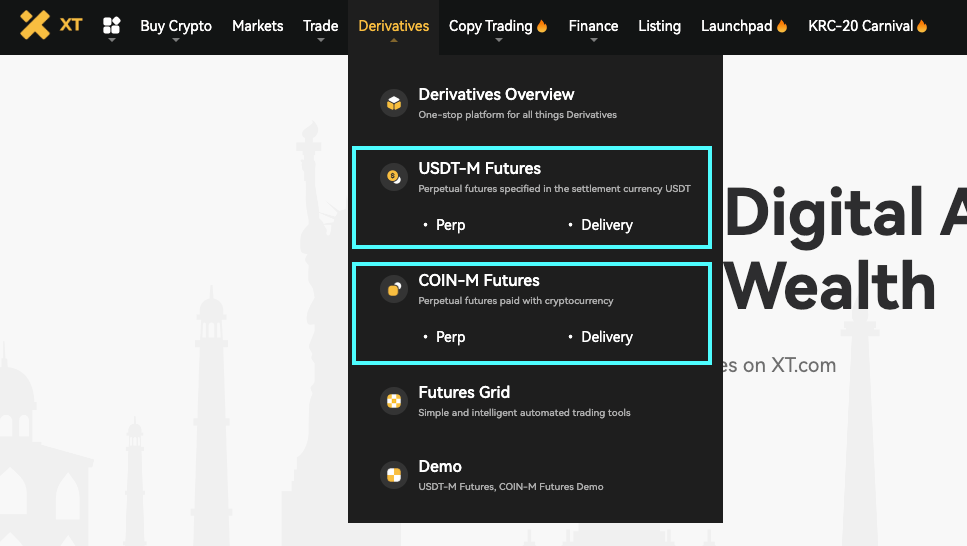

3. Choose Ethereum futures contracts. XT.COM offers two types of Ethereum futures contracts:

USDT-M futures: Settled in USDT, suitable for users who prefer stablecoin trading.

COIN-M futures: Settled in cryptocurrency (e.g., ETH), suitable for traders who want to settle in digital assets.

Choose the contract type that matches your trading strategy and risk preference.

4. Adjust leverage. Leverage can amplify your trading capacity. On XT.COM, the default leverage is 20x, and you can adjust it based on your risk tolerance:

Beginner suggestion: Start with low leverage (like 2x or 5x) to reduce risk.

Experienced traders: Can strategically use high leverage for higher returns.

Remember, high leverage amplifies both profits and potential losses, so use it cautiously.

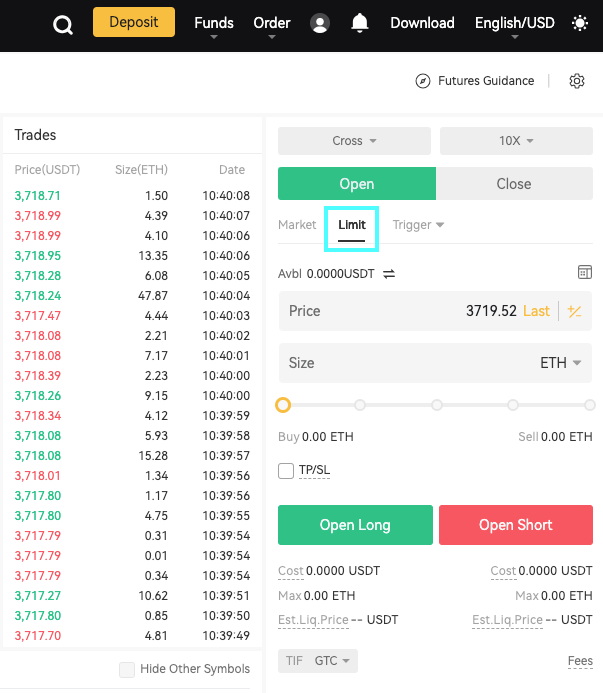

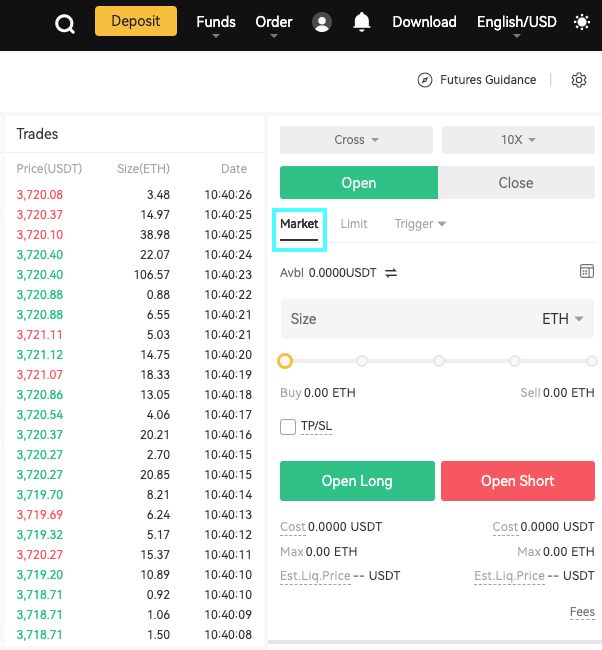

5. Start trading. After depositing funds and selecting a contract, you can start trading:

Choose your order type:

- Limit order: Set your ideal buy price, and the trade will execute when the market reaches your target price.

- Market order: Execute the trade immediately at the current market price.

- Set your position size and confirm the trade.

Why choose XT.COM? XT.COM is a trusted Ethereum futures trading platform with the following advantages:

User-friendly interface: Intuitive operations suitable for both beginners and experienced traders.

Rich futures options: In addition to Ethereum, it supports futures trading for various other cryptocurrencies.

Safe and reliable: Employs advanced security measures to provide a secure trading environment.

Whether you are a beginner or an experienced trader looking to optimize your trading strategy, XT.COM provides you with the necessary tools and support.

Common Trading Strategies for Ethereum Futures

Whether you are a beginner or a seasoned trader, finding the right strategy is crucial for success. Here are some common Ethereum futures trading strategies:

Beginner Strategies

Scalping

Quick trades to profit from small price fluctuations.

Requires close monitoring of price charts and quick decision-making.

Suitable for practicing trading skills while maintaining controllable risks.

Swing Trading

Holding positions for several days to weeks to profit from market trends.

Use tools like moving averages and trend lines for analysis.

Suitable for traders with limited time who want to capture market trends.

Advanced Strategies

Hedging

Use futures contracts to reduce risk and protect your portfolio.

For example, if you hold Ethereum and expect the price to fall, you can short futures contracts to minimize losses.

Arbitrage

Profit from price differences between different exchanges.

Buy Ethereum futures at a low price on one platform and sell at a higher price on another.

Requires quick reactions and support for multiple platform accounts.

Success Tips

Start small: Trade with smaller positions to reduce initial risk.

Focus on risk management: Use stop-loss orders to avoid significant losses and use leverage cautiously.

Keep learning: Stay updated on market trends, learn technical analysis, and maintain competitiveness.

With the right strategies and risk management, trading Ethereum futures can provide you with more profit opportunities.

Frequently Asked Questions

Can I trade futures without holding Ethereum? Yes! Ethereum futures allow you to profit from price changes without needing to hold Ethereum.

Is there a minimum investment amount required to trade Ethereum futures? On XT.COM, you can start trading with just $10, thanks to the leverage feature. However, it is recommended to start with a small amount until you are familiar with the basics.

Can beginners effectively trade Ethereum futures? Absolutely! Beginners can start with simple strategies (like scalping or swing trading) while learning about risk management and the fundamentals of futures contracts.

What is the difference between perpetual futures and traditional futures?

Perpetual futures: No expiration date, more flexible, but require continuous monitoring to avoid liquidation.

Traditional futures: Have a fixed expiration date, and trades settle at expiration.

How does leverage work? Leverage allows you to control larger positions with less capital. For example, 10x leverage means $100 can control $1,000 worth of Ethereum futures. While leverage can amplify profits, it can also magnify losses.

What are common mistakes beginners make?

Overusing leverage.

Ignoring risk management tools like stop-loss orders.

Lacking a clear trading plan.

Investing large amounts of money without mastering the basics.

Summary: Ethereum futures provide an opportunity to profit from price fluctuations without holding cryptocurrency. Through perpetual and traditional futures contracts, traders can adjust their strategies based on their goals and risk tolerance. The leverage feature, flexibility to go long or short, and the convenience of not having to manage wallets make futures trading a powerful tool in many traders' portfolios. However, futures trading comes with risks, including high volatility, leverage effects, and fees. Therefore, implementing risk management strategies (such as stop-loss orders and cautious use of leverage) is crucial for protecting capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。