Author: Lorena Nessi

Translation: Vernacular Blockchain

2024 is an important year for the cryptocurrency industry, filled with exciting trends and moments that continue to spark heated discussions within the community.

From the headlines generated by memecoins to the tokenization of real assets, the entire year is packed with stories that push blockchain into new realms.

Telegram games bring cryptocurrencies closer to everyday users, while prediction markets and liquid staking tokens offer new ways to interact with digital assets.

Coupled with rollups, modular blockchains, and the race to address quantum threats, 2024 is undoubtedly an extraordinary year.

These ten trends showcase the vitality and innovation driving the cryptocurrency world forward.

1. The Rise of Memecoins

Memecoins are an unprecedented social phenomenon. While some view them as simple, trivial, or even question their legitimacy as digital assets, considering them poor financial decisions or merely fleeting trends and products of viral marketing, they undeniably occupy a place in the crypto ecosystem, blending humor, community engagement, and innovative digital value creation with a broader cultural movement.

1) Grassroots Movements and Celebrity Influence

These tokens respond to various social, political, and economic contexts, reflecting the cultural spirit. They rely on celebrity culture, often boosted by influential figures, which frequently enhances their visibility.

Memecoins often leverage grassroots movements, where communities unite around shared ideas and values, sparking collective action and forming viral trends. Memecoins also highlight the role of participatory culture, enabling users to drive the popularity of tokens and shape narratives through collective effort. Sometimes, they may simply be trivial trends.

2) Memecoins in 2024: Milestones and Influence

In 2024, memecoins solidified their status as a decisive force in the crypto space. Tokens influenced by Shiba Inu (SHIB), such as Neiro (NEIRO) and FLOKI Inu (FLOKI)—the latter of which launched a debit card—along with PepeCoin (PEPE), which capitalizes on internet memes and nostalgia, demonstrate how humor and cultural relevance can stimulate significant financial activity.

A notable example of memecoin influence in 2024 is when elected President Donald Trump appointed Elon Musk to lead the newly established Department of Government Efficiency (DOGE). The agency's mission is to streamline federal operations and reduce inefficiencies, with its acronym deliberately paying homage to Dogecoin (DOGE), which Musk is widely known to support.

3) The Intersection of Technology, Culture, and Society

Memecoins reflect the intersection of technology, culture, society, and politics, showcasing how seemingly whimsical ideas can challenge traditional values and notions of innovation. For many, they serve as a gateway into the crypto world, providing an easily accessible entry point into a technology-driven digital asset landscape.

2. The Growth of Prediction Markets

In 2024, decentralized platforms like Kalshi and Polymarket gained widespread attention for allowing users to predict events and earn rewards. These platforms cover a variety of topics, including sports event outcomes, election results, and cryptocurrency prices, leveraging blockchain technology to ensure transparency and security.

During the 2024 U.S. presidential election, Kalshi's betting volume exceeded $100 million, showcasing the potential of prediction markets in gauging public sentiment. However, this growth has also sparked criticism. Some analysts argue that low liquidity and susceptibility to manipulation undermine the reliability of prediction markets as forecasting tools.

Regulatory scrutiny has intensified as well. Kalshi won a legal battle with the Commodity Futures Trading Commission (CFTC), allowing it to offer political event contracts, but concerns about legality and market manipulation persist. Additionally, some have expressed ethical objections, questioning the morality of gambling on elections.

A user on X expressed her concerns about election gambling, posting, "I think what the CFTC is pushing for is actually correct. Why gamble on elections? I personally don't like the idea."

Despite these challenges, the rise of prediction markets highlights the demand for decentralized solutions to real-world problems, solidifying their position as a significant trend in the crypto space in 2024.

3. Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs)

In 2024, liquid staking tokens (LSTs) and liquid re-staking tokens (LRTs) gradually emerged, gaining greater influence based on earlier innovations. Although EigenLayer launched its mainnet in mid-2023, its impact became more pronounced in 2024 as re-staking adoption steadily increased.

By mid-year, over 33.8 million ETH had been staked, indicating growing market confidence in Ethereum's proof-of-stake (PoS) model and the viability of liquid staking.

LSTs allow users to maintain liquidity while staking assets, enabling decentralized finance (DeFi) activities such as borrowing and trading. LRTs further enhance this concept by allowing validators to re-stake their staked assets to other networks or support services like rollups, improving functionality and rewards. Despite a surge in adoption in 2024, achieving widespread acceptance across all sectors remains an ongoing process.

Key Platforms and Competition

EigenLayer made significant strides in re-staking, with its platform re-staking over 4.1 million ETH by April 2024. Other platforms like Lido Finance, Rocket Pool, and Frax Finance also made important contributions, expanding the application of LSTs and integrating them into the DeFi ecosystem. These projects play a crucial role in driving innovation and accessibility in the staking space.

The progress made in 2024 positions LSTs and LRTs as key tools in the staking ecosystem, laying the groundwork for the future integration of blockchain technology and DeFi.

4. Quantum Computing Threats

In 2024, discussions about the impact of quantum computing on blockchain security became a focal point. While quantum computing technology offers tremendous potential for scientific breakthroughs and innovation, it also poses a significant threat to the core of cryptocurrencies—security.

1) Quantum Threats

Quantum computers harness the power of quantum mechanics and could potentially break the cryptographic algorithms that protect blockchain networks. Algorithms like Shor's algorithm could theoretically decrypt public-private key pairs, jeopardizing the confidentiality and integrity of transactions. Imagine if malicious attackers could steal private keys; they could execute double-spending attacks or launch 51% attacks to control blockchain networks.

This potential consequence has prompted industry leaders to actively address this challenge. Professor Massimiliano Sala from the University of Trento highlighted the impending "Q Day" during a Ripple event, emphasizing that quantum computing could render traditional cryptographic techniques obsolete.

2) Seeking Quantum-Resistant Solutions

Major companies like IBM and Google are leading advancements in quantum technology while promoting the development of quantum-resistant cryptographic techniques. This race has spawned projects like the National Institute of Standards and Technology (NIST) post-quantum cryptography standardization process, aimed at creating cryptographic methods that remain secure even in the face of quantum computing breakthroughs.

3) Quantum Defense for Blockchain

The blockchain community itself is also actively exploring "quantum-safe" solutions. Lattice-based cryptography and quantum key distribution (QKD) are emerging technologies aimed at protecting blockchain communications from quantum attacks.

While the industry is taking proactive steps, transitioning to quantum-resistant infrastructure remains a complex and resource-intensive challenge. Google's latest quantum chip, Willow, has made significant progress in error correction, laying the groundwork for larger-scale quantum computers. Despite the undeniable power of this technology, machines capable of breaking encryption are still far from widespread availability.

Therefore, ensuring the long-term security of cryptocurrencies through the development and adoption of quantum-resistant solutions is crucial for the continued growth and stability of the crypto industry.

5. Decentralized Physical Infrastructure Networks (DePINs)

In 2024, decentralized physical infrastructure networks (DePINs) emerged as a major trend, connecting blockchain technology with real-world assets. These networks showcase the potential to reshape the energy, transportation, and logistics sectors.

Examples include decentralized wireless networks like Helium, blockchain-driven ride-sharing platforms, and supply chain tracking systems. DePINs bring greater transparency, enhanced security, improved accessibility, and a sense of community engagement.

Despite these advantages, challenges such as interoperability, scalability, and regulatory uncertainty remain.

As DePINs evolve and regulatory frameworks gradually catch up, they are expected to transform how various industries manage and access physical infrastructure, providing more equitable and efficient solutions for the future.

6. The Popularity of Trading Bots and AI Agents

In 2024, the crypto market witnessed a surge in the popularity of automated trading bots and AI agents. These tools are designed to execute trades based on predefined algorithms or real-time market analysis, fundamentally changing the landscape of crypto trading.

Key Trends and Innovations

AI-driven trading assistants/agents: AI-driven trading assistants, such as Near's AI assistant, have become valuable tools for various traders. Additionally, templates like Coinbase and Replit's Based AI Agent enable developers to create crypto bots for automated trading and asset management. With the rise of trading bots and AI agents, concerns about market manipulation and unfair advantages have also emerged.

Leading trading bots: Truth Terminal, an AI chatbot, gained notoriety in the crypto space for promoting a meme religion ("Goatse Gospel"). A significant amount of Bitcoin donations fueled the launch of the GOAT meme coin, highlighting the potential impact of AI on crypto trends. Although Truth Terminal itself cannot trade, its influence has sparked debates about AI ethics, particularly in the volatile memecoin market.

The increasing application of trading bots and AI agents is undoubtedly reshaping the landscape of crypto trading. While these tools offer significant advantages, caution is still required in their use, along with a deep understanding of their limitations. As technology continues to evolve, balancing automation with human oversight will be key to ensuring responsible and ethical trading practices.

7. The Application of Rollup Solutions in Layer 2 Scaling

In 2024, rollups became a cornerstone solution to Ethereum's scalability challenges. They address network congestion and high fees while maintaining Ethereum's security. As a Layer-2 solution, rollups move transaction processing off the main chain and package it into batches submitted to the main chain, enabling faster and cheaper operations.

Vitalik Buterin's Standards

In September 2024, Ethereum co-founder Vitalik Buterin emphasized that Layer-2 networks must meet "Phase One" decentralization standards by 2025. These standards include anti-fraud mechanisms, security council governance, and upgrade delays to ensure trust and transparency.

Rollup solutions like Optimism and zkSync have locked in billions of dollars in total value locked (TVL) while supporting DeFi, non-fungible tokens (NFTs), and decentralized applications (dApps).

It is worth noting that challenges such as interoperability and achieving full decentralization still exist. However, rollup solutions continue to redefine Ethereum's scalability in 2024, establishing their critical role in the future growth and adoption of the Ethereum network.

8. Tokenization of Real World Assets (RWAs)

In 2024, the tokenization of real-world assets (RWAs) is rapidly developing, creating new opportunities for investors and businesses. Here is an overview of the current situation:

1) Growth of the Fundraising Credit Market

The global fundraising credit market has reached $1.7 trillion and has expanded at a compound annual growth rate (CAGR) of 17% over the past five years. However, only about $500 million of assets have been tokenized, indicating significant growth potential in tokenizing these assets.

2) Global Tokenization Potential

The global physical asset market exceeds $867 trillion, and tokenizing these assets could significantly enhance the economic impact of the crypto industry. By 2027, tokenized assets could account for 10% of global GDP, with the potential to expand the market size to $24 trillion (World Economic Forum).

3) Industry Adoption and Initiatives

DeFi platform Ethena has invested $46 million in a fund for tokenizing RWAs, including products like BlackRock's BUIDL and Superstate's USTB. The Solana-based marketplace AgriDex collaborates with Stripe's Bridge and Circle's USDC to reduce cross-border agricultural trade costs from 2-4% to about 0.5%. Latin American banks like Littio are adopting the Avalanche blockchain to manage RWA vaults, showcasing the global appeal of tokenization.

4) Institutional Initiatives

Switzerland's largest financial holding company, UBS Group, launched its first tokenized fund, the "UBS Dollar Money Market Investment Fund Token," released on the Ethereum blockchain, marking a significant shift in institutional interest in tokenized assets. The Monetary Authority of Singapore is exploring tokenization through Project Guardian, establishing standards for tokenized assets.

China is advancing its digital asset agenda by issuing fully digital structured products on the blockchain, reflecting regional demand for tokenization.

Launched in November 2024, Hadron is an asset tokenization platform introduced by Tether, designed to simplify the creation, management, and trading of tokenized assets. Hadron aims to be an easy-to-use solution capable of tokenizing a variety of assets, from real estate to financial securities. With the continued growth of RWA tokenization, Hadron is expected to redefine the global financial system, enhancing efficiency, transparency, and providing new investment opportunities across various sectors.

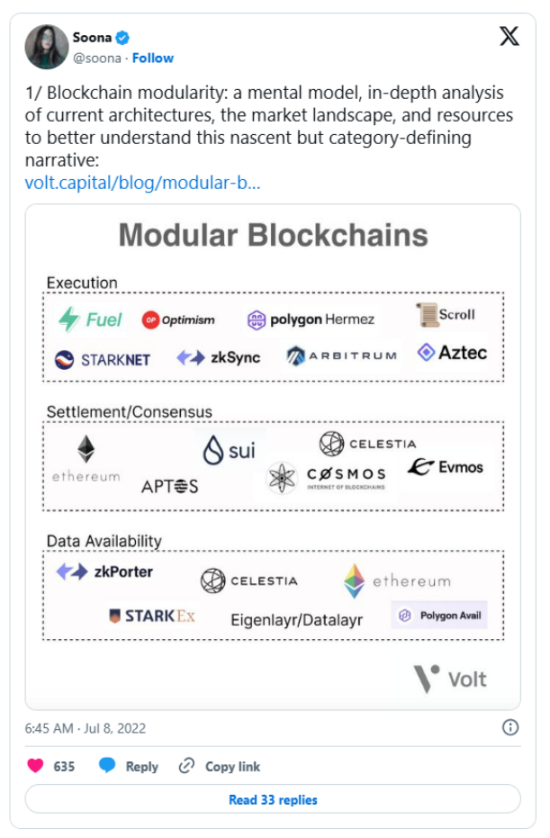

9. The Rise of Modular Blockchains

In 2024, a transformation is occurring in the blockchain space, driven by the emergence of modular blockchains. This innovative approach promises to revolutionize scalability, efficiency, and customization within the blockchain ecosystem.

1) The Modular Blockchain Paradigm

Modular blockchains differ from traditional monolithic architectures, which bundle all functionalities into a single layer. Modular blockchains adopt a modular design, breaking down the blockchain into multiple specialized components. This functional separation provides greater flexibility, scalability, and room for innovation in blockchain development.

2) Modular Blockchain Projects and Use Cases

Modular blockchains, exemplified by Ethereum, have gained widespread recognition, and in recent years, several promising modular blockchain projects have emerged, each addressing specific challenges and opportunities:

Celestia: This project focuses on creating a decentralized data availability layer, ensuring that all transaction data is accessible to all nodes in the network. This allows other modules, such as execution layers, to build on top of Celestia, leveraging its secure and scalable data infrastructure.

Fuel: This project is developing a modular execution layer capable of processing transactions in parallel, significantly increasing throughput and reducing transaction costs. Fuel's modular design facilitates integration with other blockchain components, creating a multifunctional and efficient ecosystem.

Dymension: This project aims to build a modular blockchain network that can support various decentralized applications (dApps). By separating consensus, execution, and data availability into different layers, Dymension seeks to achieve high scalability and security.

10. Telegram Games: Attracting Users to the Crypto Space

In 2024, Telegram became a key platform for crypto gaming. Independent developers launched "play-to-earn" (P2E) games that combine entertainment with crypto rewards. Telegram's user-friendly bot infrastructure and large user base provided fertile ground for these projects.

Hamster Kombat: Players manage a crypto trading platform operated by hamsters, earning HMSTR tokens on The Open Network (TON). Although player engagement and token value significantly declined by the end of the year, it showcased the appeal of P2E games, attracting up to 3 million players at its peak.

Catizen: This game allows users to earn CATI tokens through creative gameplay. While the concept resonated with many, the token's price volatility reflects the challenges of combining gaming with the crypto market.

PAWS: As a rising star in the P2E ecosystem, PAWS attracted over 25 million players through a virtual pet care model, accumulating a large user base in just a few days.

Despite facing criticism for repetitive gameplay, excessive time investment, and the need for crypto investment to maximize rewards, these games played a crucial role in the crypto narrative of 2024. Their success highlights the potential and complexity of merging gaming with digital assets, marking an important chapter in the evolution of the P2E ecosystem.

Citizen Game | Source: Citizen

11. Conclusion

2024 is filled with stories that are reshaping the crypto industry and laying the groundwork for future growth. Memecoins attracted audiences through humor and financial innovation, while prediction markets and decentralized physical infrastructure networks (DePINs) demonstrated how blockchain can address real-world issues. Telegram games drew a large number of new users into the crypto space with their engaging "play-to-earn" model.

Liquid staking and re-staking tokens strengthened Ethereum's staking ecosystem, providing users with greater flexibility. Rollups addressed scalability issues, making Ethereum faster and more efficient, while modular blockchains introduced a new way to build decentralized systems with higher customization.

The industry is also taking steps to prepare for the quantum computing era, with quantum-resistant solutions becoming a key focus. The tokenization of real-world assets bridges traditional finance and blockchain, unlocking exciting opportunities and shaping a digital future. AI agents and trading bots are changing how users interact with the market, driving automation and efficiency.

These developments highlight the innovation and challenges within the blockchain world, showcasing its potential for profound impacts in technology, finance, and culture. How the future will unfold remains to be seen.

Q&A

1) What are the main crypto trends in 2024?

2024 highlights several transformative trends, including the rise of memecoins, the popularity of prediction markets, advancements in quantum-resistant cryptography, and the growth of decentralized physical infrastructure networks (DePINs). These narratives play a crucial role in shaping the crypto landscape.

2) How will quantum computing impact the crypto industry in 2025?

Quantum computing poses significant challenges by threatening the traditional cryptographic methods used in blockchain. In response, the industry is accelerating the development of quantum-resistant solutions, such as lattice-based cryptography and quantum key distribution (QKD), to ensure the long-term security of blockchain networks.

3) Why are memecoins so influential in 2024?

Memecoins like FLOKI and PEPE continue to capture the attention of the crypto community by combining humor, cultural relevance, and community-driven initiatives. They also attract attention through high-profile endorsements, such as Dogecoin mentioned in Elon Musk's government efficiency project.

4) What role do AI and trading bots play in the crypto market in 2024?

AI-driven trading bots and agents are revolutionizing crypto trading by automating decision-making processes. These tools enhance market participation but also raise ethical and regulatory concerns regarding market manipulation and fair trading practices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。