Author: CryptoAmsterdam

Translation: Deep Tide TechFlow

1. When Will Altcoin Season Arrive?

I believe that altcoin season will arrive soon, and here are some key analysis points:

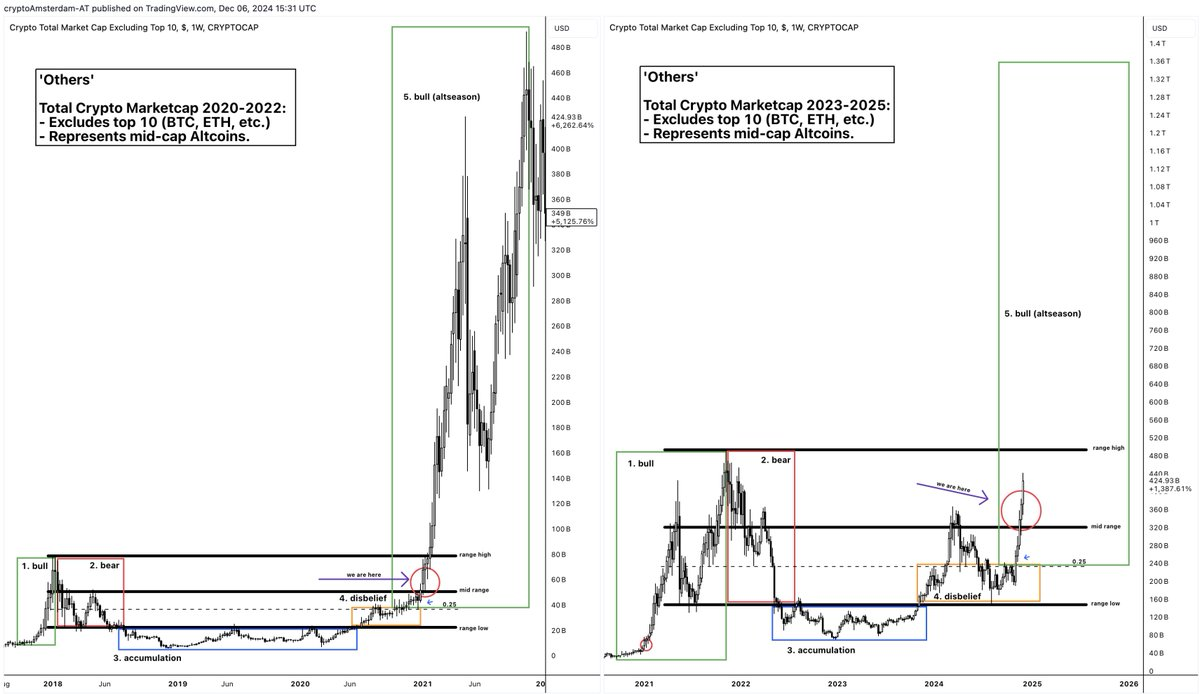

1.1 The Cycle is Divided into Two Stages

- Stage 1: Bitcoin price rises, while altcoin prices fall (Bitcoin's market share increases).

- Stage 2: Bitcoin breaks through its historical high, and altcoins begin to enter a rapid upward phase.

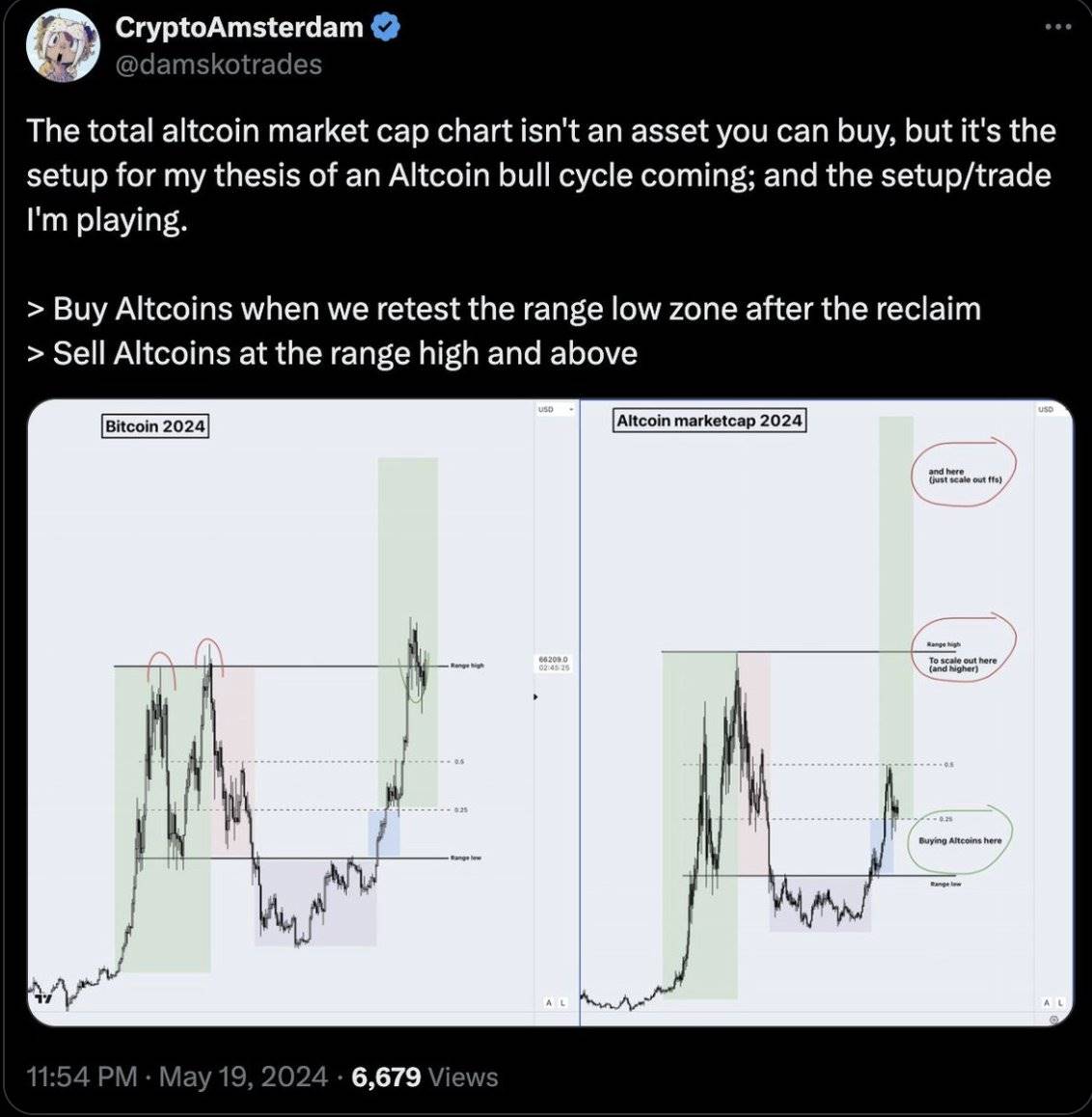

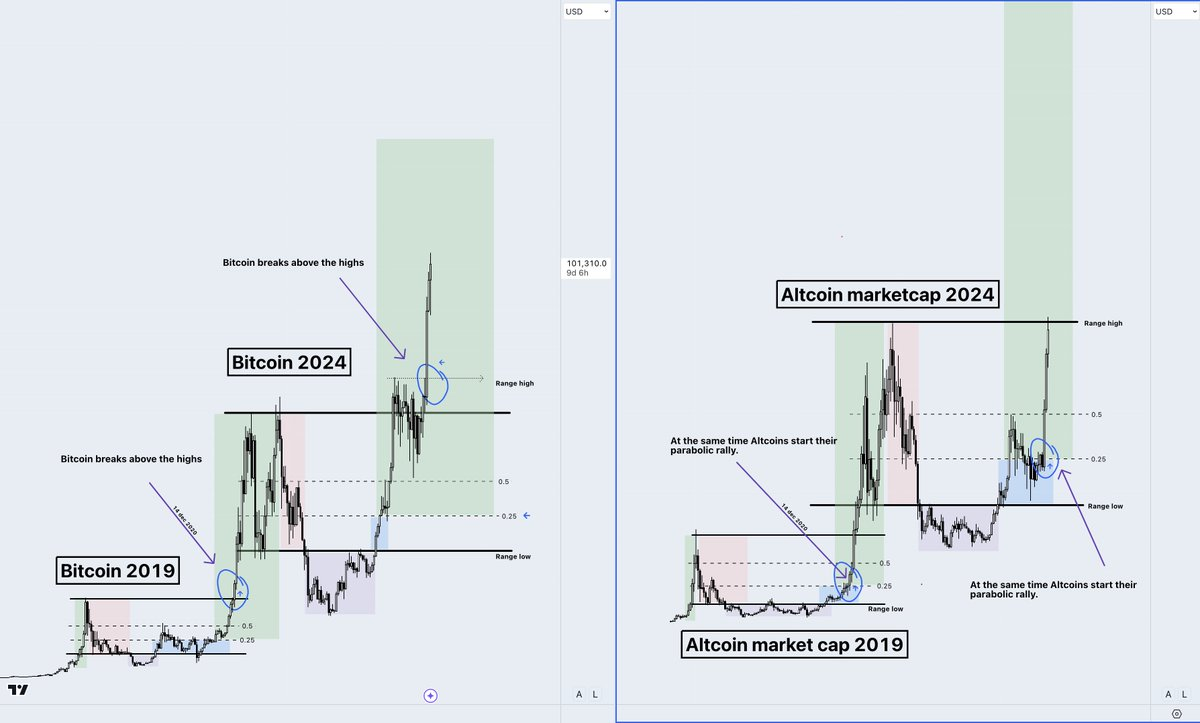

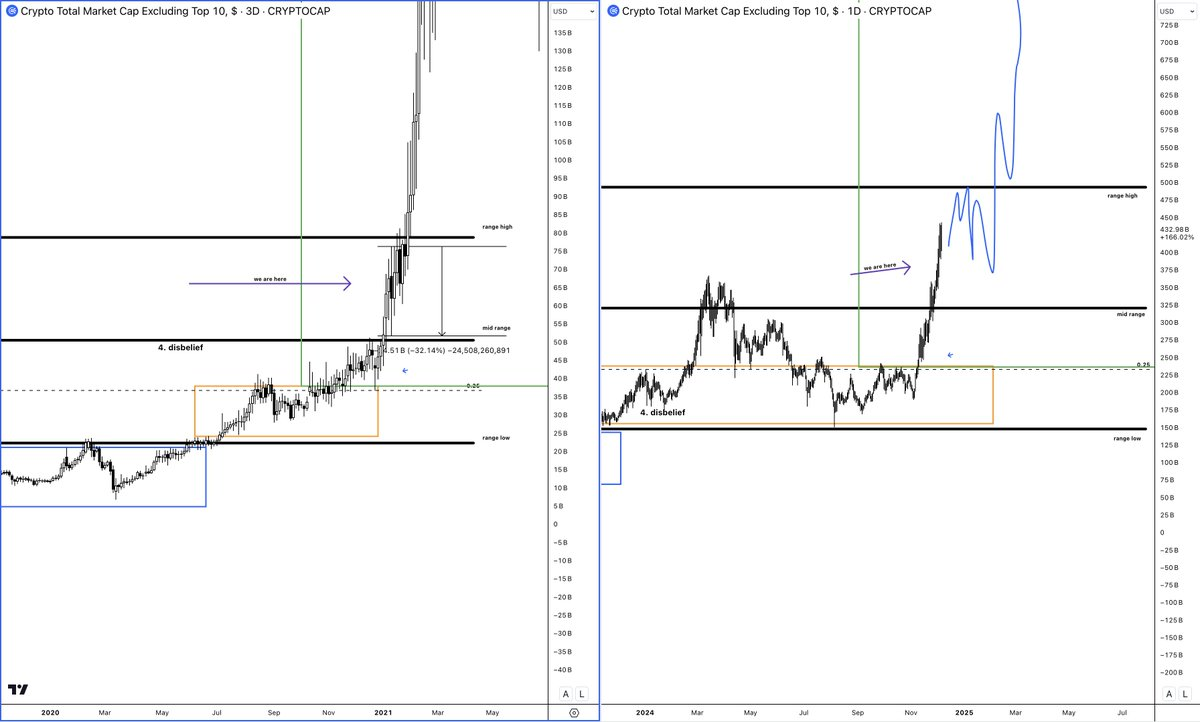

This pattern can be seen more clearly in the chart below:

During this stage, we start accumulating altcoins when the total market cap of altcoins is at a low point. I believe that altcoin prices will break new highs just like Bitcoin.

Currently, Stage 2 has already started!

For more details, please see: link.

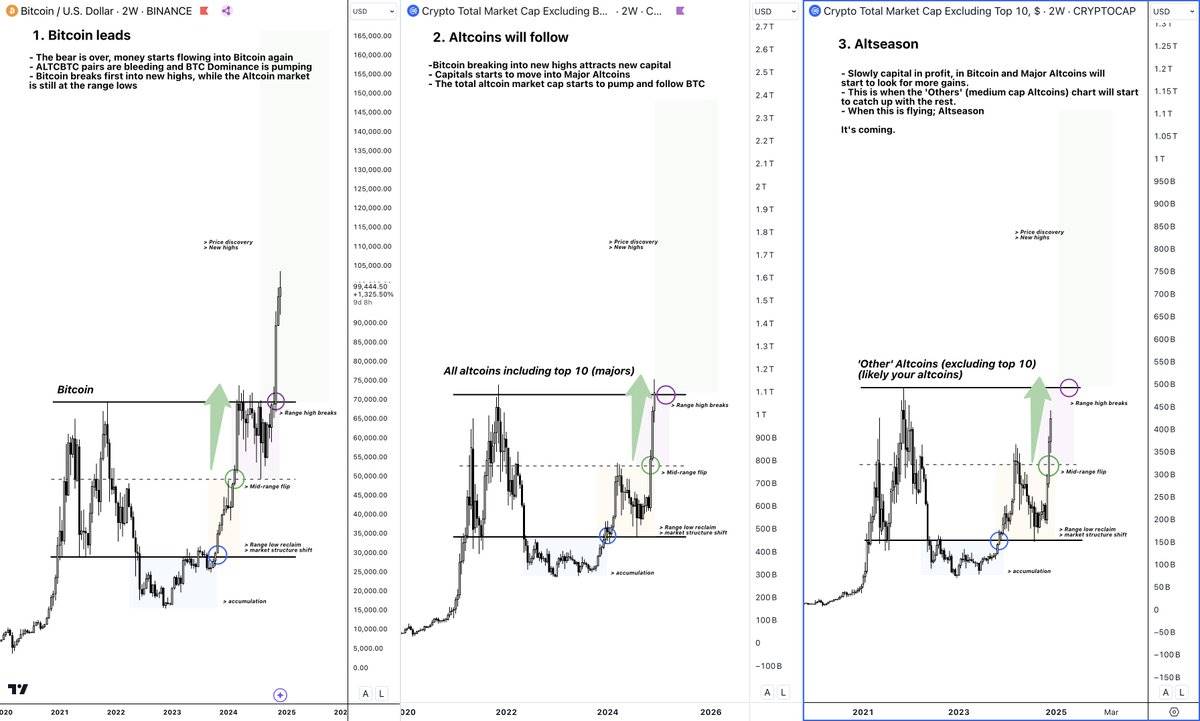

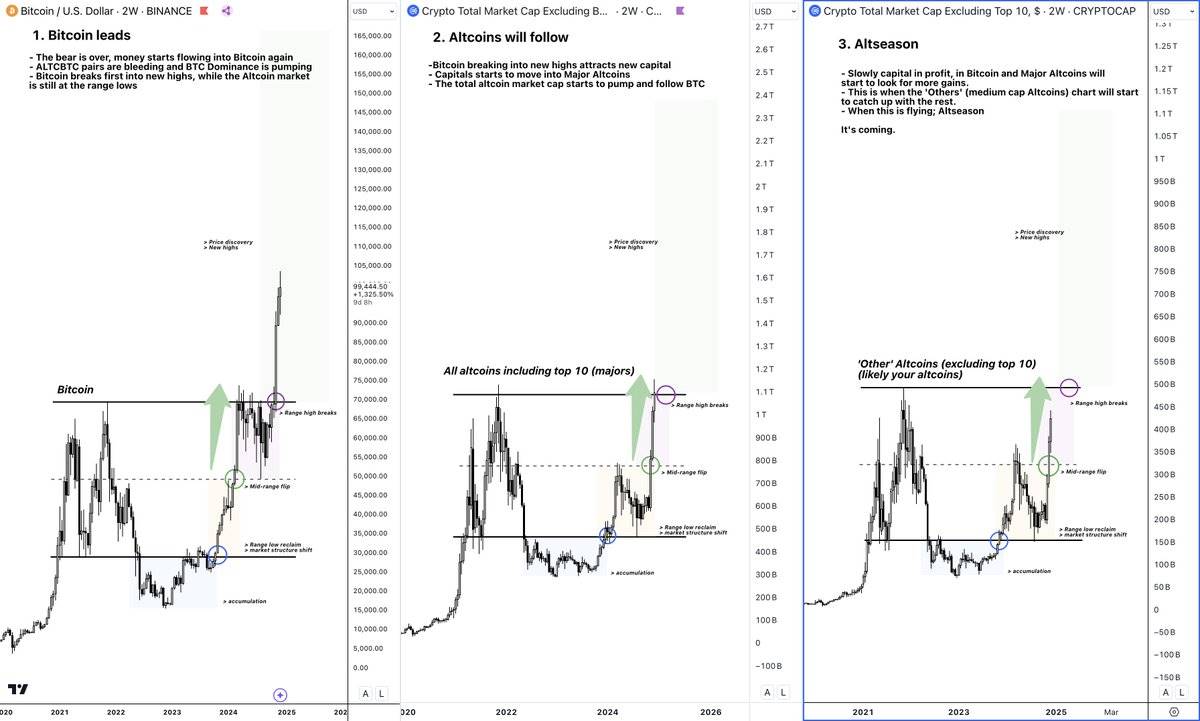

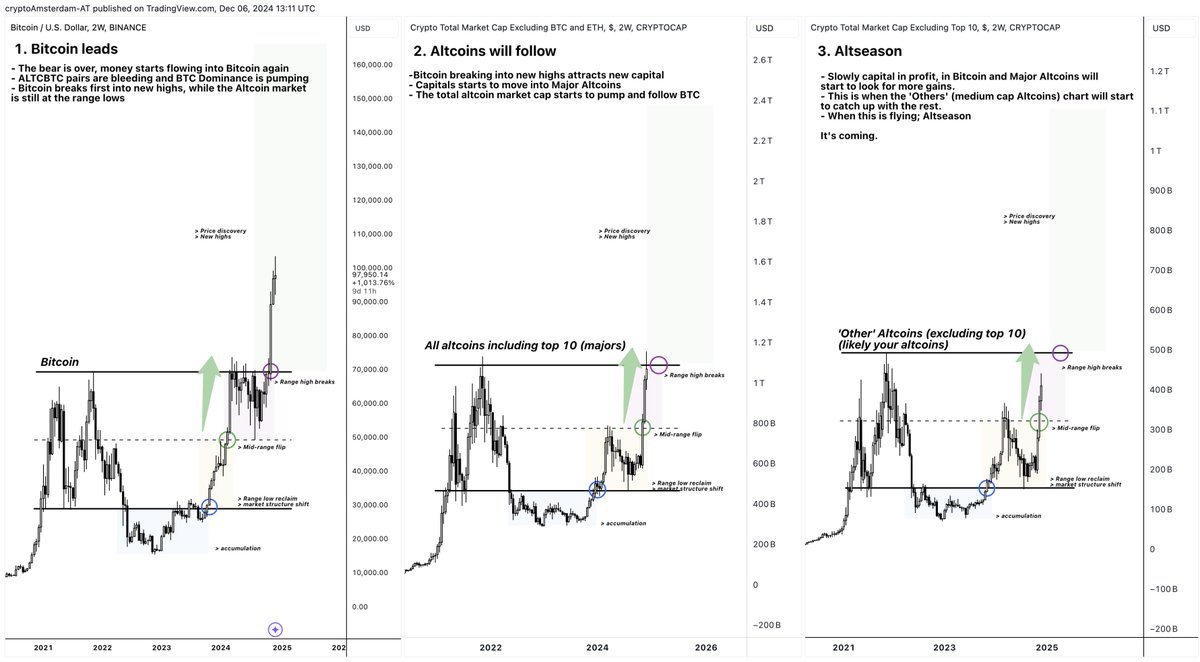

1.2 Capital Flow Patterns

The starting point of the bull market can be traced back to the end of 2023, when Bitcoin rebounded from a low, returned to the range, and rose to previous highs, while altcoins depreciated against Bitcoin, increasing Bitcoin's market share.

When Bitcoin breaks through its historical high (which is the current stage), capital begins to flow into large-cap altcoins. From the Total 3 chart (the total market cap of the top 100 altcoins minus BTC and ETH), although it is currently driven mainly by large-cap coins (like XRP), the performance of mid and small-cap coins is also catching up.

Ultimately, funds from Bitcoin and large-cap coins will gradually flow into mid and small-cap altcoins.

As market sentiment rises, investors will become greedier and start chasing mid and small-cap altcoins. I expect that mid-cap altcoins in the "Others" category will reach new highs. The real altcoin season is still ahead.

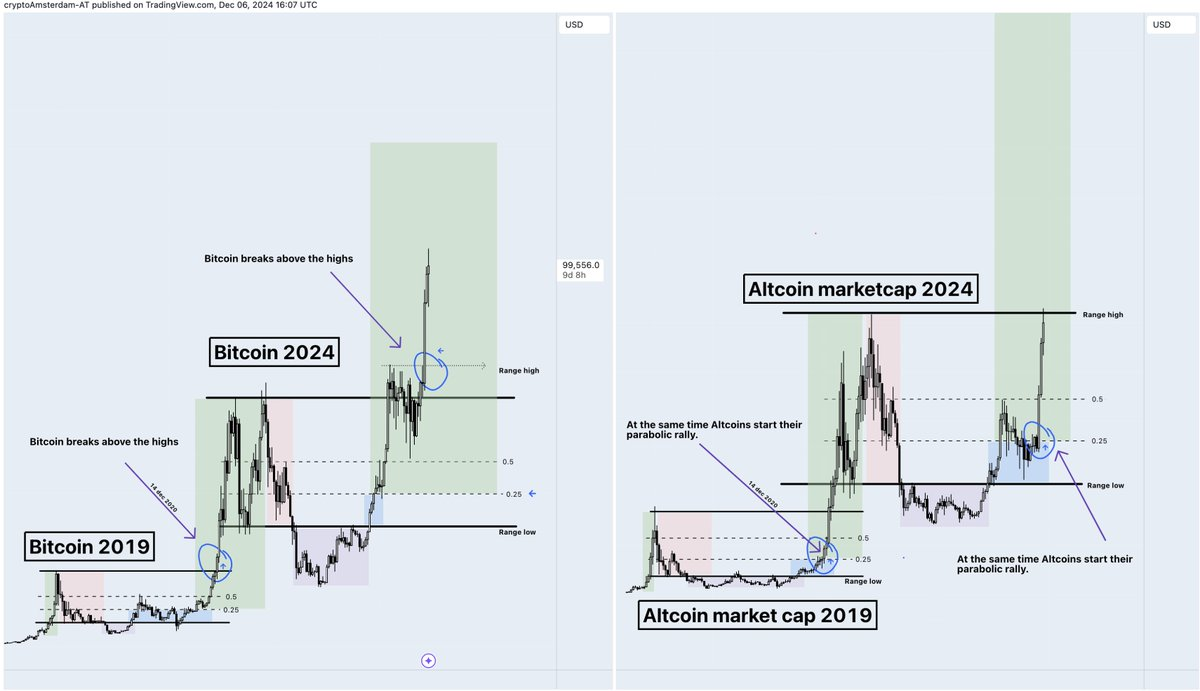

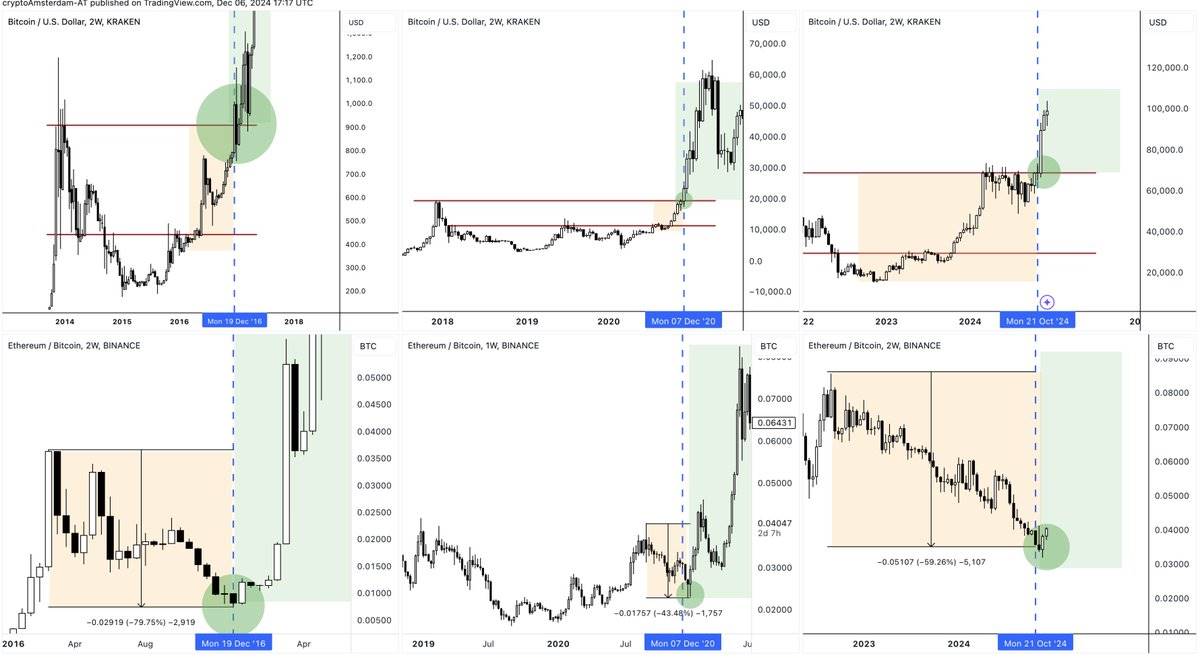

1.3 Bitcoin Market Dominance

Every cycle has a similar pattern: when Bitcoin's price breaks through previous highs and reaches new highs for the first time, its market dominance begins to decline.

Currently, Bitcoin's market dominance has broken a rising trend that lasted over 800 days.

1.4 ETHBTC Trend Analysis

In every cycle, Ethereum tends to perform weakly in the early stages (Bitcoin rises but remains below previous highs), and then rebounds when Bitcoin stabilizes above previous highs.

The current cycle is no exception. More funds are expected to flow into Ethereum ecosystem tokens, on-chain utility tokens, and high-risk tokens. Once ETHBTC truly enters an upward trend, the performance of these tokens will be even more impressive.

ETHBTC Chart Analysis

Currently, ETHBTC has retraced and is back above the range low.

In 2021, it failed to break through the resistance level of Stage 4. Will we see a "super surge" in Stage 5 during this cycle?

If it breaks the current downward trend line, it will end a bear market trend that has lasted for 1100 days.

Additionally, 2024 is also an important year for the launch of Ethereum ETFs (Exchange-Traded Funds), and I believe the market still underestimates Ethereum's potential.

2. Have You Already Missed the Opportunity?

As mentioned earlier, the Amsterdam team has been accumulating altcoins during the Total 3 market cap low over the past 5-6 months.

At the range low, it is recommended to:

- Buy at key support levels;

- Gradually accumulate during slow oscillations, rather than chasing prices;

- Set clear stop-loss points (e.g., below the range);

- Market fluctuations are smaller, making it easier to hold.

But if you choose to buy after a vertical price increase:

- You may not have a clear stop-loss point. This may not significantly affect short-term traders, but for long-term investors, lacking a stop-loss point increases risk.

- The profit opportunity from the range low to high has disappeared, and the current bet has turned into "Can the altcoin market cap break new highs?"

- Buying during a rapid price increase means you will face higher market volatility, and a 20-30% pullback is not uncommon.

Therefore, I believe it is not too late for you because:

- Bitcoin still has room to rise.

- The capital rotation has not fully reached the mid and small-cap altcoin stage (the "Others" chart shows it may reach new highs), so the most profitable stage has yet to come.

- Bitcoin's dominance may further decline, while the ETHBTC ratio will rise.

But please note the following points:

- Understand the current stage of the market cycle.

- Clarify whether you are entering a coin for short-term trading or long-term investment.

- Develop a clear profit plan.

- Recognize that this is a high-volatility phase, and rapid declines of 10%-30% may occur.

- Accept that these rapid declines are difficult to predict; if you try to trade these pullbacks, you may disrupt your originally longer-term investment plan.

For a "risk" analysis of entering at this stage (rather than entering in the past 3-6 months):

3. Suggestions on How to Enter:

If you missed the accumulation period over the past 6 months, you first need to think about why you missed it.

It is likely due to emotional influences:

- In a bull market, price increases are usually very rapid, with almost no obvious and sustainable pullbacks.

- Many people miss the opportunity to rise, and when they "fear missing out" and chase prices, the market often enters a consolidation or rapid decline phase.

- During the consolidation, they become pessimistic again, ultimately missing the opportunity for rapid increases.

The correct strategy is: to accumulate in batches during consolidation or pullback phases, and to remain patient, focusing on the market structure over a longer time frame.

For more content, please refer to this link.

Next are specific suggestions!

Suggestion 1: Stick to Spot Trading, Avoid Leverage

Prioritize spot trading.

Many people are accustomed to using leverage, but this is actually a trap. Every market fluctuation makes it feel like an "opportunity," but in reality, most of the time it is not. You do not need to rush to act. Leverage trading ultimately leads most people to losses or even zero—do not let it ruin your bull market gains.

Stick to spot trading so that you won't be unable to hold positions due to excessive leverage, or worse, be forcibly liquidated and miss market opportunities.

Trust me, stay away from leverage trading.

Suggestion 2: Do Not Chase Prices, Focus on Pullbacks

Most people trade based on emotions, only buying when prices rise (green candles) because it makes them feel "safe."

But the market does not rise straight up; even in a bull market, there will be pullbacks:

- Daily fluctuations: small pullbacks of a few percentage points.

- Every few weeks: panic declines of 10%-30%.

If you buy when prices are rising, you are likely to sell in a panic during a pullback.

- Buying during an increase may feel reassuring.

- Selling during a decline may feel like relief.

But the correct strategy is:

- Buying may make you feel scared, but this is the right time.

- Selling may make you feel reluctant, but this is the rational choice.

If you can operate against the trend, accumulating during pullbacks and boldly buying during panic declines, you will have an advantage over most people.

Suggestion 3: Accumulate in Batches, Operate with Patience

So far:

- Only choose spot trading.

- Do not chase prices, but accumulate during pullbacks.

Additionally, you do not need to invest all your funds at once.

You can choose to accumulate gradually. If the price drops by 5%, and you invest all your funds in altcoins at once, then if the market experiences a larger adjustment (such as a drop of 10%, 20%, or even 30%), you may panic and sell.

The correct strategy is: when the price drops by 5%, first invest 10% of your funds. This way, when a larger pullback occurs later (like 10%, 20%, or 30%), you can continue to gradually increase your position instead of being shaken out by market fluctuations.

What if the pullback does not deepen? That's okay. Do not invest all your funds at once out of fear of missing out; this may force you to exit during a deeper pullback.

There will be more pullback and accumulation opportunities in the future.

In a highly volatile market, you cannot perfectly grasp every fluctuation. You also do not need to buy at the lowest point or sell at the highest point; just focus on long-term gains.

Suggestion 4: Control Risks, Avoid Overexposure

You may have heard those legendary stories of people making millions with "full positions," but over-leveraging can greatly test your psychological endurance. If your position is too heavy, you may be forced to sell in a panic during market pullbacks, ultimately missing out on greater opportunities.

Suggestion 5: Develop a Plan That Suits You

Do not directly apply someone else's plan; instead, create a clear investment plan based on your own goals and risk tolerance. This plan should include risk management and various contingency strategies in case the market moves against your expectations.

A good plan can help you stay calm during market fluctuations, avoiding wrong decisions made out of panic or euphoria, while also helping you gradually realize profit exits.

Here are some key points to clarify in your plan:

Keep it simple: Do not make the plan overly complicated.

Focus on the long time frame (HTF): Pay attention to the big trends rather than short-term fluctuations.

Clarify your goals:

What market signals do I want to see?

Which tokens do I want to invest in? Why did I choose them?

How much capital do I plan to invest?

At what price ranges will I accumulate in batches?

When will I exit?

For how to develop a periodic profit plan, you can refer to this tweet.

Suggestion 6: Focus on Long Time Frames, Keep Strategies Simple

- Only focus on long time frame (HTF) charts, avoiding distractions from short-term fluctuations.

- You only need to pay attention to key price ranges and market structures, without getting caught up in excessive market noise.

- Keep your strategy simple and clear.

Even a simple strategy can give you an advantage in the market:

- Most people use leveraged trading, but you do not.

- Most people chase prices when they rise (green candles), but you do not chase.

- Most people do not have a clear profit plan, but you have your own plan.

- Most people buy or sell all at once, but you choose to accumulate and exit gradually.

Before sharing my altcoin watchlist, let’s discuss an important point:

Point of View:

In the current market, altcoins (the "Others" market cap) are expected to reach new highs and attract capital inflows from Bitcoin and mainstream coins.

Currently, the "Others" market cap is slightly above the median of the range and is gradually approaching the upper range.

It is important to note that the upper range is usually a strong resistance area, and there may be multiple tests and pullbacks before a breakout. This point is often overlooked when the market is performing strongly (like today with a sea of "green").

Recall Bitcoin's performance before it broke through the upper range: it underwent multiple pullbacks and consolidations before successfully breaking out.

Even looking back at the last bull market cycle, at the beginning of altcoin season, the "Others" market cap chart experienced a significant 30% pullback before breaking through the upper range.

So please remember the following points:

Before the full altcoin season arrives, the market may experience significant pullbacks, and there could even be weeks of declining trends.

But do not try to predict these pullbacks and wait; instead, adopt the following strategies:

Gradually accumulate in batches: increase your position step by step, rather than investing all your funds at once.

Avoid using leverage: leveraged trading carries extremely high risks and may lead to forced liquidation.

Buy during pullbacks: focus on accumulating when the market is down (red candles), rather than chasing prices when they rise (green candles).

Stay patient and follow a long-term strategy, and you will be more likely to profit from market fluctuations.

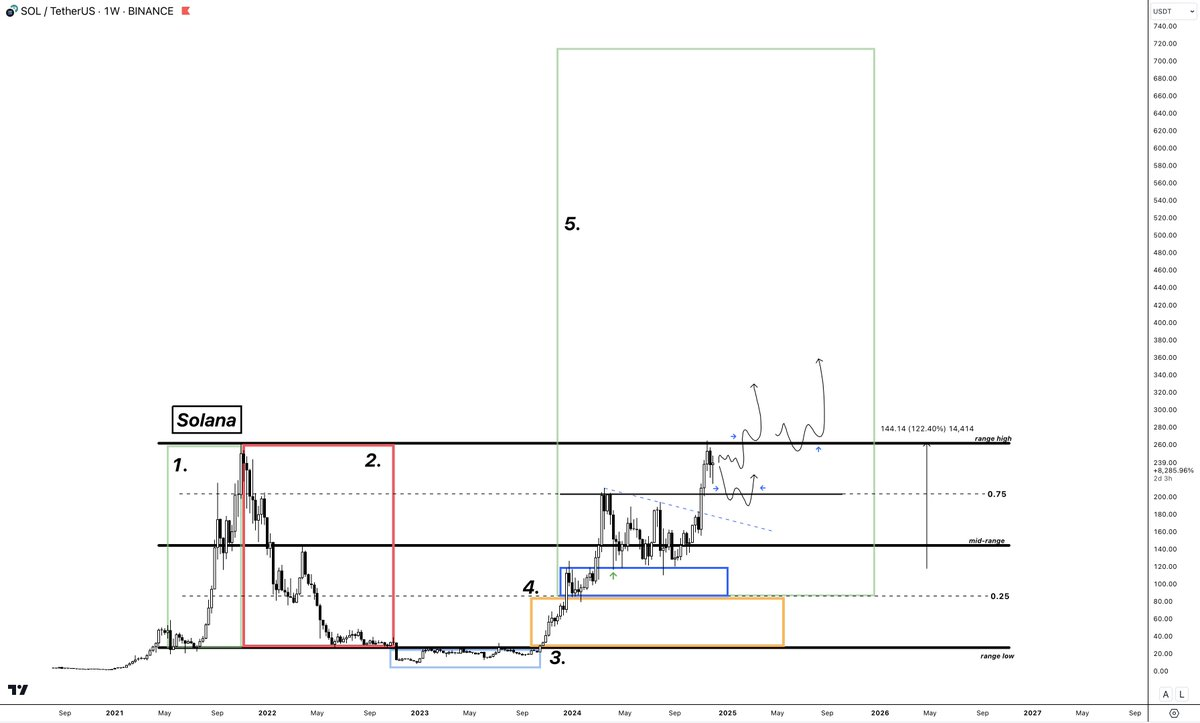

1. $SOL

SOL is currently a strong-performing large-cap coin that has shown significant advantages in this market cycle—this is a choice worth paying attention to.

From the perspective of the market cycle, I expect SOL to break through the current upper range and have significant upside potential when the price enters the "discovery phase" (i.e., when the price reaches a historical high and the market explores its true value).

Currently, it can be considered to accumulate in batches at this stage, but it is important to note that the current price is in a resistance area at the upper range. If you buy in all at once, you may find it difficult to withstand a potential 10%-30% price pullback in the future. Therefore, it is recommended to strictly follow the batch accumulation plan.

Additionally, it is advisable to use spot trading and avoid leveraged operations. Here is my operational thought process:

- Wait for the price to break through the upper range, then start with a small position.

- If the price continues to rise and stabilizes at a high level, you can continue to accumulate in batches.

- If the price falls back below the range and then breaks through again, that is another opportunity to add to your position.

- If the price pulls back to the previous consolidation range, that can also be a time to accumulate in batches.

- When the price rebounds after a pullback and breaks the short-term downtrend line, you can also consider adding to your position.

In summary, develop a clear response plan for various possible market movements and gradually accumulate through spot trading.

2. $BLUR

BLUR is a relatively unique coin. Earlier this year, it failed to hold the lower range of Stage 4 (i.e., the support in the low range failed), which may have been due to the overall slump in the NFT market at that time.

Now, the NFT market is recovering. Opensea may launch its own token, and Magic Eden's token will also go live next week.

With these positive events driving the market, combined with the current market and chart performance, BLUR may regain market attention.

My main observation point is: when the price recovers the lower range (marked by arrows on the chart), will there be an opportunity to accumulate?

If the market declines again, you can also try to accumulate at the lower range of Stage 3.

However, for me, this coin is more suitable for short-term trading rather than long-term holding.

3. $MEME

The investment cycle of meme-themed tokens is something even ordinary investors have heard of. I find it hard to imagine that a token named "MEME" would not attract widespread market attention after being listed on all top exchanges.

The price structure of this token is very perfect, currently in Stage 3. I will wait for the price to clearly break through and reclaim key positions before entering.

Additionally, this token is associated with a large NFT series. With the recovery of the NFT market, the implementation of the $ME incentive program, and the potential launch of the Opensea token, all of these could provide further upward momentum.

4. $ORAI

$ORAI is a veteran AI token. Last week, it successfully reclaimed Stage 4 (orange area) in the short-term market structure, so I bought back some positions.

If the price pulls back to this range again, I will continue to add to my position.

Additionally, I have set price alerts; when it forms a breakout above the macro range low, that will become a new entry signal.

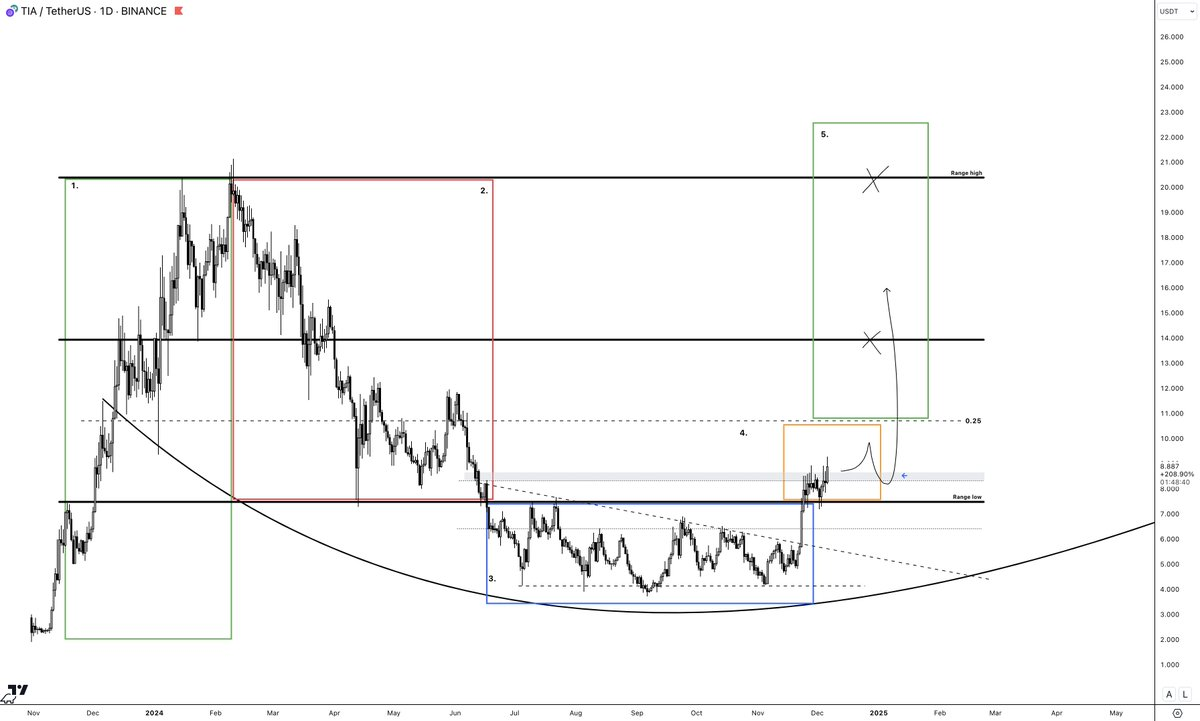

5. $TIA

Since TIA reclaimed and retested the lower range, I have been holding it.

Currently, it is attempting to break through the current price structure. I believe that if the price forms a clear breakout above the gray area, then subsequent pullbacks will be a good opportunity to add to my position.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。