Author: Kevin, the Researcher from BlockBooster

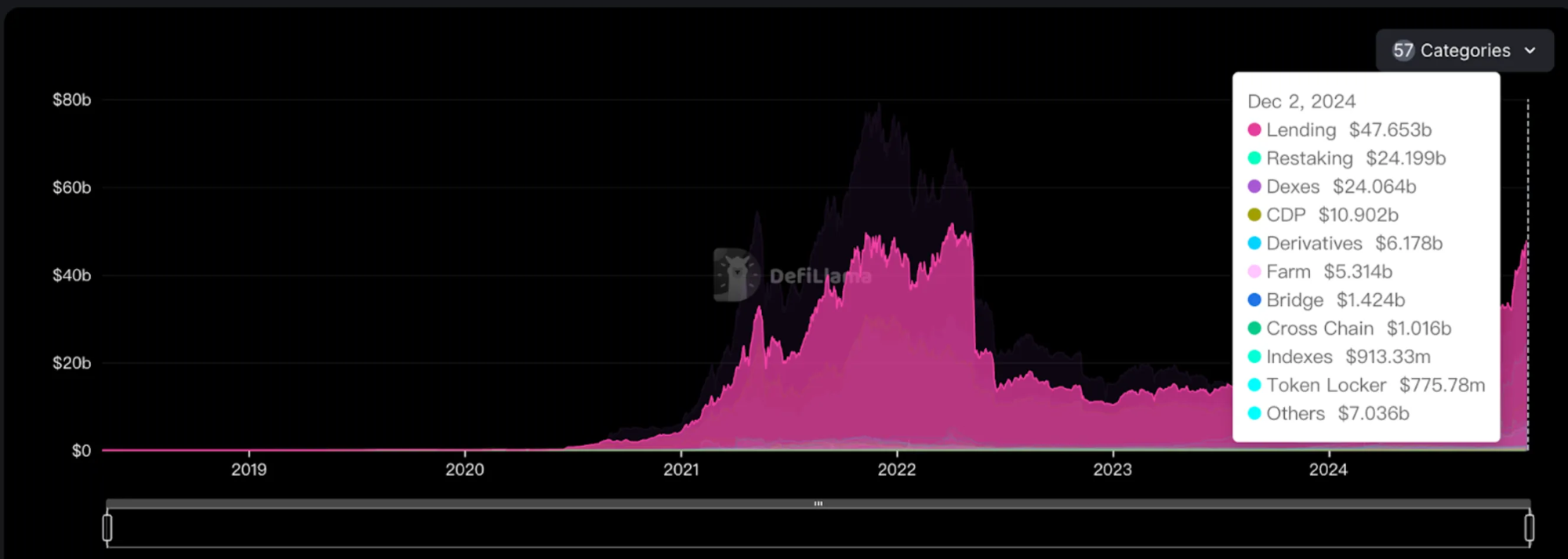

The lending protocol ranks first in the DeFi space in terms of capital capacity, making it the largest sector in terms of capital absorption within DeFi. Moreover, lending is a market that has already validated its demand, has a healthy business model, and has a relatively concentrated market share.

Source: defillama

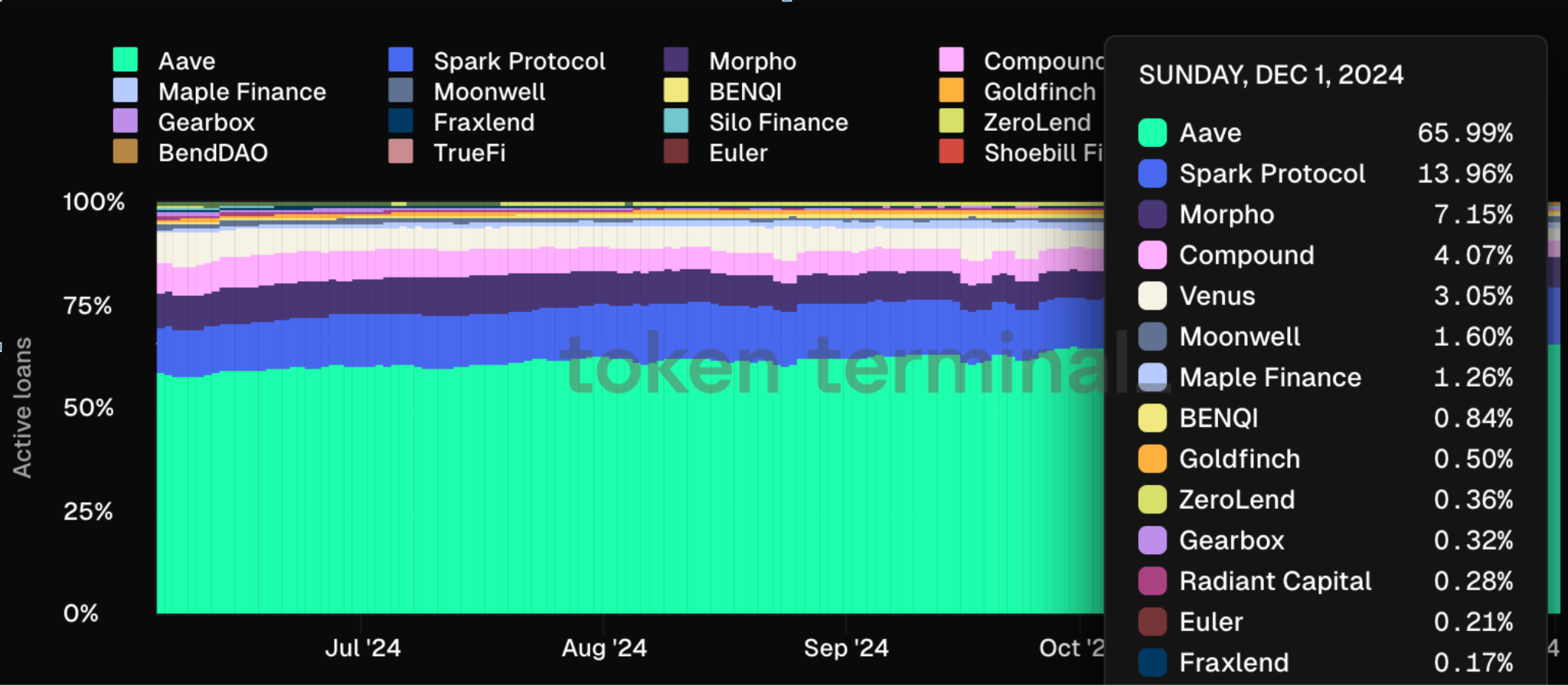

The moat of the decentralized lending market is evident: Aave's market share has further increased, stabilizing between 50-60% in 2023 and currently rising to the range of 65-70%.

Source: https://tokenterminal.com/explorer/markets/lending

After years of accumulation, Aave's token subsidies are gradually decreasing, but currently, apart from Aave, other lending protocols still require sufficient additional token incentives, including Morpho. Observing Aave's development history, we can conclude its core advantages in achieving its current market share:

- Long-term stable security performance: Aave has many fork projects, but they have all ceased operations in a short time due to theft or bad debt incidents. In contrast, Aave has maintained a relatively good security record to this day, providing an irreplaceable trust foundation for deposit users. In contrast, some emerging lending protocols, although they may have innovative concepts or higher short-term yields, often struggle to gain user trust, especially from large capital users, without undergoing years of market testing.

- More substantial security investment: Leading lending protocols, with higher revenues and ample treasury funds, can provide strong resource support for security audits and risk management. This budget advantage not only ensures the safety of new feature development but also lays a solid foundation for introducing new assets, which is crucial for the long-term development of the protocol.

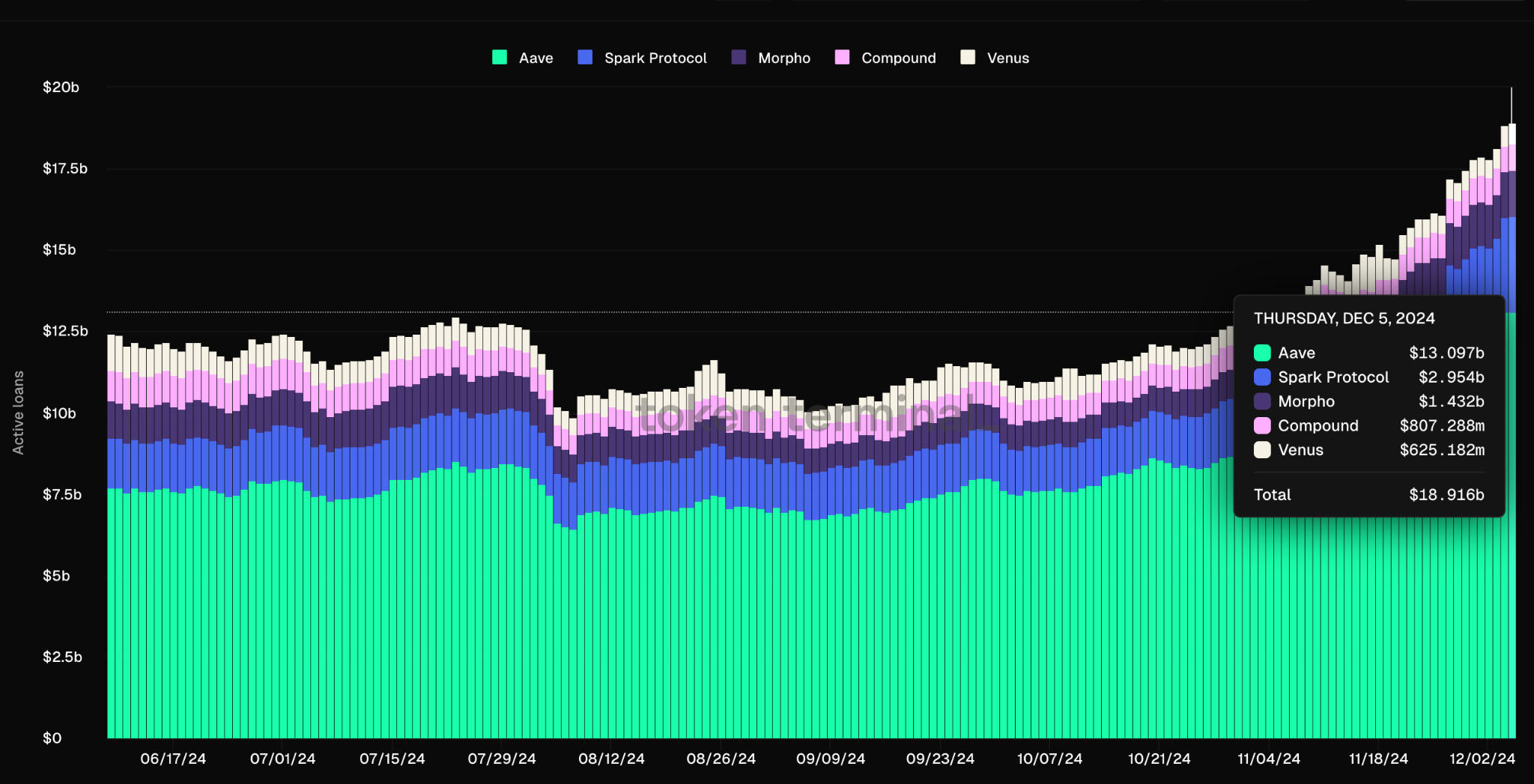

Since Morpho received funding from a16z in the second half of 2022, it has achieved a curve overtaking in the lending sector within two years. As shown in the figure below, Morpho's current lending funds have reached $1.432 billion, second only to Aave and Spark.

Source: https://tokenterminal.com/explorer/markets/lending

Morpho's success can be roughly divided into two periods, and it is through the accumulation of these two periods that Morpho's market share has steadily increased.

First Leap: Optimizing Aave and Compound for Rapid Growth

Morpho's initial business model focused on improving the capital utilization efficiency of lending protocols, particularly addressing the issue of mismatched capital deposits and loans in peer-to-pool models like Aave and Compound. By introducing a peer-to-peer matching mechanism, it provides users with better interest rate options, i.e., higher deposit rates and lower borrowing rates.

The core limitation of the peer-to-pool model is that the total deposit amount in the capital pool often far exceeds the total loan amount, leading to efficiency issues: the interest of deposit users is diluted by idle funds, while borrowing users must bear the interest cost for the entire capital pool rather than just paying interest on the actual amount used.

Morpho's solution lies in introducing a new workflow: users' deposits and collateral are allocated to Aave and Compound to ensure they receive the base interest rate. At the same time, Morpho uses a peer-to-peer matching mechanism to prioritize large orders, directly allocating deposits to borrowers, thereby reducing idle funds. In this way, deposits can be fully utilized, and borrowers only pay interest on the funds they need, achieving interest rate optimization.

The greatest advantage of this matching mechanism is that it eliminates the efficiency bottleneck of the traditional model:

- Deposit users enjoy higher returns, while borrowing users pay less interest, with both parties' rates tending to align, greatly enhancing user experience.

- Morpho operates based on Aave and Compound, utilizing their infrastructure as a capital buffer, thus controlling risks at levels comparable to these mature protocols.

For users, this model is significantly attractive:

- Regardless of whether the matching is successful, users can at least obtain interest rates comparable to Aave and Compound, and when matching is successful, returns or costs will be further optimized.

- Morpho is built on mature protocols, and its risk control model and capital management completely follow Aave and Compound, significantly reducing users' trust costs in emerging platforms.

Through innovative design, Morpho cleverly leverages the composability of DeFi protocols, successfully attracting more user capital under low-risk conditions and achieving more efficient interest rate optimization services.

Second Leap: Shifting from Application to Decentralized Infrastructure, Isolating Risks and Building an Independent Ecosystem

As previously mentioned, the Morpho optimizer only completed Morpho's first leap, allowing it to stand out among various lending protocols and become a platform that cannot be ignored in the market. However, in terms of product, protocol positioning, or ecological development openness, the optimizer cannot bring broader imaginative space. This is because, firstly, the growth of the optimizer is limited by the current underlying lending pool design, which severely relies on its DAO and trusted contractors to monitor and update hundreds of risk parameters or upgrade large smart contracts daily. If it remains stagnant, Morpho cannot attract a broader range of developers and native protocols, and can only be positioned as an ecological protocol of Aave and Compound in the market. Therefore, Morpho adopted a product approach similar to Uni V4, focusing solely on being a foundational layer for large financial services, while opening up all modules above the foundational layer, i.e., minimizing the product, which the team refers to as "primitive," allowing all lending parameters to be open to individuals and ecological protocols without permission. By transferring risks from the platform to third parties, Morpho's ecological value will continuously increase.

Why does Morpho want to create minimal components and open risk parameters to third parties?

- Risk Isolation: The lending market operates independently. Unlike multi-asset pools, the liquidation parameters of each market can be set without considering the highest-risk assets in the basket. Morpho's smart contracts consist of only 650 lines of Solidity code, are non-upgradable, simple, and secure.

- Customizability of the Treasury: For example, suppliers can lend at a higher LLTV while bearing the same market risk as when supplying to a multi-asset pool with a lower LLTV. They can also create any collateral and loan assets as well as any risk-parameterized markets.

- Cost Reduction: Morpho is completely autonomous, thus eliminating the need to incur fees for platform maintenance, risk managers, or code security experts. The singleton contract based on simple code significantly reduces Gas costs by 70%.

- Lego Foundation: Third-party protocols or individuals are allowed to add more logical layers on Morpho. These layers can enhance core functionalities by handling risk management and compliance or simplify the user experience for passive lenders. For example, risk experts can establish non-custodial curated vaults, allowing lenders to passively earn returns. These vaults reconstruct the current multi-collateral loan pools.

- Bad Debt Handling Design: Morpho adopts a different strategy for handling bad debts compared to conventional lending protocols. Specifically, if an account still has outstanding debts after liquidation and lacks collateral to cover them, the loss will be shared proportionally by all lenders. This way, Morpho will not go bankrupt due to bad debts; even if there are bad debts, they will only affect specific independent markets. Unless there are widespread issues across the market, Morpho's ecological value will not be damaged.

- Developer-Friendly: Account management enables gasless interactions and account abstraction features, and free flash loans allow anyone to access assets across all markets in a single call.

The Morpho platform provides users with a completely autonomous building space, where any individual or institution can design and implement their own lending risk management mechanisms. Professional financial institutions can also utilize the platform to collaborate with other market participants and earn fees by providing management services. Its permissionless nature allows users to flexibly set various parameters and independently create and deploy independent lending markets without relying on external governance to add assets or adjust market rules. This flexibility grants market creators a high degree of freedom, enabling them to independently manage the risks and returns of lending pools based on their risk assessments, thus meeting the diverse needs of different users in terms of risk preferences and use cases.

However, looking further, the trustless design is actually aimed at accumulating reputation and TVL at low cost. Currently, there are hundreds of vaults on Morpho, but most of those listed on the Morpho interface come from vaults designed by risk management experts. Morpho allows anyone to create vaults, which can increase TVL without risk; even if most of these vaults fail, it will not have an impact. However, the vaults that perform well will stand out, and their positioning will be elevated to the level of risk management experts, enjoying the user base brought by the Morpho platform. Before this, vaults created by individuals needed to undergo a long operational process.

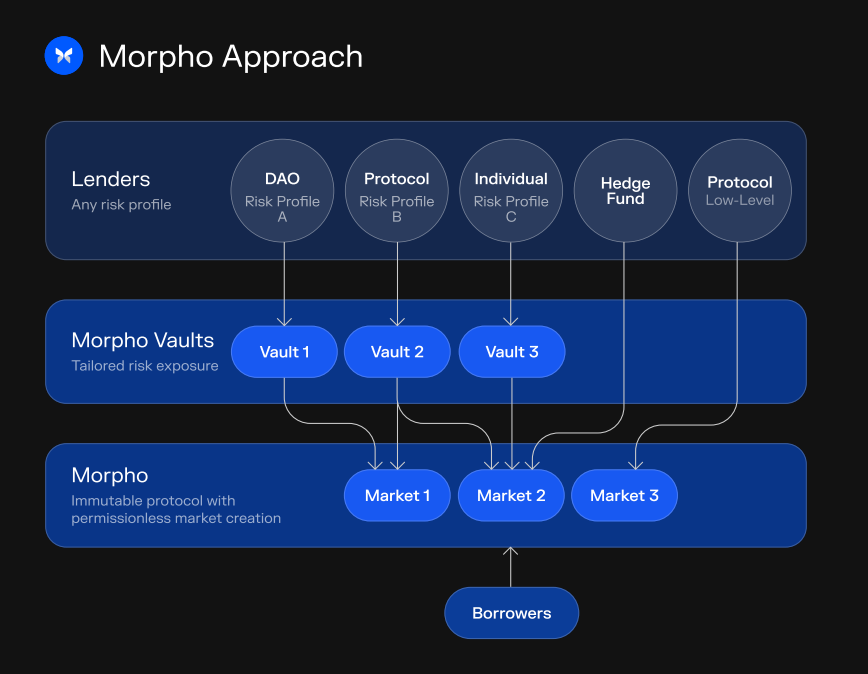

How Does MorphoVault Work?

Morpho Vault is a lending vault system built on the Morpho protocol, specifically designed for managing lent assets. Whether it is a DAO, protocol, individual investor, or hedge fund, they can freely create and manage vaults on Morpho Vault, with each vault focusing on a single loan asset and supporting customizable risk exposure, capable of allocating funds to one or more Morpho markets.

Source: Morpho

This design greatly optimizes the lending process, enhances the overall user experience, and effectively aggregates market liquidity. Users can not only enter independent markets and lending pools to participate in transactions but also easily provide liquidity, thereby earning interest passively.

Another notable feature is that Morpho Vault offers highly flexible risk management and fee structures. Each vault can flexibly adjust its risk exposure and performance fee settings based on demand. For example, a vault focused on LST assets will only involve relevant risk exposures, while a vault specifically investing in RWA assets will concentrate on that type of asset. This customization feature allows users to choose the most suitable vault for investment based on their individual risk tolerance and investment goals.

Since late November, Morpho has passed the token transferability proposal. For the current model that relies on subsidizing Morpho tokens to attract users, the tradability of Morpho tokens can draw more users to participate. Additionally, since the launch of Base in June, various metrics have been on the rise, making it a popular DeFi protocol within the Base ecosystem. With the potential staking possibilities of ETH ETFs, the discussion around RWA is also increasing. Morpho has initiated the deployment of the first Coinbase-certified RWA vault on the Base chain, with two vaults curated by SteakhouseFi and Re7Capital supporting multiple RWA collateral options, placing Morpho in a very special position within the Base ecosystem.

Looking back at Morpho's development history, other lending protocols may learn from Morpho's efforts in building its reputation. Starting with the Morpho optimizer, it utilized Aave and Compound as capital buffer pools and relied on their historical security assumptions to quickly establish its brand. When the time was right to develop its ecosystem and become an independent protocol, Morpho significantly reduced the risks it might face by opening the lending dimension to third parties and developed its ecosystem in a low-cost manner, creating native applications within its ecosystem. Morpho clearly recognizes that a stable operational history is crucial for building a security brand for lending protocols, which is also the foundation of Morpho's existence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。