Organized by: Pzai, Foresight News

The year 2024 is a milestone year for the cryptocurrency sector: cryptocurrency prices soar to all-time highs, the spot Bitcoin ETF marks the most successful ETF launch ever, and pro-crypto politicians achieve significant victories in Washington. But we see an even brighter future: 2025 will usher in the golden age of crypto. Here are 10 predictions for the coming year.

Bitcoin, Ethereum, and Solana Will Reach All-Time Highs

The three major assets in the crypto space—Bitcoin, Ethereum, and Solana—will outperform all major asset classes in 2024, rising by 141.72%, 75.77%, and 127.71%, respectively. Meanwhile, the S&P 500 index returns 28.07%, gold returns 27.65%, and bonds return 3.40%. We expect this momentum to continue into 2025, with Bitcoin, Ethereum, and Solana all reaching new all-time highs. Our expected target prices are as follows:

Bitcoin—$200,000

Record inflows into Bitcoin ETFs will drive Bitcoin to an all-time high in 2024. We believe this trend will not slow down anytime soon (see below). Combining this demand with the supply reduction caused by the halving in April 2024, along with new purchases from corporations and governments… well, we’ve seen this before. (Note: If the U.S. government implements the proposal to establish a strategic reserve of 1 million Bitcoins, $200,000 could turn into $500,000 or more.)

Ethereum—$7,000

Despite Ethereum rising 75.77% in 2024, the second-largest crypto asset has lost favor with many investors, who have either turned to Bitcoin or are focusing on rapidly growing competing blockchains. However, as Warren Buffett said, "Be fearful when others are greedy, and greedy when others are fearful." We expect a narrative shift for Ethereum in 2025, as activity on Layer 2 blockchains like Base and Starknet accelerates, and billions of dollars flow into spot Ethereum ETFs. Another catalyst could be the significant growth of stablecoins and tokenization projects based on Ethereum.

Solana—$750

The cryptocurrency phoenix rises from the ashes of the 2022 market crash, soaring to new heights in 2024, driven by the meme coin frenzy, making the legendary GameStop look relatively mild. We believe Solana's momentum is just beginning to strengthen. The catalyst for 2025 will be the migration of "serious" projects to the network, complementing its dominance in meme coins. We have already seen early examples of projects like Render making leaps. We expect this trend to accelerate in the coming year.

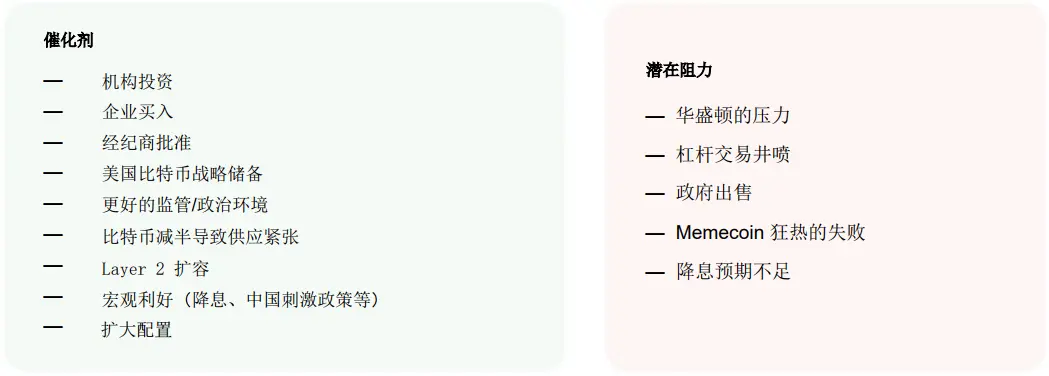

Catalysts and Potential Headwinds for the Crypto Market

More Inflows for Bitcoin ETFs

When the U.S. spot Bitcoin ETF launches in January 2024, ETF experts predict the fund will see inflows of $5 billion to $15 billion in its first year. They exceeded this upper limit within the first six months. Since its launch, these record-breaking ETFs have absorbed $33.6 billion in inflows. We expect inflows in 2025 to surpass this figure. Why? There are three reasons:

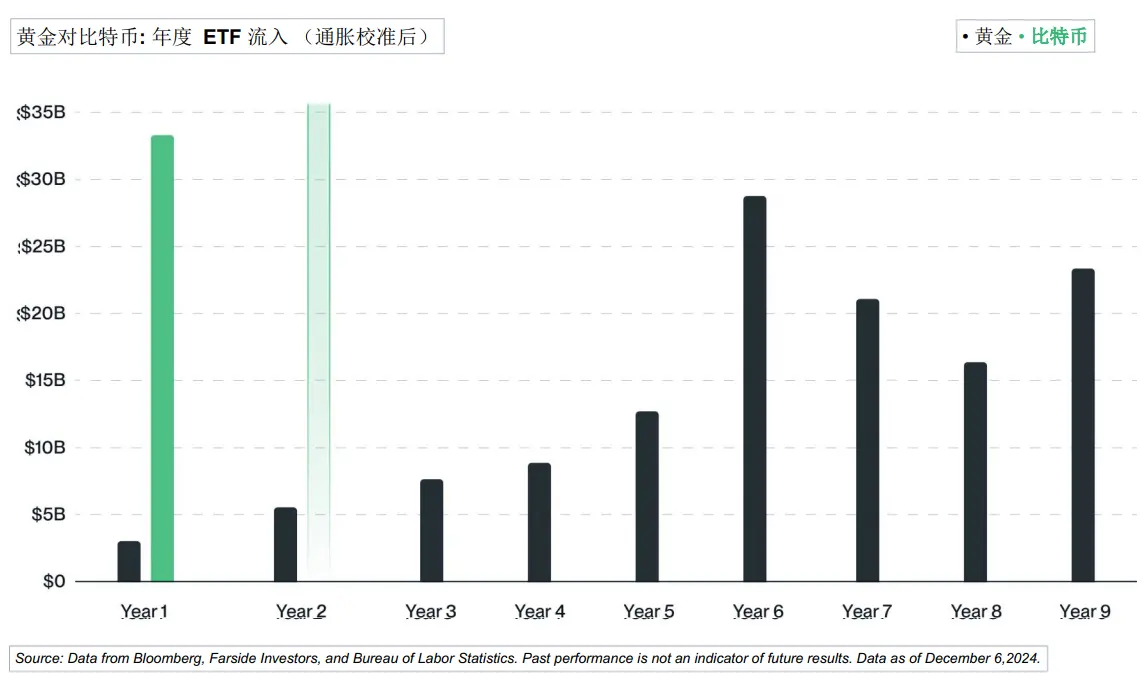

The First Year is Usually the Slowest

For the launch of Bitcoin ETFs, we have the best historical analogy in the launch of gold ETFs in 2004. That year, gold ETFs launched with $2.6 billion in inflows, and everyone was excited. But look at the following years: Year 2 $5.5 billion, Year 3 $7.6 billion, Year 4 $8.7 billion, Year 5 $16.8 billion, Year 6 $28.9 billion (inflation-adjusted). The point is: Year 2's inflows exceeded Year 1's, consistent with the gold example. It is abnormal for inflows to gradually decrease.

Major Brokerages Coming Online

Speaking of Bitcoin ETFs, the world's largest brokerages, from Morgan Stanley and Merrill Lynch to Bank of America and Wells Fargo, have yet to unleash their army of wealth managers, leaving investors largely unable to access these products. We believe this will change in 2025, as trillions of dollars managed by these firms begin to flow into Bitcoin ETFs.

Investors Gradually Increasing

In the seven years that Bitwise has helped investment professionals access cryptocurrencies, we have identified a clear pattern: Most investors start with a small allocation and then gradually increase it. We suspect that most investors who buy Bitcoin ETFs in 2024 will double down in 2025.

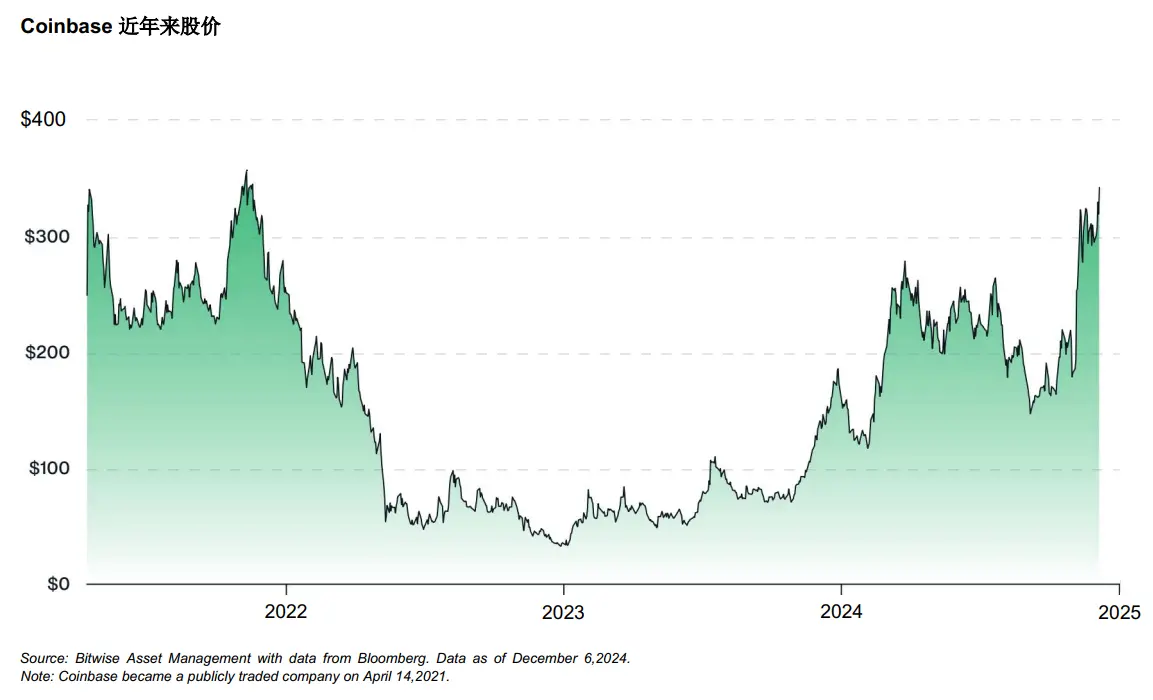

Coinbase Will Become the Largest Brokerage

In 2023, investors could buy Coinbase stock for $35. Today, it trades at $344, nearly a tenfold increase. We believe it can go even higher. Our prediction is that by 2025, Coinbase stock will trade above $700 per share (more than double today's price). This would make Coinbase the most valuable brokerage in the world, surpassing Charles Schwab. Why? Coinbase is not just a brokerage. Three major catalysts will help it achieve this:

Stablecoins

Coinbase's stablecoin business is thriving due to its partnership with USDC issuer Circle. To date, its stablecoin revenue has surged to $162 million (up 31%). If our assessment of the stablecoin development trajectory is correct, this trend should continue.

Base

Last year, Coinbase launched a new EVM-based Layer 2 network called Base. Now, it ranks second in both trading volume and TVL. With growth comes revenue—substantial revenue. Base now generates tens of millions of dollars in revenue each quarter. As more developers, users, and funds flow into the ecosystem, we expect revenue to grow further.

Staking and Custody Services

As of the third quarter, these two business lines generated a combined revenue of $589 million. This is an increase of $304 million (up 106%) compared to the same period last year. Both businesses are driven by asset balances and net new asset flows. We expect both lines to see significant growth in 2025, pushing annual revenue for these lines above $1 billion.

2025 Will Be the "Year of Crypto IPOs"

The past few years have been quiet for cryptocurrency initial public offerings (IPOs). But we expect a wave of IPOs from crypto unicorns in 2025.

Why now? The backdrop for publicly traded crypto companies today is vastly different from previous years. Cryptocurrency prices are rising, investor demand is growing, institutional adoption is surging, blockchain technology has become mainstream, the macro environment is favorable, and perhaps most importantly, the political environment is warming. This is the perfect recipe for many industry giants to go public. Here are five companies that may go public in 2025:

Circle

USDC is one of the largest stablecoins, and its issuer has been actively preparing for an IPO for some time. Circle's strong position in the stablecoin market, along with its ongoing expansion into new financial services, could prompt it to go public.

FIGURE

Figure is known for leveraging blockchain technology to provide various financial services such as mortgages, personal loans, and asset tokenization. The company has reportedly been exploring the possibility of an IPO since 2023, and with Wall Street's growing obsession with tokenization, now may be the right time.

Kraken

As one of the largest cryptocurrency exchanges in the U.S., Kraken has been considering an IPO at least since 2021. The company's plans were delayed due to market conditions but may come back into focus in 2025.

Anchorage Digital

Anchorage provides infrastructure services for digital assets, with a diverse client base that includes investment advisors, asset managers, and venture capital firms. Its status as a federally chartered bank and its comprehensive cryptocurrency services may prompt it to go public.

Chainalysis

As a market leader in blockchain compliance and intelligence services, Chainalysis is a major potential candidate for entering the market in 2025. The company's unique products and growth trajectory make it likely to enter the IPO market, especially considering the increasing importance of compliance in the cryptocurrency industry.

AI Agents Will Lead the Meme Explosion

As we enter 2025, we seem poised for an even bigger meme frenzy than in 2024. For example, a recent interaction between a16z's Marc Andreessen and an autonomous chatbot called Truth Terminal led to the AI agent promoting an obscure memecoin—GOAT. What started as a quirky experiment quickly became an asset with a market cap exceeding $1.3 billion, demonstrating the immense potential when you mix AI with the wild world of memecoins.

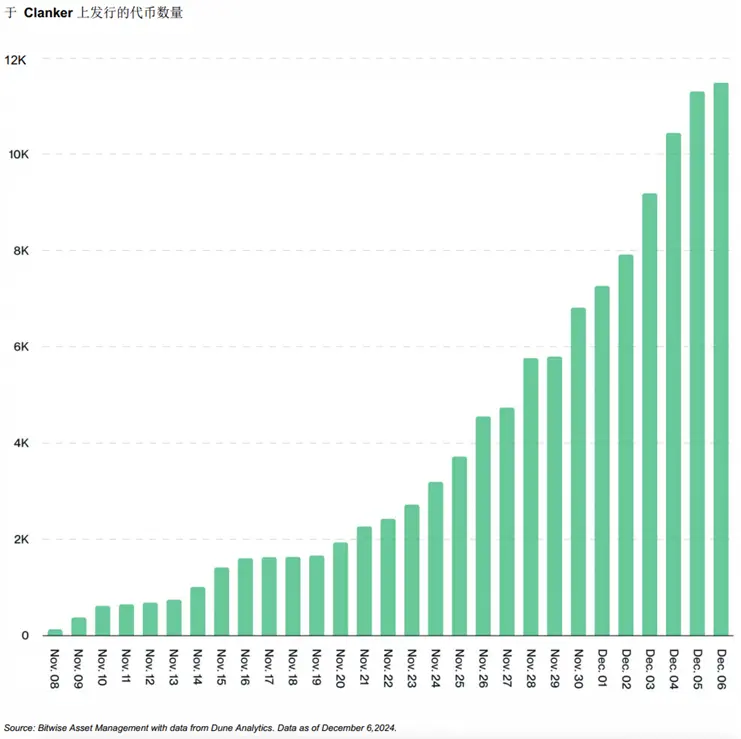

But the breakthrough that excites us the most is Clanker, an AI agent designed to autonomously deploy tokens through Coinbase's Layer 2 scaling solution, Base. Users simply need to tag Clanker in a post on Farcaster, instructing the AI agent to publish a token with a given name and image, and it will automatically deploy the token. In less than a month, Clanker has launched over 11,000 tokens (generating over $10.3 million in fees). We believe that tokens launched by AI will drive a new wave of memecoin frenzy in 2025. Are these memecoins useful in the real world? Unlikely. Will most of them go to zero? Yes. But they represent an interesting collision of two breakthrough technologies—AI and cryptocurrency—that is worth watching.

The Number of Countries Holding Bitcoin Will Double

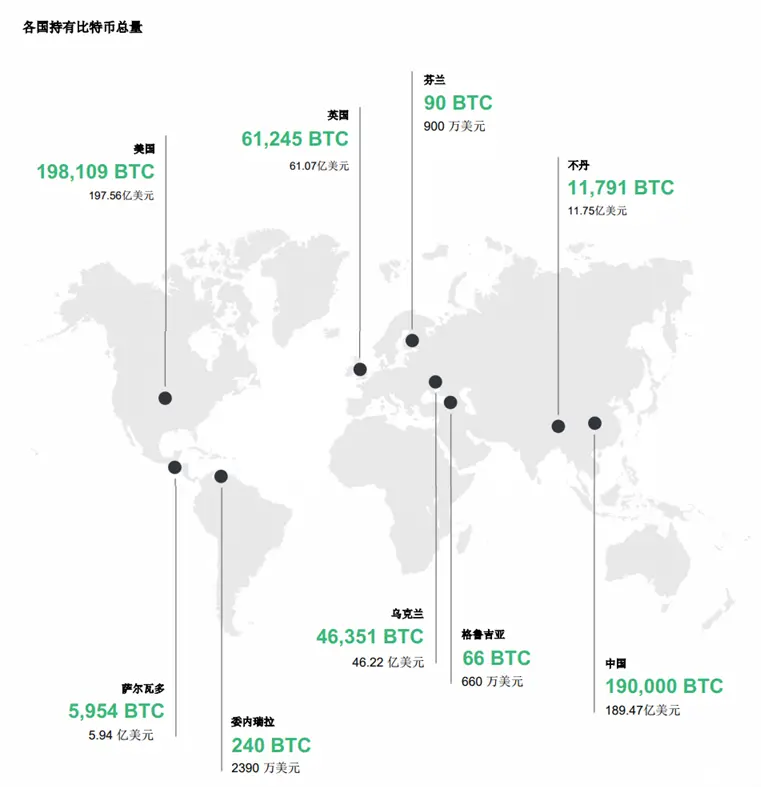

We don't know if the U.S. will establish a strategic reserve of Bitcoin by 2025, but it is certainly possible. Senator Cynthia Lummis has proposed a bill calling for the U.S. to purchase one million Bitcoins within five years, and former President Trump also supports this idea. However, Polymarket estimates the likelihood of this happening at less than 30%, and who are we to contradict the truth? Nevertheless, we believe it is not important.

The U.S. is actively considering establishing a strategic reserve of Bitcoin, which will spark a global arms race, prompting governments to buy Bitcoin early. According to BitcoinTreasuries.net, there are currently nine countries holding Bitcoin (led by the U.S.). We expect this number to double by 2025.

Emerging Crypto Companies Will Enter Stock Indices

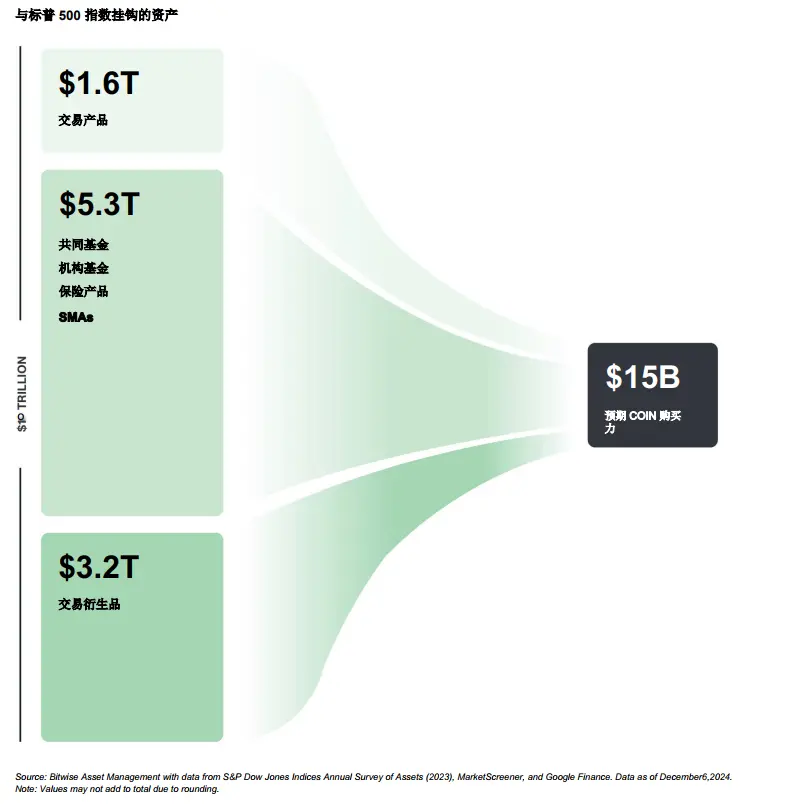

Most ordinary American investors have not been exposed to cryptocurrencies. Cryptocurrency is a new asset class that many investors either do not understand or simply choose to stay away from. However, almost every investor has funds that track the S&P 500 or Nasdaq 100 indices. Yet, so far, these indices do not include the largest publicly traded crypto companies—Coinbase and MicroStrategy. We expect this situation to change as early as the next major rebalancing of these indices this month. This could have a significant impact.

Consider this: There are $10 trillion in assets directly tracking the S&P 500 index, with another $6 trillion in assets benchmarked to it. If Coinbase joins the index, we expect funds will have to purchase about $15 billion worth of stock. Given the relative size of funds tracking the Nasdaq 100 index, the impact on MicroStrategy is expected to be smaller, but still substantial.

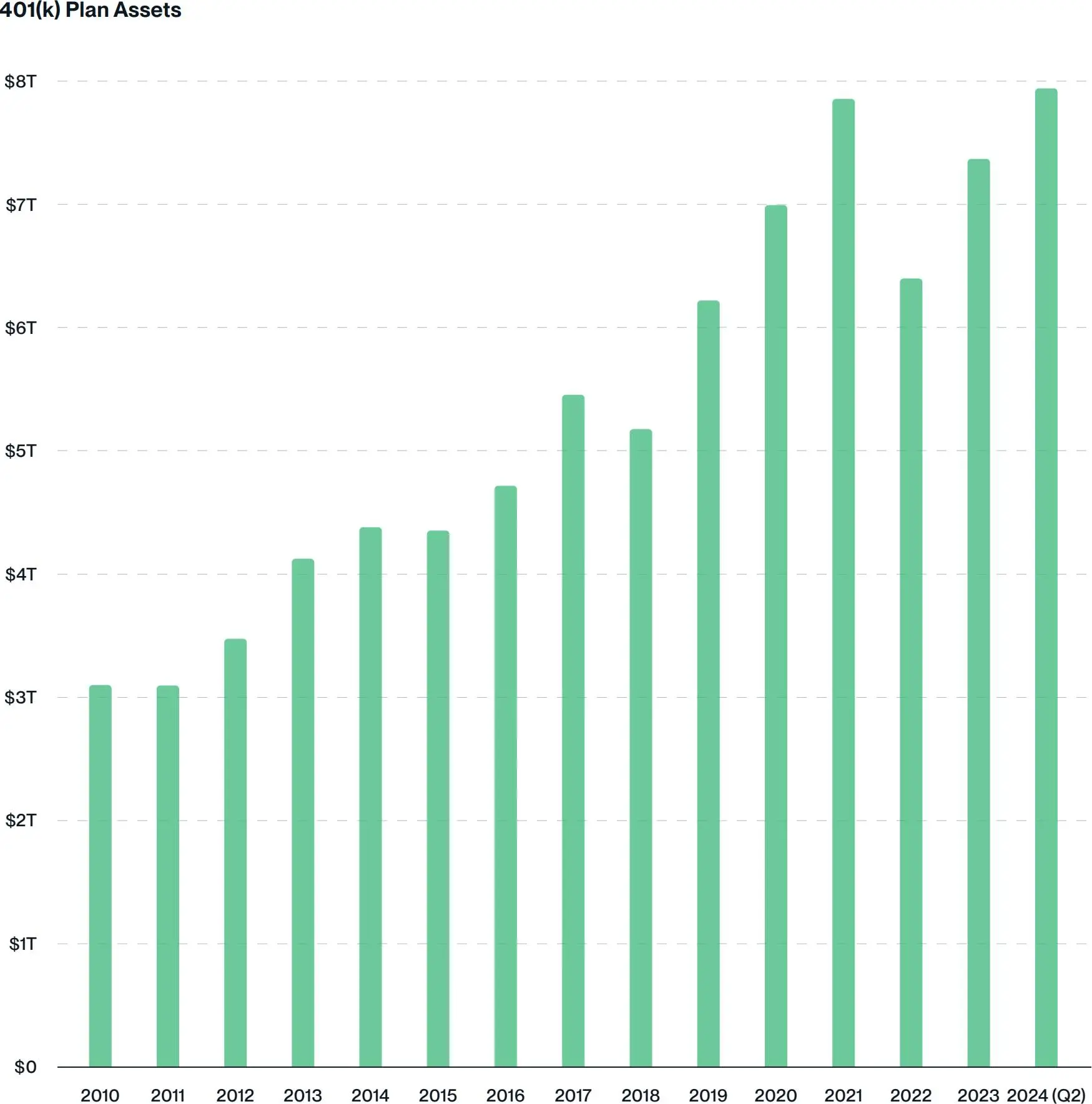

Relaxation of 401(k) Plans Will Bring Massive Liquidity

In March 2022, the U.S. Department of Labor issued guidance "reminding 401(k) plan fiduciaries of the significant risks of adding cryptocurrency investment options to their plans." The Department of Labor even stated that it would "conduct an investigation program to protect plan participants from these risks." With the new government in Washington, we expect the Department of Labor to soften this guidance. There are at least $80 billion reasons for this.

The 401(k) plans in the U.S. hold $8 trillion in assets. More funds are flowing into these plans every week. If cryptocurrencies account for 1% of 401(k) assets, that would mean $80 billion in new capital entering the space, with a continuous influx thereafter. A 3% return would yield $240 billion. That’s a big deal.

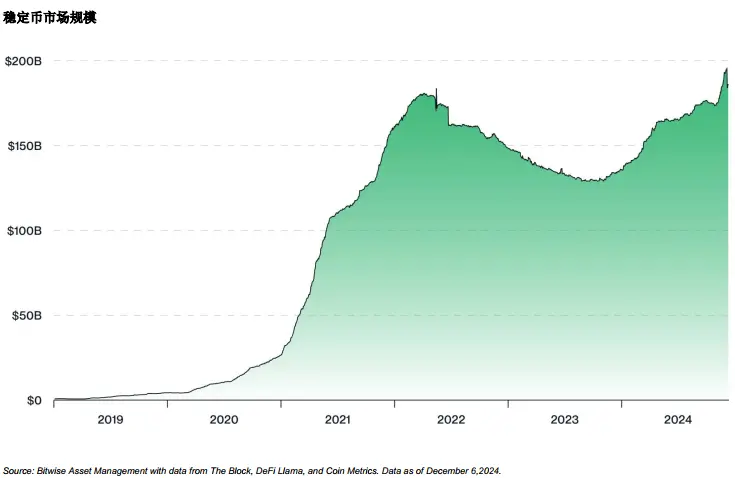

The Market Cap of Stablecoins Will Reach $400 Billion

The boom in stablecoins in 2025 will push their market cap to $400 billion or more. Four categories of catalysts will drive this growth:

Stablecoin Legislation

For new policymakers in Washington supporting cryptocurrencies, passing comprehensive stablecoin legislation is the lowest-hanging fruit. Who will regulate them? What are the appropriate reserve requirements? At that time, large traditional banks like JPMorgan are expected to enter this space.

Fintech Applications

Payment giant Stripe spent $1.1 billion in October to acquire the stablecoin platform Bridge, calling stablecoins the "superconductor of financial services," thanks to their speed, accessibility, and low cost. PayPal launched its own stablecoin (PYUSD) in 2023, and Robinhood recently announced plans to collaborate with some cryptocurrency companies to launch a global stablecoin network. As stablecoins penetrate popular fintech applications, we see the asset management scale and trading volume of stablecoins skyrocketing.

Global Trade and Remittances

Stablecoins have already been encroaching on the global payments and remittances market. We see stablecoin transaction volumes reaching $8.3 trillion in 2024, second only to Visa's $9.9 trillion payment volume during the same period. Additionally, stablecoin giant Tether recently funded a $45 million crude oil transaction with its USDT stablecoin, clearly demonstrating the potential of stablecoins to facilitate large-scale global trade. As the digital dollar continues to disrupt these massive markets, demand for stablecoins will keep growing.

Bull Market Growth

Finally, there is the most obvious catalyst: the bull market. The asset management scale of stablecoins tends to expand with the growth of the cryptocurrency economy. We are optimistic about cryptocurrency in 2025, and therefore, we are also optimistic about stablecoins.

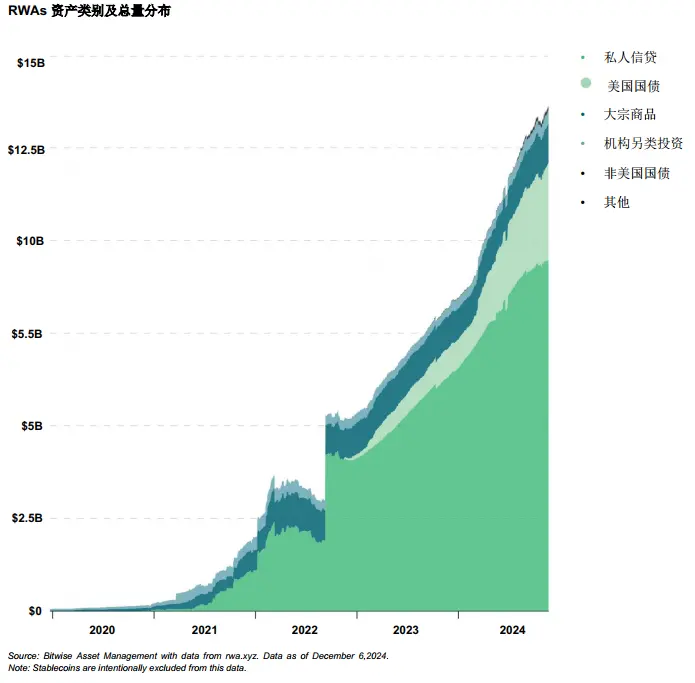

The RWA Market Will Exceed $50 Billion

Three years ago, the reality of "tokenizing" real-world assets (RWAs, such as private credit, U.S. Treasuries, commodities, and stocks) in the cryptocurrency industry was less than $2 billion. Today, the market size has reached $137 billion. What has caused such tremendous growth? Why tokenize RWAs, that is, represent real assets on the blockchain? It offers instant settlement, costs much less than traditional securitization, and provides around-the-clock liquidity, while also bringing transparency and access to almost all asset classes. This is why Larry Fink, CEO of BlackRock—once a Bitcoin skeptic—has now become the biggest advocate for tokenization, stating that "the next generation of markets will be the tokenization of securities." It is worth emphasizing: these words come from the leader of the world's largest asset management company.

In our view, Wall Street has just begun to realize this, which means that large institutional funds will soon flood into tokenized RWAs. We believe that by 2025, the market size for tokenized RWAs will reach $50 billion, with the potential for exponential growth: venture capital firm ParaFi recently predicted that by 2030, the tokenized RWA market will grow to $2 trillion, while the Global Financial Markets Association predicts it will reach $16 trillion.

Bitcoin Price Will Exceed $1 Million by 2029

When making predictions, people often look to the next year. But why? As long-term cryptocurrency investors at Bitwise, let’s look further ahead. We believe Bitcoin will surpass the gold market by 2029. Based on gold's current market cap, this means Bitcoin will rise to over $1 million per coin. Why 2029? Bitcoin has historically followed a four-year cycle. While there is no guarantee this will continue, 2029 will mark the peak of the next cycle (and also the 20th anniversary of Bitcoin's creation). If the U.S. announces the purchase of 1 million Bitcoins as a strategic reserve, Bitcoin will reach the $1 million price point even faster.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。