What is the concept of a strategic reserve asset of 1 million BTC?

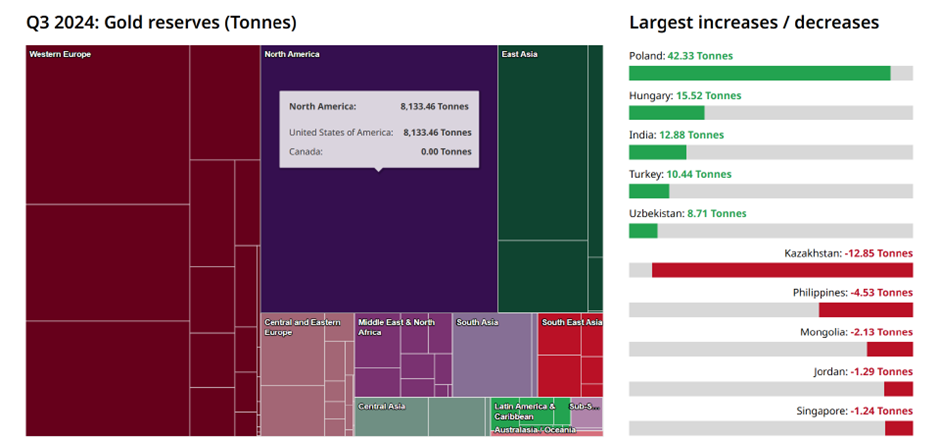

According to statistics from the World Gold Council, as of the third quarter of 2024, the total gold reserves of the Federal Reserve reached 8,133.46 tons (approximately $530 billion), maintaining its position as the largest in the world. Meanwhile, the current market value of 1 million BTC is close to $100 billion, accounting for about 19% of the U.S. gold reserves, which is quite substantial.

Source: World Gold Council

With Trump and an increasing number of institutions/enterprises and sovereign nations beginning to consider establishing a "Bitcoin strategic reserve," is Bitcoin's "Fort Knox moment" about to arrive? Can it, like gold, become an important component of the global reserve asset system?

The next decade may be a critical time window for this answer to be revealed.

What does "strategic reserve asset" mean?

At the Bitcoin2024 conference held in July 2024, Trump explicitly promised in his speech to "never sell" the Bitcoin held by the government and any future acquisitions, and insisted on the concept of a "strategic Bitcoin reserve."

With Trump's election and the recent appointments of crypto-friendly individuals to key positions, including the U.S. Secretary of the Treasury, the SEC Chair, and the White House crypto czar, the idea of incorporating Bitcoin into the strategic reserves of the United States is getting closer to reality.

What exactly is a "strategic reserve asset"?

Fundamentally, a "strategic reserve asset" refers to key assets held by a government or regional authority, used to respond to economic fluctuations, financial crises, or geopolitical risks, maintaining national financial stability, economic security, and international competitiveness. These assets typically possess characteristics such as high value and widespread acceptance, security and stability, and liquidity.

From a corporate perspective, "strategic reserve assets" help achieve financial stability, enhance risk resistance, and support long-term growth strategies. Especially during economic turmoil, strategic reserve assets often serve as the primary barrier for companies against risks.

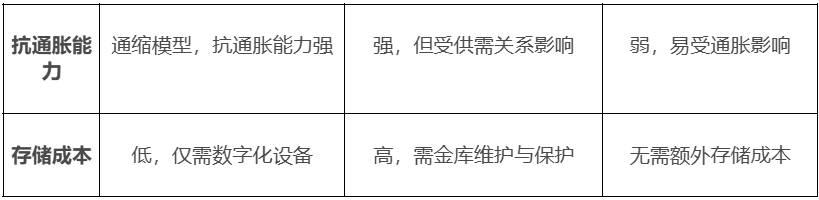

Traditional strategic reserve assets mainly include:

- Gold: Widely recognized as a stable store of value due to its scarcity and anti-inflation properties;

- Foreign exchange reserves: Primarily U.S. dollar-denominated reserve currencies, which are essential for supporting international trade and payments;

- Special Drawing Rights (SDR): Allocated by the International Monetary Fund (IMF) to supplement member countries' official reserves;

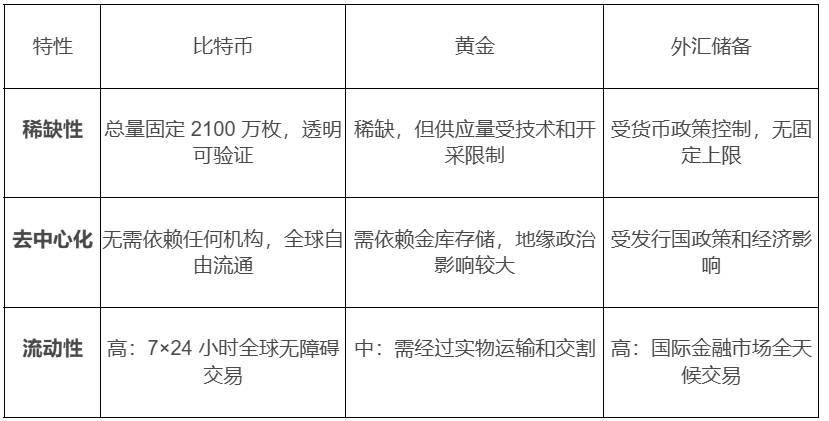

It is evident that assets capable of becoming "strategic reserves" must possess comprehensive advantages such as value stability, global recognition, and convenient circulation. Bitcoin, as an emerging digital asset, is gradually meeting these conditions and is beginning to be viewed as a potential option alongside gold.

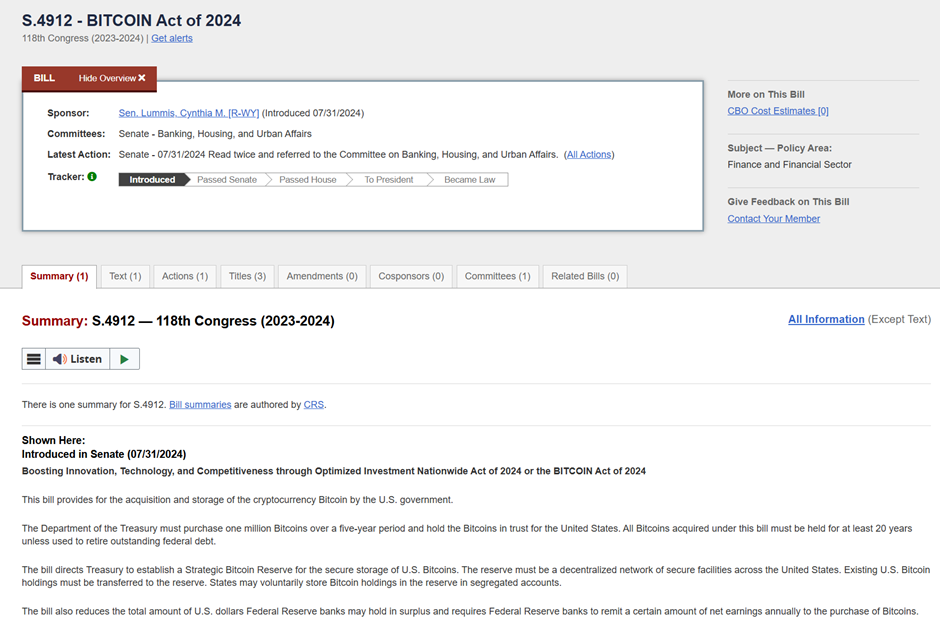

Notably, in addition to Trump's "commitment," on July 31, 2024, U.S. Senator Cynthia Lummis submitted the "Bitcoin Strategic Reserve Act of 2024" to Congress, explicitly requiring that "the U.S. Treasury must purchase 1 million BTC within 5 years and must hold them for at least 20 years, unless used to repay outstanding federal debt," and further plans to require the Federal Reserve to "use a certain amount of net income each year to purchase Bitcoin."

This plan aims to ensure that the U.S. government holds sufficient Bitcoin over the next twenty years, providing a long-term financial hedging tool for the nation. The bill has been submitted to the U.S. Senate Committee on Banking, Housing, and Urban Affairs, requiring discussion and voting, and will be sent to Trump for signing into law after passing both houses.

Why Bitcoin, beyond gold and foreign exchange?

From an asset allocation perspective, more gold reserves are not necessarily better in an absolute sense.

The primary consideration is that gold, as a physical asset, lacks interest or yield attributes, and its liquidity yield is not significant. This is the core reason for Buffett's long-standing cautious attitude towards it—"Gold cannot produce interest payments, thus lacking the effect of compound interest."

More critically, gold reserves incur high storage and maintenance costs. For the vast majority of countries, effective management and security of gold reserves have become a significant financial burden. For example, the Federal Reserve's iconic gold storage facility, Fort Knox, has astonishing security investments:

Located deep in the strategic heartland of Kentucky, it employs an underground structure, reinforced concrete protective walls, and an all-weather security system, with a military presence of tens of thousands year-round. This makes gold reserves not only a security requirement but also a continuous heavy asset financial expenditure.

In contrast, Bitcoin's storage costs are nearly negligible. It does not require physical space or expensive protective facilities; it can be efficiently stored and managed using secure wallets, multi-signature technology, and decentralized network verification systems.

At the national level, the storage expenses for Bitcoin are primarily focused on technology and network maintenance, far lower than the physical protection costs of gold. This means that even if Bitcoin does not generate direct income, its holding costs are significantly better than gold, leaving more room for net asset growth.

Additionally, physical gold transactions often involve complex processes such as physical delivery, storage, and transportation, which can take days or even weeks. The gold market is often constrained by the time and geographical limitations of traditional financial systems, while Bitcoin can be traded 24/7 through exchanges, covering the global market.

Beyond gold, foreign exchange reserves (such as euros, yen, etc.) are issued by other countries, and their value is not only dependent on the issuing country's economic conditions but is also more susceptible to geopolitical risks. Bitcoin, with its scarcity, can avoid monetary policy interventions and the devaluation risks caused by excessive issuance. It allows any holder (whether individual, institution, or sovereign nation) to freely store, transfer, and trade globally.

This decentralized characteristic ensures that Bitcoin is not affected by political or economic interventions, and even in times of global turmoil, its value storage function can still operate stably.

Enterprises/institutions and sovereign nations are becoming BTC "Pi Xiu"

Currently, with a total market value of $2 trillion, Bitcoin, due to its characteristics of not requiring physical storage, global circulation, high transparency, and anti-inflation, is gradually entering the ranks of potential reserve tools. An increasing number of companies/institutions and even sovereign nations are beginning to explore incorporating Bitcoin into their strategic reserve asset systems.

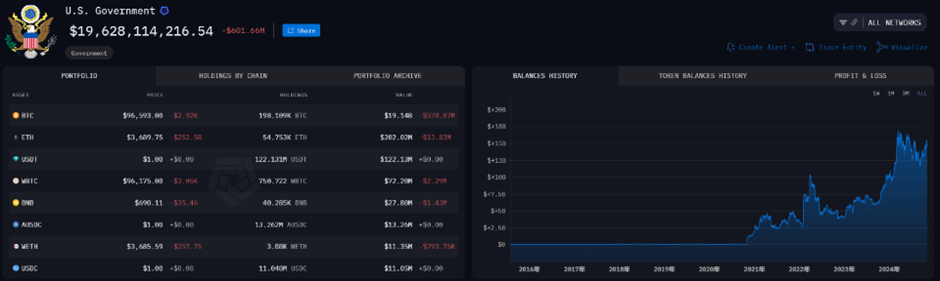

U.S. Government: One of the world's largest Bitcoin holders

Surprisingly, the U.S. government is actually one of the largest Bitcoin holders in the world. Over the years, through law enforcement actions, it has seized a large amount of Bitcoin from cybercriminals, money laundering organizations, and dark web markets, currently holding about 200,000 BTC, valued at nearly $20 billion.

As the "most crypto-friendly president in U.S. history" (in terms of public statements), it remains to be seen whether Bitcoin can be incorporated into the federal reserve asset system during Trump's next four years in office. However, it is foreseeable that the U.S. government's Bitcoin holdings may move away from frequent selling patterns and instead explore their long-term strategic value.

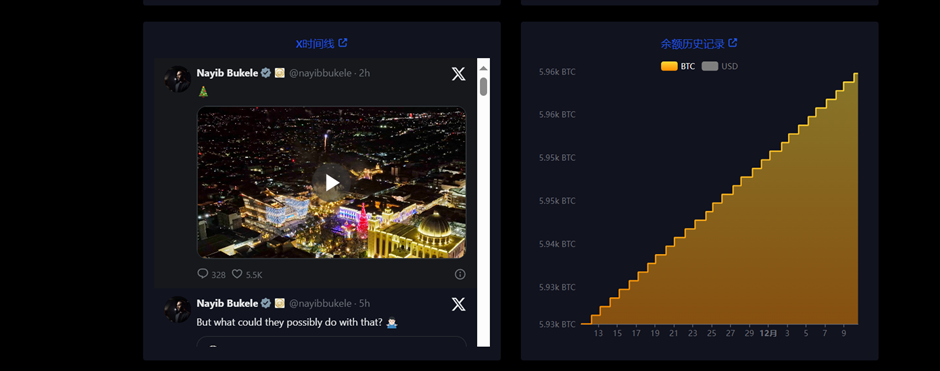

El Salvador: Daily investment of 1 BTC

El Salvador, as the first country in the world to establish Bitcoin as legal tender, enacted relevant legislation on September 7, 2021. It subsequently launched the Chivo electronic wallet, preloading $30 worth of Bitcoin for each user who downloads it, integrating Bitcoin into the national economic system and demonstrating its firm "Bitcoinization" path.

Whenever the crypto market experiences significant volatility, El Salvador's President Nayib Bukele often promptly announces Bitcoin purchases via social media, injecting confidence into the market. Currently, El Salvador maintains a daily purchase of 1 BTC, and with continuous "bottom-fishing," as of December 10, the BTC holdings reached 5,959.77 BTC, with a holding value of approximately $577 million.

Although this holding scale is not significant globally, its firm Bitcoin strategy as a small economy serves as a demonstration, providing a unique experimental case for other countries.

All in Bitcoin: MicroStrategy

Beyond sovereign nations, the publicly traded company MicroStrategy undoubtedly sets the benchmark in the Bitcoin "hoarding" field—its "buy, buy, buy" strategy for Bitcoin has long been a bold and clear approach, with holdings exceeding those of any publicly known sovereign nation reserves.

MicroStrategy's first public Bitcoin purchase dates back to August 11, 2020, when it spent $250 million to acquire 21,454 BTC, with an initial purchase cost of about $11,652 per BTC. It then entered a continuous accumulation mode, with the most recent purchase on December 9, amounting to approximately $2.1 billion for 21,550 BTC, at an average price of $98,783 per BTC.

As of December 8, 2024, MicroStrategy has cumulatively invested about $25.6 billion to acquire 423,650 BTC, with an average price of about $60,324 per BTC. Based on the current price of $97,000, the holding has an unrealized profit of approximately $15.5 billion.

Tesla: The "Hodl" of Bitcoin

On December 20, 2020, following Michael Saylor of MicroStrategy's suggestion for other CEOs to follow suit, Elon Musk expressed his interest in purchasing Bitcoin for the first time. In late January 2021, Musk changed his Twitter bio to #Bitcoin, and Tesla subsequently announced in February 2021 that it had purchased $1.5 billion in Bitcoin.

In the first quarter of 2021, Tesla sold 10% of its Bitcoin holdings. Musk explained that this move was intended to "test liquidity and validate Bitcoin as a viable alternative to cash on the balance sheet."

According to Arkham data, as of the time of writing, Tesla holds 11,509 BTC, with a holding value of approximately $1.1 billion.

Other Countries and Mainstream Enterprises/Institutions: Bitcoin Reserves are Becoming Mainstream

The strategic value of Bitcoin is permeating from the national level to enterprises and institutions. National reserve layouts directly influence the policy environment, while enterprises are the core driving force of adoption. Bitcoin is no longer just a hedging tool; it has become a key strategic component of corporate balance sheets.

Recently, tech giants like Microsoft and Amazon have received positive initiatives from investors, calling for the inclusion of Bitcoin in their balance sheets.

MicroStrategy founder Michael Saylor proposed a Bitcoin investment to Microsoft's board, believing that this move would significantly enhance corporate value and create long-term shareholder returns.

At the same time, the conservative think tank National Center for Public Policy Research in the U.S. suggested that Amazon allocate 1% of its total assets to Bitcoin to enhance shareholder value and hedge against fiat currency devaluation risks.

Incorporating Bitcoin into the balance sheets of mainstream institutions and traditional enterprises can bring the following advantages:

- Anti-inflation capability: The scarcity of the capped supply of 21 million BTC endows Bitcoin with strong anti-inflation properties, helping enterprises stabilize asset value in a global monetary easing environment;

- Diversified investment portfolio: As an emerging asset class, Bitcoin enriches the dimensions of corporate asset allocation, reducing reliance on a single asset and enhancing financial robustness;

- Enhanced corporate brand and market image: Holding Bitcoin demonstrates a company's embrace of innovative technology and future economic models, enhancing market competitiveness and shaping a forward-looking brand image;

However, in the process of incorporating BTC into their balance sheets, enterprises need to address two key issues: how to securely custody large assets and how to efficiently meet OTC (over-the-counter) demands to avoid market impact. This has spurred the vigorous development of professional custody and OTC services to meet the strict requirements of enterprises for digital asset management.

It is worth noting that as the market develops, the digital asset service ecosystem is also continuously improving. In the custody field, many platforms have begun to adopt independent wallet designs and bankruptcy isolation mechanisms, and have introduced insurance protections to address various risks. For example, licensed exchanges in Hong Kong, such as OSL, have partnered with insurance companies like Canopius to expand coverage to multiple dimensions, including cybersecurity and technical failures. At the same time, in OTC trading, licensed compliant platforms are providing institutional investors with a more regulated and efficient trading environment through connections with traditional banking systems.

The Future of Bitcoin in the Next Decade: Speculative Asset or Global Strategic Reserve?

Bitcoin has risen from a fringe asset to a new contender for global strategic reserves. From sovereign nations to mainstream institutions/traditional enterprises, an increasing number of forces are redefining its role. Its scarcity, decentralized characteristics, and high transparency have earned it the title of "digital gold."

Despite ongoing debates about price volatility, Bitcoin's adoption is advancing with unstoppable momentum. If Trump's proposed concept of "strategic reserve assets" comes to fruition, BTC's status will closely follow that of gold, and its strategic significance may surpass that of gold:

While gold has physical scarcity, its distribution and trading rely on complex logistics and regulatory systems. Bitcoin, leveraging blockchain technology, does not require physical storage or transportation, allowing for rapid borderless circulation, making it more suitable as a reserve asset for nations and institutions, bearing greater strategic responsibilities. This advantage has also driven professional service providers like OSL to continuously improve their infrastructure, creating one-stop solutions for institutional clients from custody to trading.

In the next decade, Bitcoin's potential as a global strategic reserve asset will be fully unleashed, and its application scenarios are expected to further expand. From national-level "long-term hoarding" to corporate/institutional "buy and hold," Bitcoin's influence continues to grow. Global leaders and top companies like MicroStrategy, Microsoft, and Amazon have become the best advocates for Bitcoin, significantly enhancing global market recognition of cryptocurrencies.

"The light boat has passed through ten thousand mountains." Regardless of whether Bitcoin can become a strategic reserve asset for the U.S. or other countries in the next four years, it has already achieved a key victory in its adoption journey. As more institutions position themselves in Bitcoin, the construction of professional digital asset financial infrastructure will play an increasingly critical role in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。