Let's walk into the growth history of Morpho, a leader in lending, and the new journey of project development after completing the transformation of financial infrastructure.

Author: Deep Tide TechFlow

Fame should be seized early.

This saying seems particularly fitting for the crypto industry:

In 2013, at just 19 years old, Vitalik Buterin presented the Ethereum white paper in Toronto;

In 2017, Hayden Adams, who had just graduated from college for less than two years, completed the initial version of Uniswap;

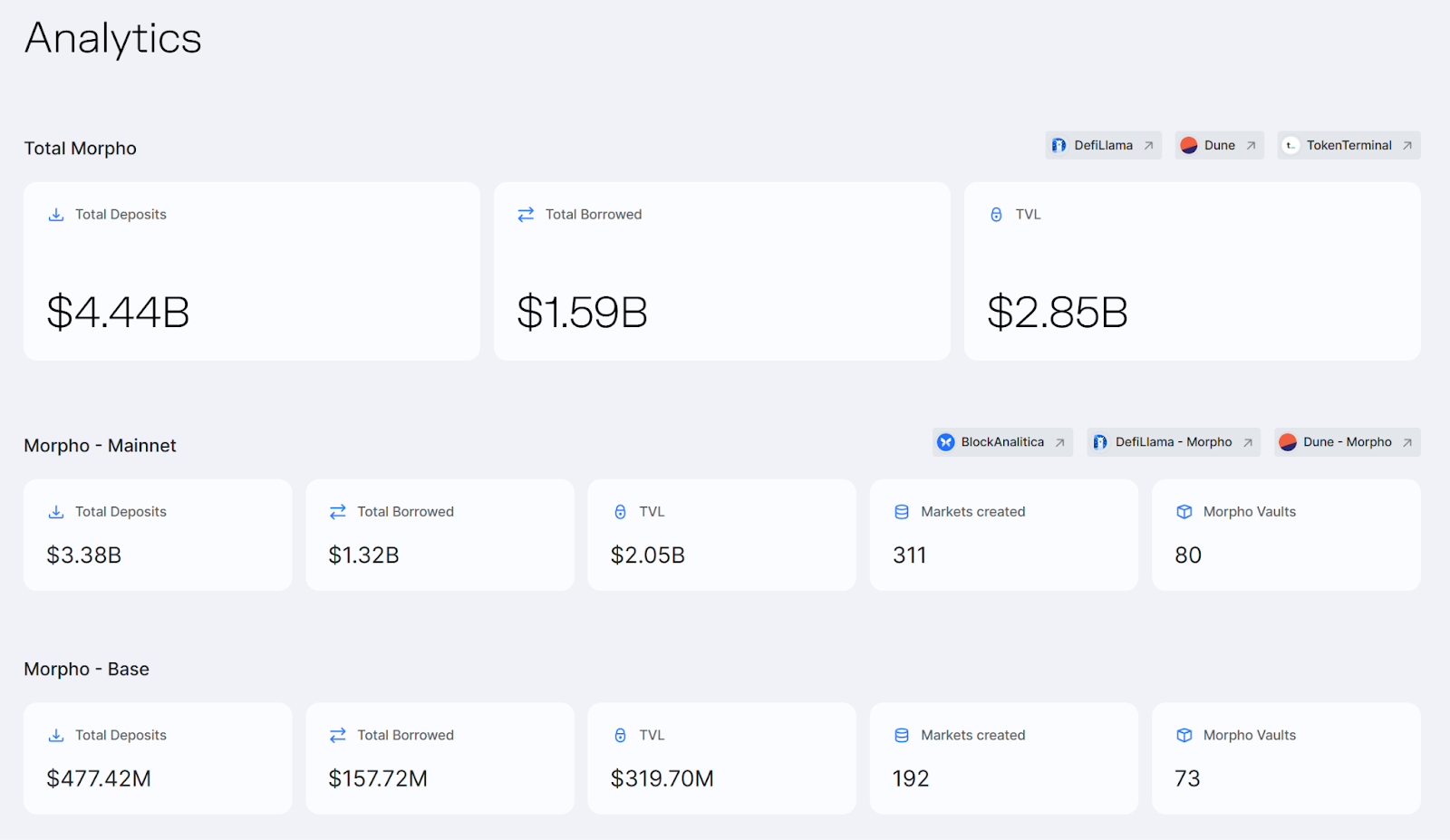

In 2021, a sophomore student in Paris launched Morpho, and in the following years, 2022 and 2024, secured two rounds of funding, totaling over $80 million. After three years of development, Morpho has grown into a significant force in the DeFi space: According to DeFi Llama data, Morpho's TVL has surpassed $4.43 billion, ranking fourth in the lending sector.

He is the protagonist of our interview today: Paul Frambot, co-founder and CEO of Morpho Labs.

Recently, the activation of the transfer function for Morpho's governance token MORPHO sparked extensive community discussions, and we had the privilege of engaging in an in-depth conversation with Paul. As a leading figure of the new generation in the industry, Paul demonstrated a maturity that belies his age during our exchange.

When discussing Morpho's transformative shift from a lending product to financial infrastructure this year, Paul stated:

DeFi not only requires specific products but also flexible, scalable, and high-performance financial infrastructure to better meet diverse user needs and compliance requirements.

In light of the rapid growth following the entry into Base, the community is curious about the next cross-chain deployment plans. Paul responded:

We believe that we should not and will not be the sole decision-makers for Morpho. Community participation shapes the future of Morpho's cross-chain deployment.

Regarding the Chinese-speaking community, Paul candidly remarked:

The power of the Chinese-speaking community should not be underestimated; Asia is a key focus for our advancement.

In this issue, let us follow Paul’s insights as we delve into the growth history of Morpho, a leader in lending, and the new journey of project development after completing the transformation of financial infrastructure.

Morpho's Narrative Upgrade: From Lending Product to Financial Infrastructure

TechFlow: It’s a pleasure to have the opportunity for an in-depth conversation with you. First, could you introduce yourself (feel free to share some of your past educational experiences, your journey in crypto, and how you came to join Morpho)?

Paul:

Hello everyone, I am Paul Frambot, co-founder and CEO of Morpho Labs. I’m glad to have this opportunity to engage in a deep conversation with you all.

Three years ago, while studying distributed computing and consensus in Paris, I co-founded Morpho with others. From the very beginning, I focused on two things: entrepreneurship and blockchain, as I believe both fields have tremendous potential to reshape industries.

Over the years, I have been dedicated to entrepreneurial projects, experimenting with different ideas and business models. Although these early ventures did not achieve immediate success, they provided me with valuable experience and a clearer understanding of how to create impactful products. Meanwhile, I immersed myself in blockchain technology from the age of 15, and by 19, I had a deeper understanding of this transformative field. Coupled with my passion for the industry, I gradually realized the immense opportunities in the DeFi space, especially in lending.

I believe that the gap between lending rates is a fundamental inefficiency we can address, and this idea prompted me to collaborate with researchers to design an algorithm that could bridge this gap.

Since then, I set out to build a team, recruited co-founders, and raised funds. Together, we turned this vision into reality. Today, three years later, Morpho is at the forefront of addressing some of the most pressing challenges in DeFi.

TechFlow: A topic frequently discussed in the community is Morpho's announcement this year of its transformation from a lending product to financial infrastructure. Many are curious: what considerations led to this narrative upgrade? What specific changes has this upgrade brought to Morpho?

Paul:

The earliest version of Morpho was a product called Morpho Optimizer, built on Aave, aimed at improving Aave's interest rates. For us, Morpho Optimizer served more as a guiding principle and a market entry strategy, leading us to build a more robust Morpho protocol that could offer something better than existing solutions.

During the development process, two important realizations became clear:

First, our growth was limited because we were building on Aave. Although Morpho Optimizer managed $2 billion, we ultimately relied on Aave's growth, which is closely tied to the broader cryptocurrency market cap. This limited our potential.

Second, we faced challenges regarding security and flexibility. Building on Aave meant dealing with frequent upgrades to smart contracts, which could disrupt integrations and destabilize the system. For example, a recent upgrade (v3.2) disrupted many integrations built on Aave, forcing them to roll back some changes.

These issues prompted us to make a shift. We realized that DeFi not only needs specific products but also requires flexible, scalable, and high-performance financial infrastructure to meet diverse user needs and compliance requirements.

Building such a platform that allows others to create tailored financial solutions not only helps us address current issues but also lays the foundation for the next wave of innovation in DeFi.

TechFlow: Observing DeFi Llama data, Morpho's TVL has rapidly grown from $2 billion to $3.1 billion in the past month. Can you share what has happened in this month? What do you think are the main drivers behind this growth?

Paul:

My TVL data is even higher now (as of the publication date, Morpho's TVL reached $4.43 billion, according to DeFi Llama).

Morpho's growth over the past year has been remarkable, thanks to three key factors:

First, the builders in our ecosystem are outstanding. They have secured new partnerships, attracted capital, and driven broader adoption at a pace that exceeded everyone's expectations. Their work powerfully demonstrates Morpho's potential to grow into a cornerstone of DeFi.

Second, the launch of the Morpho token was a significant turning point, bringing Morpho into the spotlight and exposing our brand to global users. Additionally, exchanges with millions of followers shared our story. It can be said that our token launch was an important catalyst for increasing Morpho's visibility within the entire crypto ecosystem.

Finally, the broader market environment is improving. We have seen a significant influx of capital and more exciting news and innovations, which naturally benefits Morpho as part of this industry.

Solid Lending Fundamentals: Morpho's Greatest Appeal to Users

TechFlow: Many people feel that DeFi lending is a sector where giants dominate. How do you view this perspective? As the fifth-ranked lending project on DeFi Llama, what advantages do you think allow Morpho to break through in the lending sector?

Paul:

Long-established players in the DeFi space have maintained dominance for good reason. The Lindy effect plays an important role: established players are more capable of inspiring trust because they have stood the test of time.

Another important factor is the static capital that established DeFi projects possess. For example, MakerDAO benefits from billions of largely untouched DAI, giving it greater leverage to create new financial opportunities.

In contrast, Morpho's unique vision sets us apart: we are not just another custodial product; we are building permissionless, decentralized infrastructure designed for scalability. This strategy is very similar to Uniswap, allowing us to serve as a foundational layer for other builders. By focusing on achieving strong flexibility, scalability, and performance, we not only compete with DeFi giants but also strive to bring more possibilities to DeFi.

TechFlow: Liquidity is the lifeblood of DeFi, and the increasing fragmentation of liquidity is a major headache for many lending protocols. How does Morpho address this issue?

Paul:

To understand how Morpho addresses the problem of liquidity fragmentation, we first need to define what liquidity means. In lending, liquidity refers to the amount that users can withdraw or borrow at any given time.

At first glance, Morpho's market appears highly fragmented, with assets like USDC scattered across various collateral markets. However, we have introduced two mechanisms to address this issue:

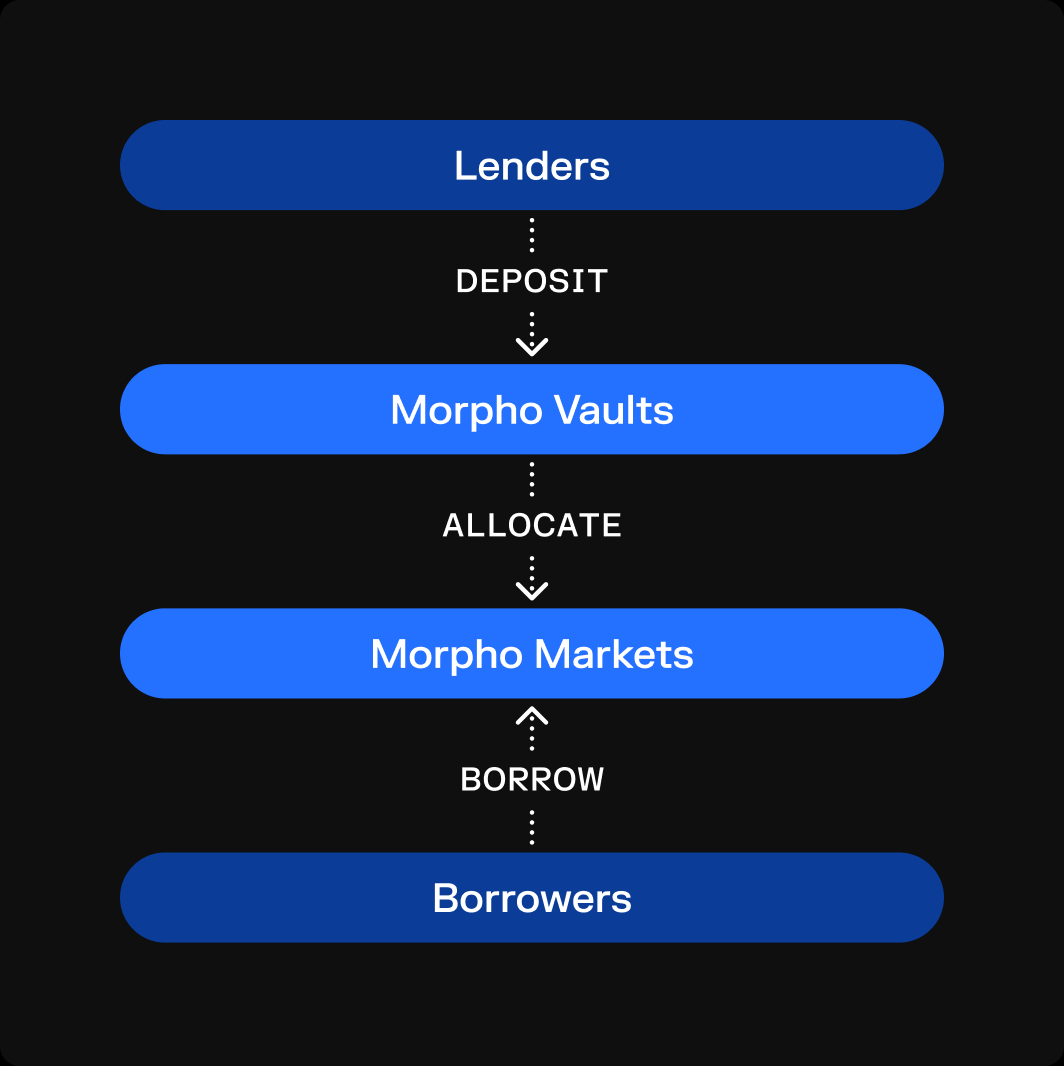

Morpho Vaults: These are designed to aggregate liquidity for lenders across multiple markets. For example, by depositing USDC into Vaults like Gauntlet or Steakhouse, users can benefit from the combined liquidity of all relevant lending markets.

Allocator Function: This mechanism is significant for borrowers, aiming to rebalance liquidity in real-time so that borrowers can access substantial funds when needed.

These mechanisms reduce fragmentation and facilitate more efficient capital flow, collectively forming the core competitive advantage that distinguishes Morpho from other protocols.

TechFlow: Permissionlessness is a standout advantage of Morpho. In what aspects is this primarily reflected? What does this bring to the development of lending?

Paul:

Making Morpho permissionless is a strategic decision that has already yielded significant benefits. The strong permissionless feature allows us to externalize risk management, scale our resources, and enable third parties to build on the protocol.

While we have not yet seen many novel use cases, we believe that the permissionless feature has tremendous potential in empowering Morpho's prosperous development. Permissionlessness lays the foundation for an ecosystem where innovation can thrive, and over time, we expect to see entirely new financial products emerge, all built on Morpho's infrastructure.

TechFlow: With the lowered barriers to user participation, the bigger challenge lies in customer acquisition. For the average user, what do you think is the biggest attraction of participating in Morpho? How can they participate more efficiently?

Paul:

Morpho adopts a layered architecture design to meet the needs of different types of users. For example, if you are a user who does not understand how to manage risk, you can use Morpho Vaults, which serve as a risk management layer. If you want to batch process transactions, we have smart contract bundlers that make the process more efficient.

This layered mechanism ensures that Morpho provides users with more flexible services, allowing them to participate in lending and earn returns based on their actual situations and preferences. Users can choose collateral, define risk conditions, and minimize risks as much as possible to suit their needs.

One of Morpho's standout features is its ability to combine capital efficiency and security. We have built a protocol that can offer richer returns, lower smart contract risks, and higher flexibility, all without incurring the operational costs that many competitors bear.

TechFlow: Security is a critical issue for any DeFi protocol. According to the Morpho Analytics page, Morpho currently has total deposits exceeding $2.8 billion. In the face of such a large volume of funds, what concrete measures has Morpho taken to protect user funds?

Paul:

Security has always been one of Morpho's strongest pillars. We have conducted approximately 30 audits, which may be the most in the DeFi space. Additionally, our approach to smart contract security is fundamentally different from other projects.

From the beginning, we prioritized minimalism in our codebase. Every function in the core Morpho protocol is essential, while additional features like liquidation protection or account abstraction are built on top of it, keeping the core protocol clear, concise, and secure.

We also have a formal verification process. To my knowledge, Morpho is the only DeFi protocol with an internal formal verification team. Some of our team members hold PhDs in the field, and they use tools like Certora, Halmos, and Why3 to ensure our contracts are verifiable and robust.

By considering and supporting formal verification from the start, we achieve unparalleled security in DeFi. Our commitment to security and simplicity is key to Morpho standing out and becoming a leader in DeFi security.

Entering Base and Experiencing Data Surge: The Next Cross-Chain Deployment Direction Depends on the Community

TechFlow: A few months ago, Morpho announced its entry into Base. Could you share why Morpho chose Base?

Paul:

When we decided to deploy on Base, it was not as well-known as it is today, but several key factors led us to make that choice.

First, the strong influence of the Coinbase brand, as the supporter behind Base, not only brings powerful global market exposure but also benefits from their excellent security practices and team quality. This made us believe that betting on Base was a wise move.

Second, the tools and products built around Base have always been impressive. The developer toolkit and on-chain tools they have created are practical and user-friendly, which gives us confidence in their future development and our integration with them. I believe this infrastructure will become a core part of the DeFi ecosystem.

Finally, communication with the team played an important role. Talking to founders like Jesse and gaining insight into their impressive development vision further strengthened our confidence that Base would thrive as an ecosystem.

So far, I believe choosing to enter Base has been a wise decision. It has not diverted our attention too much but has had a very positive impact, and we are very satisfied with the results of this decision.

TechFlow: Morpho has now become one of the largest lending protocols in the Base ecosystem, and since launching on Base, Morpho has added over 53,000 new wallets. Based on this win-win precedent, does Morpho have more multi-chain deployment plans for the future?

Paul:

Indeed, many teams have expressed strong interest in cross-chain deployment, and we are committed to hosting relevant discussions on our social media and forums to make the discussions around cross-chain deployment more open and collaborative.

We believe that we should not and will not be the sole decision-makers for where Morpho should go next. We plan to directly encourage stakeholders to share more discussions and proposals on the forum. This way, a broader community can participate and help shape the future of Morpho's cross-chain deployment.

In the past few months, the volume of requests for new chain deployments has been incredible, clearly indicating the high expectations people have for Morpho's expansion across ecosystems.

TechFlow: With BTC breaking the $100,000 mark, more and more people are paying attention to BTCFi. After all, leveraging Bitcoin's massive capital to release Bitcoin liquidity is highly attractive for any DeFi project. What actions has Morpho taken regarding the BTCFi treasury?

Paul:

While Morpho treasury does not hold Bitcoin, as we need to pay salaries, operational expenses, and development costs for the Morpho network, most of these expenses are still paid in fiat currency (we hope to achieve this on-chain soon). Therefore, the Morpho treasury is primarily composed of US dollars, euros, and cash equivalents, avoiding holding volatile assets.

However, within the Morpho protocol itself, we see growing interest in Bitcoin-related strategies. For example, the treasury developed by Gauntlet and RE7 has explored ways to provide cbBTC or wBTC yields. These treasuries aim to offer lending services to Bitcoin re-stakers (such as LBTC and other forms of re-staked BTC), helping to achieve richer returns, which is an exciting growth area for both Morpho and DeFi.

TechFlow: RWA is also a hot topic in this cycle, seen as an important force driving DeFi's penetration into the real world. How do you view the development prospects of RWA? What strategies has Morpho adopted in this regard?

Paul:

In my view, RWA is the largest growth area for DeFi, but it also presents challenges. Integrating RWA into a permissionless system is difficult because these assets often require permissions, such as contracts and whitelisting for integrations.

We have been working to address these challenges by developing account abstraction tools that make it easier for users to wrap and unwrap reward assets directly through the Morpho protocol. Once whitelisted, this process is seamless and does not require additional transactions, thereby improving the overall experience for developers and users.

Morpho Market is a vivid example, featuring verUSDC (USDC that can only be held by wallets verified by Coinbase) and LTF (Anemoy Liquid Treasury Fund) as collateral. Morpho's institutional-grade seamless user experience allows for KYC lending on a fully permissionless infrastructure.

As we address these developer experience issues and stabilize or reduce cryptocurrency rates, we will see a significant increase in interest in RWA. Currently, the high rates of cryptocurrency make it difficult for RWA to stand out, but I believe that with these positive changes coming, RWA has enormous growth potential.

The Power of the Chinese-Speaking Community Should Not Be Underestimated: A Smoother Product Experience is Brewing

TechFlow: It is understood that Morpho enabled the transfer function for the MORPHO token on November 21. Why was the MORPHO token initially deployed as a non-transferable token? What considerations led to the current "transferable" status? What was the entire process of transitioning from "non-transferable" to "transferable"?

Paul:

The Morpho token was initially launched two years ago as a non-transferable token. This decision allowed us to distribute the tokens to the community while focusing on building a better protocol, avoiding distractions related to liquidity tokens.

During our transition from Morpho Optimizer to Morpho Blue, the token remained aligned with our long-term mission. Once the protocol reached a mature stage and the project vision became clearer, we pushed to make the token transferable. This milestone is not only about token economics but also about giving the community ownership and enabling them to better drive the development of Morpho alongside us.

TechFlow: Looking ahead to the fourth quarter of 2024, an inevitable topic is the potential victory of crypto-friendly President Trump and his upcoming inauguration. Interestingly, Trump's team has also announced the launch of a lending project, WorldLibertyFinancial (WLF). Regarding this topic, could you share your thoughts on the future direction of crypto regulation? Will Trump's presidency usher in a new era for the crypto market? What are your views on WLF?

Paul:

Due to limited information, I do not have strong opinions on regulation or projects like World Liberty Financial. While people are optimistic that regulation may benefit the cryptocurrency industry, Morpho's focus remains on building infrastructure that can adapt to any regulatory environment.

TechFlow: The Chinese-speaking market is an important component of the crypto market. Could you please share your understanding of the Chinese-speaking crypto market and what expansion strategies Morpho will adopt in the future regarding this market?

Paul:

Yes, while we initially underestimated the power of the Chinese community, we have begun to realize the scale of the Chinese community and the value it brings to the cryptocurrency market.

Over the past year, we have taken deeper steps to expand into the Asian and Chinese-speaking markets, including trips to Singapore and Bangkok, and hiring talent with experience in the region for our team.

For me, the power of the Chinese-speaking community is unparalleled, and we have received a warm welcome. I am excited to continue building relationships with the Chinese-speaking market and expanding our influence. Asia is a key focus for us moving forward, and I believe its potential is immense.

TechFlow: One last question, with 2024 counting down, what is Morpho's focus in the coming month?

Paul:

I can't share too much, but recently we have been focused on rebuilding the Morpho application from the ground up to provide a top-notch user experience. We are rethinking everything, from the backend to the frontend, to make the platform more intuitive and scalable.

At the same time, we are doubling down on building partnerships and developing our network. Getting more people to use Morpho is our top priority, and I hope we can inspire the Chinese community to get involved.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。