Author: Ltrd

Compiled by: 1912212.eth, Foresight News

This crash is the largest liquidation since 2021. I want to analyze the entire situation from a microstructural perspective.

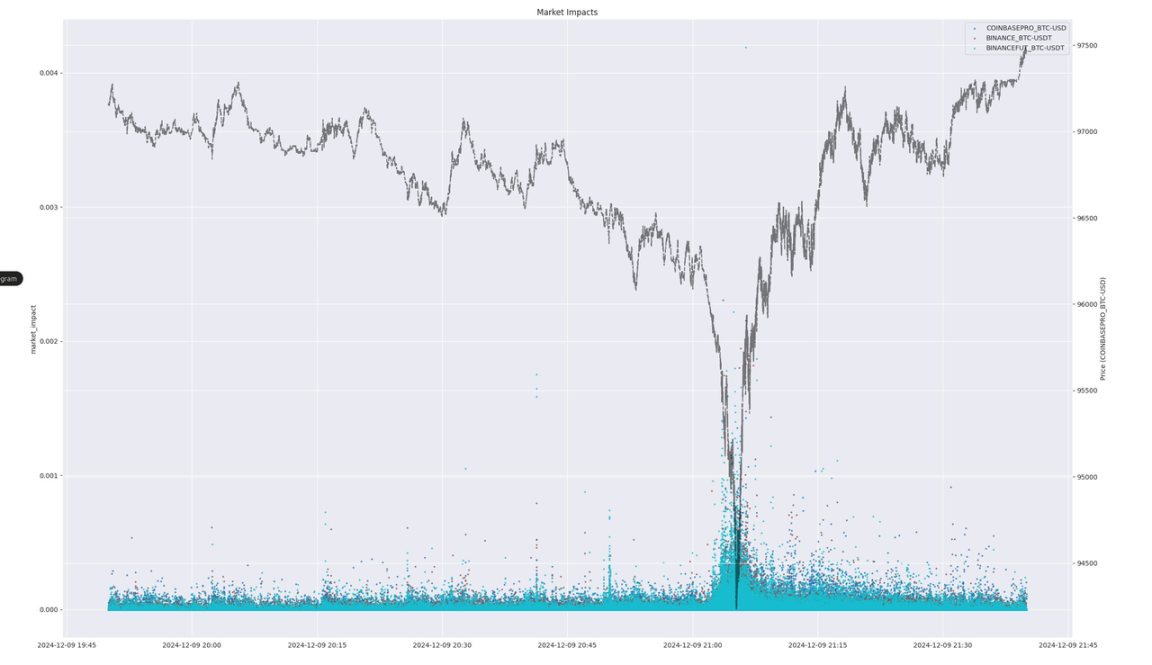

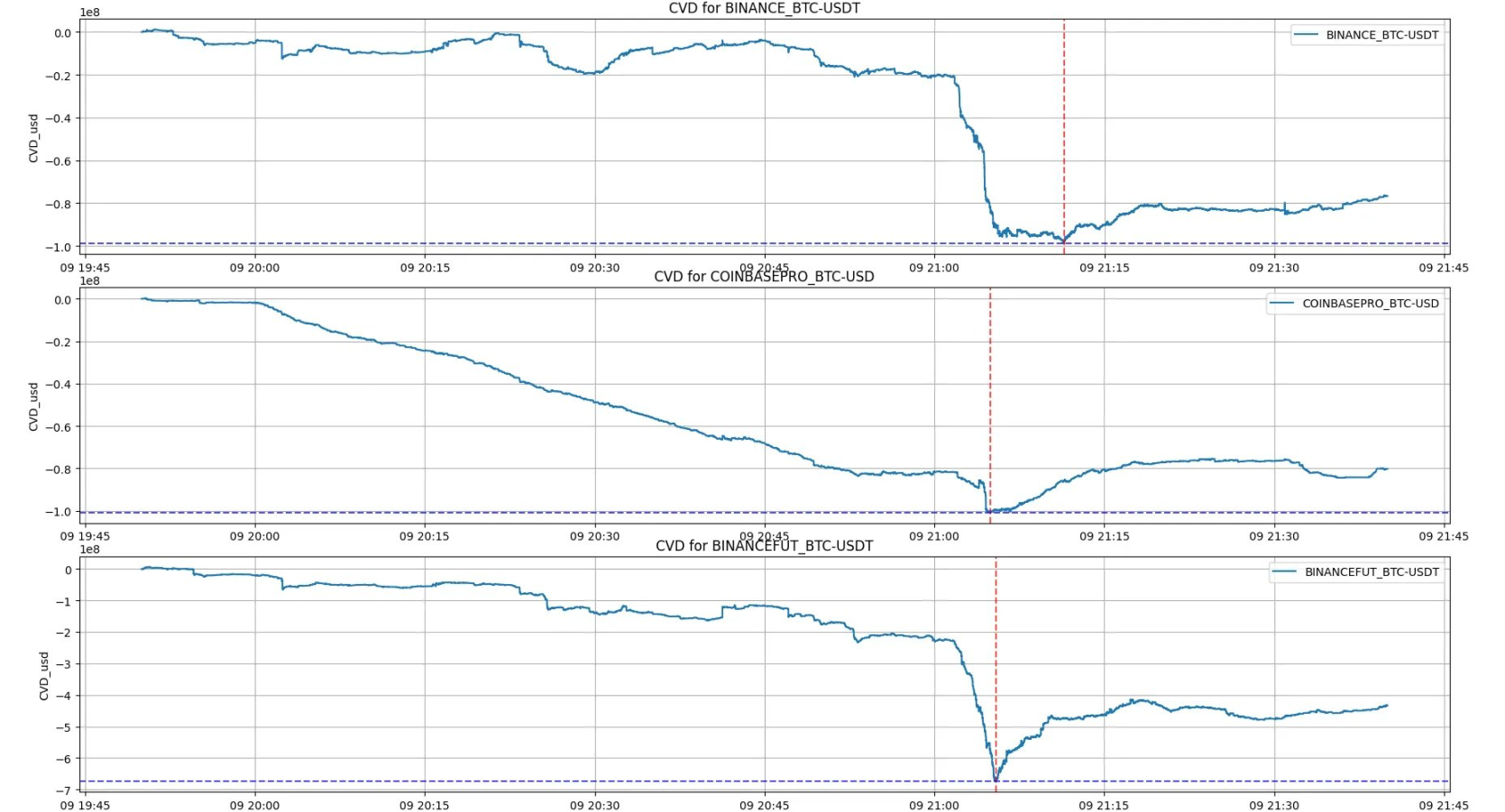

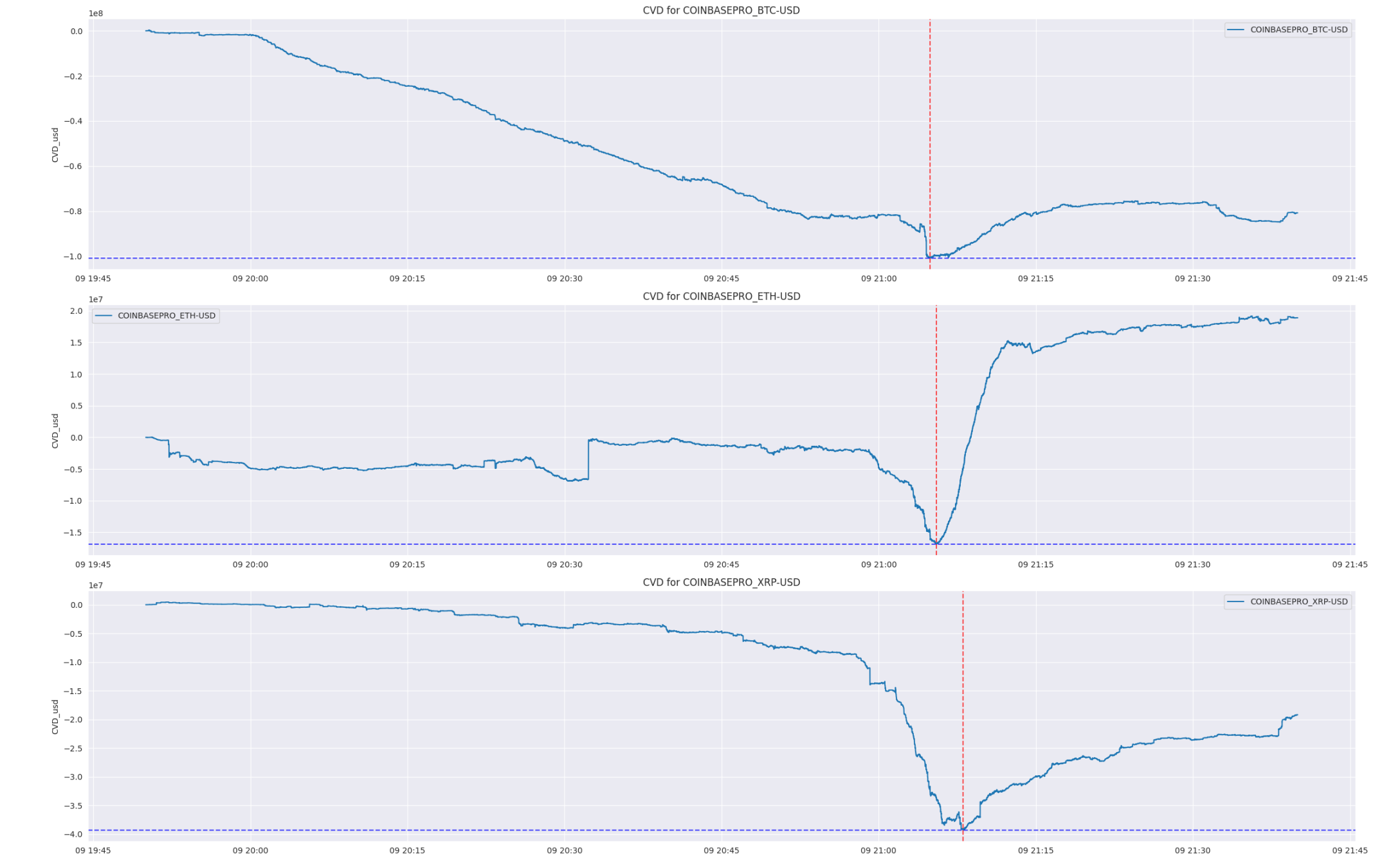

First, we need to identify where the selling pressure is the greatest. We found that traders on Coinbase began to sell heavily nearly an hour before this massive crash occurred.

Of course, the largest drop was triggered by a chain of liquidations, but this sustained selling pressure played an important role in pushing prices into the area where leverage was forcibly liquidated. So how do we determine if the market is overheated? It's simple—by looking at the funding rates and the increase in open interest. These two factors are the driving forces in the current market, indicating that people are using excessive leverage.

After the crash, ETH saw strong buying interest. The relative strength in recent days is also quite evident—could someone be buying?

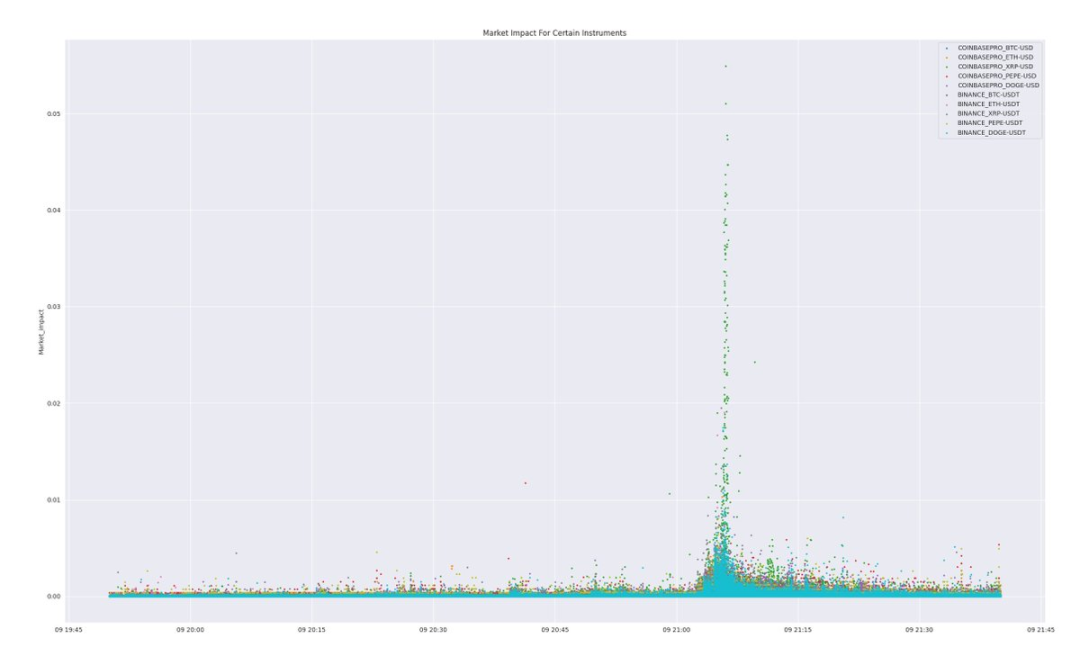

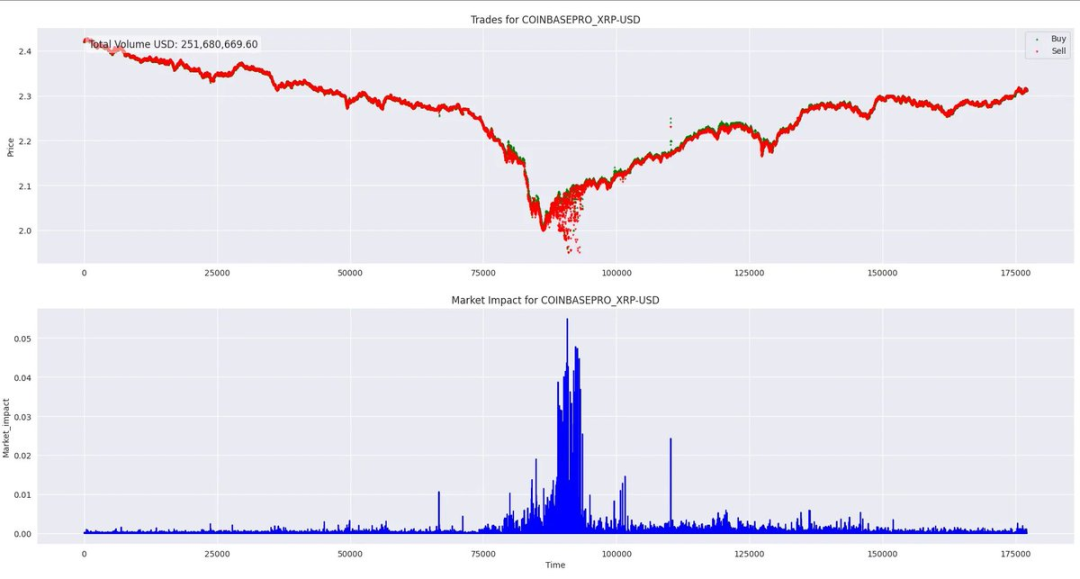

I personally enjoy analyzing market impact. If I could only focus on one feature in the market, it would definitely be market impact. Here, you will see some shocking things—XRP's market impact on Coinbase is quite significant.

In a relatively mature large market, we witnessed a series of large sell orders, causing the market to drop over 5%. We are still unclear about what exactly happened, but this is clearly unusual.

You can see that these sell orders are not normal. In the coming days, this situation may be worth monitoring. Perhaps a large player was forced to sell.

When similar situations occur, it is usually a chain reaction of forced liquidation sell orders. Market makers absorb this selling pressure and hedge, causing signals to spread across major exchanges. For perpetual contract exchanges, this means stop-losses and liquidations are triggered, and the final impact becomes more pronounced, especially when this happens within minutes.

Coins like XRP, even with a market cap comparable to the largest companies in the U.S., can surge by hundreds of percentage points. Relative to its market cap, XRP's liquidity in the market remains poor.

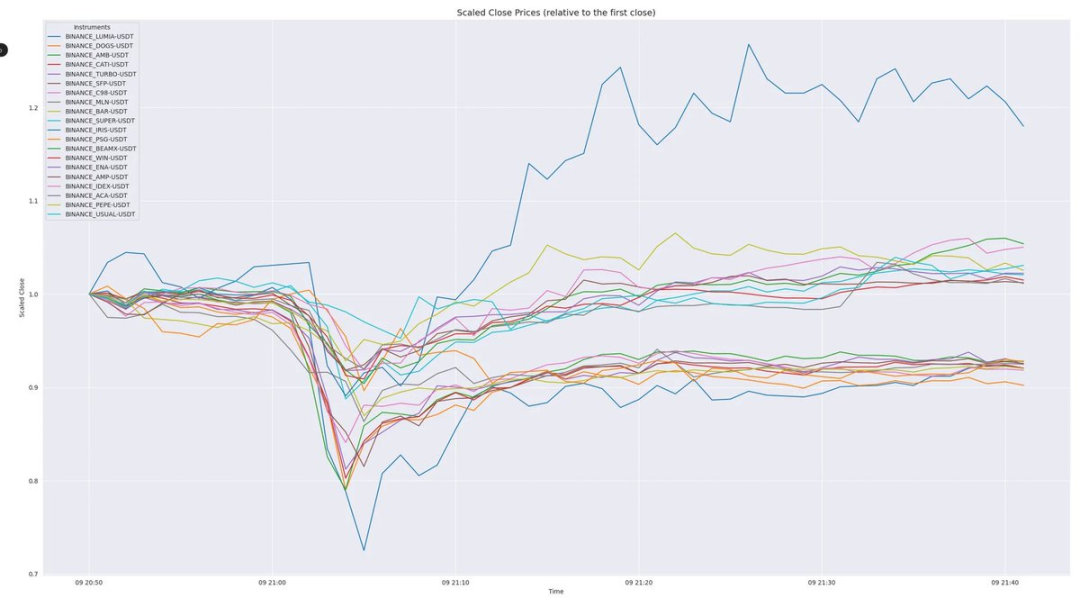

In a hot market, the next common phenomenon is a rapid price reversal from the lowest point. At this time, there will be a large number of liquidations, liquidity constraints, and many profitable players looking to buy the dip.

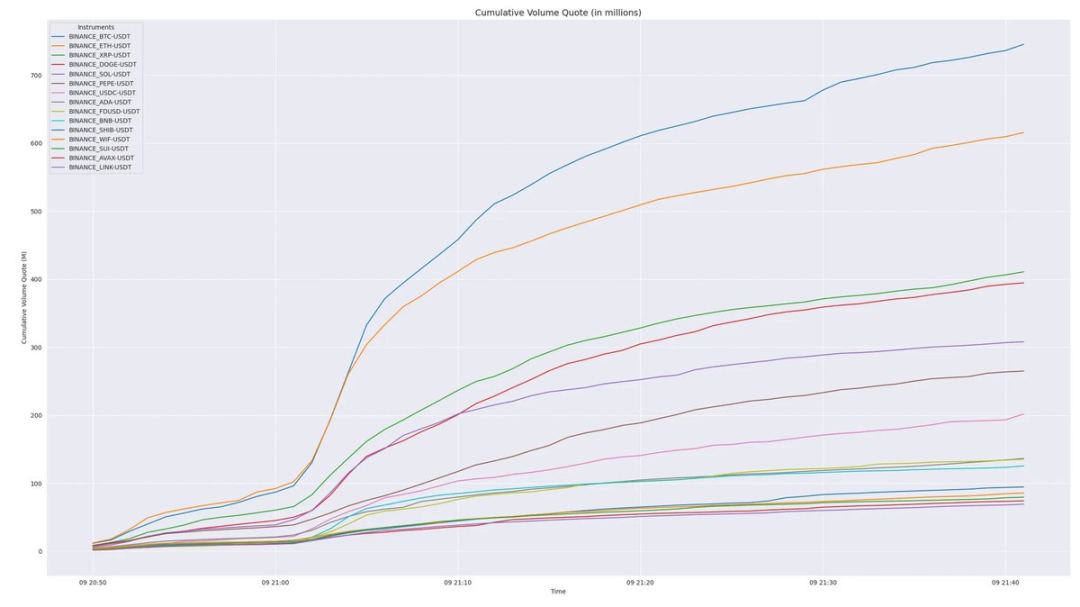

The volume chart shows the cumulative trading volume during the crash. Surprisingly, both USDC and FDUSD had significant trading volumes, but ADA's trading volume was particularly large.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。