Author: YBB Capital Researcher Zeke

Introduction

According to CoinGecko data, the total market capitalization of stablecoins has now surpassed $200 billion. Compared to when we mentioned this sector last year, the overall market cap has nearly doubled and broken historical highs. I once likened stablecoins to a key component in the crypto world, serving as a stable store of value and acting as a crucial entry point in various on-chain activities. Now, stablecoins are beginning to enter the real world, demonstrating financial efficiency that surpasses traditional banks in retail payments, business-to-business (B2B) transactions, and international remittances. In emerging markets such as Africa, Asia, and Latin America, the application value of stablecoins is gradually being realized, with strong financial inclusivity enabling residents of third-world countries to effectively cope with high inflation caused by government instability. Through stablecoins, they can also participate in global financial activities and subscribe to cutting-edge virtual services (such as online education, entertainment, cloud computing, and AI products).

Entering emerging markets and challenging traditional payments is the next step for stablecoins. In the foreseeable future, the compliance and accelerated adoption of stablecoins will become inevitable, and the rapid development of AI will further strengthen the demand for stablecoins (for computing power purchases and subscription services). Compared to the developments of the past two years, the only constant is that Tether and Circle still hold a dominant position in this sector, while more startups are beginning to focus on the upstream and downstream of stablecoins. However, today we will still discuss the issuers of stablecoins; in this highly competitive hundred-billion-dollar sector, who else can take a slice of the pie?

I. Evolution of Trends

In the past, when we mentioned the classification of stablecoins, we generally divided them into three categories:

Fiat-collateralized stablecoins: These stablecoins are backed by fiat currencies (such as USD, EUR) as reserves, typically issued at a 1:1 ratio. For example, each USDT or USDC corresponds to one dollar stored in the issuer's bank account. The characteristics of this type of stablecoin are relatively simple and direct, and theoretically, they can provide a high degree of price stability;

Over-collateralized stablecoins: These stablecoins are created by over-collateralizing other volatile and liquid high-quality crypto assets (such as ETH, BTC). To address potential price volatility risks, these stablecoins often require a higher collateralization ratio, meaning the value of the collateral must significantly exceed the value of the minted stablecoins. Typical representatives include Dai, Frax, etc.;

Algorithmic stablecoins: These stablecoins adjust their supply and circulation entirely through algorithms, which control the supply and demand relationship of the currency, aiming to peg the price of the stablecoin to a reference currency (usually the USD). Generally, when the price rises, the algorithm issues more coins, and when the price falls, it buys back more coins from the market. A representative example is UST (the stablecoin of Luna).

In the years following the collapse of UST, the development of stablecoins has mainly revolved around micro-innovations based on Ethereum LST, constructing some quasi-over-collateralized stablecoins through different risk balances. The term "algorithmic stability" has not been mentioned again. However, with the emergence of Ethena earlier this year, stablecoins have gradually established a new development direction, combining high-quality assets with low-risk financial management to attract a large number of users through higher yields, creating an opportunity to seize market share in a relatively fixed stablecoin market structure. The three projects I will mention below all belong to this direction.

II. Ethena

Ethena is the fastest-growing non-fiat collateralized stablecoin project since the collapse of Terra Luna, with its native stablecoin USDe surpassing Dai with a volume of $5.5 billion, ranking third. The overall idea of the project is based on Delta Hedging with Ethereum and Bitcoin collateral, and the stability of USDe is achieved by Ethena shorting Ethereum and Bitcoin on Cex in an amount equivalent to the value of the collateral. This is a risk-hedging strategy aimed at offsetting the impact of price fluctuations on the value of USDe. If both prices rise, the short position will incur losses, but the value of the collateral will also increase, offsetting the loss; and vice versa. The entire operation relies on over-the-counter settlement service providers, meaning that the protocol's assets are held by multiple external entities. The project's revenue sources mainly include three points:

Ethereum staking rewards: The LSTs staked by users generate Ethereum staking rewards;

Hedging trading profits: The hedging trades of Ethena Labs may generate funding rates or basis spread profits;

Fixed rewards from Liquid Stables: Deposited in USDC on Coinbase or in other stablecoins on other exchanges to earn deposit interest.

In other words, the essence of USDe is a packaged low-risk quantitative hedging strategy financial product on Cex. Combining the above three points, Ethena can provide floating annualized returns of up to several tens of points (currently at 27%) when the market is good and liquidity is excellent, which is even higher than the 20% APY of the Anchor Protocol (the decentralized bank in Terra) back in the day. Although it is not a fixed annualized return, it is still extremely exaggerated for a stablecoin project. So, in this case, does Ethena carry extremely high risks like Luna?

Theoretically, Ethena's biggest risk comes from the potential collapse of Cex and custodians, but such black swan events are unpredictable. Another risk to consider is a bank run; large-scale redemptions of USDe require sufficient counterparties. Given Ethena's rapid growth, this situation is not impossible. If users quickly sell USDe, it could lead to a decoupling of the secondary market price. To restore the price, the protocol would need to close positions and sell the collateral to buy back USDe, potentially turning unrealized losses into actual losses and ultimately exacerbating the vicious cycle. "1" Of course, this probability is much lower than the probability of a single-layer barrier breaking like UST, and the consequences are not as severe, but the risk still exists.

Ethena also experienced a long period of downturn in the middle of the year. Although yields significantly decreased and its design logic was questioned, there was indeed no systemic risk. As a key innovation in this round of stablecoins, Ethena provides a design logic that integrates on-chain and Cex, bringing a large amount of LST assets from the mainnet into exchanges, becoming a scarce source of short liquidity in a bull market, and providing exchanges with substantial fees and fresh capital. This project represents a compromise but is an extremely interesting design approach that achieves high yields while maintaining good security. In the future, with the rise of order book Dex matching more mature chain abstractions, will there be an opportunity to realize a fully decentralized stablecoin based on this idea?

III. Usual

Usual is an RWA stablecoin project created by former French Congressman Pierre PERSON, who was also an advisor to French President Macron. The project has seen a significant increase in popularity due to the news of its launch on Binance Launchpool, with its TVL rapidly rising from tens of millions to around $700 million. The project's native stablecoin USD0 adopts a 1:1 reserve system. Unlike USDT and USDC, users do not exchange fiat currency for equivalent virtual currency but instead exchange fiat currency for equivalent U.S. Treasury bonds, which is the core selling point of the project, sharing the profits obtained by Tether.

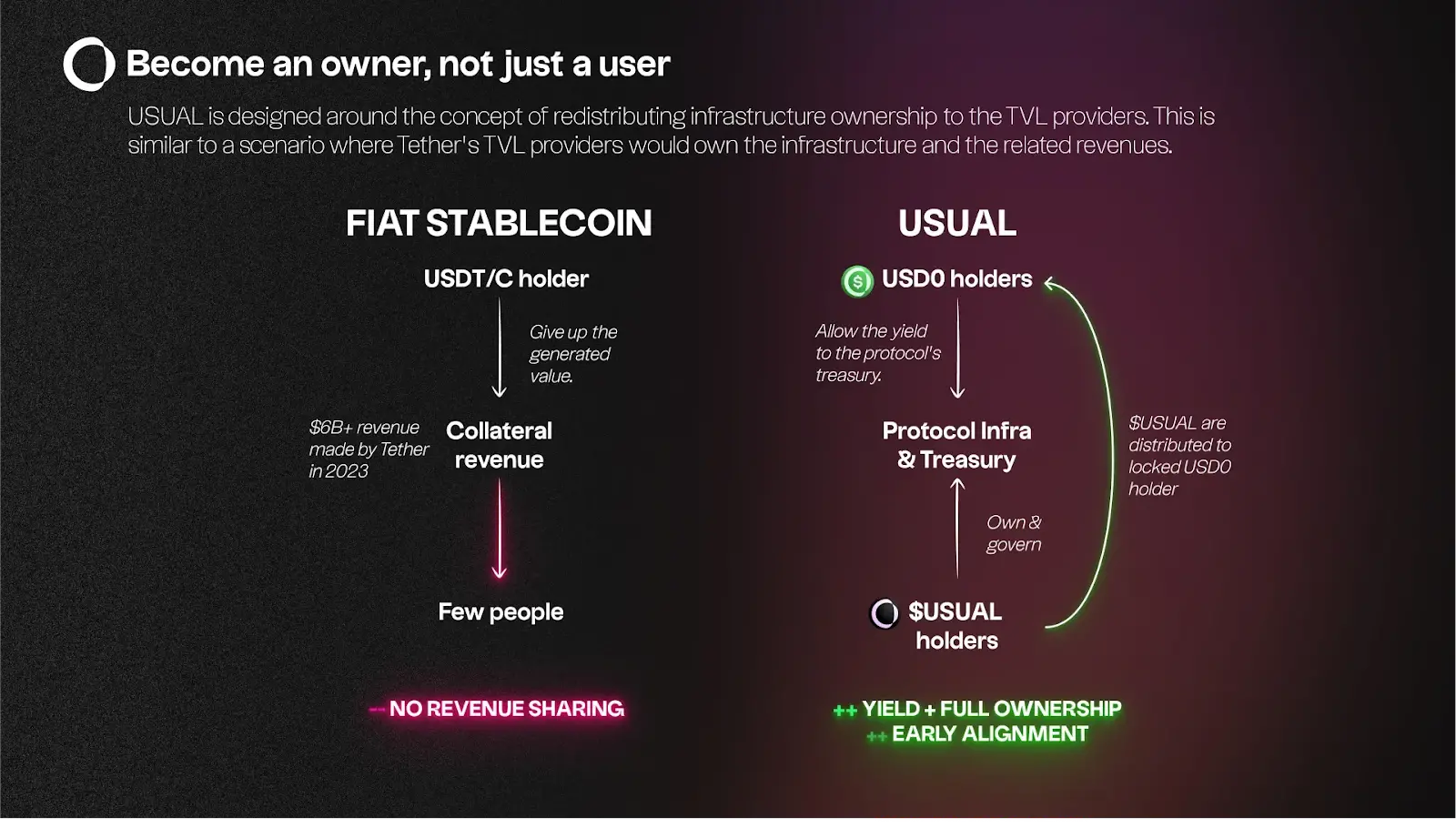

As shown in the image above, the left side illustrates the operational logic of traditional fiat-collateralized stablecoins. Taking Tether as an example, users do not earn any interest when minting USDT from fiat currency; to some extent, Tether's fiat can be considered as "getting something for nothing." The company purchases low-risk financial products (mainly U.S. Treasury bonds) with a large amount of fiat currency, generating profits of up to $6.2 billion in just one year, and then reinvests these profits into high-risk areas to earn passive income.

On the right side is Usual's operational logic, with the core concept being "Become An Owner, Not Just A User." (Become an owner, not just a user.) The project's design revolves around this concept, redistributing ownership of infrastructure to the total locked value (TVL) providers, meaning that users' fiat currency will be converted into ultra-short-term U.S. Treasury bonds as RWA, and the entire process is facilitated through USYC (USYC is operated by Hashnote, which is currently one of the leading on-chain institutional asset management companies supported by partners from DRW). Ultimately, the profits enter the protocol's treasury and are owned and governed by the protocol token holders.

The protocol token USUAL will be distributed to locked USD0 holders (locked USD0 will be converted to USD0++), achieving profit sharing and early alignment. It is worth noting that this locking period lasts for four years, aligning with the redemption period of some U.S. medium-term Treasury bonds (U.S. medium to long-term Treasury bonds generally have a duration of 2 to 10 years).

Usual's advantage lies in maintaining capital efficiency while breaking the control of centralized entities like Tether and Circle over stablecoins, and it equally distributes profits. However, the longer locking period and relatively lower yield compared to the crypto space may make it difficult to achieve the rapid growth seen with Ethena in the short term, and for retail investors, the appeal may be more concentrated on the value of Usual's tokens. In contrast, in the long term, USD0 has more advantages: first, it facilitates citizens of other countries without U.S. bank accounts to invest more easily in U.S. Treasury bond portfolios; second, it has better underlying assets as support, allowing for a much larger overall scale than Ethena; third, the decentralized governance model also means that this stablecoin is not as easily frozen, making it a better choice for non-trading users.

IV. f(x)Protocol V2

f(x)Protocol is currently the core product of Aladdindao, and we provided a detailed introduction to this project in last year's article. Compared to the two star projects above, f(x)Protocol is less well-known. Its complex design has also brought about many flaws, such as vulnerability to attacks, low capital efficiency, high transaction costs, and complex user access. However, I still believe that this project is one of the most noteworthy stablecoin projects born during the bear market of 2023, and I will provide a brief introduction to it here. (For more details, please refer to the f(x)Protocol v1 white paper.)

In the V1 version, f(x)Protocol created a concept known as "floating stablecoins," which disassembles the underlying asset stETH into fETH and xETH. fETH is a "floating stablecoin" whose value is not fixed but fluctuates slightly with the price of Ethereum (ETH). xETH, on the other hand, is a leveraged long position in ETH that absorbs most of the price volatility of ETH. This means that xETH holders will bear more market risk and reward, but it also helps stabilize the value of fETH, making it relatively smoother. Earlier this year, following this line of thought, a rebalancing pool was designed, within which there exists only one highly liquid stablecoin pegged to the dollar, namely fxUSD. All other stable leveraged tokens in the stablecoin pairs no longer have independent liquidity but can only exist within the rebalancing pool or as part of the support for fxUSD.

A basket of LSDs: fxUSD is supported by multiple liquid staking derivatives (LSDs) such as stETH, sfrxETH, etc. Each LSD has its own stable/leverage pair mechanism;

Minting and redeeming: When users want to mint fxUSD, they can provide LSD or withdraw stable currency from the corresponding rebalancing pool. In this process, the LSD is used to mint the stable derivative of that LSD, which is then deposited into the fxUSD reserves. Similarly, users can also redeem LSD with fxUSD.

In simple terms, this project can also be seen as a super complex version of Ethena and early hedging stablecoins. However, in the on-chain scenario, the balancing and hedging process is very complicated. First, there is the splitting of volatility, followed by various balancing mechanisms and margin for leverage, which has resulted in negative impacts on user access that outweigh the positive attraction. In the V2 version, the entire design focus shifted to eliminating the complexities brought by leverage and providing better support for fxUSD. In this version, xPOSITION was introduced, which is essentially a high-leverage trading tool, a non-homogeneous product with a high beta value (i.e., highly sensitive to market price changes). This feature allows users to engage in high-leverage trading on-chain without worrying about individual liquidations or paying funding fees, with obvious benefits.

Fixed leverage ratio: xPOSITION offers a fixed leverage ratio, meaning that users' initial margin will not be subject to additional requirements due to market fluctuations, nor will unexpected liquidations occur due to changes in leverage;

No liquidation risk: Traditional leveraged trading platforms may force users' positions to be liquidated due to severe market fluctuations, but the design of f(x) Protocol V2 avoids this situation;

Exemption from funding fees: Typically, using leverage involves additional funding costs, such as interest incurred when borrowing assets. However, xPOSITION does not require users to pay these fees, reducing overall trading costs.

In the new stable pool, users can deposit USDC or fxUSD with one click, providing liquidity support for the protocol's stability. Unlike the stable pool in the V1 version, the V2 version stable pool acts as an anchor between USDC and fxUSD, allowing participants to engage in price arbitrage in the fxUSD—USDC AMM pool and helping fxUSD achieve stability. The entire protocol's revenue sources are based on opening and closing positions, liquidations, rebalancing, funding fees, and collateral earnings.

This project is currently one of the few non-over-collateralized and fully decentralized stablecoin projects. However, for stablecoins, it still seems somewhat overly complex and does not align with the minimalist design premise of stablecoins. Users must also have a certain level of understanding to comfortably get started. In extreme market conditions, during a bank run, the framework design of various defensive barriers may also inadvertently harm users' interests. Nevertheless, the project's goal indeed aligns with every crypto enthusiast's ultimate vision for stablecoins: a native decentralized stablecoin backed by top-tier crypto assets.

Conclusion

Stablecoins will always be a battleground and a highly challenging sector in crypto. In last year's article "In a Near-Death Situation, But Algorithmic Stability Has Not Stopped Innovating," we briefly introduced the past and present of stablecoins and hoped to see some more interesting decentralized non-over-collateralized stablecoins emerge. Now, a year and a half later, we have not seen any startup projects other than f(x)Protocol pursuing this direction. However, it is fortunate that Ethena and Usual provide some compromise ideas, allowing us to choose some more ideal and Web3-oriented stablecoins.

References

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。