As the last key economic data before the Federal Reserve's year-end meeting, tonight's CPI data is highly anticipated. The market generally expects a slight rebound in overall CPI. Although the Federal Reserve strives to keep the inflation rate within the target range of 2%, the recent volatility in economic indicators has raised considerable uncertainty, especially against the backdrop of Trump's imminent return to the White House, where future trade policies and tax reforms may have additional impacts on the path to interest rate cuts.

CPI is coming, but the outlook for rate cuts is changing

AICoin (aicoin.com) data shows that the market expects tonight's U.S. inflation data to possibly exceed the levels of the past three months, recording 2.7%. Although inflation data will significantly impact the short-term market trends, the threshold for this CPI data to completely reverse rate cut expectations is relatively high, given that a 25 basis point rate cut is almost a certainty. As of the time of writing, the interest rate market bets on an 86% probability of the Federal Reserve cutting rates by 25 basis points next week.

It is reported that most Federal Reserve officials still have high hopes for the medium-term targets, but the path for inflation to return to the Fed's 2% target seems increasingly difficult. Federal Reserve Chairman Powell stated last week that a strong U.S. economy means the Federal Open Market Committee can be "more cautious" on the path to lowering rates to neutral levels. Some viewpoints suggest that in the short term, an economic slowdown will support the Fed's continued rate cuts, but combined with concerns about re-inflation after Trump's future presidency, it may constrain the medium to long-term space for rate cuts. Market expectations indicate that the Federal Reserve is likely to remain on hold at the beginning of next year.

Capital inflow, BTC mainstreaming trend accelerates

Currently, the market has largely digested the expectation of the Federal Reserve continuing to cut rates this month. On a daily level, the U.S. dollar index shows signs of further strengthening, while the Nasdaq has been in a downward trend. However, it has consistently found support near the EMA52 moving average over the past quarter, and BTC is experiencing a critical turning point. After breaking through $100,000, Bitcoin has seen two extreme price drops, aligning with Galaxy Digital CEO Mike Novogratz's expectations. He previously warned that a global surge in Bitcoin purchases is underway, but there is significant leverage in the system, which will likely lead to one or two sharp corrections.

Additionally, U.S. institutional investors are aggressively buying Bitcoin. From established players like MicroStrategy and Tesla to potential entrants like Microsoft and Amazon, Bitcoin's expansion into the mainstream world seems to be accelerating.

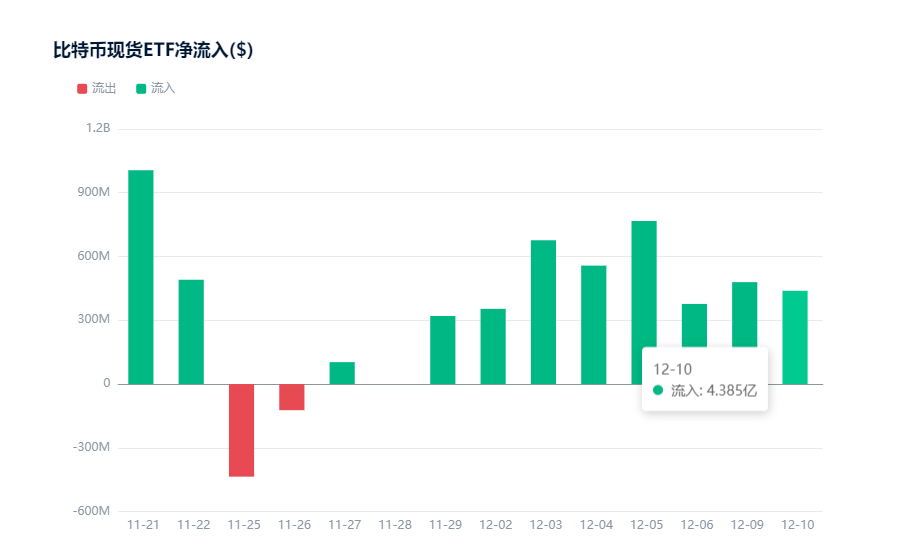

At the same time, the capital scale of the U.S. spot BTC ETF continues to expand, achieving net inflows for eight consecutive trading days, with a cumulative amount reaching $3.969 billion. This trend of capital inflow indicates a long-term optimistic outlook for Bitcoin in the market.

ETF data tracking: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn

Additionally, sources reveal that Trump is very concerned about Bitcoin's price and is now "hoping" for Bitcoin to continue rising and eventually break through $150,000.

Expectations for new Bitcoin highs

The market consensus seems to be that Bitcoin is sprinting towards $120,000, or even $150,000.

(1) Strong bullish sentiment from major players

Large holders have strong confidence in Bitcoin's future price. According to tracking of large orders, major players are bullish in the short term, targeting $100,000 to $105,000, with Binance spot large holders placing a massive order of $149 million in this range; for a longer-term trend, major players are bullish up to $110,000 to $120,000. Combining full-depth data, Coinbase large holders have placed sell orders of $22 million (≈200 BTC) at the $110,000 mark and are betting over $24.6 million (≈205 BTC) at the $120,000 mark.

At the same time, Coinbase's premium has turned positive, and the main players in the U.S. market have shifted back to buying, further confirming the market's positive sentiment.

Usage of major sell orders: Before the transaction, large units are above the current price, and the price must rise to complete the transaction, indicating a bullish sentiment; after the transaction, it creates selling pressure, indicating a bearish sentiment. Experience it now: https://www.aicoin.com/vip

(2) Positive technical outlook

• Short-term: BTC has formed a W bottom pattern on the 30-minute and 1-hour timeframes. If it breaks through $98,135 to $98,320, it will challenge the $100,000 mark again.

• Medium-term: BTC is supported by the Vegas channel on the 4-hour timeframe; the 8-hour timeframe is testing the MA40 moving average resistance. If it breaks through, the prospect of returning to $100,000 will be validated again.

• Long-term: A strong adjustment structure has emerged. Although the MACD fast and slow lines are at the zero axis, the price remains above the EMA24, indicating the potential for a significant upward trend.

In summary, tonight's CPI data will be an important factor influencing short-term market trends, but it is unlikely to shake the Federal Reserve's rate cut expectations. Looking at the long term, BTC's momentum remains strong, and future market conditions may still see breakthrough developments.

For more market opportunities, feel free to join the 【PRO CLUB】 group to discuss with the editor~

Data is for reference only and does not constitute any investment advice!!!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。