Original | Odaily Planet Daily (@OdailyChina)

The ME token, which has attracted the attention of many users for a long time, finally opened for airdrop claims and TGE last night.

The total supply of ME tokens is 1 billion, with an initial circulating supply of 125 million airdrop tokens, and the distribution of other tokens will be gradually released over 4 years. Due to the recent good price performance of airdrop projects like Hyperliquid and Movement after TGE, combined with Magic Eden currently being the leading multi-chain NFT trading market, the community has high expectations before the token launch:

"The opening price of ME is expected to be $10, with a long-term potential to reach $30."

"The airdrop distribution of ME is quite reasonable, taking into account most real users, platform whales, and those looking to take advantage."

"The price of ME is benchmarked against HYPE, but it shouldn't be worse than MOVE's opening price."

Of course, some community members remain rational, believing that the price of ME before the opening is already too high:

"I've already shorted ME in pre-market trading on OKX; the current FDV is already higher than its intrinsic value."

"Sell ME as soon as it opens; starting with a $10 billion FDV is just setting up for a VC dump."

So, what kind of script unfolded before and after the ME token claim and TEG yesterday? Is there still hope for ME's price (current price $5.6) to challenge $10? Odaily Planet Daily will briefly introduce this in the article.

Launched on Binance and Upbit, pre-market price exceeds expectations

In the current market situation, if a token can launch on Binance and Upbit, it is a significant positive—Binance, as the "largest exchange in the universe," will bring the most traffic and liquidity to the token; due to the closed and crazy nature of the Korean market, a "kimchi premium" phenomenon will form during a bull market, so Upbit, as the largest exchange in Korea, is expected to bring strong purchasing power to the launched token and create a price difference with external markets in the short term.

Previously, MOVE announced its launch on three major exchanges (Binance, Upbit, and Coinbase), which also validated this positive phenomenon, so many players hoped or even firmly believed that ME would go on these three exchanges before its launch.

The script indeed developed in this direction. On December 9, according to @ai_9684xtpa's monitoring, a Binance address seemingly appeared among ME's holding addresses; the address AG8Xp…xW4PM had recharged 1 ME to Binance three days prior, and tracing the funds back three layers leads to the token deployment address. On December 10, the community's speculation was confirmed when Binance released an announcement stating it would launch ME spot trading, and subsequently, according to OKX pre-market trading data, ME surged in pre-market trading, breaking through 6 USDT, with a 24H increase of 33.82%.

While the community was still excited, another good news came in the afternoon of December 10, as Upbit announced it would launch ME/KRW, USDT, and BTC trading pairs. Following this, according to OKX pre-market trading data, ME in OKX pre-market trading surged to 7.45 USDT, with a 24H increase of 55.75%. At this price, ME's initial circulating market cap exceeded $930 million, with an FDV exceeding $7.4 billion.

Before the opening, ME's price had already greatly exceeded the market's expectations when the token economics were just announced (3-4 USDT). Optimistic players believe ME will start with a $10 billion valuation and continue to rise, while more pessimistic players or those who have reached their psychological price point are calculating how to quickly claim the airdrop and sell.

OKX reaches peak, severe price differences between exchanges and on-chain

OKX announced it would open ME spot trading at 22:00 (UTC+8) on December 10, making it the first mainstream exchange to open ME trading, so many users chose to recharge ME to OKX for trading. ME's performance on OKX can be described as stunning; according to OKX market data, ME broke through 22 USDT after opening, reaching a high of 22.632 USDT, but then began to decline.

However, according to community discussions, due to the massive traffic from claiming airdrops, retail investors could not claim ME at all when OKX opened at 22:00, and only after 22:30 did ME token claims gradually return to normal. By this time, ME's price on OKX had dropped to between 5.6 and 4.8 USDT, lower than the pre-market price on OKX. The community humorously referred to this phenomenon as the unique "leadership exit" of VC tokens.

Although ME's price on OKX declined, many players still held expectations for ME since Binance and Upbit had not yet launched, and some even engaged in bottom-fishing and going long. However, when Binance officially opened ME spot trading at 23:00 on December 10, ME's opening price peaked at 6.24 USDT, far from many players' expectations, and under the influence of sentiment, ME's price on Binance began to fall, dropping to a low of 4.137 USDT.

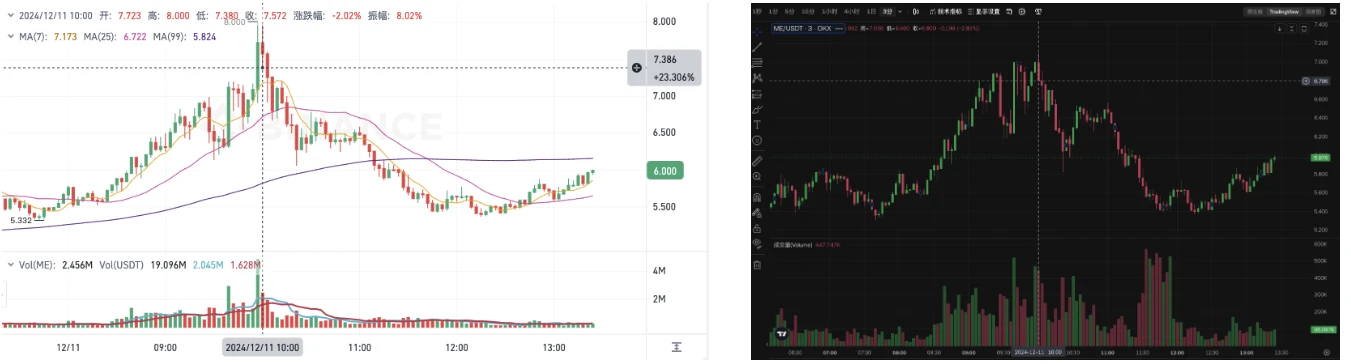

Additionally, there were price differences between exchanges and on-chain. After Binance opened, ME consistently had a price difference of 0.3 to 0.6 USDT between OKX and Binance. At 9:30 this morning, Upbit announced it would open ME spot trading, with ME's price reaching a high of 11.3 USDT, a premium of over 60% compared to other major CEXs. Influenced by Upbit, at 10:00, ME's price on Binance peaked at 8 USDT, while OKX's price at the same time was only 7.09 USDT.

Price differences of ME between Binance and OKX (left is Binance, right is OKX)

At the same time, there were also price differences between CEX and DEX. According to Raydium data, at 10:00, the price of ME in the ME/USDC pool was between 9 and 10 USDT, higher than the prices on Binance and OKX.

Price of ME on Raydium

This morning, Coinbase announced that ME is now available on coinbase.com and the Coinbase iOS and Android apps, allowing Coinbase customers to log in to buy, sell, convert, send, receive, or store these assets. However, this did not bring much upward stimulus to ME's price.

Can ME reach $10 again?

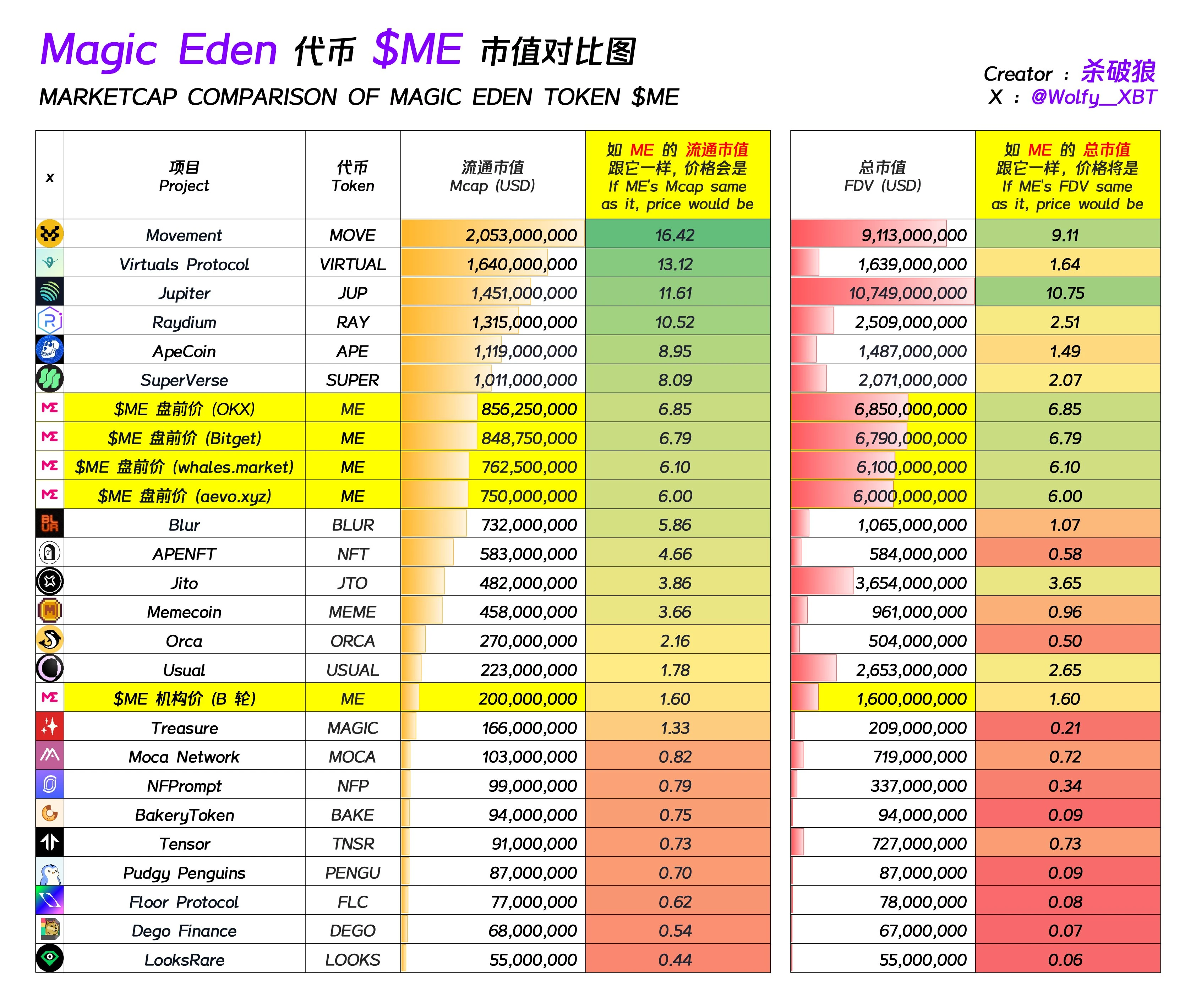

The price increase of ME to 10 USDT has become a psychological price point for many community members, but since Binance launched ME, its price has only peaked at 8 USDT, and although OKX broke through 22 USDT at opening, most retail investors could not sell at that price. Whether ME can reach 10 USDT again fundamentally depends on whether Magic Eden is worth a $10 billion valuation. Previously, Twitter KOL Kills the Wolf compared ME's market cap with other projects, as shown in the image below.

Before ME's launch, if calculated at the pre-market price, Magic Eden's circulating market cap had already surpassed the FDV of NFT trading markets like Tensor and Blur. From the data perspective, Magic Eden's market share in Solana NFTs is indeed less than that of the top-ranked Tensor, but in supporting and developing multi-chain NFTs, Magic Eden has performed quite well, especially having an absolute leading advantage in the Bitcoin NFT and rune trading markets.

At the same time, many viewpoints also compare ME with the TEG performance of HYPE and MOVE, arguing that ME's initial circulation is even smaller than HYPE and is also a highly profitable project; regarding exchange support, ME is similar to MOVE, having also launched on Binance, Upbit, and other mainstream exchanges. Therefore, many users believe ME's price should at least maintain above 10 USDT for a considerable time.

However, the current situation for Magic Eden is not as optimistic as described. In terms of products, the rise and fall of a trading market always depend on the development of its ecosystem. Currently, the Bitcoin ecosystem is in a bear market, and none of the top 10 NFT projects by market cap are Bitcoin NFTs (Bitcoin Puppets ranks 12th), and in the currently hot Solana market, its share is also less than Tensor, making it difficult to support a $10 billion valuation.

Based on the price performance of previous airdrop projects this year, the opening price is generally the peak, and after market sentiment fades, it is challenging to have a second wave of momentum. MOVE has currently fallen back to around 0.68 USDT, with FDV dropping to about $6.7 billion, so for ME to reach 10 USDT again, the difficulty still exists.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。