Cryptocurrency News

December 11 Highlights:

1. Ray Dalio: Turning to gold and Bitcoin investments under high debt risk

2. MicroStrategy may be included in the Nasdaq 100 index, expected to trigger $2.1 billion in ETF purchases

3. Microsoft shareholders oppose Bitcoin investment proposal in preliminary vote

4. LayerZero will hold its first protocol fee referendum on December 19

5. Goldman Sachs CEO: Will assess participation in Bitcoin or Ethereum markets if regulations allow

Trading Insights

Reasons why the bull market is still not profitable!

Lack of precise layout during declines

Even with some layout, lack of patience leads to being easily washed out by market makers

Funds are too dispersed, making it difficult to form a collective force

Frequent operations, chasing highs and cutting losses, missing the golden opportunities of the bull market

Blindly chasing highs in a bull market, fully invested, forced to cut losses once there is a pullback

Lack of sharp judgment on the arrival and departure of the bull market, missing the best timing for increasing and decreasing positions

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading orders from the Big White Community this week. Congratulations to the friends who followed along. If your operations are not going smoothly, you can come and test the waters.

The data is real, and each order has a screenshot from the time it was issued.

Search for the public account: Big White Talks About Coins

BTC

Analysis

Bitcoin's daily line fell from a high of around 98,300 to a low of around 94,250 yesterday, closing around 96,600. The support level is near MA30, and a pullback can be used to buy near this level. The upper pressure is near the MA7 moving average; a breakout could see it rise to around 100,000. MACD shows an increase in bearish momentum. The four-hour bottom has tested the 94,500 level multiple times, forming support. A pullback can be used to buy near this level. The upper pressure is near MA30, and MACD shows a decrease in bearish momentum with signs of a golden cross forming. Short-term buying can be considered around 96,500-94,600, with rebound targets looking at 98,700-101,500.

ETH

Analysis

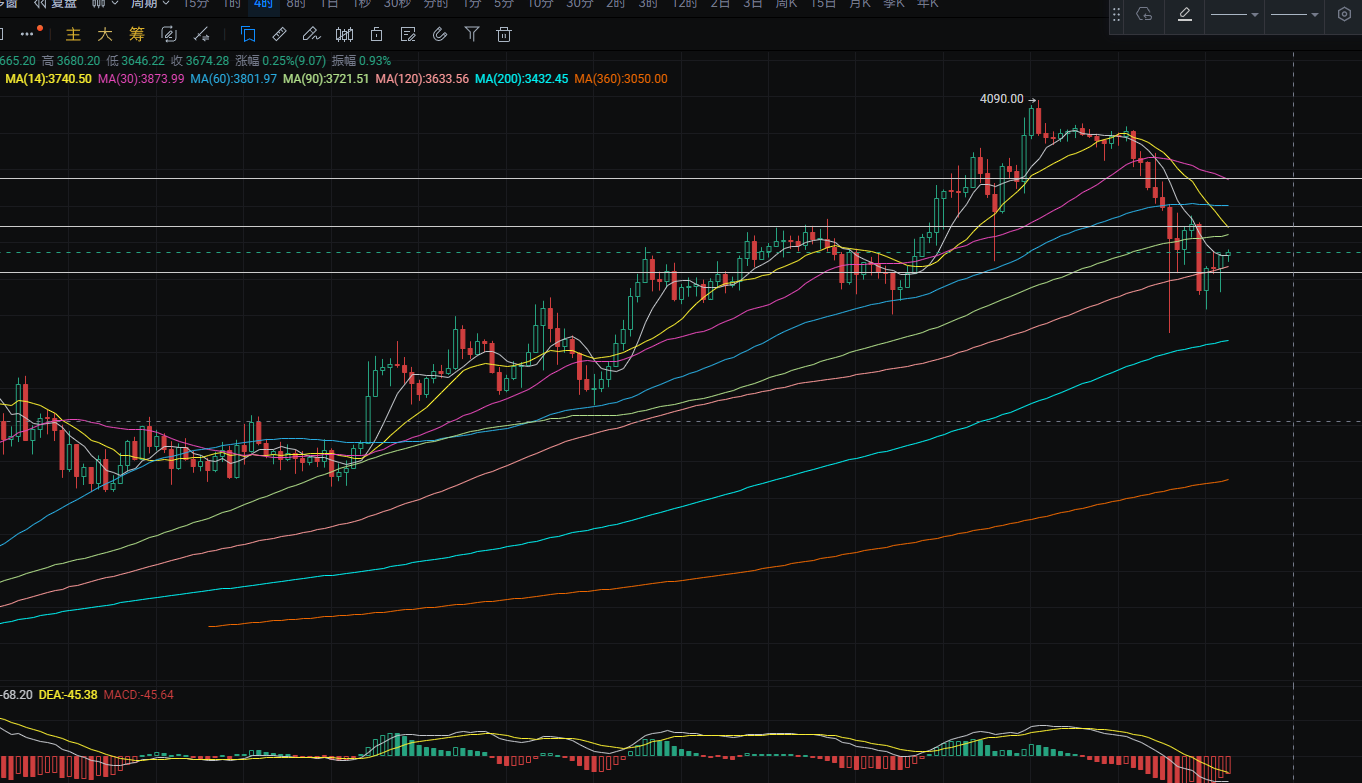

Ethereum's daily line fell from a high of around 3,780 to a low of around 3,515 yesterday, closing around 3,630. There have been multiple tests around 3,620 forming support; if it breaks, it could look towards MA30. A pullback can be used to buy near this level. The upper pressure is near MA14; a breakout could see it rise to MA7. MACD shows an increase in bearish momentum, forming a death cross. The four-hour support is near MA120; a pullback can be used to buy near this level. MACD shows a decrease in bearish momentum with signs of a golden cross forming. Short-term buying can be considered around 3,618, with rebound targets looking at 3,745-3,875.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific operational advice and does not bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。