Stablecoins are a type of digital currency designed to reduce the price volatility of cryptocurrencies. They are designed to be pegged to stable assets, such as fiat currencies. Common stablecoins include tokens pegged to assets like the US dollar, euro, or gold. The emergence of stablecoins meets the market's demand for the convenience of blockchain technology while addressing the issue of severe price fluctuations in traditional cryptocurrencies.

1. Stablecoins are mainly divided into the following types:

1. Fiat-collateralized stablecoins: Tether (USDT), USD Coin (USDC).

These are backed by fiat currencies (such as the US dollar or euro) as reserve assets. The issuers of these stablecoins typically hold an equivalent amount of fiat currency in bank accounts as reserves.

2. Crypto-collateralized stablecoins: Dai (DAI).

These use cryptocurrencies as collateral. These stablecoins lock up crypto assets through smart contracts to generate an equivalent amount of stablecoins.

They are usually over-collateralized to cope with price fluctuations.

3. Algorithmic stablecoins: Ampleforth (AMPL).

These do not rely on any collateral assets but instead maintain their value stability by algorithmically adjusting the supply.

These systems stabilize supply and demand through automated market operations (such as minting and burning).

2. Analysis of USDT Premium Phenomenon:

The USDT premium refers to the phenomenon where the price of purchasing USDT in the over-the-counter market exceeds the exchange rate of the Chinese yuan to the US dollar. This phenomenon is particularly evident in the cryptocurrency market, reflecting the interaction of market liquidity, supply and demand relationships, and exchange pricing methods.

1. Pricing Mechanism and Market Performance

Dollar-denominated exchanges: Exchanges like Coinbase and Kraken in the US allow users to trade directly with fiat currency, and these platforms respond more quickly to market changes due to the convenience of fiat currency inflows and outflows.

USDT-denominated exchanges: Binance, Huobi, OKEx, etc., primarily price in USDT. Due to the difficulty of fiat currency inflows and outflows, USDT has become the main trading medium in many regions.

2. Generation of USDT Premium

- During market recovery: The USD-denominated market, due to the convenience of fiat currency inflows, is the first to experience positive price changes, leading to BTC/USD prices potentially being higher than BTC/USDT, resulting in a positive USDT premium.

Arbitrage opportunity: Users can buy USDT with USD and then sell it to other users to profit from the price difference.

- During market sell-off:

A large number of Bitcoin sell-offs occur in the USD market, causing BTC/USD prices to potentially be lower than BTC/USDT.

Converting USDT to USD is inconvenient, lacking large-scale arbitrage opportunities, leading users to primarily choose to hoard USDT.

- Supply and Market Response:

During positive premium: Tether may issue more USDT to balance supply and demand.

During negative premium: Tether may buy back and destroy USDT to maintain its exchange rate stability with the US dollar.

3. Potential Risks

- Exchange operational risk: There may be risks of exchanges trading with "fake USDT."

- Credit risk: USDT may be used for lending, posing bad debt risks, as its value is based on "the total of all receivables."

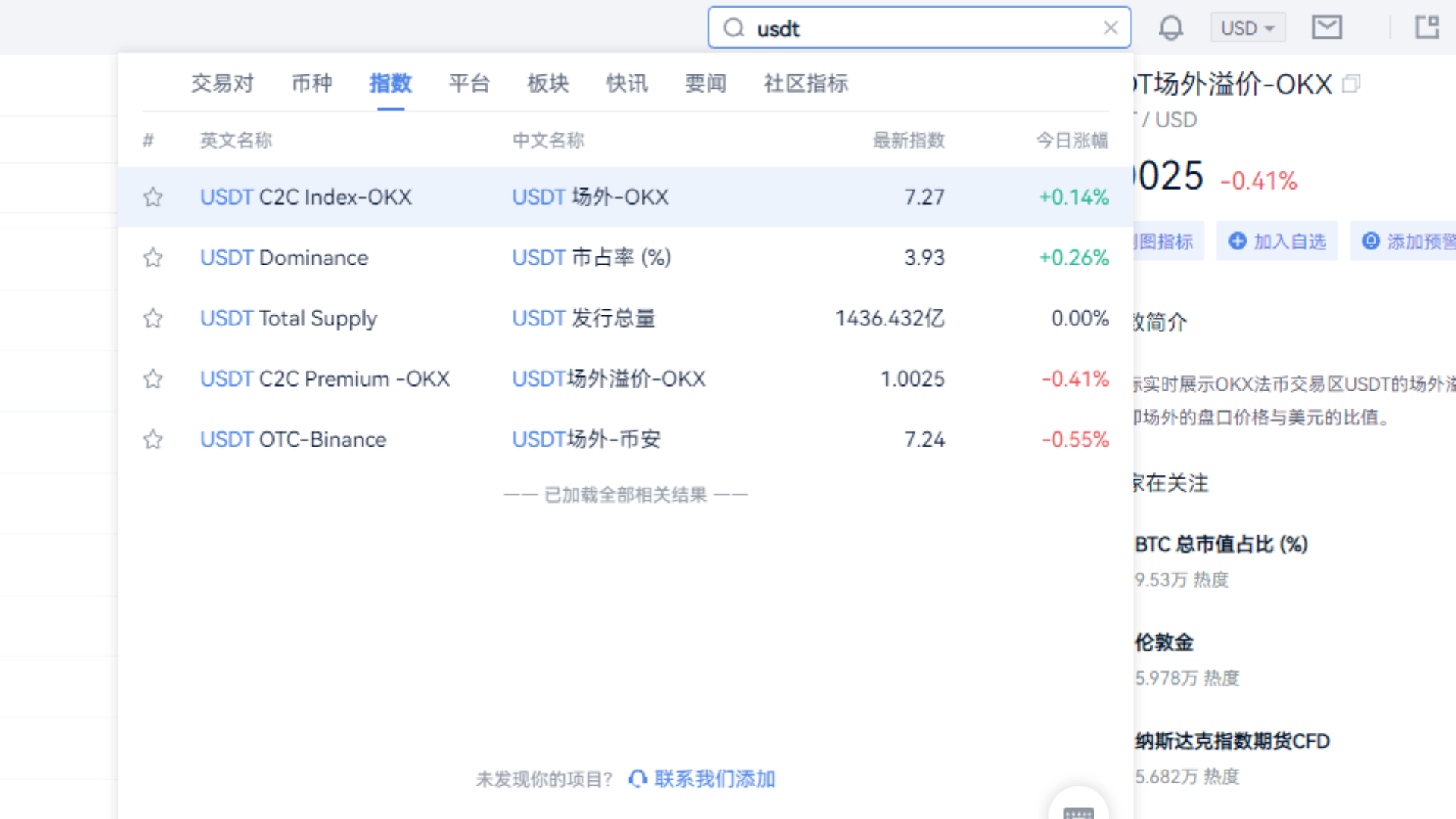

3. The USDT OTC Premium Rate Affects Trading Costs, How to Check?

A positive USDT premium reflects market capital inflows, rising prices of mainstream coins, and increased market activity.

A negative USDT premium indicates capital outflows and market pressure.

Product Path: AICoin PC - Search Index - USDT OTC - OKX

Additionally, the AICoin Research Institute has created a USDT Discount/Premium + Automatic Bottom-fishing Strategy specifically for USDT premiums, which interested users can access for free in the indicator square.

【Disclaimer】The market has risks; investment requires caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。