Master Discusses Hot Topics:

First, let's talk about Microsoft's shareholders rejecting proposals related to cryptocurrency. It's not surprising, as the market had already anticipated this outcome. Although this result has had some impact on sentiment, the overall effect is limited. As the old saying goes: "The great river flows, but there are always places to turn; the world is unpredictable, yet it has its own logic."

However, after Trump was elected president, the Bitcoin spot ETF attracted a significant net inflow of funds—surpassing $10 billion in a short time. This reflects institutions' expectations and confidence that Trump may introduce favorable policies for the cryptocurrency industry.

At the same time, the Ethereum ETF is also showing strength, with a weekly net inflow of $837 million, setting a historical record. The flow of funds clearly indicates that, amidst the ongoing global economic uncertainty, mainstream institutions are repositioning themselves in the cryptocurrency market to seize new trends.

Nevertheless, this optimistic sentiment has not masked the recent market volatility. The consecutive declines over the past few days have triggered some analysts' "predictions," with numbers like 80K and 70K flying around.

However, upon analysis, it is easy to see that these statements are mostly subjective guesses without any basis. The market, like life, is most afraid of being disturbed in judgment by external noise. For short-term traders, focusing on daily rhythms rather than the final outcome is the way to go.

Recently, Bitcoin has repeatedly dipped below 95K but quickly recovered to the 96K-99K range, indicating that the bullish rebound trend is still ongoing. This shows that the market still has resilience. For short-term operations, the most important thing is to take profits on time, enter and exit quickly, and avoid chasing highs and cutting losses.

Chasing shorts when the market is down may catch you off guard during a rebound; chasing longs when the market is up may leave you helpless during a nighttime pullback. Therefore, rather than being swayed by bullish or bearish news, it is better to focus on the present and seize the profit from each trade. As the ancient saying goes: "Do not be greedy for small profits, do not cling to small worries, and you will rise step by step."

Additionally, tonight's CPI data release is undoubtedly the market's focus, and many friends have already begun to speculate on how Bitcoin will react. Personally, I am optimistic about a rally, with logic similar to last Friday's non-farm payrolls. Currently, inflation is expected to rise, and even if the inflation data shows a slight increase, it will not affect the Federal Reserve's established path of rate cuts in December.

A continuous 72-hour decline is also rare in history, so the possibility of a short-term rebound remains high. Just like a bowstring pulled tight, it will inevitably be accompanied by strong rebound force.

For tonight's market, I suggest responding with the logic of a technical rebound. Near important support lines, one can seize entry opportunities after appropriate adjustments, and do not let short-term fluctuations affect your rhythm.

Remember the recent market movements; each time Bitcoin dipped below 95K, it managed to recover strongly. This trend has proven that the market still has strength.

Master Looks at Trends:

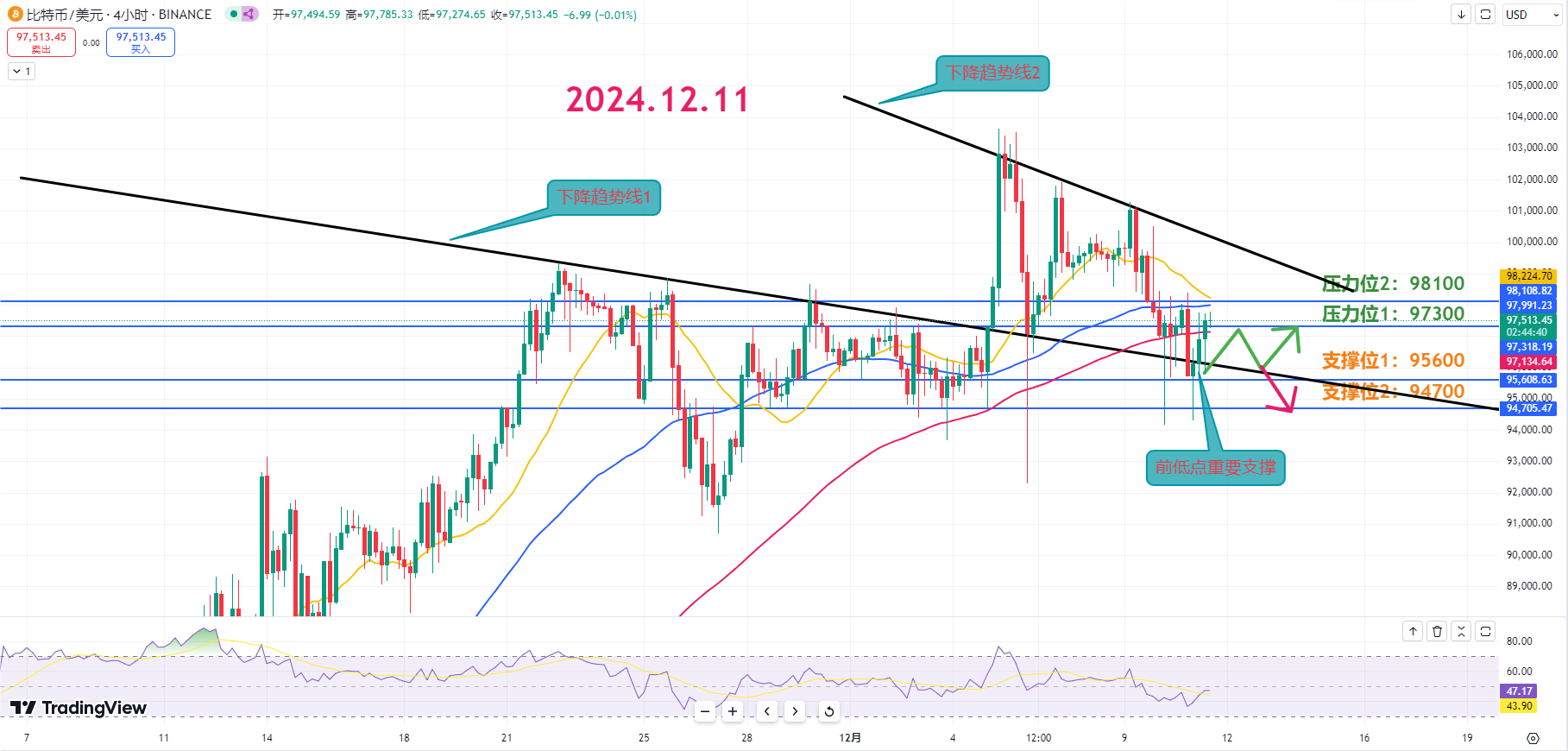

Bitcoin continues to be in an adjustment trend and has now returned to a recovery trend. The K-line from above shows clear actions to wash out retail investors, so even during a short-term rebound, do not easily assume it is a low point.

Resistance Levels:

First Resistance Level: 97300

Second Resistance Level: 98100

Support Levels:

First Support Level: 95600

Second Support Level: 94700

Today's Suggestions:

In the short term, the first support can be set as a low point forming a zone, which is also an important support level for short-term trading. It is recommended to use this as a benchmark for today's short-term trades. The first support has already rebounded; if there is another adjustment, this area needs to be defended.

If another adjustment occurs and the first descending trend line is maintained, it can be considered an entry opportunity. If it breaks below the first support, be aware that an N-shaped decline may occur.

If an appropriate adjustment occurs, it can be considered an entry opportunity, and corresponding position operations can be taken. If the trading volume is low during the adjustment, and small K-lines gradually decline while maintaining the low point, it indicates a suitable adjustment range.

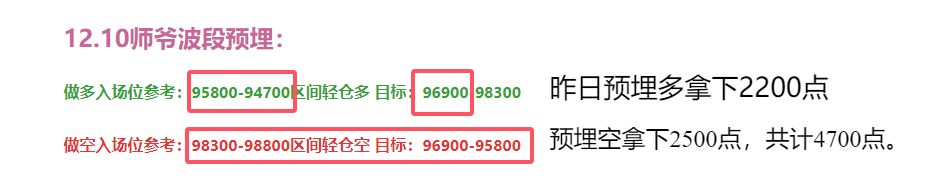

12.11 Master’s Wave Strategy:

Long Entry Reference: Light long in the 93300-94150 range, Target: 95600-97300-98000

Short Entry Reference: Light short in the 97500-98550 range, Target: 95600-94700

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about K-lines, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and other advertisements at the end of the article and in the comments are unrelated to the author! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。