Key Indicators: (December 2, 4 PM -> December 9, 4 PM Hong Kong Time)

BTC against USD increased by 3.9% (from $95,900 to $99,600), ETH against USD increased by 7.4% (from $3,640 to $3,910)

BTC against USD December (end of year) ATM volatility decreased by 0.6 points (from 55.8 to 55.2), 25d skew decreased by 0.7 points (from 4.9 to 4.2)

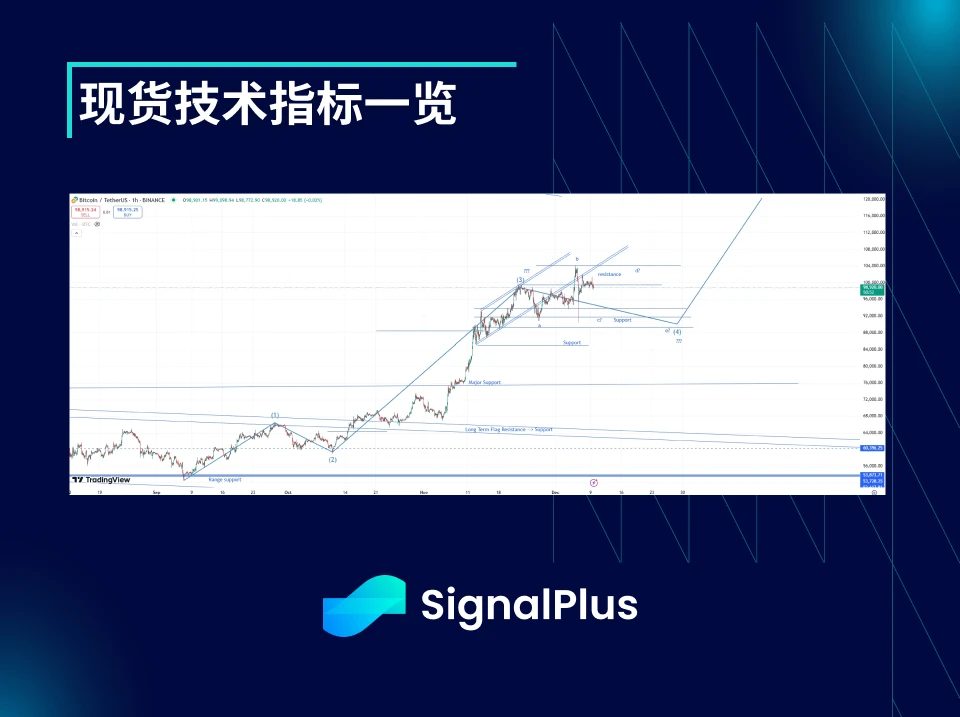

Looking at the trend, the spot market is still correcting the price. Although the coin price set a new high above $100,000, it quickly and heavily fell back. We believe that any rise will be met with selling, but there will be significant market demand during declines, leading to an expectation of a one-sided correction trend (price fluctuations gradually flattening). Currently, the resistance level is mainly between $99,000 and $104,000, with support starting from $94,000 down to $85,000.

Although the price will initially fluctuate within this range, we expect the actual volatility to eventually weaken (provided the price does not break through). If the price breaks down, we will be brought back to $76,000. Any substantial upward breakout will lead to the price reaching the ultimate range of $115,000 to $120,000 ahead of schedule (which we originally expected to occur between January and February next year).

Market Themes:

Bitcoin finally broke through the psychological barrier of $100,000 last Thursday, causing the price to test $104,000 twice, both times receiving good support. Initially, it felt like this level was the answer that the recent bull market trend was eagerly hoping to see, but momentum quickly weakened within the next 24 hours, and we retreated back below $100,000. This triggered the liquidation of fresh long positions above $100,000, causing the price to drop as low as $90,000. However, this did not last long, as the market regained $100,000 during the New York trading session and stabilized relatively within the range of $96,000 to $100,000.

Overall market sentiment remains bullish, with other cryptocurrencies continuing to rise. The price of ETH against USD also pushed above the psychological barrier of $4,000, but is still 20% away from its historical high.

Price fluctuations in traditional financial markets have calmed somewhat. The implementation of martial law in South Korea caused brief concerns (leading to a temporary drop in Bitcoin to $93,000), but it was soon confirmed to be just a local political turmoil that quickly subsided. China has once again promised to provide stimulus policies next year in response to the overall market weakness following Trump's election and the promise of a new round of tariffs. Finally, U.S. labor data continues to show signs of gradual weakening. Last week's non-farm payroll report did not impact the Federal Reserve's gradual rate-cutting actions. Therefore, overall, we continue to believe that the macro backdrop supports risk assets.

BTC ATM Implied Volatility:

Overall, the market volatility last week was very high. It first dropped to $93,000 due to the South Korean martial law, then broke through $100,000 and approached $104,000, before falling back to a low of $90,000 due to liquidations. Despite such large fluctuations, the high-frequency actual volatility was around 60 points, which is merely the market pricing for the average weekly implied volatility for the first quarter of next year!

Therefore, most of the spikes in implied volatility have subsided, especially for expiration dates before the end of the year. Unless the price range of $90,000 to $104,000 is completely broken, it will be difficult for actual volatility to maintain at that level. However, at the far end of the term structure, the market has seen significant buying flow, especially above the March and June expirations (with strike prices of $150,000 to $200,000), leading to elevated premiums after the January expiration. Again, it is emphasized that considering last week's high actual volatility, maintaining a weekly implied volatility of 60 points will be difficult for the market before a significant breakthrough in spot prices.

BTC Skew/Kurtosis

Despite some quite intense corrections in the spot market, the skew price has remained relatively stable this week. Ultimately, market demand is still mainly concentrated above the price, with limited demand for hedging below the coin price in the short term.

Accompanied by the rise in actual volatility, the kurtosis has generally increased this week, also due to the market's demand for single-sided purchases (especially the upper wing).

Wishing everyone good luck in the coming week!

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。