Original Author: BitpushNews

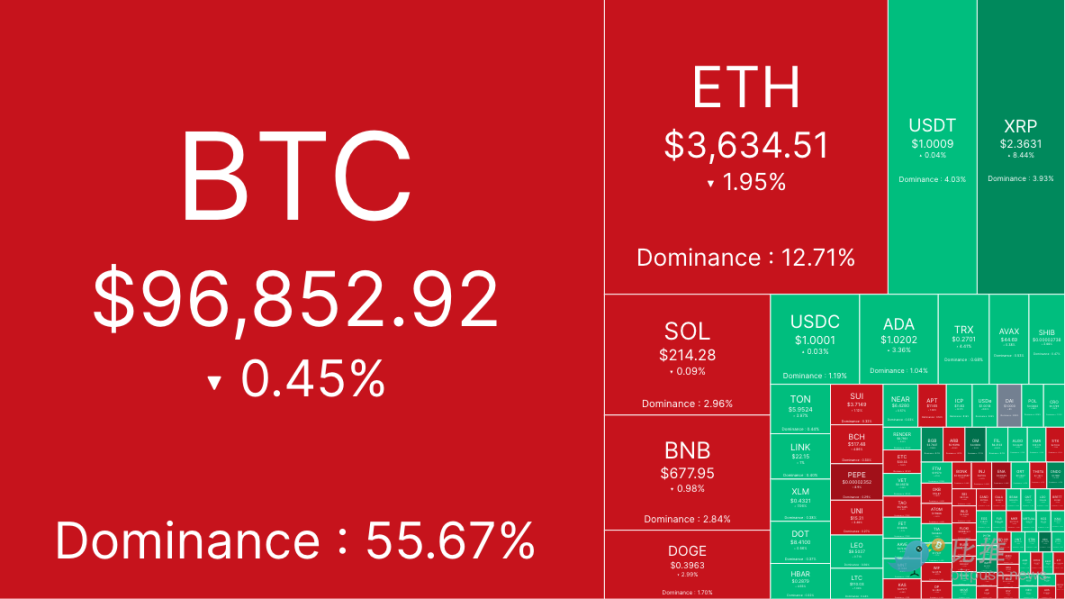

On Tuesday, the cryptocurrency market continued to adjust.

According to Bitpush data, BTC fell by 0.45% in the past 24 hours, maintaining above $96,000 at the time of writing. Altcoins experienced widespread declines, while XRP, among the established coins, rose against the trend, with a nearly 8% increase in 24 hours.

Ruslan Lienkha, market director at Youholder, stated that the overall market adjustment may be a response to the inflation data set to be released on Wednesday. He said, "The market expects inflation to rise slightly. However, if the CPI data exceeds expectations, it may exacerbate the ongoing adjustment in the financial markets. In this case, the timing and possibility of the Federal Reserve cutting interest rates will become a key focus in the new year."

"Market confidence is low"

Famous trader Skew commented on X: "It seems that bulls are exiting / taking profits here. Further confirmation that $97,700 - $98,000 is a key level for buyers to break even. This usually indicates that the market currently lacks confidence in the price until it strengthens further."

The crypto technical analysis team More Crypto Online warned that after reaching $94,000 the previous day, another local low may be created. Their latest tweet on X stated, "There is still a possibility of another low. After another low, the white wave d may test $100,000 again."

Bitcoin ETF unaffected by BTC price fluctuations

Data from Farside Investors shows that the daily net inflow amount for the U.S. spot Bitcoin exchange-traded fund (ETF) continues to reach millions of dollars, with nearly $500 million in inflows on December 9 alone.

Trading firm QCP Capital wrote in its latest market report on its Telegram channel: "Bitcoin suffered a $1.5 billion hit during the bull liquidation, plummeting $3,000, and then rebounding from the key support level of $95,000. Currently, the trading pair is consolidating around $97,000 to $98,000, with altcoins following closely. However, the performance of BTC and ETH spot ETFs is impressive, achieving net inflows for 8 and 11 consecutive days, respectively."

What’s next for the market?

Current market sentiment indicates that Bitcoin's upward trajectory is far from over. Analysts like Doctor Profit believe that the recent sideways consolidation is just a brief pause, and Bitcoin's price is likely to break through the target range of $125,000 to $135,000.

Historical data shows that the price fluctuations of Bitcoin are quite pronounced. In past bull markets, Bitcoin has experienced multiple 20%-30% corrections, followed by strong rebounds, ultimately reaching new highs.

As for altcoins, Michaël van de Poppe believes that altcoins are about to break free from the longest bear market. He thinks that with the expectation of a weaker dollar and increased liquidity, altcoins seem ready for a significant rise.

Charts released by Kaizen show that if compared to the situation in December 2020, when altcoins fell by 30%, followed by a three-month rebound with an increase of over 400%. Recently, altcoins have dropped by 25%, and if historical data is any reference, this could be a precursor to explosive growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。