🧐Must-Read Article|The Selling Rules of Altcoins Known by All Experienced Investors: How I Formulated My Selling Strategies During Three Bull Markets—

This is the most frequently asked question in the comments section recently, so I’m discussing it separately;

In a bull market, every rise is accompanied by excitement and an amplified desire, so most of the time, it seems like many people's assets are increasing in value. However, when the bear market comes again, the actual assets may not have increased;

The biggest reason for this is human greed and misconceptions;

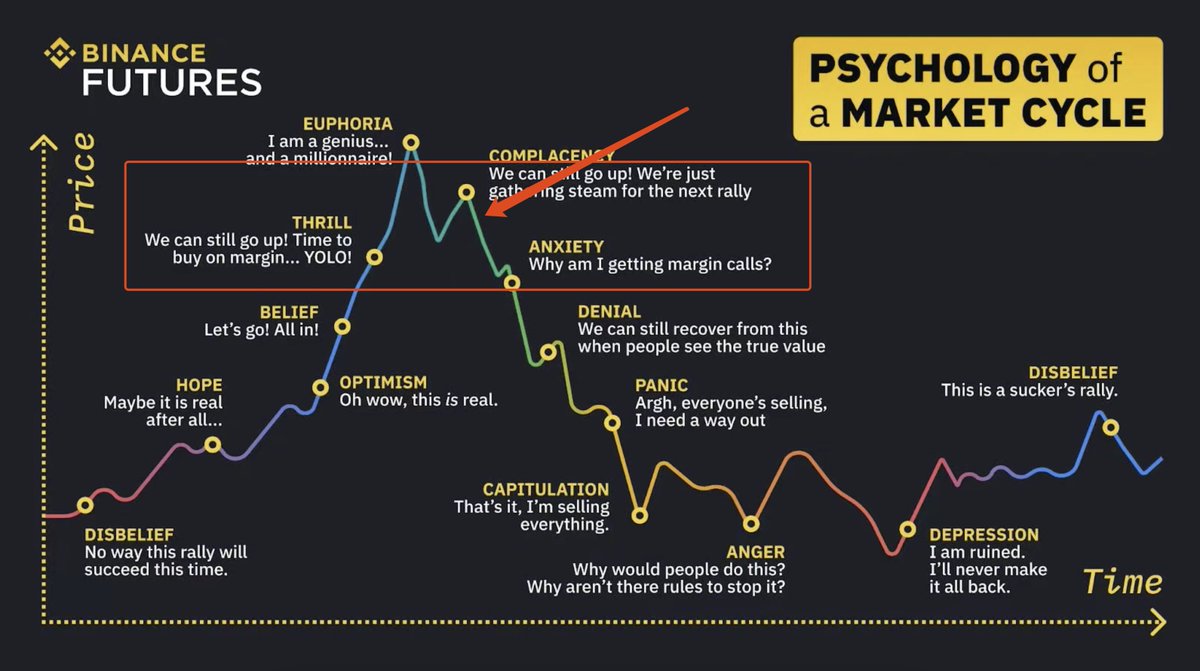

I previously wrote the following article: "How to Achieve the Perfect Exit"; it mainly focuses on judging the market trend through emotions and analyzing stages to achieve the best exit. Now, this article is more about the exit strategies for altcoins during different phases;

In a bull market, we need to formulate strategies for ourselves: how to set selling strategies for Bitcoin and Ethereum in the long term; how to set selling strategies for our altcoins in the short term; all of these are very important;

More importantly: once you have a strategy, you need to execute it firmly!

Last time I saw @kiki520_eth's method, I made some enhancements—

1⃣️ In a bull market, when the price doubles, gradually withdraw your principal.

The main goal of this step is to bring the psychological cost of the tokens to zero, so there’s less mental struggle;

If it drops—your principal has already been withdrawn, and what remains is profit, just a matter of how much you earn;

If it rises—there’s still more than half of the chips left, feeling great;

This way, you can avoid anxiety, and without anxiety, you can avoid internal conflict, allowing you to make big money.

Because money flows to those who are calm inside!

This rule can be used in a bull market because the probability of tokens doubling or even increasing many times is relatively high. In a bear market, it is crucial to avoid this, as you may not be able to double and could be stuck for many years;

2️⃣ In a bull market, do not sell all your good tokens; you must keep a base position!

After the first step, keeping a base position is essentially at zero cost. If the price continues to rise, you can gradually reduce your holdings, but you still cannot sell everything because you can’t imagine what the future will be like;

Because you’ve completed the first step, your mindset becomes proactive, making this step easy to execute. So when your tokens rise again, you can sell a portion each time it reaches your expected price, rather than selling everything; never sell everything;

My personal approach is:

Withdraw the principal when it doubles; for the remaining portion, when it reaches a certain price, sell half; then when it rises to another level, sell half again, always ensuring you have a certain amount of chips in hand;

If you get overly excited and sell everything, it’s irrational. As long as your assets are decent, the probability of a bull market taking off is very high. Selling everything at the bottom and missing out is a very painful experience;

Why do I say this? Because during the Gamefi boom in 2021, I bought Axie very early, but sold it all when it doubled, resulting in missing out on the profits, which almost drove me crazy;

Later, with Shiba Inu and other tokens, I followed the above rules and sold in batches, which led to huge profits. I think this part is not difficult to achieve, but sticking to it is very hard. Everyone can formulate rules that suit themselves.

So when should you sell everything?

Referring to my previous analysis of market sentiment, once there is a clear bear market process, you should sell all your remaining chips. Having already taken most of the profits earlier is a very comfortable thing.

3️⃣ Cycle it, and try to have several good tokens with a barbell strategy;

This is also very important; we all agree on the barbell strategy;

The barbell investment strategy is an asset allocation method whose core idea is to hold both low-risk and high-risk assets in an investment portfolio, thereby pursuing stable returns while not giving up the opportunity for high returns. The name of this strategy comes from the shape of a barbell, with one end being low-risk assets and the other end being high-risk assets, while the middle has relatively few or no medium-risk assets.

We believe the barbell strategy fits well with the early forms of the crypto space;

Because there are fundamentally no intermediaries; the early intermediaries were like EOS and Polkadot, which may not seem as good as Bitcoin and Ethereum, but are better than other coins. However, very few have managed to break out over the years; aside from Solana, there have been very few that have made it;

So my approach is to avoid allocating to such assets or to allocate very little;

Aside from Bitcoin and Ethereum, the remaining 20% of assets are mainly invested in early projects and high-risk assets;

These high-risk assets may include meme coins or sectors you believe will explode in a bull market. At certain points, as long as you have the bullets and make good allocations, when the opportunity arises, you can decisively invest;

This betting method will allow you to profit more easily, and even if you incur losses, it won’t be a big deal. The rise of Bitcoin will help you recover, making it more reasonable;

However, this strategy requires you to have the ability to filter and judge the market, as well as analyze projects and sectors, or you may need some industry connections to increase your win rate;

Conclusion—

Knowing how to buy is for novices, knowing how to sell is for masters; judging the bottom is relatively simple, especially after we understand the cyclical patterns; however, reaching the top requires enough courage, action, desire, and even a degree of insensitivity!

"Exiting at the top" is the most critical step in investing. In any bull market's peak area, almost 100% of investors are in a profitable state, but in the very short time when the "crazy bull" turns into a "crazy bear," only 10% of people can cash out and preserve profits to become winners.

This is especially important for altcoins because Bitcoin can drop and then rise again, but most altcoins, once they drop, may never recover. The next round will have new narratives and plays, and your wallet could end up permanently deflated!

The selling logic for altcoins and the main assets is two different sets of logic, but the timing should be in the same phase. The following diagram illustrates a range I drew, showing the rise approaching high points and the drop nearing high points. In these two phases, people still have a lot of fantasies, believing that miracles will happen, so the time frame is relatively long, generally lasting several months to half a year;

Therefore, your selling opportunities are quite long; it only depends on whether you can execute your strategy!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。