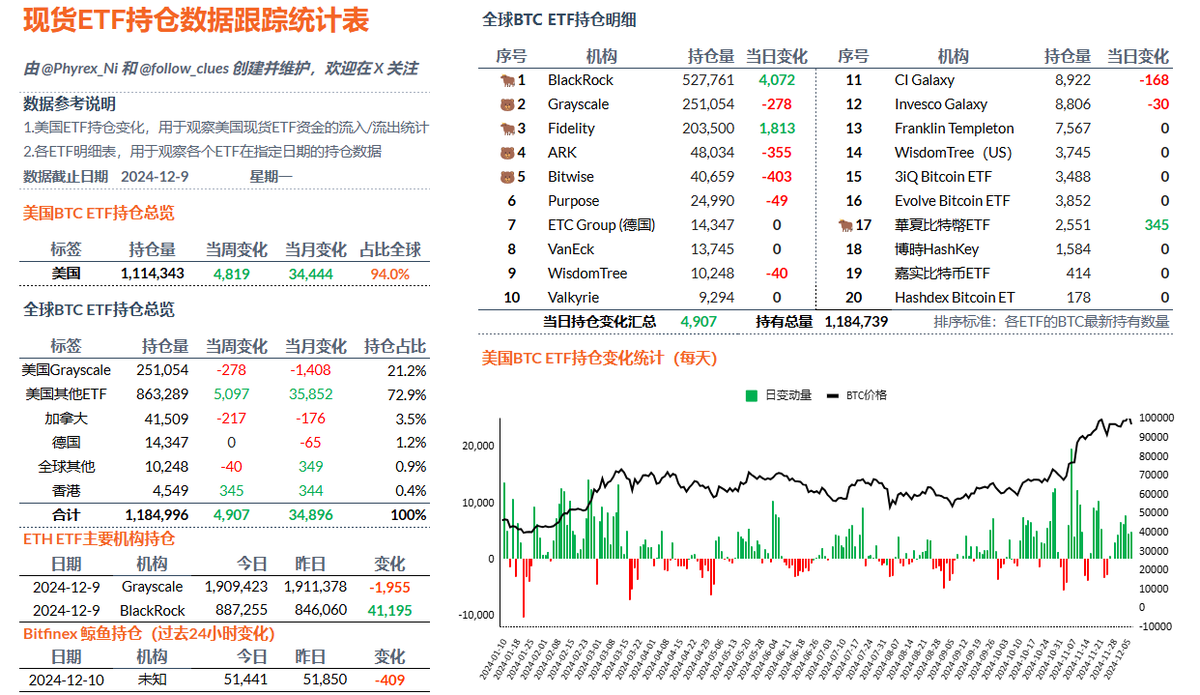

Although the data for BTC is not as dynamic as that for ETH, it can still be felt that while the FOMO sentiment among investors for BTC has faded, the purchasing power remains at a basic level and has not continued to decline. This indicates that many investors still believe that buying #BTC now is a worthwhile business. BlackRock and Fidelity continue to be the leaders, with a total of 5,885 BTC combined on Monday.

On the selling side, besides Grayscale, there are also Bitwise and ARK. Although the amounts are not large, it also reflects from another perspective that our previous judgment is correct: the FOMO sentiment among most investors has ended, and some investors believe that it is a good time to exit when the price is around $100,000.

This is not a problem. Yesterday, we discussed some topics about trends in our work. Currently, the positive news being released is very limited, making it difficult to continue driving users' FOMO sentiment. Unless new positive information comes out, it is very normal for investor sentiment to return to a lukewarm state, especially now that a consensus is being re-established among users between $95,000 and $98,000. A bit of fluctuation in this range is not a bad thing.

Once new positive news emerges, it is very likely that there will be another surge. As for negative news, the biggest possibility currently is the Federal Reserve's interest rate meeting in December. Theoretically, there shouldn't be much of an issue, with another 25 basis point cut expected in December, but it might be a bit difficult in January. Other negative news, such as the yen's interest rate hike, is still manageable. It should just cause some fluctuations.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。