Reviewing the Morning Plunge from the Perspective of Contract Data

This morning around 05:00, the cryptocurrency market experienced a sharp decline across the board.

Aside from $BTC and $ETH showing relatively high resilience, the situation for altcoins was not so optimistic.

There is a saying: "The real big money is often lost in a bull market."

This is because the bullish sentiment is high, and the usage of leverage is greater, leading to higher volatility.

Moreover, due to the forced liquidation mechanism of contract positions, when volatility suddenly amplifies and leads to liquidations, prices will further react to these liquidations, accelerating both upward and downward movements.

Now, let’s review some data from this downturn:

As shown in the image above, there was a particularly significant amount of liquidation data, with nearly $600 million in long positions liquidated within just a few minutes.

These positions, upon liquidation, effectively executed a "sell" action, which further exacerbated the speed of the decline.

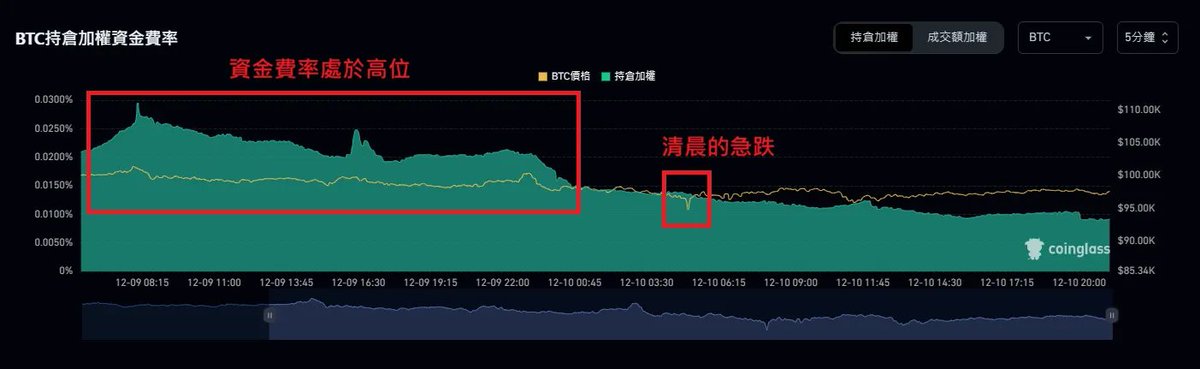

Next, let’s take a look at the funding rate:

A high funding rate usually indicates elevated market sentiment, even overheating.

This morning's sharp drop also caused the funding rate to gradually decrease afterward.

While a high funding rate does not necessarily mean that liquidations will occur, it does create an environment that is more susceptible to them.

Finally, although the bull market is filled with opportunities, the use of leverage to amplify profits is also common.

However, as mentioned earlier, bull markets often come with high volatility, and if risk management is not properly executed, it could lead to significant losses!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。