Author: 1912212.eth, Foresight News

After Bitcoin broke through the $100,000 mark, it did not stabilize as expected. Around 11 PM yesterday, it briefly surpassed $100,000 before declining sharply, dipping to around $94,150 by 5 AM today, and has since slightly rebounded to around $96,000.

Although Bitcoin did not experience a significant drop, the outlook for Ethereum is not optimistic. This morning at around 7 AM, it fell from $4,000 all the way down to around $3,500 before a slight rebound to about $3,700, with a daily decline of over 5%. With Ethereum unstable, other altcoins collectively showed signs of "shaky morale."

In the 24-hour decline, the public chain sector saw SOL drop over 8%, SUI over 12%, APT over 16%, SEI over 16%, and in the AI sector, WLD dropped over 19%, ARKM over 20%, and IO over 12%. In the L2 sector, OP dropped over 14% and ARB over 17%.

The contract data is grim. According to Coinglass data, the total liquidation across the network in the past 24 hours reached $1.725 billion, with long positions liquidated amounting to $1.557 billion, affecting approximately 574,168 people, with the largest liquidation occurring on Binance's ETH/USDT, valued at $16.69 million.

If we consider only the number of liquidations, today's figures even exceed the 100,000 people liquidated during the "312 crash."

The market is in turmoil; what is the cause of the sharp decline?

There is a lot of leverage in the market

The market is heavily leveraged. As early as December 6, Galaxy Digital CEO Mike Novogratz, in a recent interview with CNBC (commenting on BTC breaking $100,000), stated that there is a global surge in Bitcoin purchases, making it one of the first global assets. He warned that there is a lot of leverage in the system, and he is certain there will be one or two sharp corrections that will "test your soul," and this leverage will eventually be cleared out.

Since Trump's election victory on November 5, Bitcoin futures open interest has surged significantly, rising from $39 billion on November 5 to as high as $60 billion in early December, with trading activity and market speculation increasing wildly.

Taking the frenzied trading in South Korea as an example, last month CryptoQuant data showed that the total monthly trading volume of stablecoins on South Korea's top five CEXs—Upbit, Bithumb, Coinone, Korbit, and GOPAX—was approximately 16.17 trillion Korean won ($11.5 billion). This figure includes the total trading volume of stablecoins such as Tether (USDT) and USDC issued by Circle, and it has increased sevenfold compared to about 2 trillion won recorded at the beginning of the year. This is also the first time that South Korea's monthly stablecoin trading volume has exceeded 10 trillion won.

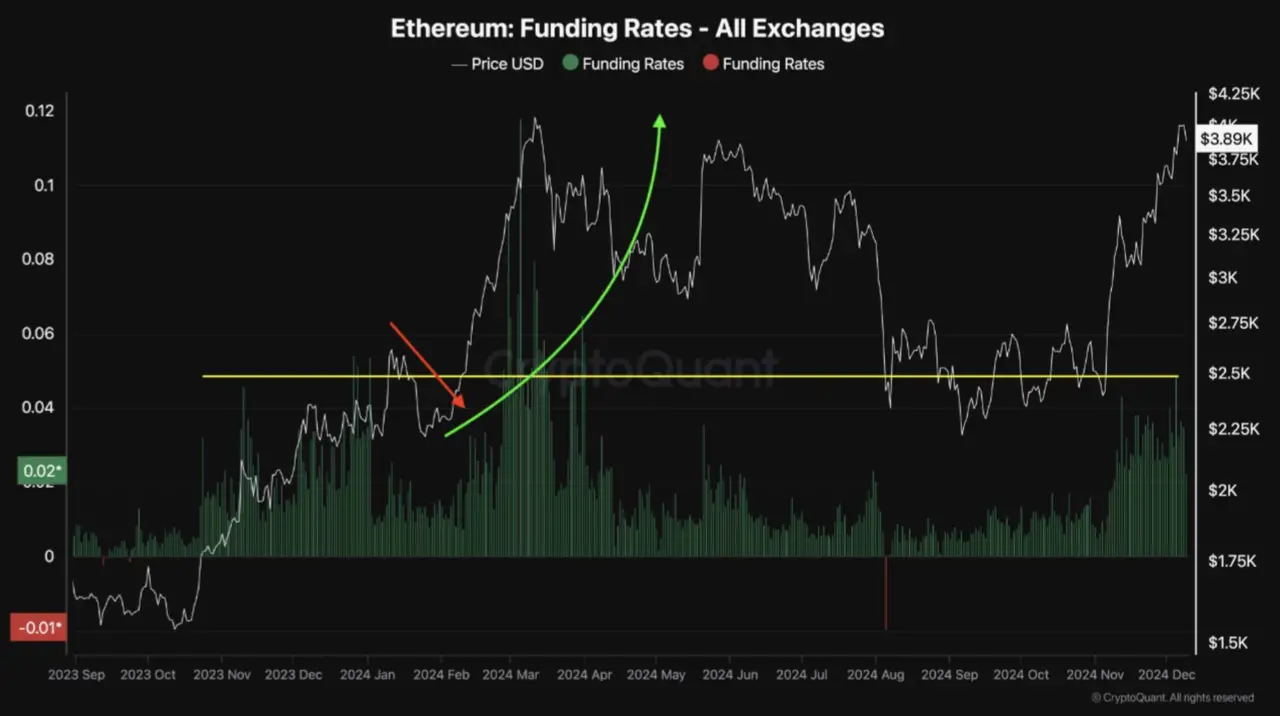

Yesterday, CryptoQuant analyst ShayanBTC's chart also showed that the Ethereum funding rate indicator in the futures market has surged to its highest level in months, with traders generally expecting a new historical high. However, the market may need to adjust to maintain this momentum.

Recently, various centralized exchanges like Binance and Bybit have seen the annualized rate for borrowing USDT exceed 50% during the recent altcoin frenzy, indicating that a significant number of users are leveraging by borrowing USDT through staking. The on-chain lending leader AAVE saw its USDC deposit annualized rate on the Ethereum network reach as high as 46%, while the USDT deposit rate reached 34%.

As of the time of writing, the annualized rates for stablecoins on exchanges and on-chain lending have returned to normal levels.

Global liquidity is continuously decreasing

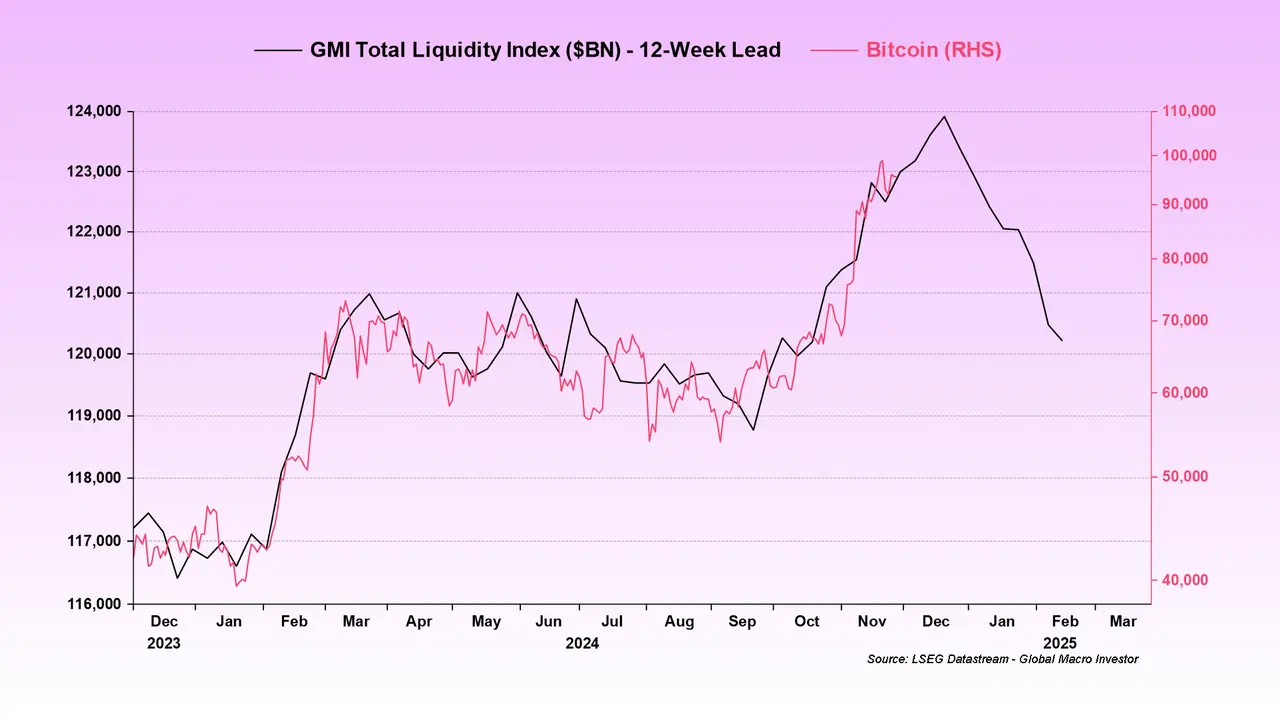

Cryptocurrency assets are increasingly influenced by macroeconomic factors, while the global liquidity that supports their prices is decreasing.

Moreover, many investors believe that the Federal Reserve will continue to cut interest rates, but currently, many institutions predict that the number of rate cuts by the Fed may be limited. Morgan Stanley economists expect the Fed to cut rates by 25 basis points in December and again in January, totaling only two cuts.

The liquidity fuel available in the market is becoming increasingly scarce, making price increases more difficult. The chart above shows that the decline has become quite steep, prompting some liquidity analysts to warn of an impending correction.

- In the 2017 cycle, this situation occurred in December 2017, and the bull market ended a month later.

- In the 2021 cycle, this situation occurred again in April 2021, and a month later, altcoins plummeted by 50%.

Weiss Crypto analyst Juan M Villaverde stated in his analysis of this major drop that it may not necessarily be the time to sell, but it serves as a warning that the recent market is unhealthy, and it always ends with a collapse of altcoins. The $100,000 level for Bitcoin is critical; if Bitcoin can break through and stabilize again, the current altcoin rebound will not end prematurely. However, if Bitcoin cannot stabilize at $100,000, the fate of altcoins is likely to fall back to the starting point.

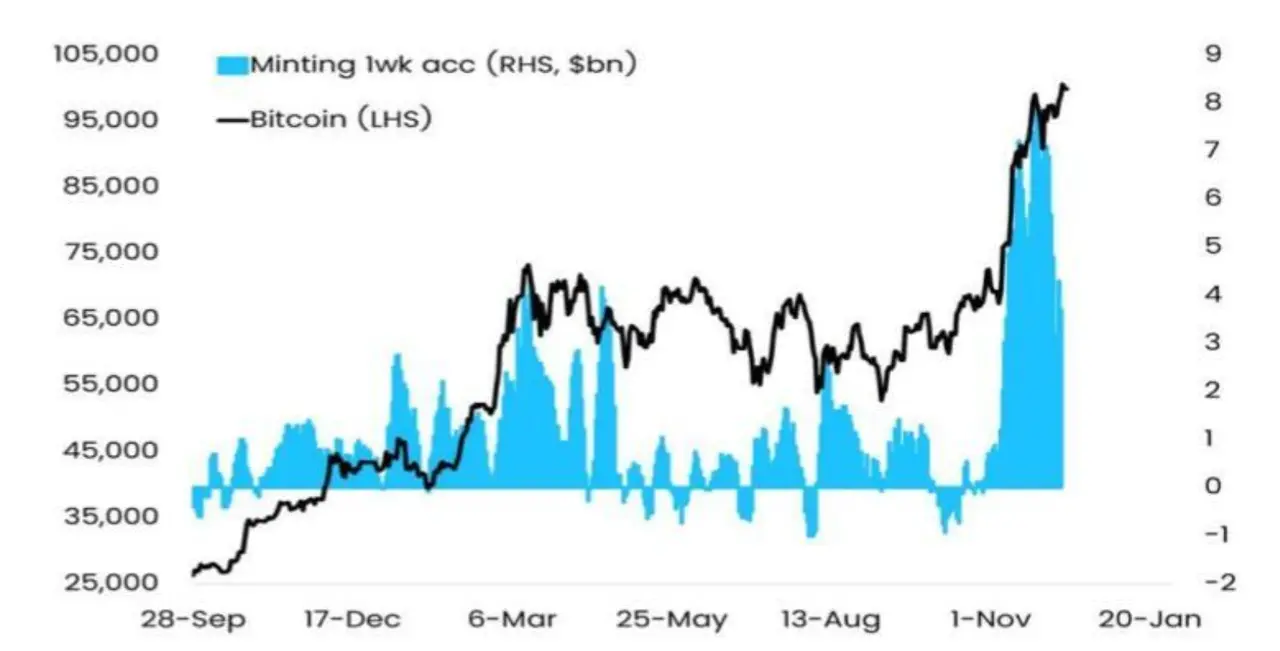

Matrixport's analysis indicates that while stablecoin-related indicators remain at relatively high levels over the past 12 months, the weekly inflow has significantly decreased, dropping from a peak of $8 billion to $4 billion.

This indicator needs to be closely monitored; if inflows continue to decrease, it may indicate that the market will enter a prolonged consolidation period, especially during the typically quiet year-end Christmas holiday period. Even if the trend of slowing inflows may persist, the outlook for the market performance in 2025 remains optimistic. Bitcoin prices are expected to rise steadily, but short-term gains may become moderate.

Additionally, according to CryptoQuant data, during the Bitcoin decline, the premium on Coinbase surged.

This kind of rebound typically indicates that when a significant number of small retail investors engage in panic selling, U.S. institutional investors are aggressively buying.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。