Original Title: "Bitcoin Plummets to $94,000, $1.716 Billion Liquidated Across the Network: In-Depth Analysis of Ethereum and Altcoin Market"

Original Author: Alvis, MarsBit

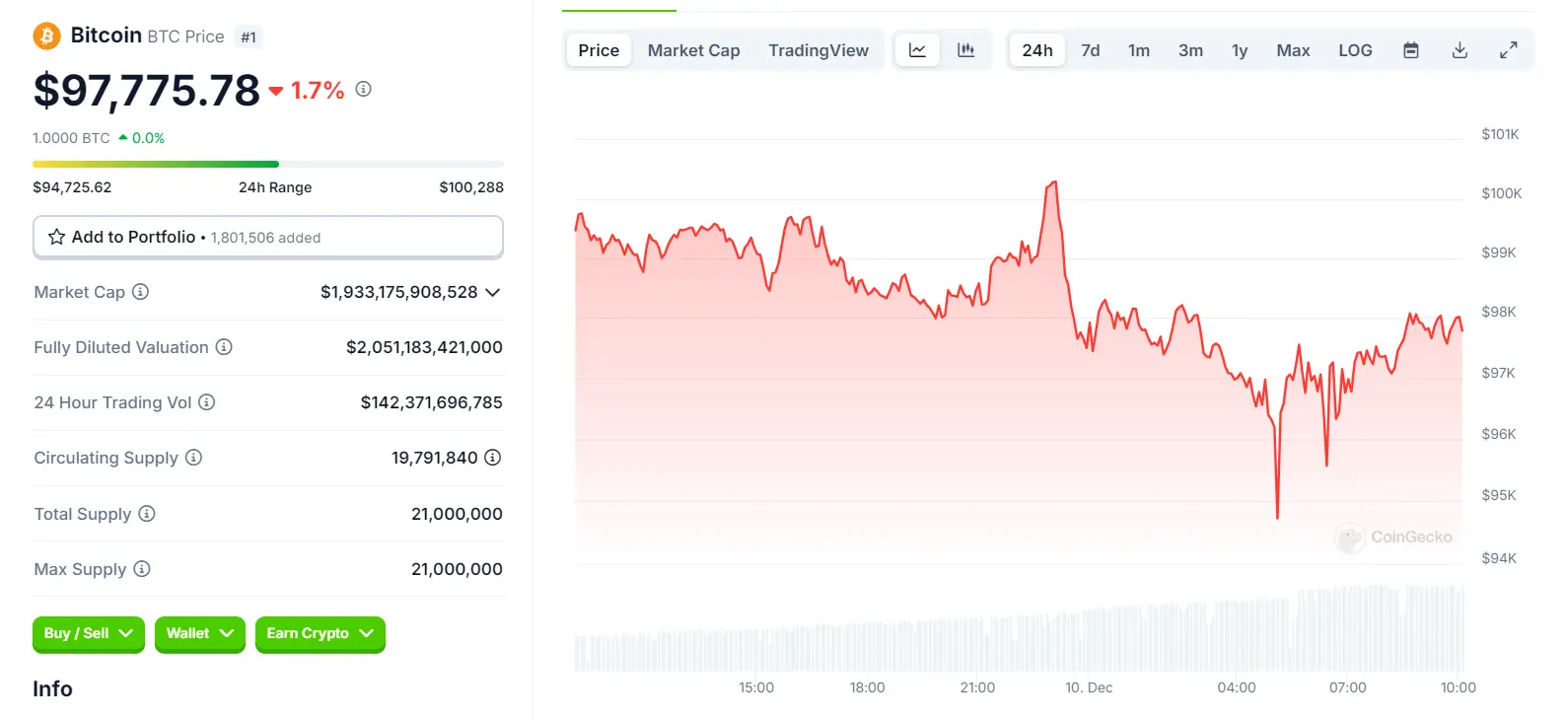

Early this morning, the price of Bitcoin briefly dropped to $94,000, triggering severe turbulence in the cryptocurrency market, with altcoins suffering even more, as most tokens fell by 20%-30%. As of the time of writing, Bitcoin has rebounded somewhat. This market turmoil resulted in a total liquidation amount of $1.716 billion across the network, involving 570,876 traders. This event not only marks the largest liquidation wave in nearly two years but also reflects the current structural risks and emotional volatility in the crypto market.

This article will deeply analyze the background, data, market impact, and future trends of this event.

Market Liquidation Scale Hits One-Year High: Leverage Trading Becomes Risk Flashpoint

This liquidation event set a new record with a liquidation amount of $1.716 billion, surpassing last month's single-day liquidation scale of about $500 million. Among these, long positions suffered particularly heavy losses, amounting to $1.53 billion, while short positions lost $155 million. Data shows that small altcoins became the "disaster zone" for this liquidation, with a liquidation amount reaching $564 million, of which over 96% were long positions.

Liquidation Disaster Zone: The Logic Behind the Platform Data

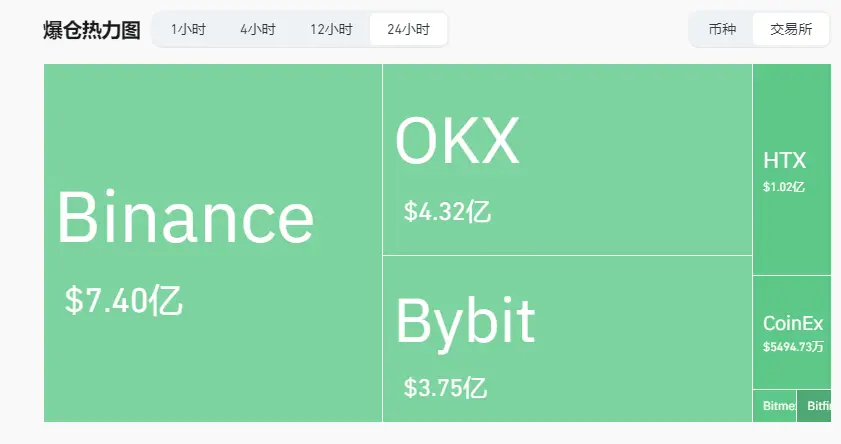

Binance led the liquidation with a total liquidation amount of $740 million, accounting for 42% of the total network liquidation.

OKX and Bybit ranked second and third, with liquidation amounts of $422 million and $369 million, respectively. The largest single liquidation transaction occurred in Binance's ETH/USDT contract, amounting to $19.69 million.

Bitcoin and Ethereum, as the two core assets of the crypto market, were not spared.

Bitcoin briefly fell below the psychological threshold of $100,000, dropping over $6,000 in one day, resulting in $182 million in liquidations, with long losses accounting for 77%.

Ethereum, after failing to break through the key resistance level of $4,050, re-tested the support at $3,500, recording $243 million in liquidations, with long positions losing $219 million.

Historical Perspective: Why Is This Liquidation Scale So Huge?

Large-scale liquidation events in the crypto market are not uncommon, but the scale of this liquidation wave is evidently exceptional.

From a trend perspective, since 2022, as the market size has expanded and leverage has increased, the total liquidation amount has continued to rise. More importantly, the concentrated risk exposure of leveraged traders has made the market more vulnerable in the face of extreme volatility.

It is noteworthy that the market has experienced several peaks of liquidation in the past year, but the scale has mostly hovered between $500 million and $1 billion. However, this amount has exceeded the previous high of liquidation amounts in the crypto market since the March 2021 incident, potentially setting a record for this bull market, and far surpassing the March 2020 incident.

The reasons for this liquidation wave mainly include: the chain reaction of high-leverage positions, the liquidation chain triggered by extreme market volatility, and the dominant structure of long positions. Especially, the spike in Bitcoin's price drop triggered leveraged liquidations, coupled with the high volatility of the altcoin market, caused the liquidation amount of long positions to exceed 90%. Compared to the external shocks of the March 2020 incident, this time it is more a result of internal leverage imbalance.

This serves as a reminder to investors: in a high-volatility market, rationally controlling leverage is key to long-term participation.

Ethereum: From On-Chain Activity to Resilience in the Derivatives Market

On-Chain Data and Network Activity

In the past 7 days, DApp transaction volume ranking

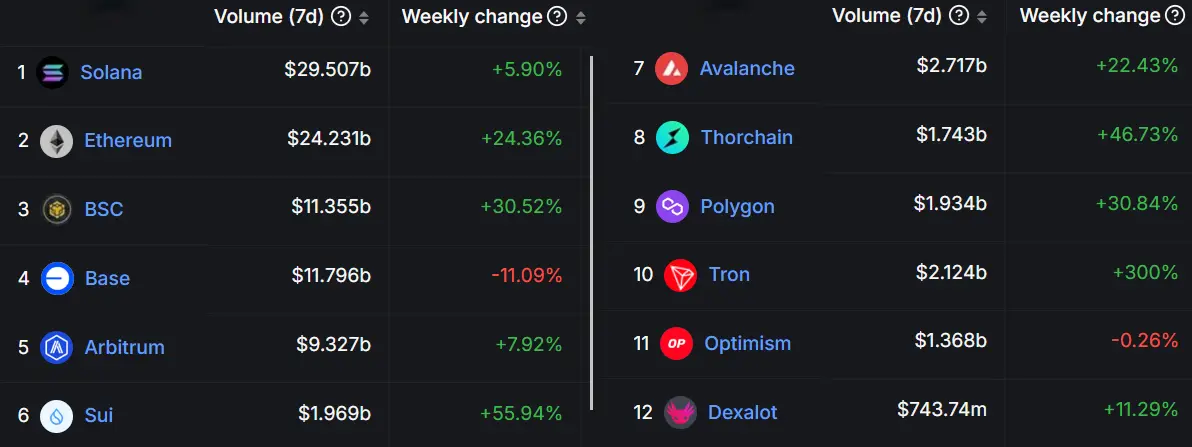

As the second-largest asset in the market, Ethereum has shown a certain degree of resilience during this liquidation wave. On-chain data shows that Ethereum network transaction volume surged by 24% in the past week, reaching $24.2 billion. Including second-layer solutions like Base, Arbitrum, and Polygon, the total transaction volume skyrocketed to $48.6 billion. This figure far exceeds Solana's $29.5 billion, indicating that Ethereum's network activity remains high.

Additionally, since November 29, the inflow of ETH ETF funds has reached a historical high of $1.17 billion, injecting liquidity into the market. Nevertheless, the ETH price still failed to break through the long-term resistance level of $4,050, and the pressure from this technical threshold clearly restricts price movements.

Derivatives Market Signals: Optimism Not Fully Dispersed

From the futures and options market perspective, the ETH derivatives market still maintains strong resilience.

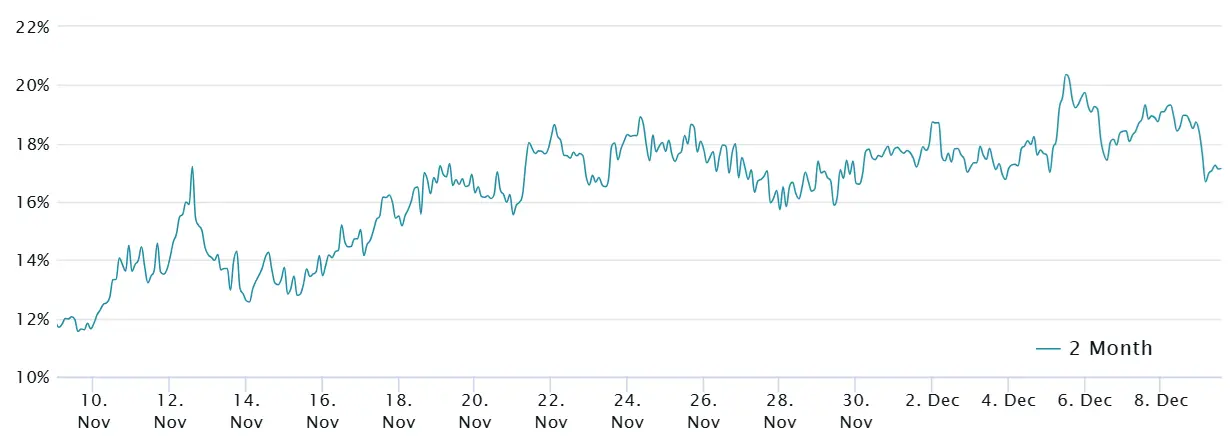

The annualized premium for Ethereum futures remains at 17%, well above the neutral level of 10%, indicating sustained demand for ETH leverage.

Meanwhile, the skew of Ethereum options has shifted from -7% to -2%, showing that market sentiment has transitioned from extreme optimism to neutrality, but no significant bearish signals have emerged.

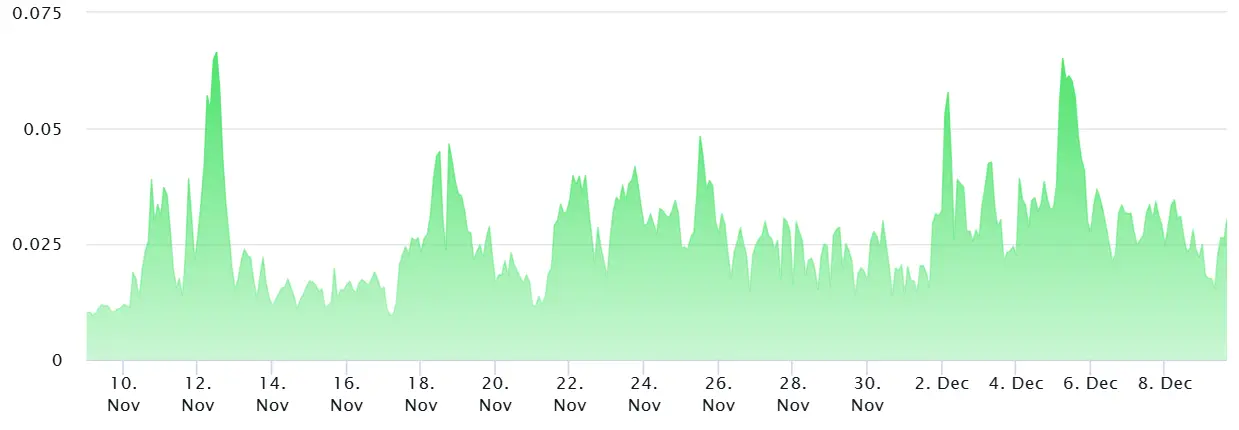

Furthermore, the perpetual contract financing rate is currently at 2.7%, above the neutral threshold of 2.1%, indicating that demand for short-term leverage remains strong. However, the financing rate has gradually decreased from a peak of 5.4% on December 5, which may also reflect an increased caution among some traders regarding market volatility.

Macro and Micro: Dual Factors Affecting Market Sentiment

Volatility in the crypto market often accompanies changes in macroeconomic variables. This recent plunge is no exception, as the macroeconomic environment has significantly impacted investor confidence.

Recently, China's November inflation data fell by 0.6% month-on-month, reflecting the risks of weak global economic growth. Additionally, Nvidia's stock price decline due to monopoly investigations has intensified downward pressure on the tech sector, indirectly affecting investors' preferences for risk assets.

At the same time, the inherent volatility and structural risks of the cryptocurrency market have exacerbated panic sentiment. Although the activity level of on-chain data and the inflow of ETF funds provided some support for the market, they did not fully offset the negative impact of the external environment.

Future Outlook: Can Altcoins Find a Breathing Space?

Technical Aspects and Key Support Levels

Bitcoin needs to stabilize above the key psychological threshold of $100,000 to stabilize market sentiment; Ethereum must re-challenge the resistance level of $4,050 to restore investor confidence. Regarding altcoins, although the current liquidation ratio is high, the market may present rebound opportunities after experiencing a deep correction, especially for projects with strong fundamentals and community support.

Structural Opportunities and Risks

The actions of institutional investors during this liquidation event are worth noting. The inflow of ETF funds and the improvement in on-chain data may provide a foundation for future market recovery, but the high-leverage operations of retail traders remain a major source of market vulnerability. In the short term, as market turbulence gradually calms, professional investors may reposition their holdings to lay the groundwork for the next market trend.

Conclusion: Market Review and Warnings After the Liquidation Storm

This liquidation event once again highlights the high volatility and high-risk characteristics of the cryptocurrency market. The spike in Bitcoin and Ethereum prices not only brought about short-term panic but also reminds investors to prudently manage leverage positions to avoid falling into uncontrollable risks due to market fluctuations.

According to CoinGlass data, the probability of Bitcoin rising in December and January over the past 12 years has been around 50%. This historical data indicates that the overall performance of the crypto market at the end of the year and the beginning of the year tends to be relatively flat, with increased volatility but unclear trends. In the future, investors need to pay more attention to market data, macroeconomic conditions, and the dynamic changes in leverage positions, ensuring effective risk management to support long-term investment strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。