The total disclosed financing in November is $2.1 billion, distributed across 106 projects, showing only a slight decrease compared to last month.

Author: Cheeky Rolo

Translation: Deep Tide TechFlow

Comments from @cheeky_rolo:

In last month's Web3 fundraising snapshot, I mentioned that venture capital firms (VCs) typically "reduce operational activity" in the last two months of the year. Looking back at that statement, I feel it may not have accurately conveyed my meaning. "Reducing operational activity" can be interpreted in two ways:

It may mean that the end of the year is very busy, focusing on closing long-delayed deals to clear up work as the new year begins;

It may also mean a reduction in workload, with a more relaxed pace.

According to data from Carta, November and December are actually the months with the highest transaction volume of the year, busier than most other months. However, this trend does not apply to the Web3 sector. From the data we have, Web3 venture capital does not show a similar behavior of concentrating on closing deals at the end of the year. Specifically for the data in November 2024, we did not see a significant increase in the number of transactions. I will explore this in more detail in future articles.

Additionally, the data for November 2024 also indicates that the volatility of the cryptocurrency market does not have a direct impact on the financing of early-stage startups. As mentioned in previous months, the inflow of venture capital funds typically experiences a significant delay after Bitcoin (BTC) reaches an all-time high (ATH). The performance in November 2024 is relatively sluggish, and I do not expect much improvement by the end of the year.

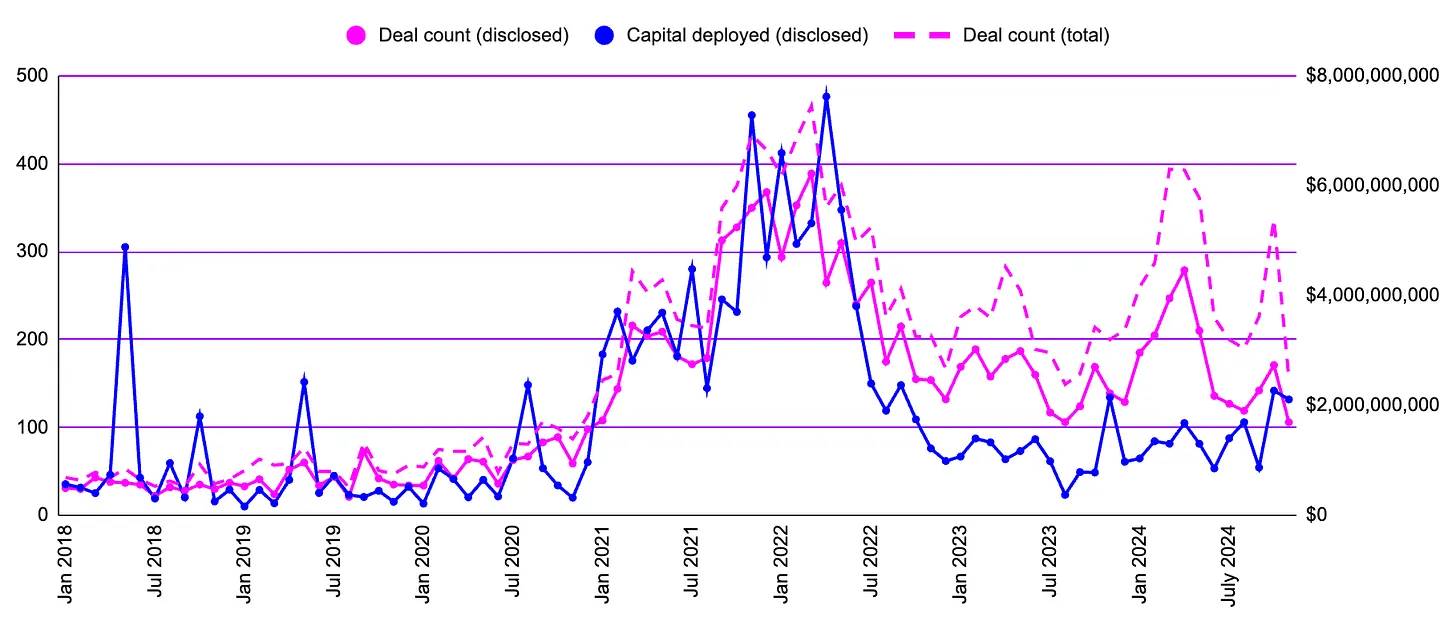

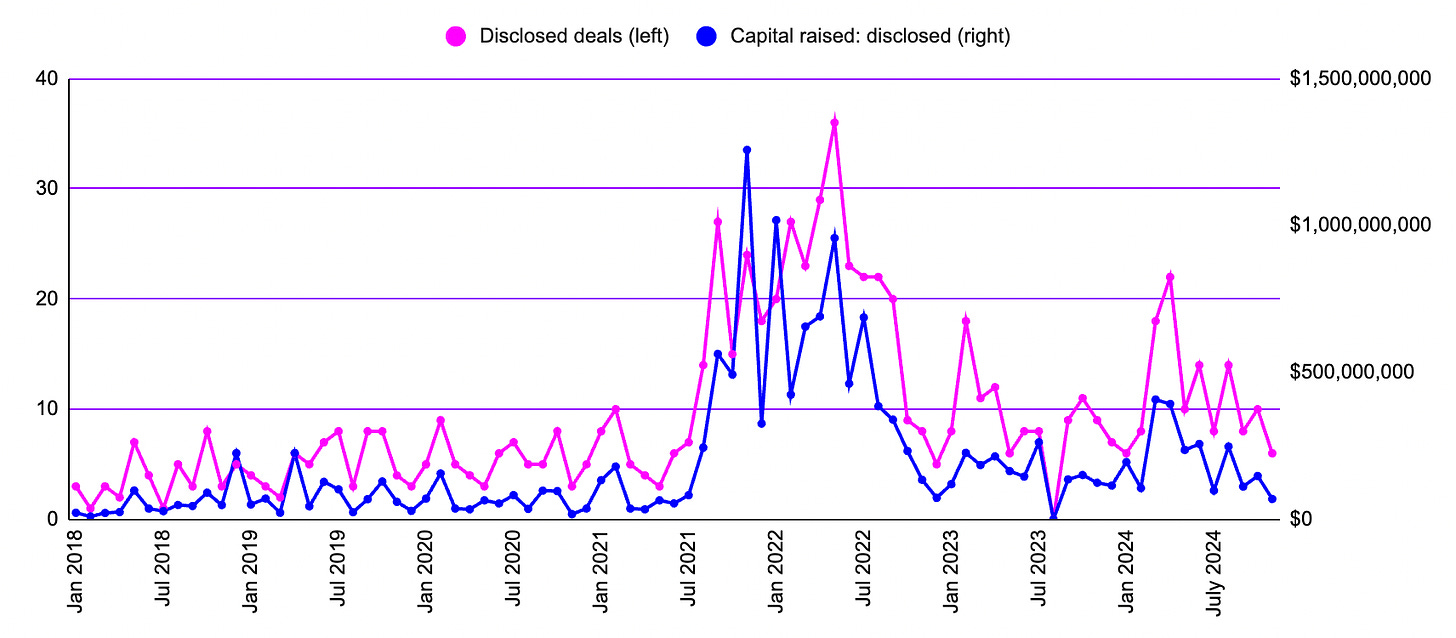

Web3 Market Overview: Financing Situation of Companies at Various Stages Since 2018

Source: Messari. Data is updated monthly, and previous months' data may be slightly adjusted (for example, previously unreported financing activities may be included, or duplicate records may be removed).

Key Data for November 2024:

The total disclosed financing is $2.1 billion, distributed across 106 projects, showing only a slight decrease compared to last month.

- The total number of transactions is 156, which is only half of the total transactions in October 2024. Based on this, we can estimate that the total financing across all stages is approximately $3.1 billion.

So far in 2024, the total disclosed financing is $15.8 billion, involving 1,927 projects.

- The total number of transactions is 3,033, with an expected total financing of $25.4 billion for the year.

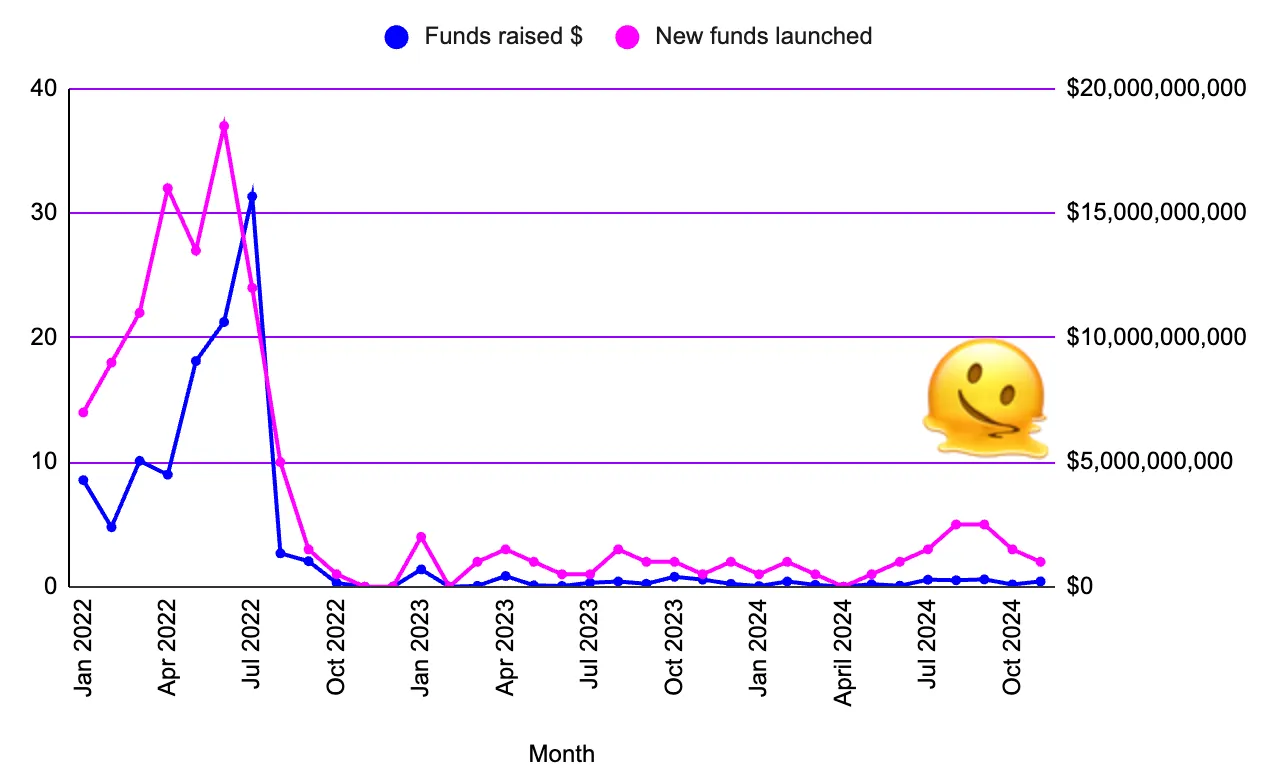

Launch of Crypto Venture Capital Funds Since 2022:

Two funds launched, raising a total of $215 million:

Portal VC launched a $75 million fund, focusing on investing in one founder per category, with an emphasis on Bitcoin programmability, decentralized physical infrastructure networks (DePIN), and maximum extractable value (MEV) business models.

Accolade Partners raised $135 million through two investment vehicles.

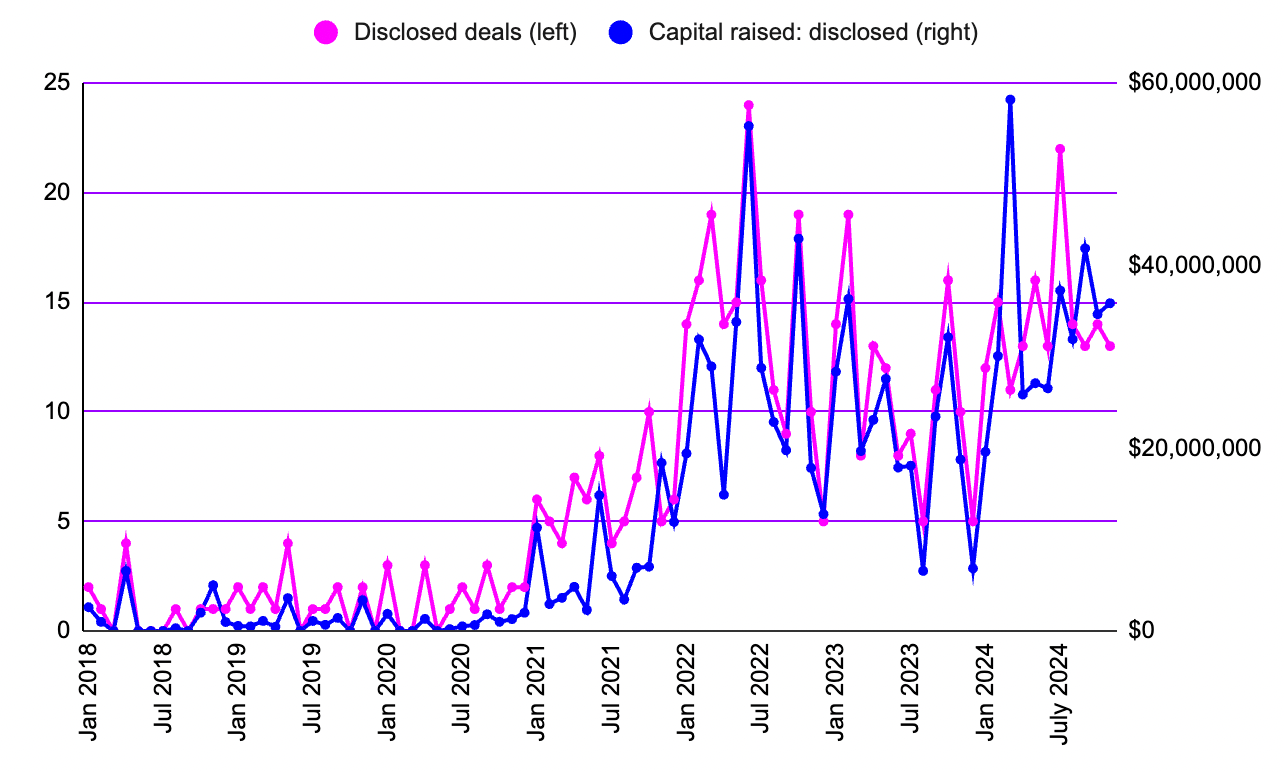

Pre-seed Web3 Financing Data Since 2018

The total disclosed financing is $36 million, distributed across 13 pre-seed financing activities.

- The total number of transactions is 13, down from 18 in October 2024.

The average financing size for pre-seed this month is $2.7 million.

- Since 2018, the average financing size for pre-seed companies has been $1.6 million.

Market Highlights This Month:

vlayer secured $10 million in pre-seed financing, supported by top venture capitalists and industry builders, which is significant for the Web3 ecosystem as it addresses a key challenge of connecting blockchain with real-world systems through verifiable data.

vlayer introduced four groundbreaking Solidity functions—Time Travel, Teleport, zkTLS (Web Proof), and zkEmail (Email Proof)—enhancing Ethereum's capabilities to enable smart contracts to seamlessly interact with on-chain and off-chain data. By leveraging advanced cryptographic technologies such as Zero Knowledge Proofs (ZKPs) and Multi-Party Computations (MPC), vlayer aims to make decentralized applications (dApps) more powerful, scalable, and impactful, paving the way for broader adoption and real-world applications.

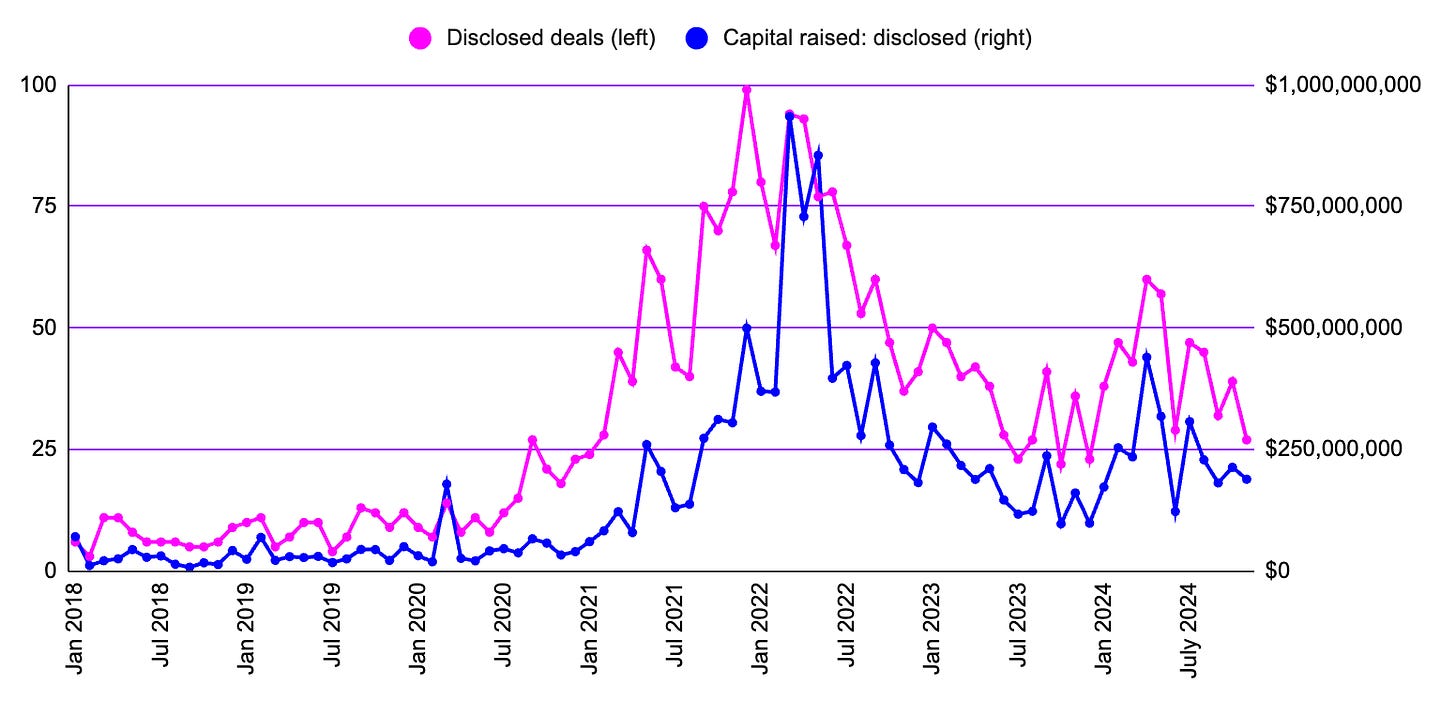

Seed Round Web3 Financing Data Since 2018

In November 2024, the total seed round financing is $18.9 million, down 11% from last month, involving 27 seed-stage companies (disclosed).

- The total number of transactions is 33, down from 43 in October; the expected total seed round financing for this month is approximately $23.1 million.

The average financing size for seed rounds this month is $7 million.

- Since 2018, the average financing size for seed round companies has been $4.6 million.

Market Highlights This Month:

0G Labs completed a total financing of $290 million, including $40 million in seed round financing and a $250 million token purchase commitment. This milestone financing marks the accelerated development of the integration of blockchain and AI, bringing significant breakthroughs to the Web3 ecosystem.

0G Labs is developing a decentralized AI operating system (dAIOS) that combines scalability, privacy, and verifiability, aiming to define AI as a public good, making it more inclusive and less susceptible to censorship. Its technological innovations include a data availability layer supporting data processing speeds of up to 50GB/second, and a decentralized AI service marketplace that significantly enhances the efficiency of AI and blockchain integration. This financing not only addresses key bottlenecks in the current integration of AI and blockchain but also reflects investors' high confidence in decentralized AI solutions. With this breakthrough, 0G Labs is poised to become a leader in the next wave of Web3 innovation.

Series A Web3 Financing Data Since 2018

In November 2024, the total Series A financing is $69.5 million, involving 6 Series A stage companies (disclosed).

The average financing size for Series A this month is $11.5 million.

- Since 2018, the average financing size for Series A companies has been $17.5 million.

Market Highlights This Month:

Monkey Tilt completed $30 million in Series A financing, reflecting the growing trend of integration between entertainment, gaming, and Web3 technology, while showcasing the potential of crypto technology platforms to reshape traditional industries.

The Monkey Tilt platform is redefining online gambling as a more interactive and community-driven experience by integrating multi-currency crypto payment systems, immersive social features, and collaborations with culturally relevant brands and influencers. The platform focuses on combining traditional casino games, sports betting, and crypto technology, demonstrating how Web3 can open new use cases for the entertainment industry and attract mainstream audiences. In this way, Monkey Tilt not only promotes the adoption of decentralized technology but also injects new vitality into the entertainment industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。