1. Project Overview

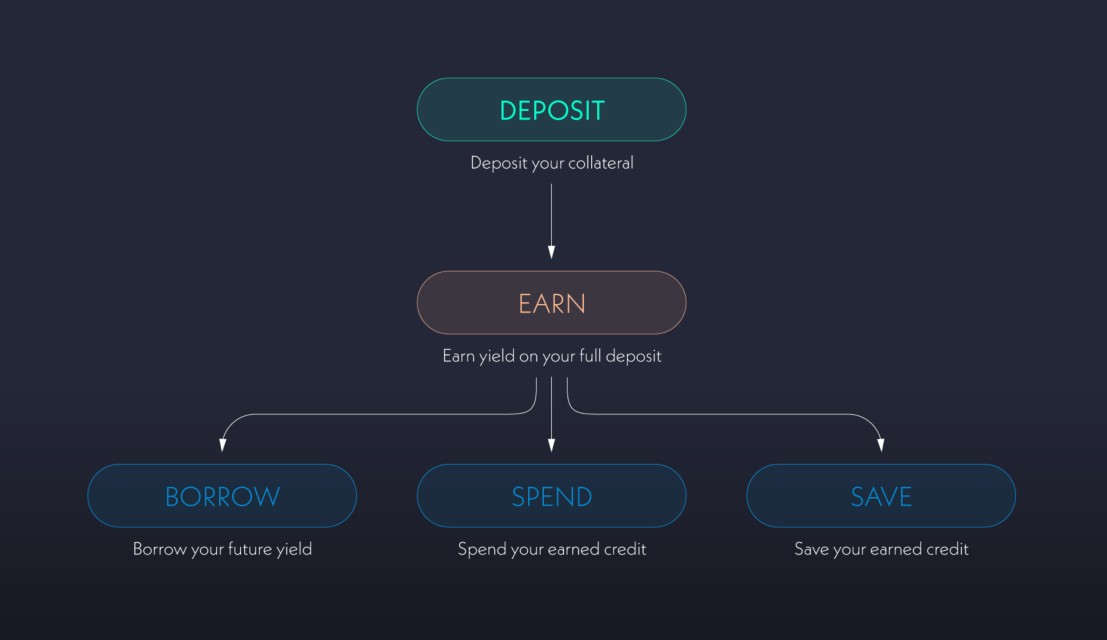

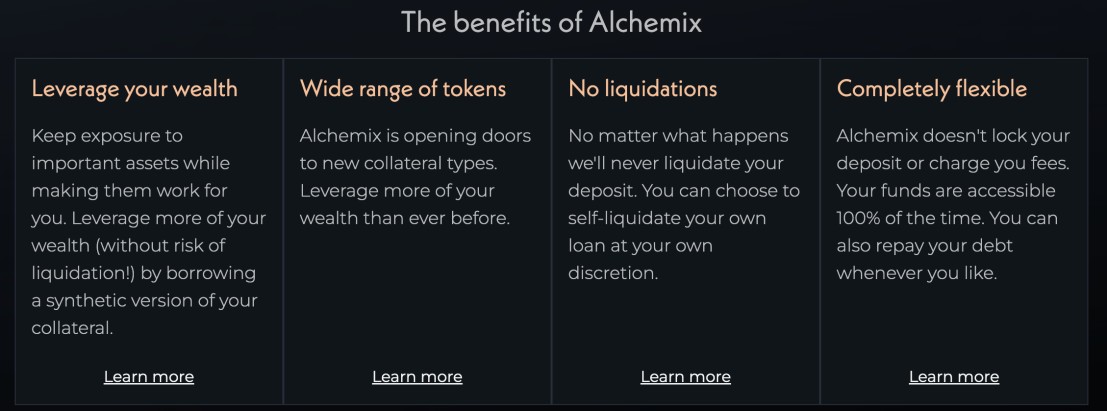

Alchemix is a DeFi protocol designed to provide users with a new financial experience based on collateralized assets. Through Alchemix, users can advance future asset earnings without paying interest or facing liquidation risks, greatly enhancing capital efficiency. The project is centered around decentralized governance, advocating for transparent and fair financial services, injecting new vitality into the DeFi ecosystem.

The core feature of Alchemix is its unique self-repaying loan mechanism. After users collateralize their assets in a smart contract, they can immediately borrow the corresponding alAssets (such as alUSD). Over time, the earnings generated from the collateralized assets will automatically be used to repay the loan. Users do not need to intervene manually, and loans will not be liquidated due to market fluctuations, providing users with great convenience and security.

Alchemix supports various types of collateral and offers diversified earning strategies. Users can choose the collateralization plan that best suits their asset management needs, allowing for flexible capital allocation.

Additionally, its Transmuter feature allows users to deposit the generated alAssets into a converter to gradually convert them into their corresponding underlying assets at a 1:1 ratio. This feature not only stabilizes the price of alAssets but also provides users with diverse asset management options.

Alchemix is managed by a decentralized autonomous organization, and ALCX token holders can participate in governance decisions through voting. This governance mechanism ensures the protocol's transparency and deep community involvement, laying the foundation for the platform's sustainable development.

In summary, Alchemix has become an important pioneer in the DeFi space with its innovative mechanisms and user-friendly feature design. Its unique self-repaying loan model, diverse collateral strategies, and decentralized governance structure provide users with efficient, flexible, and secure asset management tools.

2. Latest News and Developments

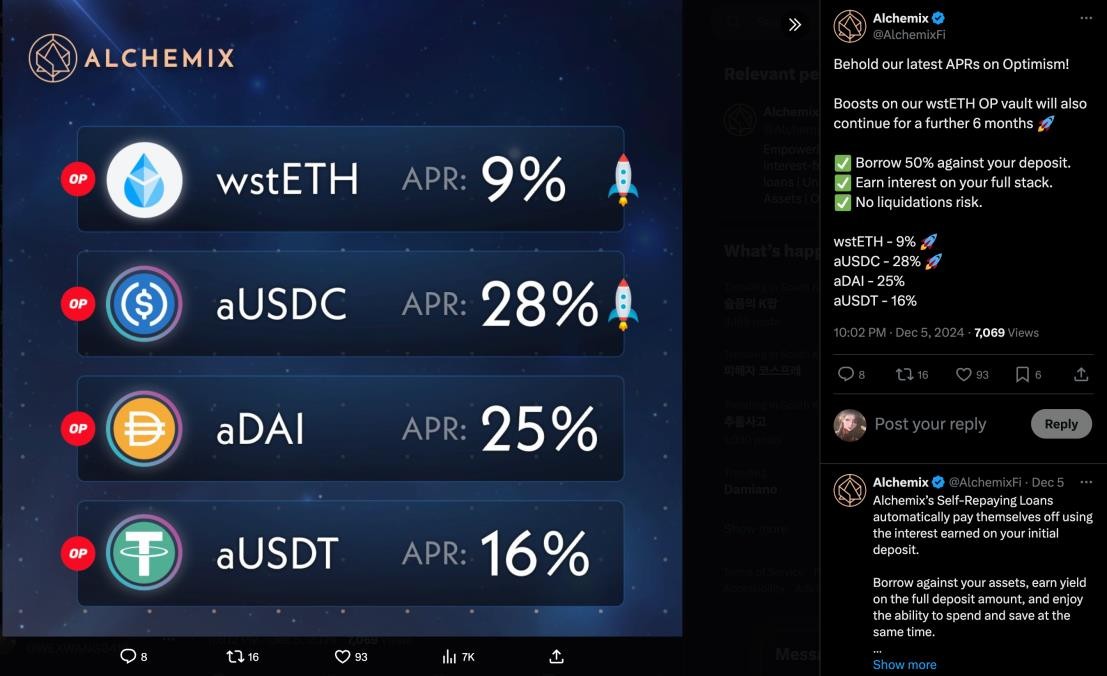

According to an official X message, ALCX has updated its latest optimized annual profit, and the appreciation of the wstETH OP vault will continue for 6 months, with 50% of deposits used as collateral for borrowing. Users can earn full interest without liquidation risk.

The official X message announced that the ALCX/ETH pool generated $875,000 in incentives. The incentive method adopted by the official is a typical 80/20 Balancer pool fee-sharing model.

Of this, 50% is for liquidity providers, 12.5% is for the DAO organization, and 37.5% is for veBAL lockers.

At the same time, the ALCX/ETH "core pool" status transforms this split into: 50% for liquidity providers, 12.5% for Balancer DAO, and 37.5% for voting incentives for veBAL/vlAura holders supporting the core pool.

Through adjustments in the core pool, ALCX has created $875,000 in rewards for voters supporting this pool. Thanks to the voting multiplier, this number expands to over $1 million in rewards. Overall, this is positive news for the platform's liquidity and governance.

3. Large Unlocks and Distribution

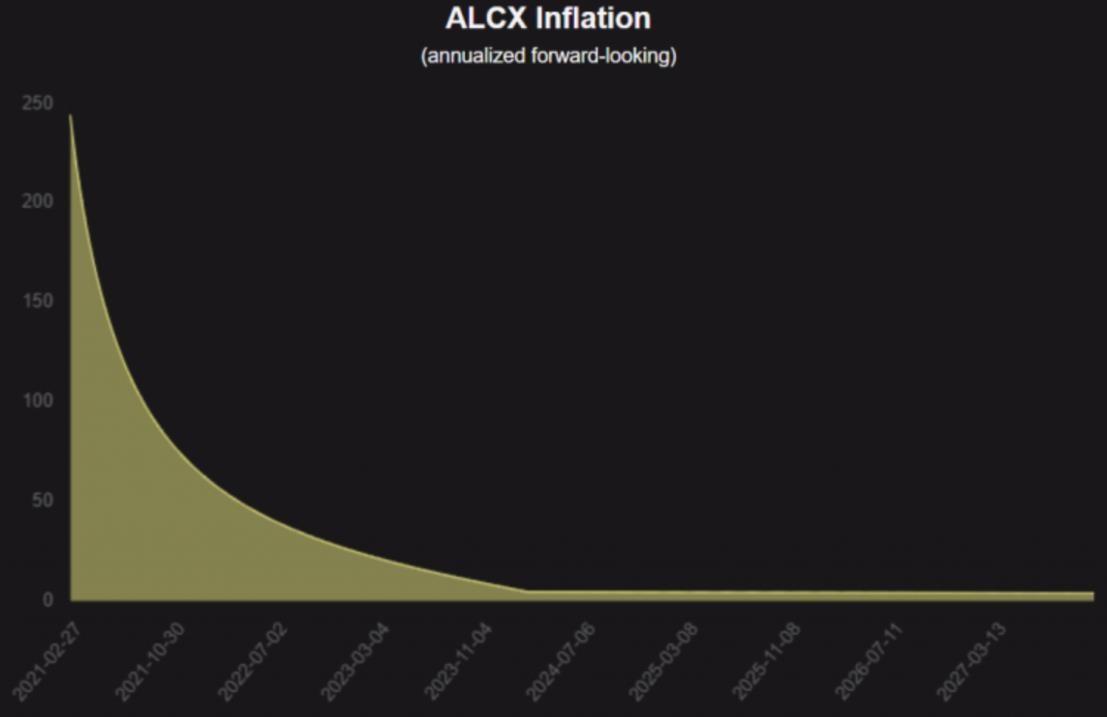

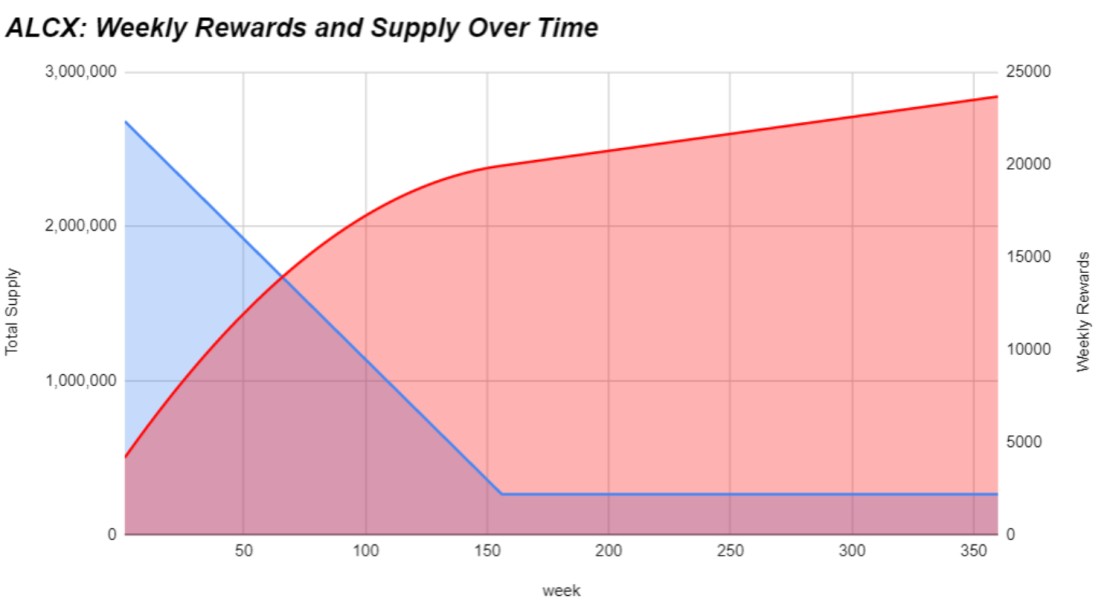

The ALCX token had no pre-sale or external financing at issuance, with no hard cap, but there is a predetermined token unlock and minting plan. The issuance volume is the rate at which new ALCX tokens are minted. The token issuance volume is allocated to liquidity providers, the treasury, and protocol contributors.

The issuance of ALCX (slow minting) gradually decreases over three years while maintaining a fixed weekly issuance volume in a long tail. Alchemix is currently in the long tail phase, minting 2,200 ALCX tokens weekly indefinitely.

In the initial issuance of the project tokens, 15% was pre-mined for Alchemix DAO, 5% for bug bounties, and 80% of the tokens can be obtained through LP staking.

Founders, developers, and community contributors have access to an exclusive staking pool, which will receive 20% of the current ALCX issuance. This equates to 16% of the supply after three years.

Stakers and liquidity providers are eligible for 80% of the ALCX block rewards, which will amount to 64% of the supply after three years. Currently, a portion of these issuances is sent to the treasury.

The initial supply of the token was 478,612 $ALCX, minted as pre-mining. Alchemix calculates that there will be 2,393,060 $ALCX in circulation after three years, distributed as follows: 15% to the DAO treasury, 5% for the bug bounty program. The staking pool distributed approximately 22,344 $ALCX tokens in the first week, decreasing by 130 $ALCX each week for the first three years. The calculated results are approximations, as $ALCX rewards are calculated per block, and while network conditions can be negligible, they may slightly affect the timeline.

Alchemix has a history of over three years, which means a fixed weekly issuance of 2,200 ALCX. This will lead to a gradual decrease in the inflation rate over time.

The above two images mainly reflect the ALCX supply, incentives, and supply situation over time.

4. On-Chain Situation

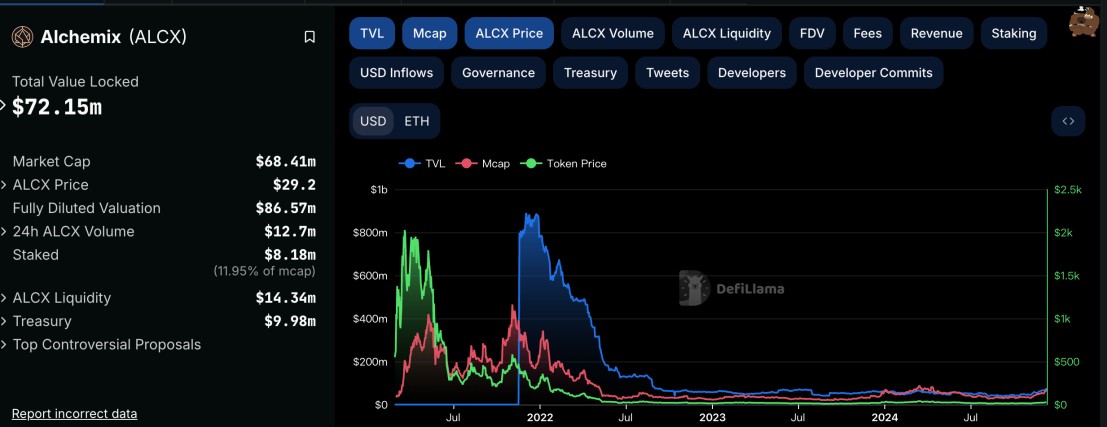

The following chart shows the TVP, market capitalization, and token price of the ALCX token on DefiLlama. Overall, after a sharp decline in TVL in 2022, the market capitalization and token price have also stagnated, showing little improvement so far.

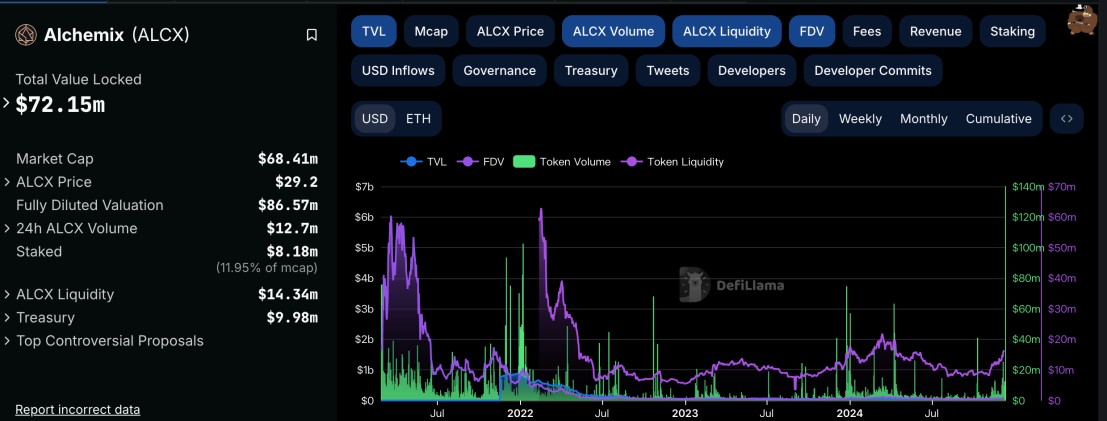

The following chart mainly reflects the trading volume, liquidity, and fully diluted market capitalization data of ALCX. It can be seen that the trading volume has not shown excessive weakness overall, liquidity is at historical lows, but overall, it has recently been recovering.

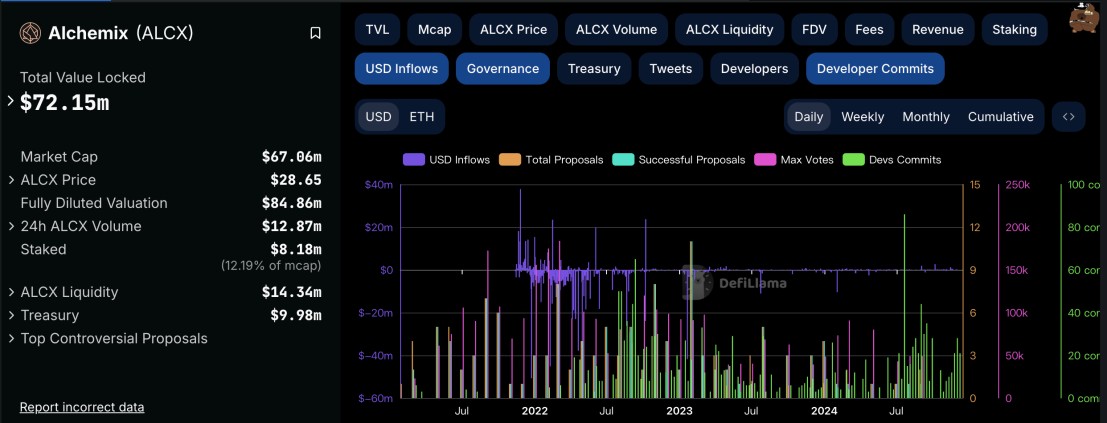

The following chart mainly captures the dollar inflow and community governance tendencies, including developers' expectations. Overall, after the sharp drop in TVL, dollars have basically stopped flowing into the ALCX token. However, relatively speaking, the community's attitude is quite positive, and developers have not engaged in excessive arbitrage behavior; overall, the community atmosphere is very good.

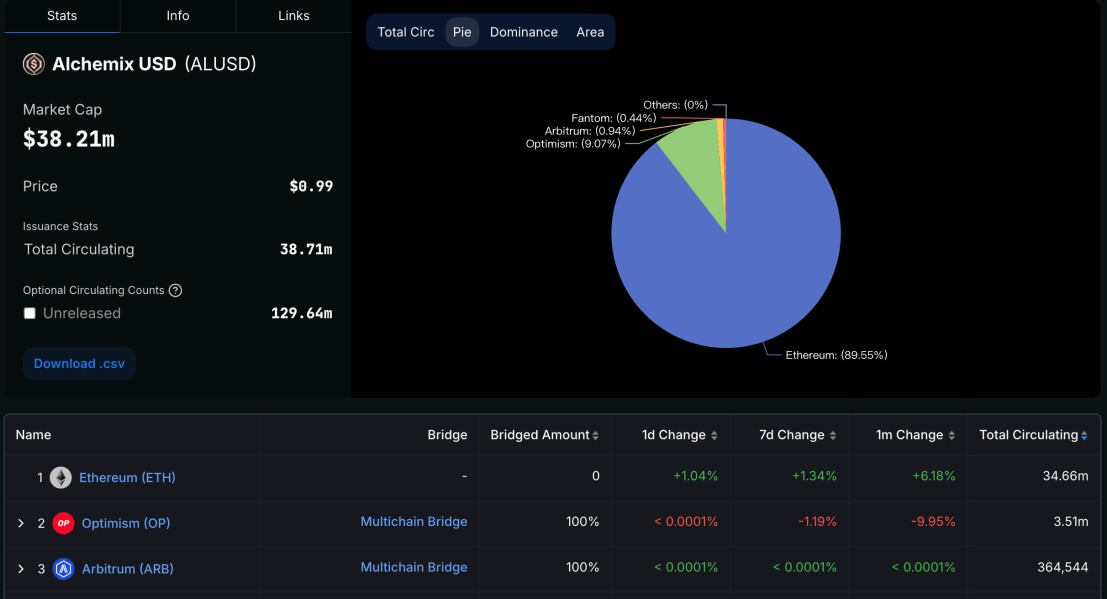

The following chart shows the stablecoin ALUSD issued by the Alchemix project. Overall, it can be seen that the main supporting assets are ETH and OP, and considering the supply volume, there is no outstanding performance, making it difficult to distinguish core competitiveness.

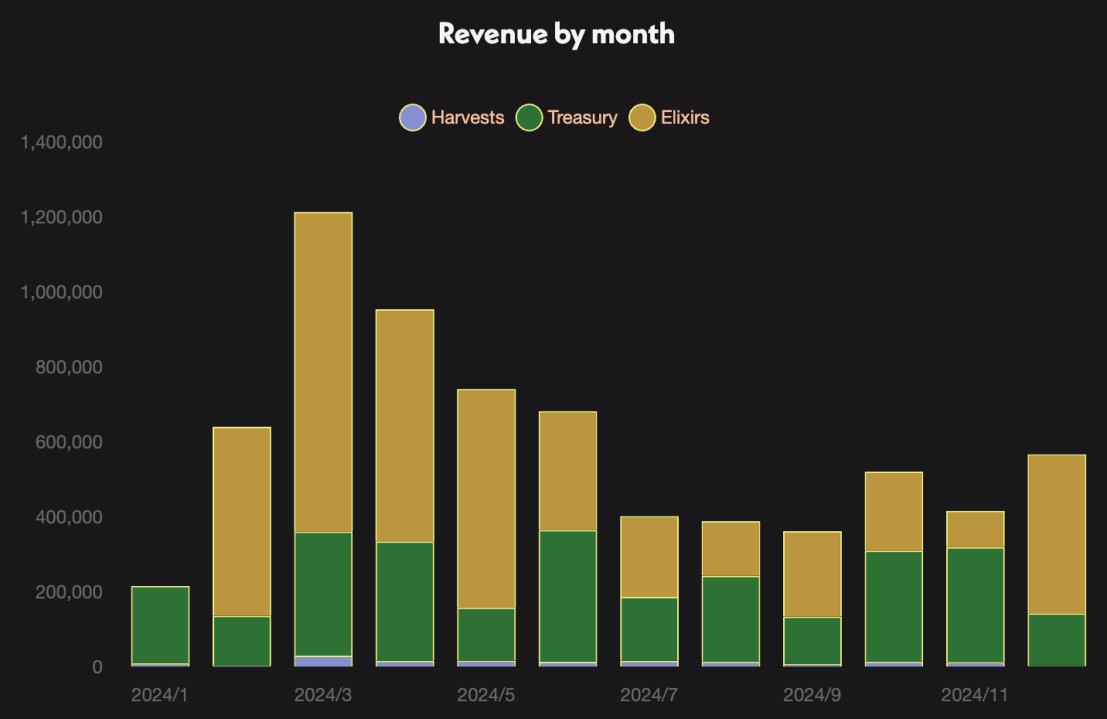

The following chart shows the income situation of the ALCX platform this year, with data provided by the official statistics platform.

The following chart also reveals the ALCX-related holding data.

5. Off-Chain Situation

The above chart shows the overall volatility over the past year. Overall, with the recent hype around decentralized finance concepts, ALCX, as an established platform, is gradually gaining attention.

However, from a long-term trend perspective, the current ALCX, even with some increase, is still far from its initial issuance price, which is not conducive to boosting market confidence.

The above chart mainly shows the distribution of ALCX token holdings, indicating that very few whales hold over 70% of ALCX token assets, meaning the price could be easily manipulated and does not signal sufficient liquidity for trading.

6. Conclusion, Background Supplement, and Opinions

As an important innovative project in the decentralized finance (DeFi) space, Alchemix's self-repaying loan mechanism and diversified asset management solutions provide users with an unprecedented financial experience. By offering a borrowing method with no liquidation risk, Alchemix provides a flexible, secure, and efficient solution, which is highly competitive in the DeFi industry. However, despite Alchemix's innovative products and efficient features, the volatility of its token price and market performance, as well as liquidity issues, still require attention. Overall, Alchemix has significant development potential, but whether it can continue to attract users and stabilize its market performance will require more efforts in future operations.

Currently, Alchemix's biggest highlight is its unique self-repaying loan mechanism, which is a very rare and revolutionary feature in DeFi projects. This mechanism not only improves capital utilization efficiency but also significantly reduces the risks brought by market volatility, allowing users to enjoy borrowing services while avoiding liquidation risks. At the same time, the diversified earning strategies and decentralized governance model provided by Alchemix also inject more sustainability into its platform. However, the market's sluggishness and lack of core competitiveness remain urgent issues for the project to address. Although the community atmosphere is positive, the low liquidity of the ALCX token, mostly held by a few large holders, may pose a risk of price manipulation.

For investors, Alchemix's token ALCX currently faces certain market pressures, making it almost impossible to return to its initial issuance price in the short term. However, in the long run, Alchemix's innovations in the decentralized finance space and its unique self-repaying loan mechanism still hold strong market appeal.

Investors can pay attention to the project's technological progress and market dynamics, especially changes in its liquidity improvement and token distribution structure. In the short term, as the upward trend in token prices has not fully broken the original bottom consolidation structure, caution is advised, and excessive investment is not recommended; while in the medium to long term, if Alchemix can further enhance its market liquidity and expand its user base, it will be a potential project worth continuous attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。