1. Growth of the Iranian Cryptocurrency Market and User Base

Market Revenue Growth: According to Statista, the revenue of the Iranian cryptocurrency market is expected to reach $807.1 million by 2024. Although the annual growth rate is projected to be -3.06% from 2024 to 2025, market revenue will still reach $782.4 million by 2025.

User Growth: It is expected that the number of cryptocurrency users in Iran will reach 3.89 million by 2025, with a penetration rate of 4.31%.

2. Three Major Potentials of the Iranian Cryptocurrency Market

- Economic Potential

Channels for Capital Inflow: In the face of harsh international sanctions, Iran has found an innovative way to bypass traditional financial barriers through cryptocurrency to promote international capital inflow. The decentralization and non-regulatory nature of the cryptocurrency market allow Iran to attract global funds, especially when traditional financial channels are restricted, providing significant support for its national finances.

International Trade Payment Methods: Iran utilizes its energy resources for large-scale cryptocurrency mining activities to reduce dependence on sanctioned settlement currencies in international trade. By converting energy resources like oil and gas into cryptocurrency assets that can be traded in international markets, Iran has successfully created a new type of trade payment method, which not only facilitates the import and export of goods but also enhances its voice in international markets.

- Technological Potential

Development of Blockchain Technology: Iran has shown a strong interest in promoting the application and research of blockchain technology, particularly notable is its leading position in the development of Central Bank Digital Currency (CBDC). The introduction of blockchain technology is not limited to the financial sector but extends to government services, supply chain management, and the automation of commercial contracts, bringing technological innovation to multiple industries.

Progress in Digital Currency: The Central Bank of Iran is actively developing the "Digital Rial," a digital currency project aimed at reducing the use of cash in circulation, optimizing the efficiency of domestic payment systems, and enhancing the transparency and security of the financial system. Additionally, the launch of the Digital Rial may lay the foundation for Iran in the digital economy era, enhancing its adaptability to global digital finance.

- Social Potential

Improvement of Financial Inclusion: Driven by cryptocurrency, the accessibility of financial services in Iran has significantly increased, especially among residents in remote areas and cities with inadequate traditional banking services. As an innovative financial tool, cryptocurrency allows unbanked populations to engage in economic interactions and investments more conveniently, thereby promoting financial inclusion in society.

3. Arbitrage Signal Indicators in Iran

- Signal Sources and Trigger Conditions

Local Demand Leads to Premium: The demand for cryptocurrency in Iran is mainly concentrated on stablecoins (such as USDT) for international trade settlement and value storage. An escalation of international sanctions typically drives up local market demand for cryptocurrencies, resulting in price premiums.

Trigger Conditions: Government announcements regarding new agreements for cryptocurrency settlements, changes in central bank policies, or escalations in international sanctions.

Restricted Trading Channels: Iranian users primarily purchase cryptocurrencies through OTC trading or decentralized exchanges. Trading restrictions may lead to insufficient liquidity and rising local prices.

Trigger Conditions: Events such as payment gateways being shut down or restrictions on cross-border transfers.

- Technical Indicators for Signal Monitoring

Spread Analysis:

Compare cryptocurrency prices on major global exchanges (such as Binance) with local OTC prices in Iran (IranCoin, BTXCapital, FaraPay, Exir, etc.) to identify price premiums.

Using Indicator: Price Difference Percentage = (Local Price - Global Average Price) / Global Average Price.

Signal: When the price difference exceeds 5%-10%, there may be arbitrage opportunities.

Volume Spike:

Monitor changes in cryptocurrency trading volume in the Iranian market. An abnormal increase in trading volume may reflect a surge in demand.

- Arbitrage Strategy Entry

Entry: Strategy - Arbitrage Opportunity

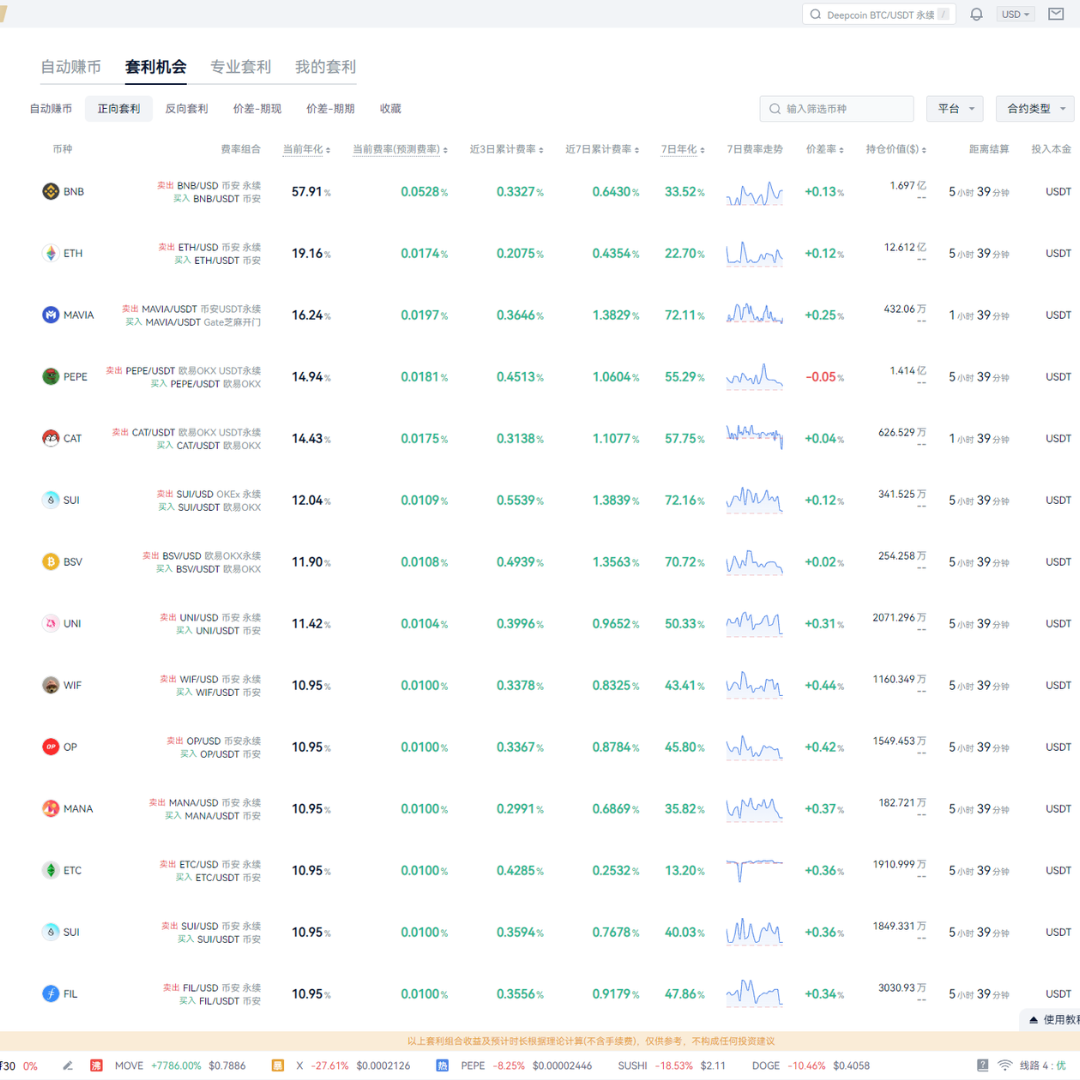

Covers both directional arbitrage and spread strategies such as cash-futures spread and futures-futures spread. Choose your preferred arbitrage plan to earn coins steadily around the clock.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。