The platform and users are destined to complement each other. A platform that can truly benefit users will naturally be pushed to the forefront by them.

Author: Martin Talk

"In the crypto world, a day is like a year in the human world," crypto players often use this phrase to describe the fast-paced changes in the cryptocurrency market. With each transition between bull and bear markets, the CEX market landscape undergoes a reshuffle, and those who follow the trend ride the wave.

The gears of fate are turning again, and a new round of three major patterns is quietly taking shape, with Bitget gradually becoming a key player that cannot be ignored at the table. Supported by its rapidly developing platform business, Bitget's platform token BGB has also achieved impressive results, with a cumulative increase of 391% this year, surpassing BTC and ETH.

With BTC successfully breaking the $100,000 mark, crypto has once again become the focus of mainstream attention. For leading platforms like Binance, OKX, and Bitget, attracting new incremental users and expanding their user base has become the key to the new round of competition.

1. The Narrative Returns to the Platform Token Sector, BGB Dominates This Year

Recently, the platform token sector has been bustling, once again attracting market attention.

On December 4, Binance's platform token BNB, which had been silent throughout the bull market, began a violent surge, nearing $800 and setting a new high, with a daily increase of over 20%, quickly becoming industry headlines.

Bitget's platform token BGB also refused to be outdone, dominating the increase charts for several consecutive days starting from December 4, with a cumulative increase of over 70%; furthermore, the price of BGB also broke through to $2.8, with a circulating market value reaching $3.9 billion.

In fact, the value of platform tokens has been largely overlooked this year, with market narratives focusing more on various short-term hot topics like memes. However, looking at the entire crypto market, only platform tokens can be said to have value support. After all, the only truly profitable business in the current market is the "selling water" business, where users provide trading services and collect transaction fees—exchanges are typical representatives of this type, and platform tokens naturally rise with the tide.

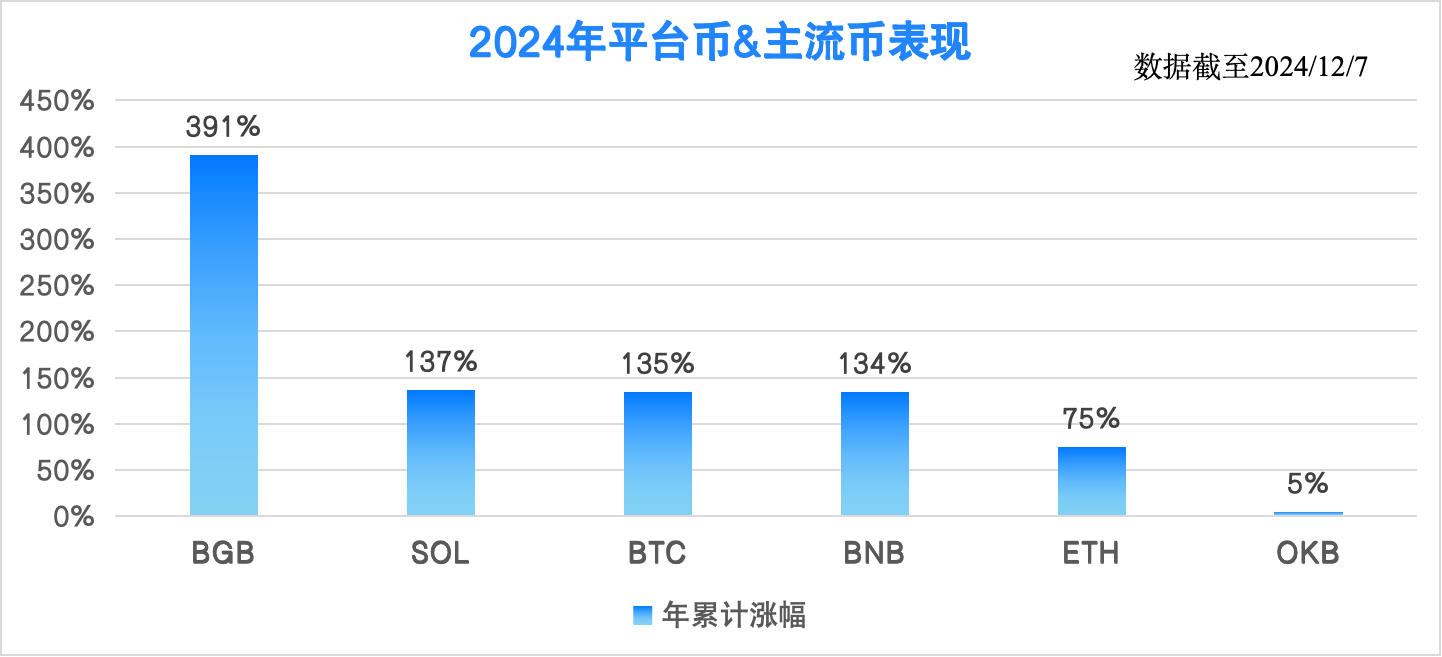

Therefore, platform tokens with value support are bound to become the focus of the next round of narratives in the crypto market. How to select the best alpha assets from numerous platform tokens? We will compare the three major platform tokens with BTC, ETH, and SOL, which may provide an answer, as shown below:

Data shows that since the beginning of this year, among mainstream CEX platform tokens, BGB has the highest cumulative increase, reaching 391%, surpassing BNB (134% increase) and OKB (5% increase); moreover, BGB's cumulative increase also exceeds SOL (137% increase), BTC (135% increase), and ETH (75% increase).

Additionally, BGB's circulating market value ($3.9 billion) still has significant growth potential compared to BNB's circulating market value of $106.7 billion. For crypto users, holding BGB and growing together with Bitget can yield higher excess returns in the future.

The market's recognition of BGB is also inseparable from Bitget's continuous introduction of empowering measures, including Launchpad new token offerings, Launchpool new token mining, VIP experiences, transaction fee discounts, preferential prices for mainstream token subscriptions, additional returns on financial products, and free withdrawals, among other benefits.

Among these, the most core aspect is the wealth generated from BGB's new token offerings, with high frequency and high returns becoming the most prominent highlight. Data shows that in the past two months, Bitget's Launchpool has launched an average of three projects per month, with BGB pool ARP consistently maintaining above 40%, peaking at 170%, as shown below:

In the future, Bitget will continue to address the last shortcoming of BGB—buyback and burn. Bitget CEO Gracy Chen stated, "In the future, Bitget will also consider BGB buyback and burn plans as well as the golden shovel attributes of BGB."

2. Business Flywheel Growth, Value Support Behind BGB

The operational status of the business is the true moat of CEX and also an important cornerstone supporting platform tokens. Since the bull market that began in October 2023, Bitget has truly achieved leapfrog development. According to Bitget's third-quarter transparency report, its registered user count has exceeded 45 million, a 400% increase from last year.

Derivatives, as the foundation on which Bitget was built, have made significant strides in market share this year.

Coinglass data shows that among the top three centralized trading platforms for Bitcoin 24-hour contract trading volume, Bitget ranks second with $11.77 billion; in terms of Ethereum contract trading volume, the top three centralized trading platforms are Binance, Bitget, and OKX, with Bitget's 24-hour contract trading volume reaching $5.99 billion, second only to Binance.

Regarding this achievement, Bitget CEO Gracy Chen stated that recent metrics such as trading volume, open interest, and daily active users have reached historical highs, nearly doubling from previous peaks.

Many crypto users highly praise Bitget's derivatives trading. According to CoinMarketcap global crypto CEX weekly visit data, Binance ranks first with 11.2 million weekly visits, followed by OKX (5.45 million) and Bitget (4.98 million).

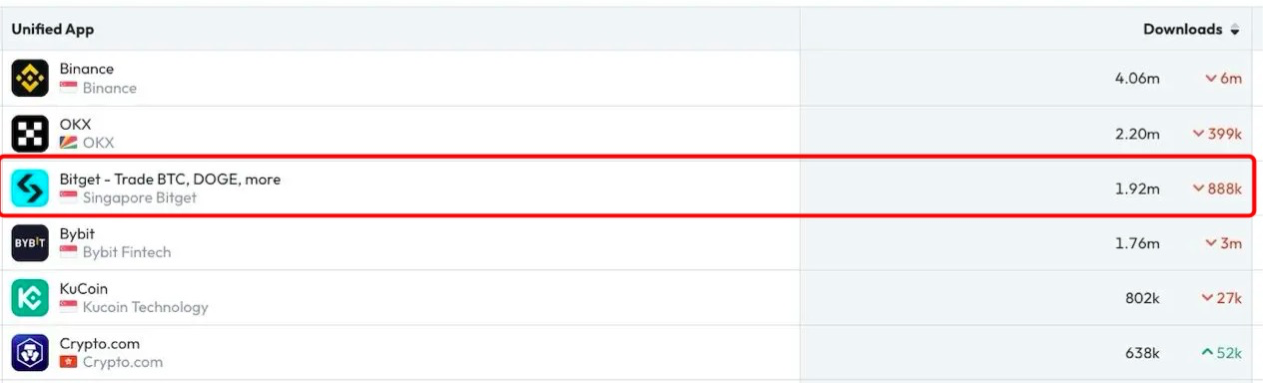

In addition to retaining existing users, Bitget is also one of the top choices for many new users entering the market. According to Data.ai data, Bitget's app reached 1.92 million downloads in October, ranking third globally among centralized exchange app downloads, only behind Binance and OKX.

Today, after six years of development, Bitget has become one of the industry leaders, gaining recognition from an increasing number of users.

3. Innovation is Always the Core Gene of Bitget

In recent years, the landscape of crypto CEX has undergone numerous changes, and players who remain conservative have long been swept into the dust of history. Bitget has been able to break through in a fiercely competitive market, with "persistence in innovation" being the core gene that has always run through its development.

This year, Bitget has turned its attention to innovative asset categories: meme coins. Bitget has partnered with Nansen to improve its token discovery strategy, utilizing on-chain data and community insights to provide traders with an advanced toolkit for identifying potential tokens.

Since April, Bitget has listed 240 new tokens, making it one of the most active exchanges in early token issuance, with the vast majority being first listings, showing a significant listing effect and successfully helping users capture excess returns, further increasing user affection for Bitget. Some statistics on first-listed tokens are as follows:

In addition to new token listings, Bitget has also creatively launched "pre-market trading" this year to attract early traders, allowing users to buy or sell corresponding tokens in advance to enhance returns. According to the third-quarter report, Bitget launched 12 popular tokens in pre-market trading, including CATI, MOCA, HMSTR, DOGS, and ZKL, attracting 53,800 early traders with a cumulative trading volume of $23 million.

Bitget CEO Gracy Chen once mentioned in an open letter: "Bitget still has a long way to go, Think Big, Think Long."

The platform and users are destined to complement each other. A platform that can truly benefit users will naturally be pushed to the forefront by them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。