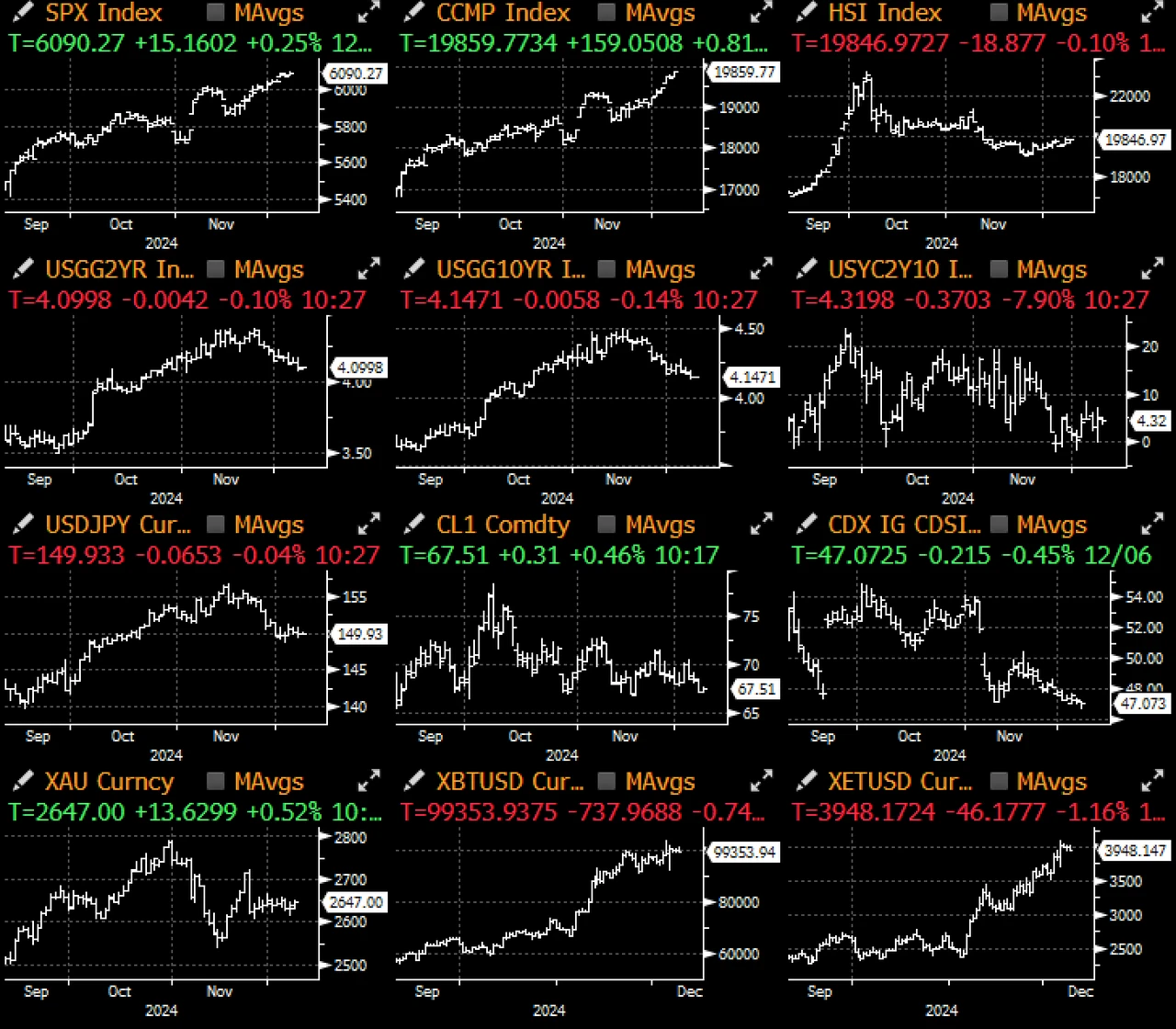

Last Friday's non-farm payroll report was somewhat lackluster, with a high chance of a rate cut in December. The overall non-farm employment data was slightly above expectations, but the weak data from last month (only 12,000) was hardly revised, indicating some signs of weakness in the labor market. However, the slightly higher unemployment rate shows that the job market is gradually cooling down without significant deterioration. In the current positive risk backdrop, this supports the Federal Reserve's potential rate cut in December. The market currently estimates an 85% chance of a 25 basis point cut in December, with about a 30% chance of another cut in January.

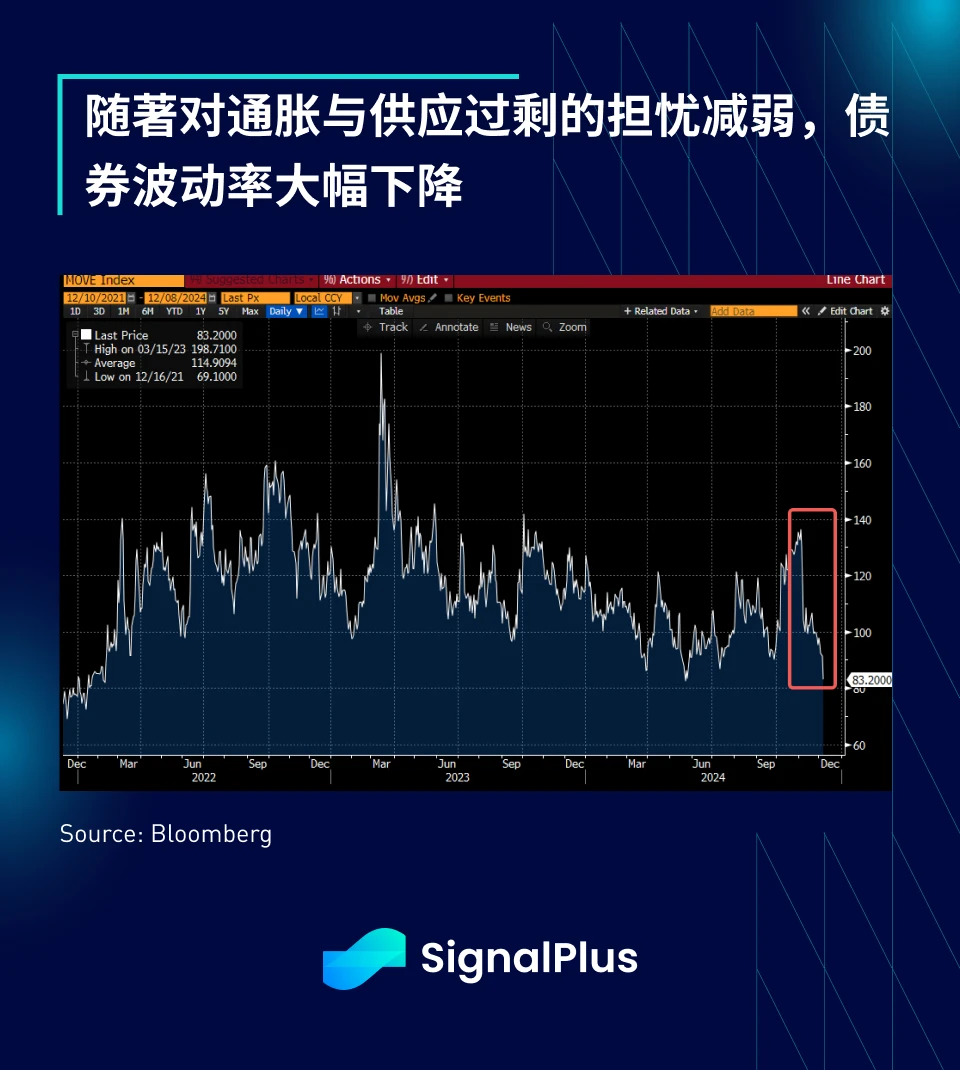

Bond volatility has dropped to multi-year lows, with yields further declining. The 2-year yield is approaching 4%, and the 10-year yield has returned to 4.15%. Before the FOMC meeting, the market will see the release of CPI and PPI data, which are the last few important economic data points before the end of the year. As Trump 2.0 policies gradually take shape, the yield curve may steepen again.

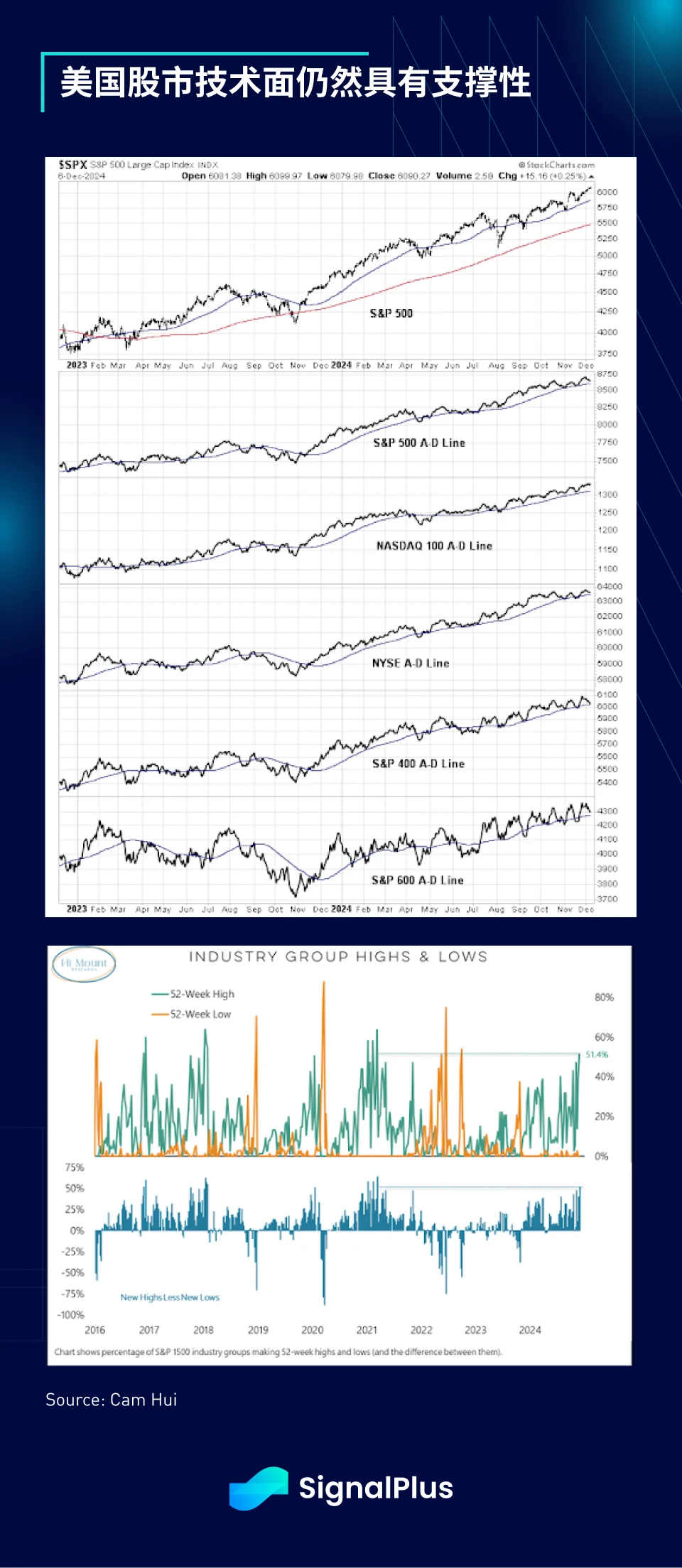

In the U.S. stock market, due to favorable data and the dovish performance of the bond market, U.S. stocks are once again approaching historical highs. The technical indicators remain supportive, with the advance-decline line continuing to move upward, and the number of stocks reaching new 52-week highs still exceeding those hitting new lows, leading to a broad rise in the stock market.

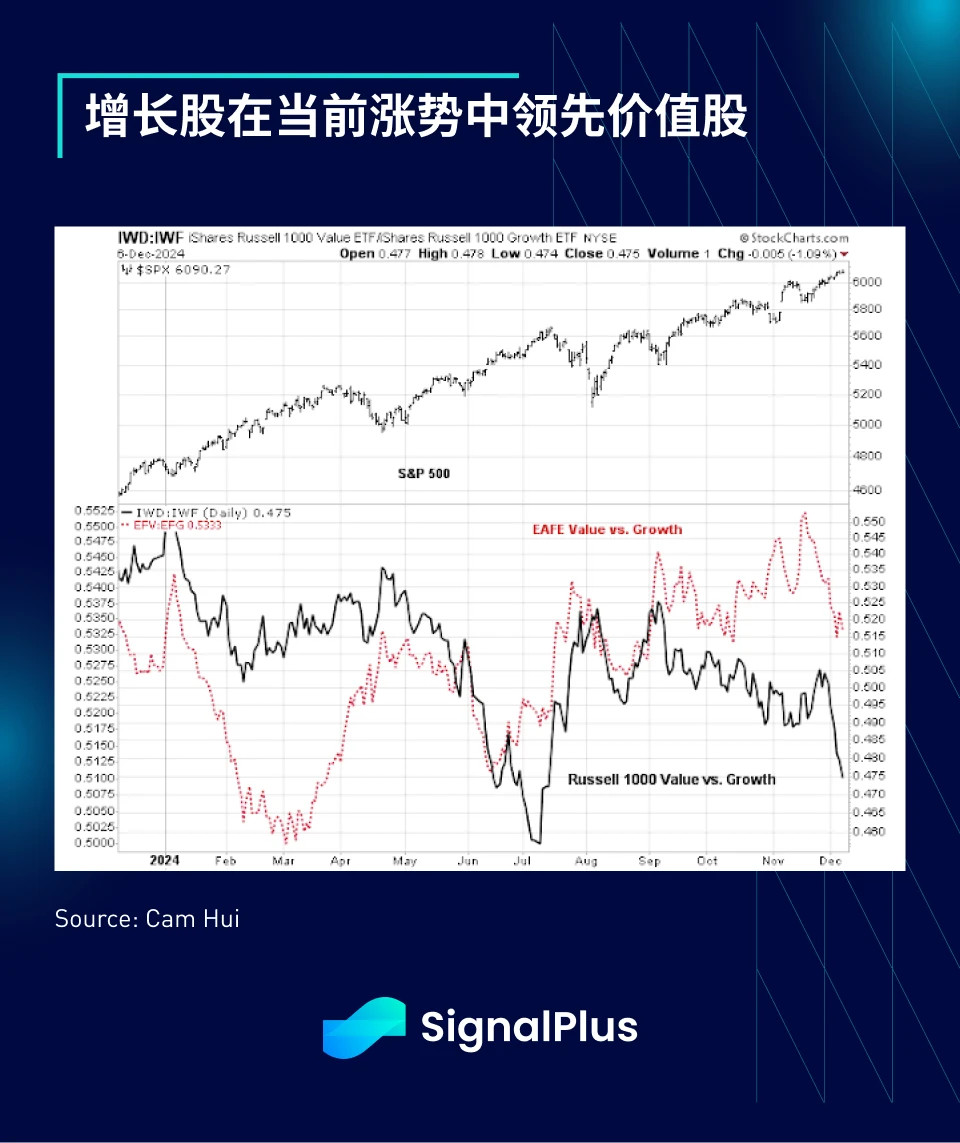

Interestingly, the risk appetite is so widespread that growth stocks are once again outperforming value stocks, which is relatively rare in the late stages of economic growth. Is this a contrarian signal of the current market overheating, or an early indication that the market may welcome a new round of increases in January? One thing is certain: in the current market, any form of short position faces significant risks…

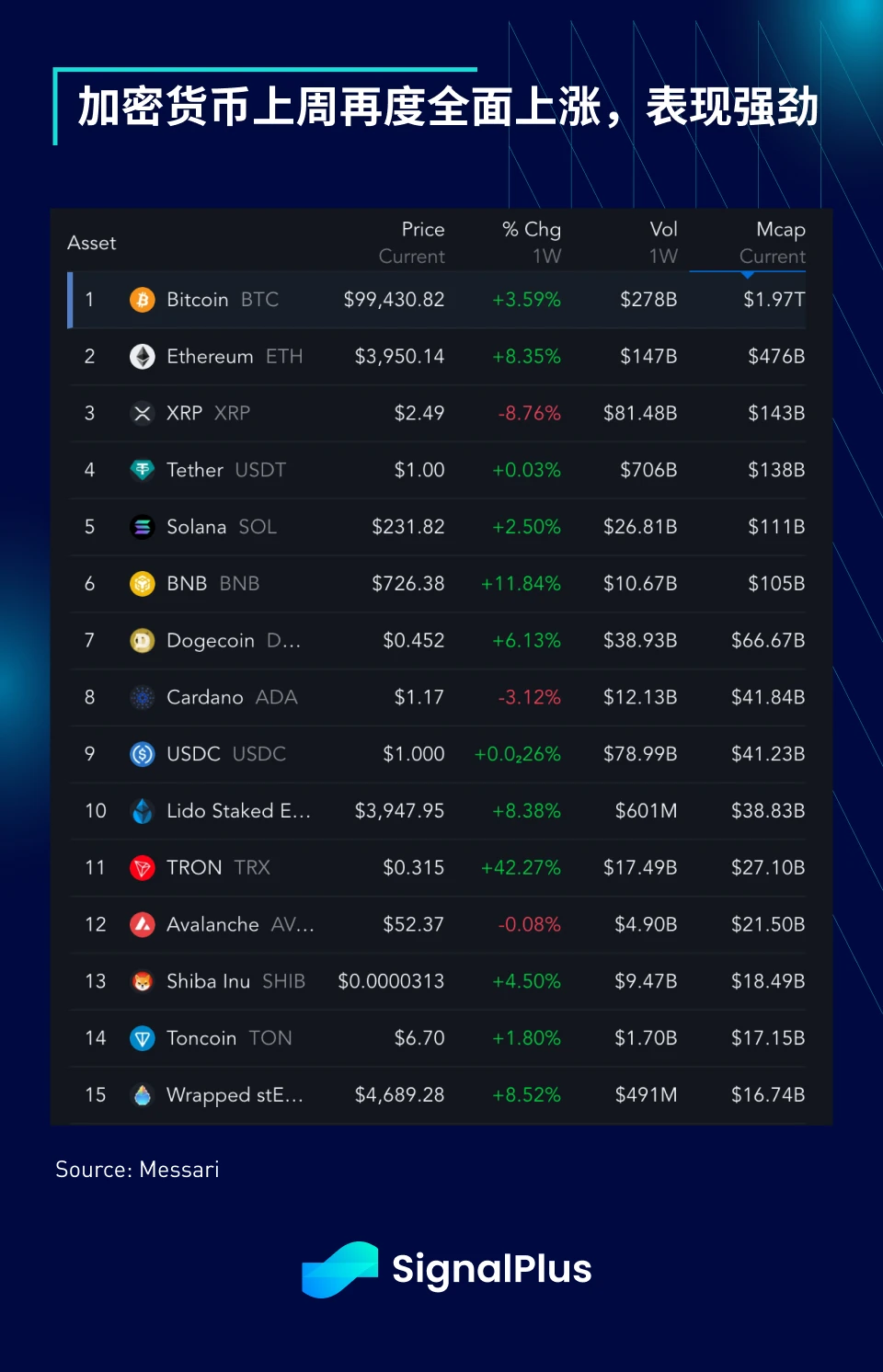

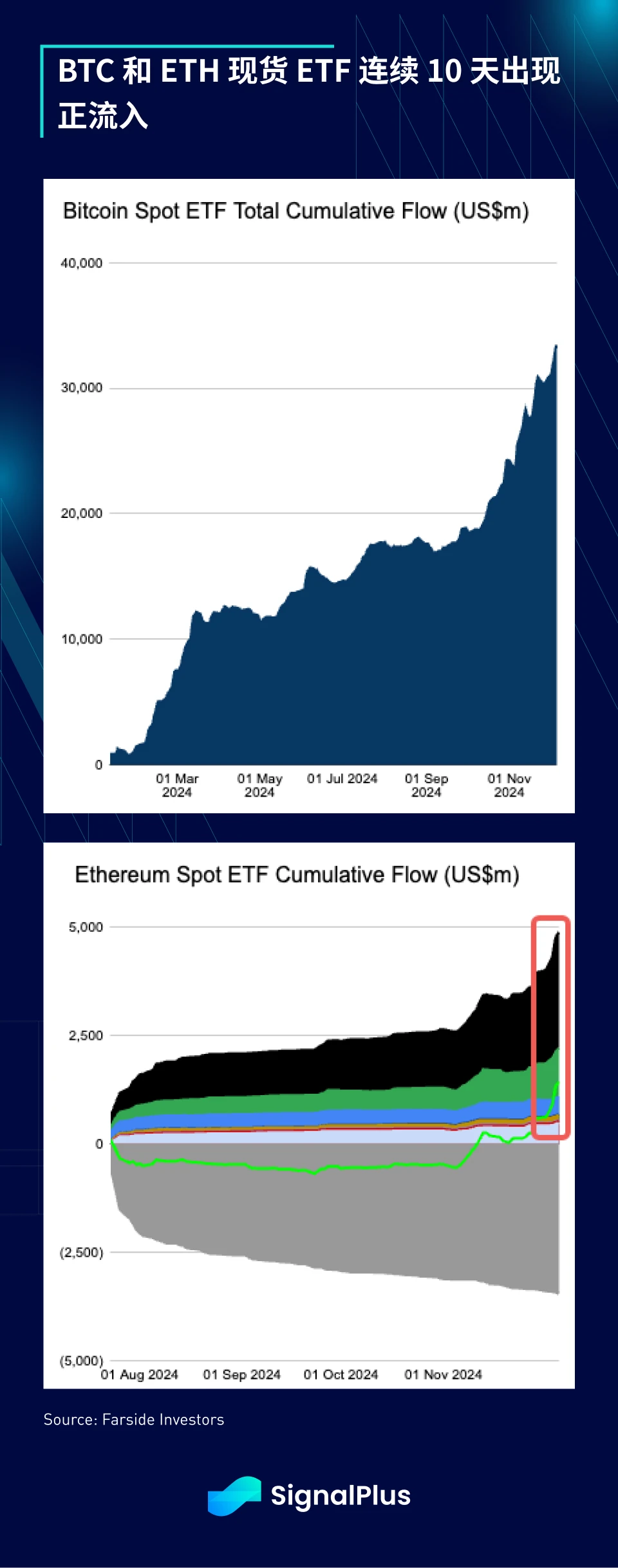

In the cryptocurrency space, all indicators are looking positive, with BTC once again closing around $100,000, while ETH is expected to break through $4,000. There has been a massive inflow of ETF funds, with BTC ETF and ETH ETF seeing an additional $2.7 billion and $800 million, respectively, with positive inflows for 10 consecutive days. The inflow from TradFi remains the dominant factor behind the spot performance, with a cumulative inflow of about $12 billion since the election. Meanwhile, Blackrock and Microstrategy have quietly become the largest holders of BTC in the market, collectively holding nearly 1 million BTC, permanently changing the market's supply and landscape.

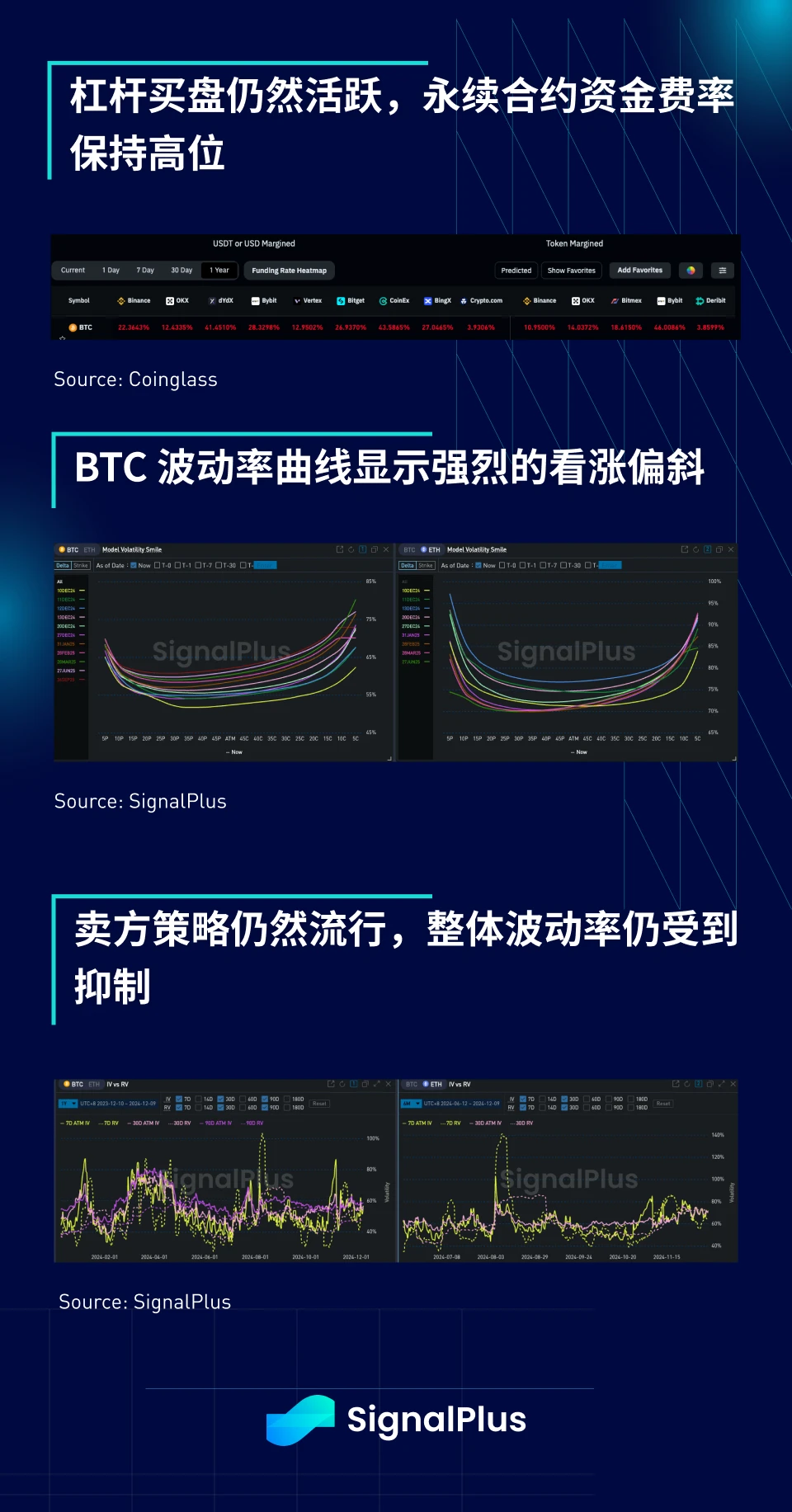

Finally, as market bullish sentiment continues, the funding rates for perpetual contracts remain relatively high, with annualized rates exceeding 20% on major exchanges. The BTC volatility curve also shows a strong bullish skew, although selling strategies remain popular, keeping overall volatility stable.

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。