Arbitrum DAO spent $112M USD (116.4M $ARB) to boost user engagement, trading volume, and TVL since Nov, 2023.

Result?

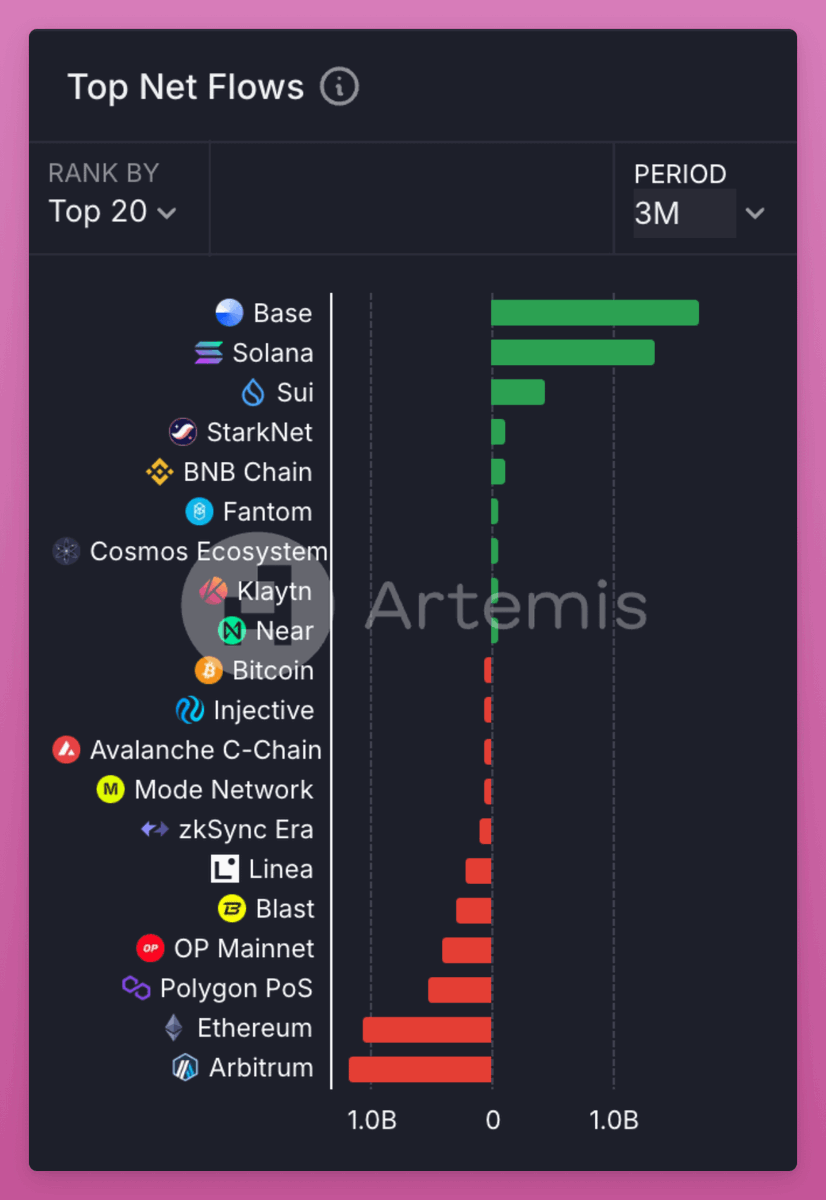

Arbitrum is quickly losing mindshare and TVL to Base and Solana.

Although the year started strong, Arbitrum saw the largest TVL outflow over the past three months.

Incentives didn't help.

The two largest grants recipients were GMX and MUX, but both are losing out to competitors.

• GMX received $18M in ARB, but TVL dropped 20% post-incentives ($480M → $380M)

• MUX got $9M, yet TVL fell 37.5% ($48M → $30M) and daily volume dropped from $100-$200M to $20M.

-------

These are the research results by @IOSGVC who submitted a DAO discussion to change incentive program.

They claim that many projects avoid Arbitrum because established protocols use large ARB grants to sway incentives, driving new entrants to platforms like Base..

IOSG proposes a new, unbiased reward distribution system:

• Shift from upfront grants to performance-based rewards

• Incentives go directly to liquidity providers, not protocols

• Focus on deepening spot market liquidity for blue-chip assets, stablecoins, & trending tokens.

I personally prefer LP incentives over grants to protocols, which later determine the distribution of rewards.

If you agree and hold $ARB tokens, consider delegating them to me :)

My delegation address is: 0x3DDC7d25c7a1dc381443e491Bbf1Caa8928A05B0

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。