During a time when almost everyone was FUD-ing the absence of an altcoin season, the market finally emerged from nearly half a year of "garbage time," and the altcoin season has indeed arrived as expected. According to data statistics, among the 388 tradable crypto assets on Binance, nearly 299 have increased by over 50% in the past 30 days, 98 have increased by over 100%, and only 10 assets have shown no increase at all.

However, in the broad market rally during this "money-making time," selecting the top-performing tokens to maximize the use of funds has become an art. Which altcoins should you buy to outperform the market average? Instead of following KOLs to buy, it’s better to let Grayscale and Coinbase do the work for you.

Leading the Market: Grayscale Funds

In the last bull market, the Grayscale concept was everywhere. This time around, the Grayscale concept continues to dominate the crypto space.

Mainstream Coin Funds

Grayscale has launched a series of funds around the top 20 cryptocurrencies by market cap, such as BTC, ETH, SOL, XRP, AVAX, SUI, BCH, LINK, XLM, LTC, etc. Some leading tokens in their respective sectors have also made the cut, such as STX, BAT, ZEC, MKR, and ZEN.

In addition to single-asset trust funds, Grayscale's bundled cryptocurrency combination funds still hold significant reference value.

Grayscale Decentralized AI Fund

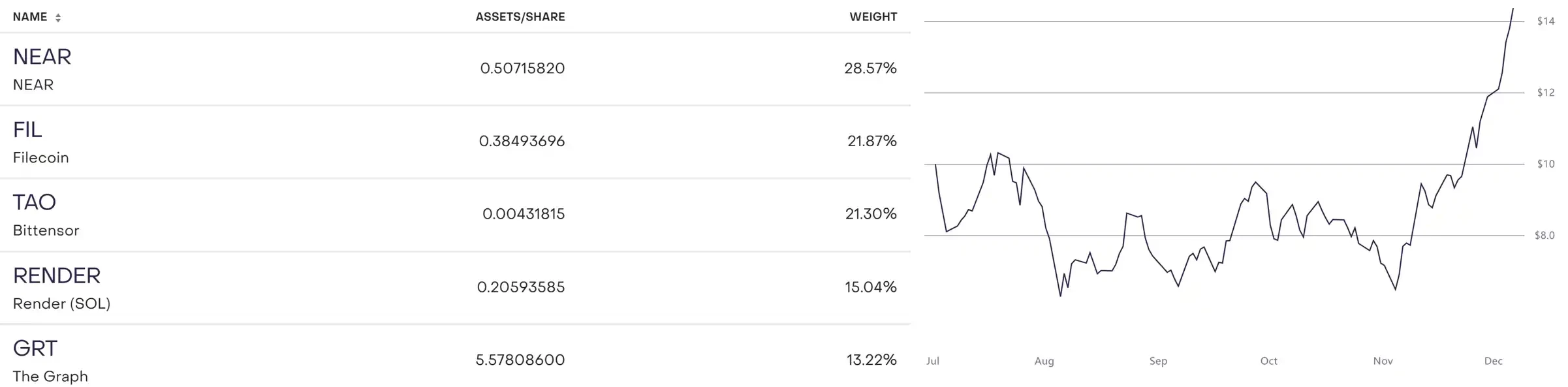

This bundle of decentralized AI funds includes AI tokens like Near, Filecoin, Bittensor, Render, and Graph. These tokens have performed well this month, with NAV per share soaring from $6 to $14. The current assets under management amount to $2.2 million.

Left Image: Holdings of the Decentralized AI Fund; Right Image: NAV per Share

It is worth noting that Near, FIL, Bittensor, and the same sector's Livepeer all have independent Grayscale funds.

Grayscale DeFi Fund

Grayscale's Decentralized Finance (DeFi) Fund is one of the first securities to invest separately in a basket of decentralized finance applications and derive value from them, including UNI, AAVE, LDO, MKR, SNX, etc. It has performed well in the past month, with NAV per share rising from $13 to $35. The current assets under management amount to $8 million.

Left Image: Holdings of the Decentralized AI Fund; Right Image: NAV per Share

It is noteworthy that Grayscale also has an independent AAVE fund.

In addition to the above funds, Grayscale is expected to add new fund tokens across various sectors:

The DeFi sector includes a total of 7 tokens: Jupiter (JUP), Ondo Finance (ONDO), Ethena (ENA), Core (CORE), THORChain (RUNE), Aerodrome (AERO), Pendle (PENDLE);

The underlying infrastructure sector includes a total of 6 tokens: Celestia (TIA), Pyth Network (PYTH), Cosmos (ATOM), Akash (AKT), UMA Project (UMA), Neon (NEON);

The Layer 1 sector includes a total of 9 tokens: Toncoin (TON), TRON (TRX), Aptos (APT), Injective Protocol (INJ), Internet Computer (ICP), Kaspa (KAS), VeChain (VET), Mantra (OM), Celo (CELO);

The Layer 2 sector includes a total of 8 tokens: Optimism (OP), Arbitrum (ARB), Sei (SEI), Starknet (STRK), Polygon (POL, formerly MATIC), Mantle (MNT), Immutable (IMX), Metis (METIS);

The DePIN sector includes a total of 2 tokens: Arweave (AR), Helium (HNT);

The AI+ sector includes a total of 2 tokens: Fetch.ai (FET), Worldcoin (WLD);

The Meme sector includes a total of 1 token: Dogecoin (DOGE).

Among the Grayscale concept tokens listed above, almost all have outperformed the average bull market increase. In addition to the essential Grayscale Select, the Coin50 Index established by Coinbase is also a great reference standard.

Coin50: The Nasdaq of Crypto

What is the Coin50 Index?

As the saying goes, "First-class companies set standards, second-class companies build brands, and third-class companies make products." In comparison to the S&P and Nasdaq, Coinbase has created the COIN50 by weighting the top 50 quality cryptocurrencies by market cap, establishing a premier digital asset benchmark index. COIN50 aims to provide investors with a transparent and reliable tool to better understand and evaluate the performance of the cryptocurrency market.

How has Coin50 performed?

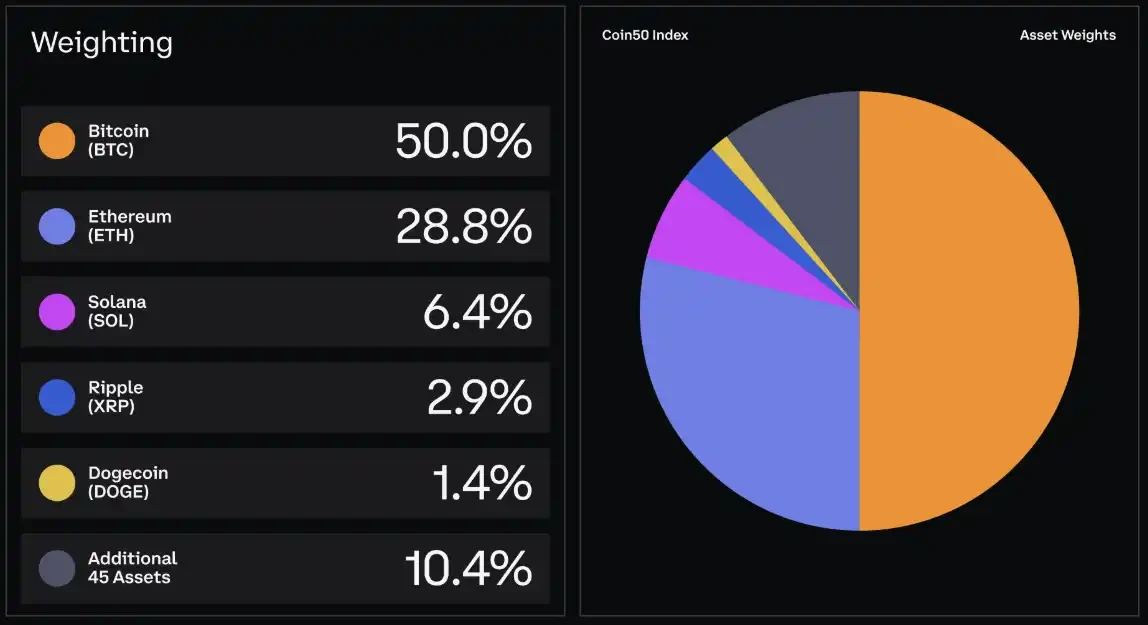

In terms of weight composition, BTC, ETH, and SOL remain the most important assets in crypto, with BTC accounting for 50%, ETH for 28.8%, and SOL for 6.4%.

Among the top five are also XRP and DOGE, accounting for 2.9% and 1.4%, respectively, while the remaining crypto assets account for 10.4% of the weight.

The COIN50 Index has achieved a return of 68.30% over the past 30 days, while the return over 90 days has been 99.64%. Even with BTC and ETH accounting for 70% of the weight, such an impressive return is evident. This shows how exaggerated the returns of other crypto assets within this index are, excluding large-cap coins like BTC and ETH.

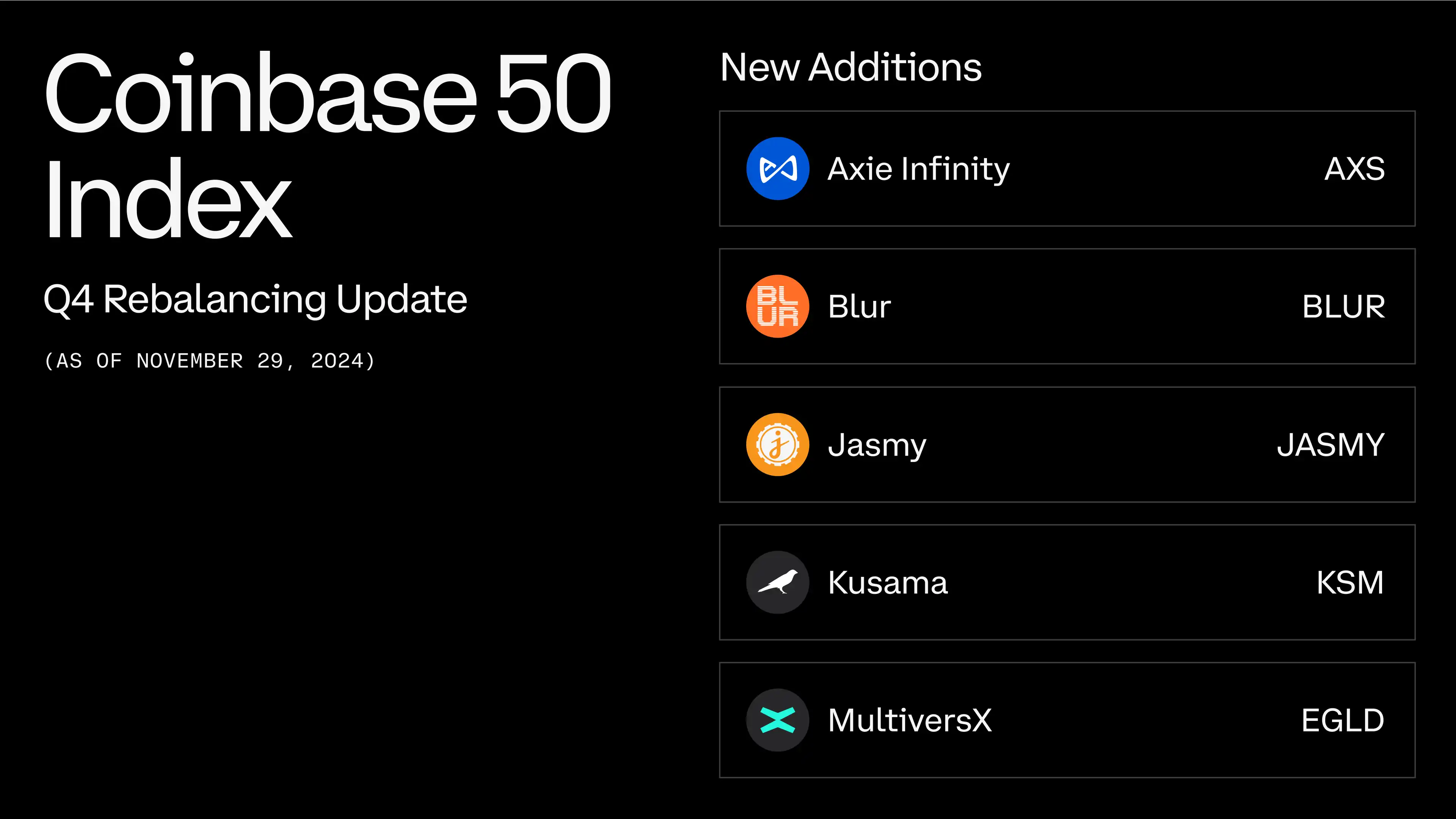

It is important to note that the COIN50 Index is not static; it will be evaluated quarterly based on the fundamentals of the tokens for additions and deletions. Recently, tokens AXS, BLUR, JASMY, KSM, and EGLD have been included in the COIN50 Index.

Where are the Opportunities?

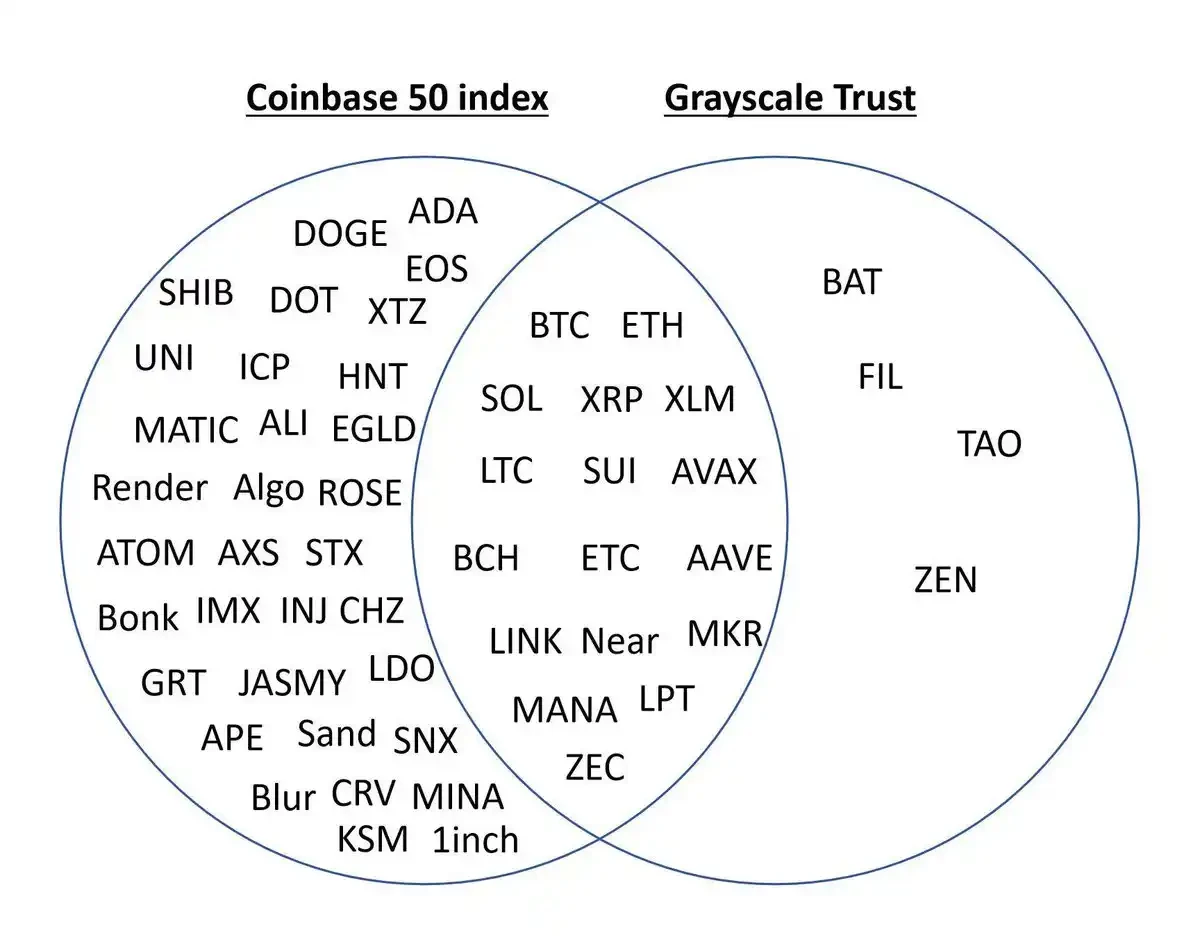

By summarizing the crypto assets in the COIN50 and Grayscale trust funds, we can find some highly overlapping assets. In addition to BTC, ETH, and SOL, tokens like XRP, XLM, SUI, AVAX, AAVE, LINK, and LPT have all experienced "exponential" growth in the past 60 days. Moreover, the main funding for these tokens has come from U.S. institutions, which can accommodate large capital.

At the same time, many people believe this is just hindsight. "What you mentioned has already surged; where is the opportunity?"

However, a bull market allows those who are well-prepared to make big money, those who are somewhat prepared to earn money, and those who are unprepared to experience making money.

After understanding the power of Coin50 and Grayscale holdings, there are still many "wealth codes" surrounding this main line that can help "somewhat prepared" individuals make money.

For example:

(1) You can explore projects that are due for a rebound. Not all tokens in the above list surged at the same time; there has been a certain "sector rotation." After SOL and SUI cooled off, it was XRP and XLM, and after XRP and XLM took a break, it was blue-chip DeFi, followed by hot sector projects like LPT. You can position yourself for projects that are due for a rebound, such as APE, BLUR, ZEC, etc.

(2) In traditional financial markets, we can analyze using the U.S. stock market as an example. In 1993, the first ETF, the SPDR S&P 500 ETF, was listed on the New York Stock Exchange. From 2000 to 2009, the U.S. ETF market rapidly expanded, forming a diversified asset class that includes broad-based, industry-themed, Smart Beta, fixed income, and commodity ETFs. The crypto market is still in its early stages compared to the already mature traditional financial market.

Currently, ETFs for BTC, ETH, SOL, etc., have been approved, and there is a high probability that the XRP ETF will be approved as well. Once these leading ETFs are completed, there will certainly be a series of ETFs based on various niche sectors in the future, such as DeFi ETFs, AI ETFs, Meme ETFs, etc.

The compound annual growth rate of U.S. ETFs from 2010 to 2021 was 19.7%, and it is foreseeable that there will still be many growth opportunities for crypto asset ETFs in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。