This article will conduct an in-depth analysis from four dimensions: time cycles, macroeconomic factors, market demand, and on-chain data.

Written by: Miles Deutscher, Crypto Analyst

Translated by: Yuliya, PANews

The market is experiencing a critical turning point. After Bitcoin broke through the $100,000 mark this week, investors are now focusing on the next price target. Based on comprehensive data analysis, multiple indicators are showing that Bitcoin is expected to reach a new height of $150,000 by 2025.

This report will provide an in-depth analysis through 10 key indicators from the following four dimensions:

Time Cycle Analysis

Macroeconomic Factors

Market Demand Dynamics

On-Chain Data Indicators

Time Cycle Analysis

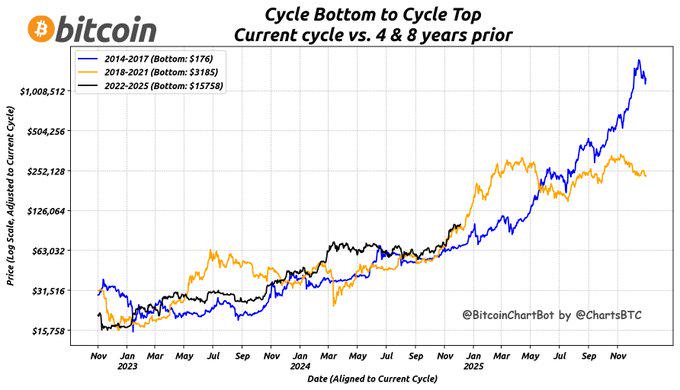

- The current Bitcoin price trend is highly similar to previous cycles.

- The market has entered the most explosive phase, which is the period of the fastest price acceleration.

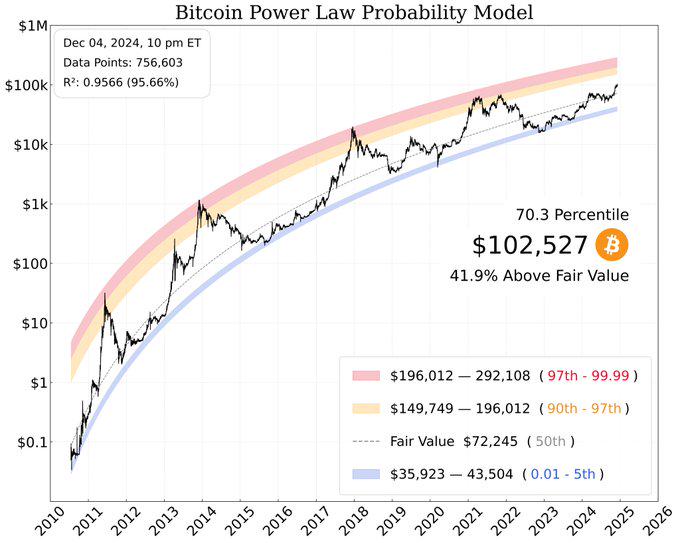

- Throughout historical cycles, Bitcoin tends to enter the red zone of the power law probability model (97% percentile). If this cycle repeats this pattern, it means Bitcoin's price will break through $196,000.

Macroeconomic Factors

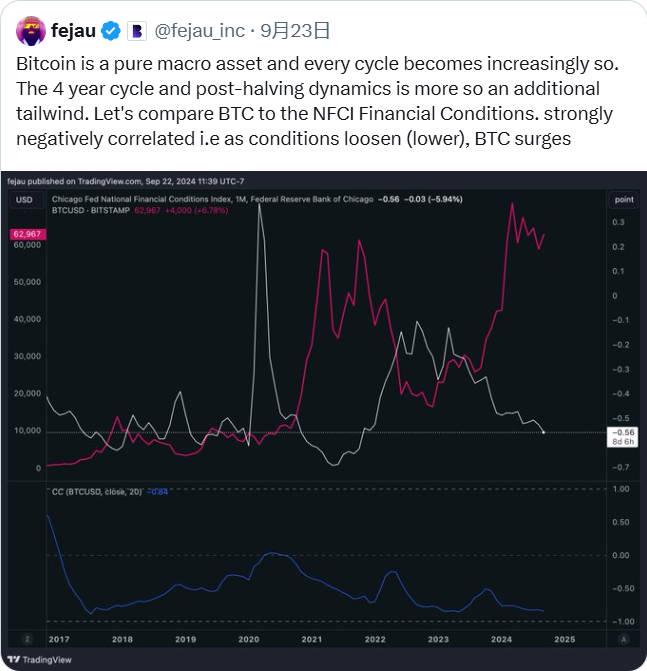

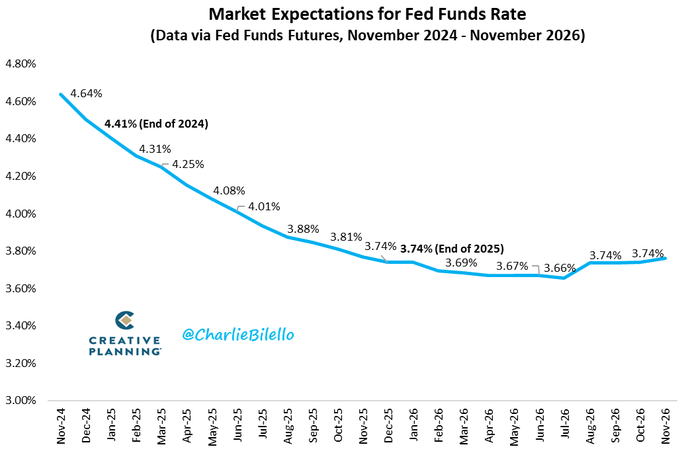

- The current macro environment is in the most favorable state since 2021. Bitcoin is extremely sensitive to changes in monetary policy and global liquidity.

- It is expected that interest rate cuts will continue in 2025, which will create strong macro support for risk assets.

Market Demand Dynamics

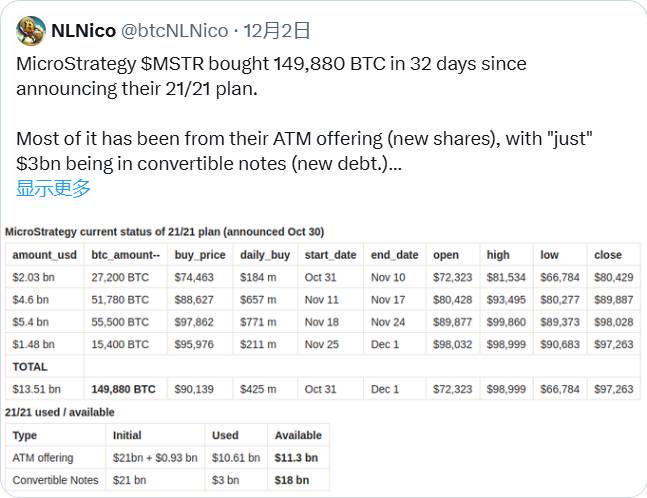

- MicroStrategy continues to buy according to its 21/21 plan (aiming to hold 21% of Bitcoin's total supply, with $29.3 billion remaining to be invested).

This impacts Bitcoin demand in two ways:

Continuous and aggressive buying pressure from MicroStrategy

Speculative funds positioning in advance to respond to future buying pressure

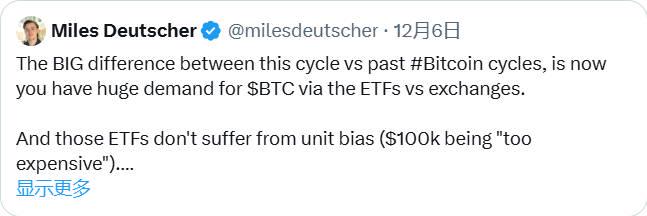

- The holdings of U.S. spot ETFs have exceeded 1.1 million Bitcoins, surpassing the amount held by Satoshi Nakamoto. This brings sustained buying pressure. Spot ETFs also create an extremely powerful "unit bias" effect.

On-Chain Data Indicators

- Retail demand for Bitcoin has surged, reaching the highest level since 2020.

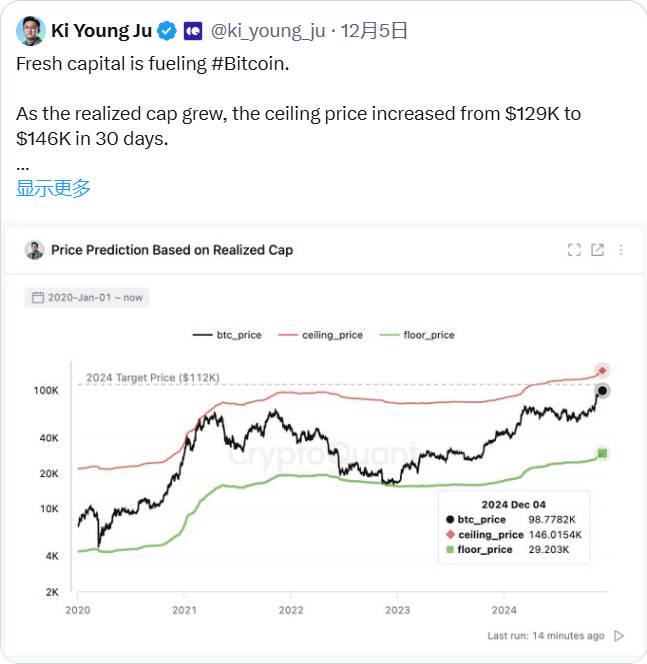

- New funds are driving the current price trend of Bitcoin. "Even at $102,000, it is far from bubble levels - a further increase of 43% is needed to reach what is typically considered the bubble threshold."

- Even at the $100,000 level, profit-taking pressure is weakening, indicating that selling pressure is cooling down.

Market Outlook

Currently, multiple factors are highly aligned, indicating that the upward trend will continue. In such a macro environment, Bitcoin breaking through $150,000 will inject strong momentum into the entire cryptocurrency market.

The increase in market liquidity will undoubtedly lead to a more significant upward trend, especially for the altcoin market. In the coming weeks, we will continue to track and share noteworthy altcoin investment opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。